“Buy bonds!” – Contrarian Outlook, 2H 2022

Two years later, the herd finally hopped on our fixed-income bandwagon…

“Buy bonds!” – Wall Street, 2H 2024

Yes, it is satisfying to be right. But it also makes me nervous that mainstream (“vanilla”) investors now agree with us.

If you bought with us, you are sitting pretty. On the other hand, if you are trying to put new money to work today, this is a challenging time. I don’t like buying high and I especially avoid purchasing popular names.

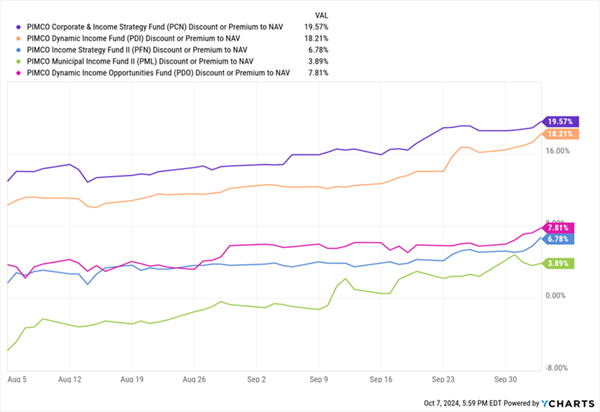

Case in point, my favorite PIMCO products in the closed-end fund (CEF) space.

I’m an admitted PIMCO fanboy (I have a used copy of The Bond King: How One Man Made a Market, Built an Empire, and Lost It All that you can borrow!). I can be objective, however, and objectively speaking, PIMCO has some of the best fixed-income CEFs on the market.

Two years ago, Wall Street had these high-quality PIMCO funds marked as dead money! Today, they command premiums instead of the discounts we contrarians fawned over:

PIMCO Has Become Even Pricier

Thus we look past PIMCO for under-owned CEFs that still dish big divvies and still trade at discounts to their net asset values (NAVs). Let’s dive into a trio that yields up to 11.6%.

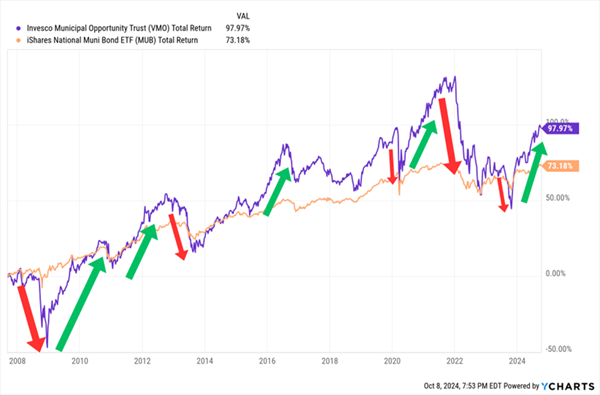

Invesco Municipal Opportunity Trust (VMO)

Distribution Rate: 7.4%

Discount to NAV: 7.8%

Municipal bond funds accounted for more than 75% of the fixed-income CEFs that popped up on my discount radar. Among them is Invesco Municipal Opportunity Trust (VMO), which is issued by one of the largest players in the muni CEF space.

VMO doesn’t have much of an investment bent past targeting tax-exempt debt, but it’s aggressive. For one, nearly 20% of the portfolio is in junk or unrated bonds; not only is that much higher than ETF standards like the iShares National Muni Bond ETF (MUB) and SPDR Nuveen Bloomberg Municipal Bond ETF (TFI), but even VMO’s investment-grade munis are a little farther down the quality scale.

But Invesco Municipal Opportunity’s real bite comes from management’s eagerness to use debt leverage, currently at a high 37%. Despite having $745 million or so in actual assets, its total investment exposure is closer to $1.2 billion. This helps to amplify income—the 7.4% distribution rate dwarfs comparable ETFs and comes out to an 11.4% tax-equivalent yield for those in the highest federal tax bracket—but it also makes VMO’s price action look downright aggravated compared to plain-vanilla index funds.

