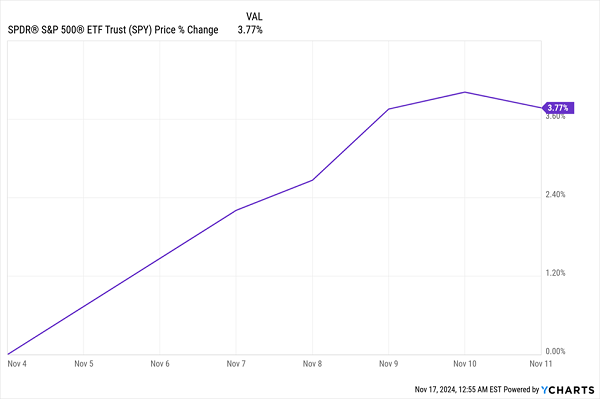

Well, that was fast. As you no doubt know by now, stocks gave back their post-election bump nearly as fast as they took it. Now they’re more or less where they started pre-election.

There’s a story behind this “pop and drop” that showed me something we need to bear in mind more and more as we head into 2025 (and a new presidential term): The need to diversify our portfolios, not only within stocks but (especially, with more volatility likely) beyond them.

And that need for diversification goes for our holdings of high-yielding closed-end funds (CEFs), too.

Now, market veterans will no doubt be quick to say that these short-term moves are just noise, and in the long term it doesn’t really matter who is the president. There’s definitely some truth to that.

Market Euphoria Followed the 2016 Vote …

Back in 2016, when President-elect Trump’s first win stunned the world, stocks rose, even as some commentators predicted a slump.

However, we should note the shape of the line in the chart above: Stocks were already soaring before November 8, 2016, when the results became clear.

And as is the case in any other administration, stocks also saw some rough patches during Trump’s first term, as the S&P 500 fell just over 6% in 2018, the index’s first down year in a decade.

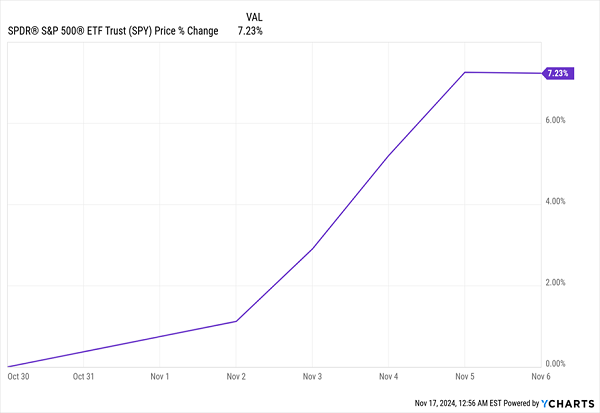

And, yes, when President Biden won in 2020, we saw a similar market jump:

… And the 2020 Election, Too

Truth is, election results really don’t change the long-term trajectory of the stock market, and it’s really not all that surprising that stocks have returned to pre-election levels.

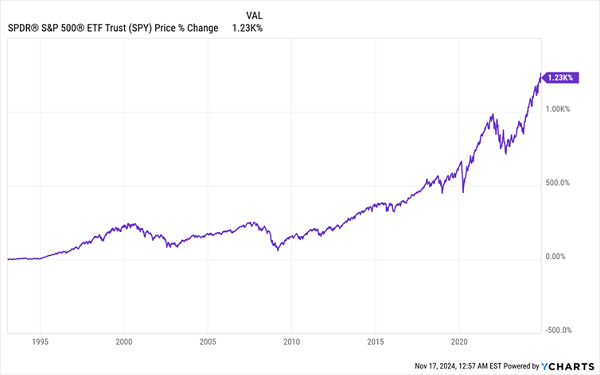

Long Term, Stocks Create Wealth

But that said, there are proposals, especially around tariffs, that would affect some sectors more than others. And there is the fact that the market has soared this year. And then, of course, there are the things that catch everyone off-guard, like the selloff we saw earlier this week on higher tensions around Ukraine.

