Let’s jump on the market’s September slide and grab ourselves a sweet “double discount” on 358 totally ignored income plays—and some sweet 6%+ dividends, too. And our new income stream will pay us monthly!

Going Where Other Dividend Investors Don’t

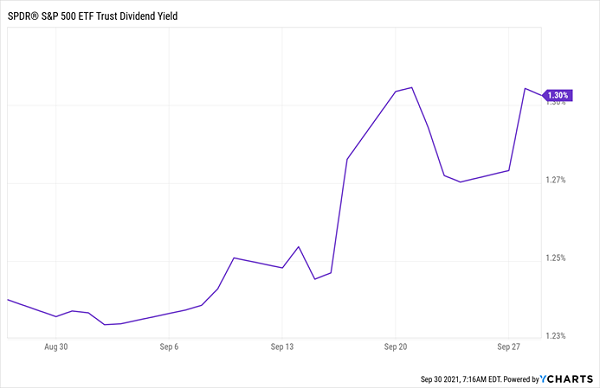

Our route to this big monthly payout does an end run around the misers of the S&P 500. Even though the market dove 3.5% in September, that was only enough to drive yields on the big-name stocks up by—wait for it—0.07%.

In other words, if you dropped a million bucks into an ETF like the SPDR S&P 500 ETF Trust (SPY) in early September, you’d be generating $12,300 in yearly dividends.

And if you waited and grabbed a “deal” at the end of the month, your income stream would have risen to … $13,000. Spread your extra $700 out over a year and you can buy yourself an extra coffee a day!

Buying the September Dip Failed to Pay Off for Income Seekers

So let’s skip the big names. They just don’t pay enough! And they certainly won’t pay us monthly. For that, we’ll look to lesser-known yield plays like real estate investment trusts (REITs) and closed-end funds (CEFs).

Cashing in on Lazy First-Level Thinking

Let’s stop here for a second, because it’s vital that we don’t make the mistake of associating “lesser known” with “low quality.” Too many folks think that way—and it’s why many are forced to scrape by with yields that are being lapped (often two or three times over) by today’s high inflation.

Truth is, REITs and CEFs are among the best places to get high, safe dividends and bargains, too. Every income investor should own one or both asset classes. This realization alone puts us one step ahead of the rest of the crowd.

Consider CEFs, which yield around 6.2%, on average, today, or about $62,000 in dividends on a million-dollar investment. And of the 460 or so CEFs out there, 288 trade at discounts to net asset value (NAV, or the value of their portfolios) and 358 pay dividends monthly!

Those monthly payouts are manna for retirees because they take that $62,000 in dividend income and break it out into nice, predictable $5,167 monthly payouts that roll in steadily, right in line with your bills.

REITs, too, are known for above-average dividends. And while the sector isn’t as flush with monthly payers as CEFs are, there are some standouts, like 4.3%-yielding mall landlord Realty Income (O)—more on that one below—warehouse REIT STAG Industrial (STAG) and senior-care facility manager LTC Properties (LTC).

Let’s pull out two specific corners of the REIT and CEF markets (complete with names and tickers) that are worth taking a close look at now.

Bargain Monthly Dividend Play No. 1: Healthcare CEFs

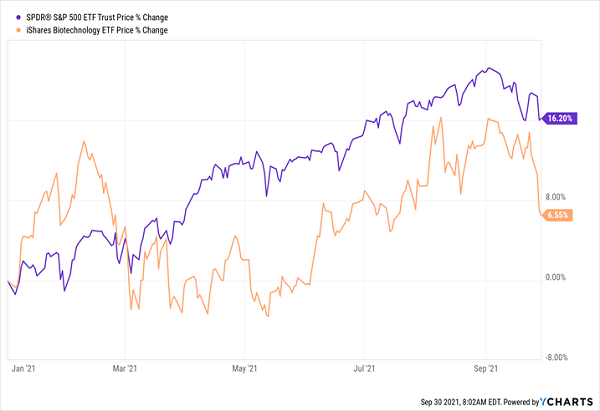

Pharma stocks might not jump out as bargains, with COVID-19 putting them in the spotlight over the last couple years, but they’ve actually trailed the market in 2021. Consider the pharma benchmark iShares Nasdaq Biotechnology ETF (IBB), in orange below, which is well behind SPY, in purple:

Pharma Lags, Our Opportunity Arrives

This is the first part of our “double discount” in the sector. To get the second, we’ll look to a CEF called the Tekla Healthcare Opportunities Fund (THQ). It yields 5.9% as I write this and holds big-name drug and medical-device makers, such as Johnson & Johnson (JNJ), Abbott Laboratories (ABT), AbbVie (ABBV) and Thermo Fisher Scientific (TMO).