VMO: A Volatile Way to Lock In Municipal Income

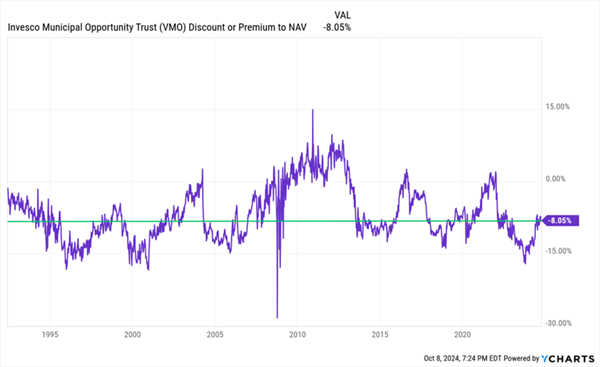

This Invesco CEF’s recent growth spurt has brought its current 7.8% discount to NAV almost perfectly in line with its five-year average. But looking across more than three decades’ worth of data from this well-established fund, VMO’s discount has a propensity to narrow even further in each up-cycle.

It’s an Up-and-Down Fund, But VMO’s Price Is Still Attractive

Flaherty & Crumrine Preferred Securities (FFC)

Distribution Rate: 6.6%

Discount to NAV: 6.1%

We won’t find as much income potential in preferreds right now, but we will find a total return-potential juggernaut in the form of Flaherty & Crumrine Preferred Securities (FFC).

FFC comes across as a standard-issue preferred fund. It’s heavily tilted toward the finance sector, with 55% of assets in banks and another 20% or so pegged to insurance companies. (I like the intra-sector diversity. Insurers don’t have the same liquidity issues some banks can run across if customers decide to withdraw all at once.)

Management also favors huge, established financial firms with healthy balance sheets—names like MetLife (MET), Citigroup (C) and Morgan Stanley (MS) pepper its top holdings.

This Flaherty & Crumrine CEF also provides some international diversification. Preferred funds can vary wildly on this front; in FFC’s case, 30% of the portfolio is invested in predominantly developed countries such as France, Canada and the U.K.

The two places where FFC stands out?

- Credit quality. Management’s weighting toward investment-grade preferreds is about 5 to 15 percentage points lower than what we see in basic ETFs like the iShares Preferred and Income Securities ETF (PFF).

- Leverage. At 38% in debt leverage, FFC is every bit as feisty as the aforementioned VMO.

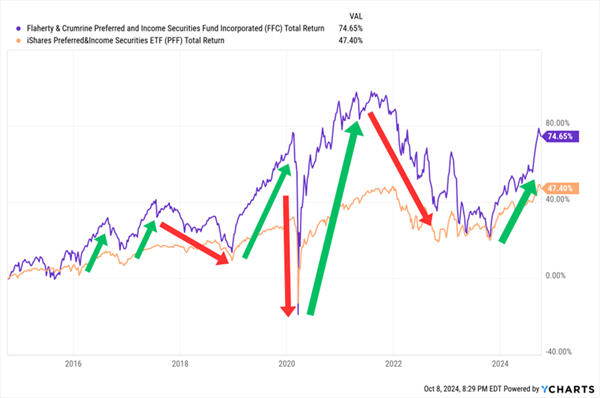

Unsurprisingly, this leads to massive swings in this Flaherty & Crumrine fund’s returns. When I wrote about FFC more than a year ago, I said, “The result, over the past decade, has been a roller-coaster performance—one where the difference between outperformance and underperformance is stark, and largely determined by your entry point.” At the time, its longer-term returns were almost indistinguishable from a basic preferred index.

Fast-forward to just a few months ago, and I wrote that when bonds take off, preferred funds will join them. They have, and that includes FFC, whose most recent run significantly changes the calculus since last year.

The Latest Burst of Outperformance From FFC

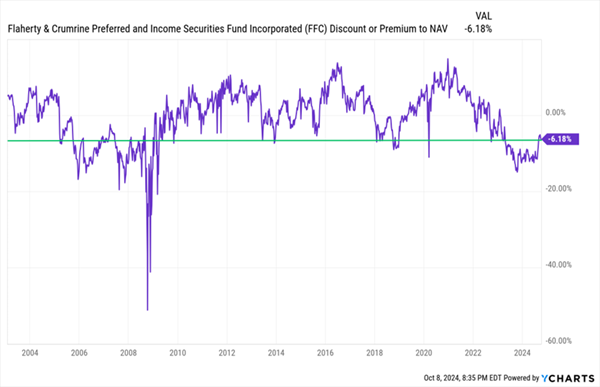

Meanwhile, FFC is still cheap any way you slice it. A roughly 6% discount to NAV is much better than its five-year average, which sits close to fairly valued.

And Longer-Term, FFC Is on the Inexpensive Side of History

abrdn Asia-Pacific Income Fund (FAX)

Distribution Rate: 11.6%

Discount to NAV: 6.3%

The abrdn Asia-Pacific Income Fund (FAX) represents a third way to invest outside of basic market favorites like corporates: emerging-market debt.

