“Do you have cherries?” my buddy Ralph asked over the phone.

It was January 2021. Sports bars here in California were closed, so we naturally turned our backyard into one.

“No,” I replied. And sighed in an honest admission. “Only beer. Lots of beer.”

“No problem. I got ‘em.”

My buddy also had a mini-keg of delicious old-fashioneds. His creations were dangerously delicious. He’d begun making and aging fine adult beverages to pass time in the pandemic.

And the maraschino cherries he brought played no small role in his cocktail’s critical acclaim.

Is it five o’clock yet? Just kidding (mostly). We are talking about maraschinos in a dividend column because we finally have some bond funds worth cherry picking.

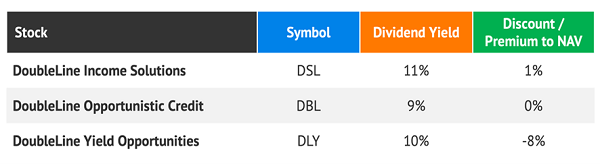

Let’s look at the three funds below. They are all run by the same fixed-income deity. One is ridiculously cheap:

DoubleLine Yield Opportunities (DLY), of course, wins the maraschino cherry award for this month. It’s run by the “Bond God” Jeffrey Gundlach and his crew, yields 10% and trades at an 8% discount to its net asset value (NAV). A cherry indeed!

Here’s how that works. The bonds that DoubleLine owns in DLY add up to an NAV of $15.28. But as I write, the fund trades around $14 per share.

This means we have an 8% discount window (eight-point-three percent, to be exact). If and when this window shuts, as it has for DLY’s two sister funds, it will equal price upside for us.

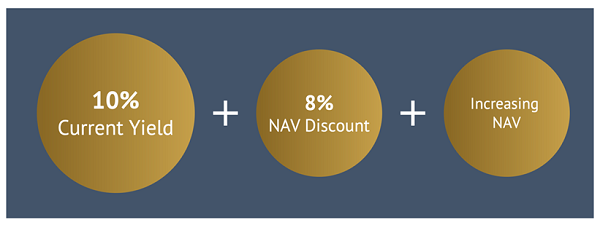

DLY’s 8% Discount Window

Riding with the Bond God for 92 cents on the dollar is a sweet deal. But there’s more. DLY employs only 23% leverage, which is on the lower end for a closed-end bond fund.

That’s important now because the Federal Reserve (as you may have heard) is still raising rates. Which increases the cost of capital for closed-end funds like DLY. Yes, a creditworthy outfit like DoubleLine gets to borrow for cheap, but its costs are still ultimately tied to short-term rates.

Same goes for a firm like PIMCO. The agency gets sweet deals, but connections and credibility only go so far. As short-term rates continue to rise, they crimp PIMCO’s borrowing model.

Which is why we’ve been down on leverage lately. We want bond funds that are less susceptible to rising short-term rates.

Which is why we picked on PIMCO Dynamic Income Fund (PDI) five weeks back:

PDI uses a lot of leverage—48% to be exact! This is great when rates are low. Borrow for 1%, earn (say) 7%, it’s a slam dunk.

But money is more expensive today, with short-term rates approaching 5%. Even now it still makes sense for PDI to use leverage—it’s just not as lucrative.

PDI traded at a premium to its NAV then. We contrarians reasoned this didn’t make much sense. Besides, at the end of the day, we always demand discounts from our CEFs.

But the big dividend! Many income investors were tempted by the big headline yield. We held strong. And PDI dropped 5% in five weeks! It was a smart stay away.

These deals are, in fact, unique to CEFs. Unlike their mutual fund and ETF cousins, CEFs have fixed pools of shares. Which means they can trade at premiums and discounts to the values of their underlying assets, their NAV.

Until rates reach their eventual ceiling, bond funds—especially those trading at premiums like PDI—are “avoids” for me. After all, why overpay when we have cherries like DLY trading for 92 cents on the dollar?

DLY: 3 Ways to Win

Brett, why not DSL—it pays 11%?! I realize we have readers who never made it past the biggest yield on the board. Yes, DSL pays 11%. It levers up a bit more than DLY to do it (29% versus 23%). That’s all right, but in this fickle financial world, give me the safer fund and the bigger discount.

After all, they are run by the same people! The disparity in valuations doesn’t make much sense. We’ll gladly take advantage.

It’s been a rough 18 months in the bond market. Bargains are starting to pop up. We’ll grab them as they become available starting with the maraschino dividends.

Another sweet thing about CEFs is that many pay their dividends monthly. In this foggy financial climate, it’s tough to beat being paid every 30 days.

This is my favorite way to retire. Why worry about stock prices? It’s pointless when we can simply buy 7%+ dividends (like these!) that are paid monthly.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.