That uncertainty, combined with stocks’ strong run this year, does suggest we could see a pullback in the short term.

But we do not want to go to cash in response. For one, we’ll cut off our payouts! Plus we’ll likely miss out on stock gains (since investors who sell in a panic almost always buy back in too late) and leave ourselves vulnerable to inflation.

This is where CEFs come in, because they let us do the opposite of cash: Set ourselves up for gains and higher income as volatility ticks up.

Members of my CEF Insider service know the value of CEFs’ high yields at times like these: CEFs yield 8% on average, and our CEF Insider portfolio pays even more—9.4% as I write this, with 80% of our holdings paying dividends monthly.

Another thing that often surprises newbie CEF investors is the diversification we can get from these funds—there are CEFs holding everything from stocks and bonds to preferred stocks, real estate investment trusts (REITs) and utility stocks (even blue chip techs). So if the market pivots from stocks to, say, bonds or REITs, we’re covered if we have a diversified CEF portfolio, because we’ll own all three.

Here’s a quick three-CEF sample portfolio that will give you just this kind of diversification, along with a sweet 7.9% average dividend, too.

CEF No. 1: A 6.5% Payer That Profits From Volatility

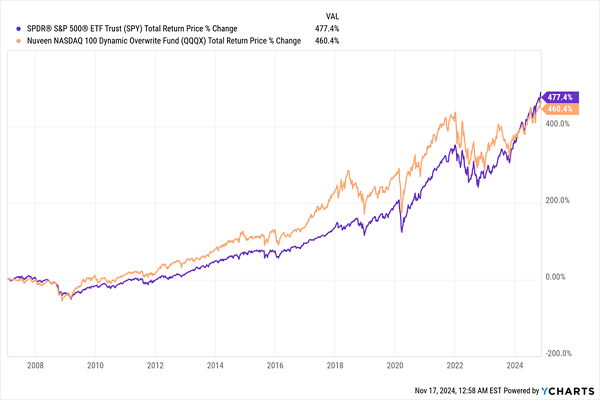

The Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) is a 6.5%-yielding stock fund that, as the name says, focuses on the NASDAQ 100 index. If you’ve been investing for a while, you know that the NASDAQ is a higher-performing index than the S&P 500, but it’s more volatile, too.

QQQX mitigates this volatility by selling call options on its holdings, which translates that volatility into an income stream that backstops that payout. The cost of that higher dividend is the fact that selling calls does hamper the fund’s overall return, as its best performers are sold, or “called away.”

However, that effect is somewhat offset by the stronger historical returns of the NASDAQ vs. the S&P 500. The overall result is an S&P 500–like return from QQQX, with a much bigger income stream than the 1.3% payout on an S&P 500 index fund:

6.5%-Paying QQQX Delivers S&P 500–Style Returns

Moreover, the fact that the fund “clones” the NASDAQ means you get exposure to top techs, like NVIDIA (NVDA), Apple (AAPL) and Microsoft (MSFT) as well as non-tech firms in the index, like PepsiCo (PEP), Costco Wholesale (COST) and Starbucks (SBUX).

Finally this one stands out for its 10% discount to net asset value (NAV, or the value of its underlying portfolio). That’s particularly attractive given the heightened volatility we’re seeing these days.

CEF No. 2: A Corporate-Bond Fund Run By the Premier Name in CEFs

Let’s top up that 6.5% dividend yield with a fund with a portfolio of corporate bonds and bond derivatives it actively manages to respond to the Fed.