This abrdn CEF invests in emerging-market sovereign, quasi-sovereign and corporate debt from Asian and Pacific countries such as India, Indonesia and China. Its weighting toward investment-grade credit is actually similar if not higher than many of its basic index counterparts, though it leans much more heavily on BBB-rated bonds (48%) for that exposure.

EM debt tends to favor U.S. rate cuts, as they provide cover to emerging-market central banks that might want to loosen policy even further. Plus, lower U.S. rates are generally better for EM investing in general, as investors look abroad toward riskier assets for better sources of return and yield.

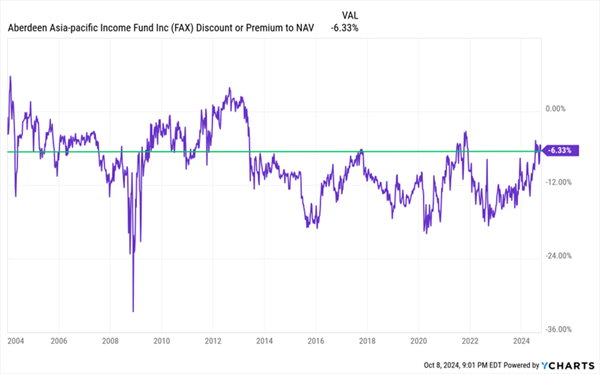

The market might be wise to it, though. FAX’s 6%-plus discount to NAV is roughly half of its five-year average and actually represents one of its most expensive prices of the past decade.

How a 6% Discount Isn’t Necessarily a Bargain

Asia-Pacific’s biggest strength, like the other two CEFs mentioned here, is a willingness to take on debt to amplify its highest-conviction bets. Leverage currently sits at a crisp 30%.

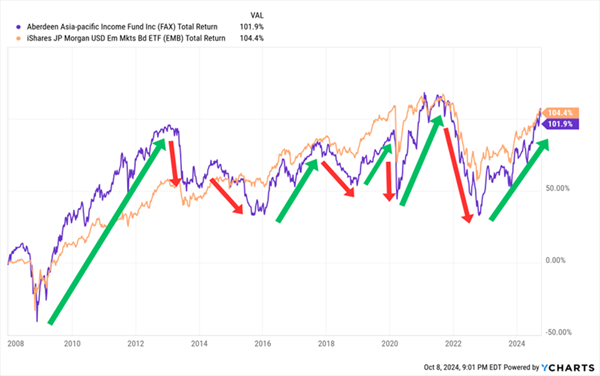

We’ve used this to our advantage in the past, owning FAX at times to turbo-charge our returns in emerging-market debt. But we have to be agile and keep a close eye on it, because it can turn ugly on a dime.

FAX’s Latest Recovery Is Underway, But Will It Last?

Think You Can’t Retire Comfortably With $500,000? Think Again!

The gold standard portfolio size for a secure retirement used to be a million bucks.

Then it slowly floated up to $1.1 million.

Then it became $1.3 million.

And the latest pop survey I’ve read says that number is now nearly $1.5 million!

Yes, you’ll probably need that much if you invest in the market’s most saturated blue chips—chintzy mega-corporations with mammoth market caps but miserly yields.

But if you don’t settle for the same familiar names every robo-advisor stuffs their clients into, you can retire on dividends alone with just a third of that nest egg!

All you need to do is ditch the crowd and look where they aren’t—like the stable, secure payouts I’ve targeted in my 9% “No Withdrawal” Retirement Portfolio.

My “No Withdrawal” portfolio can do what your average blue-chips-and-basic-bonds retirement portfolio can’t: Allow you to retire on dividend and interest income alone, without ever having to touch a penny of your nest egg.

It might sound like hype, but it’s simple math. I’ll even show you my work!

- Take a $500,000 nest egg,

- Put it to work in a portfolio yielding 9%, on average,

- You’ll earn a $45,000 “salary” of dividends and interest from your retirement account.

Tack on your Social Security payments, and you’re looking at a much friendlier retirement budget once you call it quits at work.

And if you have an even bigger pile of cash to plug into our 9% “No Withdrawal” Retirement Portfolio? Well, even just the thought brings a smile to my face—and I bet you’re wearing one, too.

Let me show you the stealth payout plays that Wall Street overlooks—names that do yield the 9% or more that we need to coast forever on dividends alone. Please click here and I’ll share how to get these secure funds with very generous dividends!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report