The fund delivers the second part of our double discount with its 5% markdown to NAV, which is a sweet deal in this (still) overbought market, especially considering that THQ traded at a 2.6% premium as recently as June.

So how does that translate into upside?

A 2.6% premium would boost the fund’s price by around 7.5%, and that’s before any jump in its portfolio value (which is a certainty, in my view, given these stocks’ attractive valuations and locked-in demand for their products in the years ahead).

So if we’re dropping, say, $50K into THQ, we can think of its 7.5% discount-driven upside as a $3,750 bonus before our real gains start—and a sweet “add-on” to the 5.9% monthly dividend we’re getting.

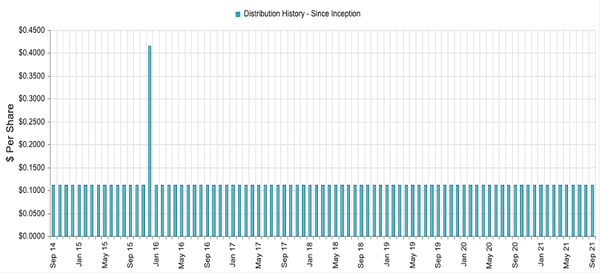

And this payout is as steady as they come: it’s hummed along, rolling in every month since THQ’s launch in 2014:

THQ’s Steady Monthly “Paychecks” Roll In

Source: CEF Connect

Now let’s take a look at a monthly paying REIT that’s been unfairly beaten down in the market’s September slide.

Bargain Monthly Dividend Play No. 2: Mall REITs

Despite last month’s turbulence, REITs have soared this year, with returns tracking well ahead of the S&P 500. But one corner of the REIT market is still cheap: mall landlords.

Check out how Realty Income (O), a stock so devoted to monthly dividends it bills itself as the “monthly dividend company,” has lagged the S&P 500 (in blue) and the Vanguard Real Estate ETF (VNQ), in orange:

REITs Revive, but Mall Owner Lags

You might be surprised to hear me talking up mall REITs; after all, I’ve spent the last few years going on about how they’re getting crushed by Amazon.com (AMZN) and its ilk.

My view hasn’t changed. That’s why I only recommend holding retail REITs for the short term—over the next six to 12 months, say—as the reopening hits its stride. The delta variant has delayed things somewhat, but that only extends our opportunity here.

And Realty Income, which yields 4.3% today, has a business model nicely suited to the months ahead. The REIT rents standalone buildings to tenants who take on the taxes, maintenance and insurance costs themselves. It’s a savvy approach that frees up the REIT from extra costs. That’s a particularly important advantage in a time of rising inflation.

That, plus the wide range of retailers it rents to, has helped Realty Income bounce back from the pandemic: rent collections were up to 99.4%, as of the end of the second quarter. Management also recently increased its forecast adjusted per-share funds from operations (FFO, the main REIT cash flow metric) for 2021. The new range of $3.53 to $3.59 a share is up 4% to 6% from 2020.

Despite that, Realty Income trades 20% below pre-pandemic highs. That’s too low for a REIT renowned for growing its payout every quarter and paying a 4.3% dividend that’s well supported by FFO: the current annualized monthly dividend comes in at a conservative (for a REIT) 79% of the midpoint of this year’s forecast adjusted FFO.

My Top Monthly Payers Could Pay You $2,916 a Month, Forever

These 2 picks are absolutely worth a close look, but neither have made my “7% Monthly Dividend Portfolio” for three reasons:

1) They pay dividends that don’t quite hit the 7% yield we need, or

2) Their discounts, while attractive, aren’t quite as high as we’d like, or

3) In the case of mall REITs, this is more of a swing trade—one we’ll likely get out of in a few months to a year. For our monthly dividend portfolio, we want stocks and funds we can hold for the long haul.

The carefully selected stocks and funds inside the 7% Monthly Dividend Portfolio, on the other hand, deliver big, steady payouts of 7% and more, just like the name says. That’s well ahead of inflation, and of course, these dividends line straight up with your monthly bills.

With a payout like that, you’ll be pulling in $35,000 in yearly income on just a $500K nest egg. That amounts to $2,916 every month—easily enough income for many folks to clock out of the workforce today. And if you’ve got a million bucks, you can look forward to a tidy $70,000 in yearly dividend income!

Meantime, the big discounts on these stout income plays set you up for strong upside in a rising market and help cushion our nest egg in a pullback.

Click here to get the full story on my very best 7%-paying monthly dividend picks—names, tickers, current yields and much more.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report