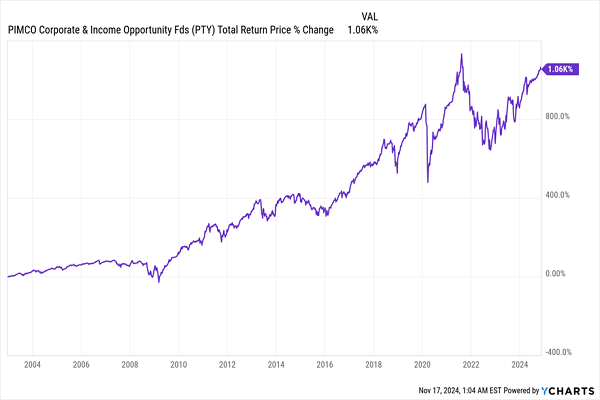

The upshot? Whether rates go up or down, the PIMCO Corporate & Income Opportunity Fund (PTY) will position itself to keep up its 9.8% dividend yield. It’s got a tremendous track record, too, returning over 1,000% in the last 20 years.

Big Gains for PTY Shareholders

I do have a word of caution here, though: This one trades at a 25% premium to NAV today, but that’s the price of owning a fund run by PIMCO, a vaunted name in CEFs. It’s also roughly the premium at which the fund has traded over the last five years, so that markup isn’t completely unusual (though I prefer discounted funds like the 5 I’ll tell you more about here).

CEF No. 3: A REIT Fund Paying More Than You’d Ever Get From Rental Property

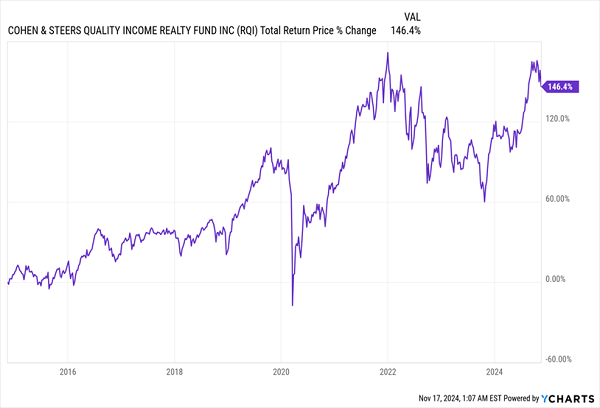

Finally, we can pick up attractive real estate with the appropriately named Cohen & Steers Quality Income Realty Fund (RQI).

This one is always on my watch list due to its 197 holdings, many of which are in REITs that themselves hold thousands of buildings. Top holdings include cell-tower owner American Tower Corp. (AMT), warehouse REIT Prologis (PLD) and data-center landlord Digital Realty Trust (DLR).

This is about as diversified as you can get, and it’s an approach that’s provided a strong total return that includes a high payout: RQI yields 7.4% and trades at a 4% discount, which is around where it has traded, on average, over the last five years.

Reliable Profits Over the Long Haul

In addition to REITs, RQI also holds some bonds and preferred stocks (stock-bond hybrids that trade on a market, like stocks, but whose payouts tend to be fixed, like a bond). With diversification like this, no matter where America’s flows under President Trump’s second administration, you’ll be there to collect a piece of it.

Buy These 5 “Low Drama” Funds Now (for 10.5% Yields, Monthly Payouts)

At times like these, stocks and funds that pay dividends MONTHLY give us even more peace of mind than those that simply pay a high yield alone.

Sure, monthly payouts roll in along with our bills, and that’s a very good reason to prefer them. But more important, it’s just plain comforting to have that reliable payout coming your way every 30 (or 31) days, rather than having to wait for 90 or more. Especially when the markets are roiling beneath our feet.

That’s why NOW, with so many things seeming uncertain, I’m recommending a diversified collection of 5 CEFs that pay us every single month. And they yield an outsized 10.5% too.

Think about that for a second: Every year, we’re earning more than 10% of the value of our upfront investment in these funds in dividend cash. And that comes our way in the form of reliable payouts that drip, drip, drip into our accounts monthly.

The time to buy these 5 monthly paying CEFs is now, while they’re still bargains. Click here and I’ll tell you more about these 5 “Gibraltar-like” income plays and give you a free Special Report revealing their names and tickers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report