These days, many of the dividend investors I talk to feel squeezed between:

- Weak yields (which have plunged as stocks have surged) and

- High taxes (which are likely to rise further).

You’re no doubt feeling this pinch, too. The good news is that there’s an investment that lets you wiggle out of this trap, regularly offering steady-as-she-goes dividends up to 5%.

There’s another nice twist that works in your favor here, because these payouts are tax-free, so they could be worth a lot more to you—I’m talking payouts north of 7.5% with tax savings factored in, depending on your tax bracket.

I’ll single out three of these timely picks in a moment, complete with tickers, dividend yields and the discounts we can expect on them. Better still, I’ll rank them from worst (a ho-hum ETF yielding just 2%) to first (a smartly run closed-end fund, or CEF, throwing off a 4.6% payout that, as I just said, is worth much more once you factor in the tax savings).

Escaping the Low-Dividend/High-Tax Trap

Anybody hunting for reasonable investment income these days knows what a tough slog it is: the typical S&P 500 stock yields 1.3%. Ten-year Treasuries? The same! (And you’ll have to lock up your cash for a decade.) Yields that low instantly devoured (and then some) by today’s higher inflation.

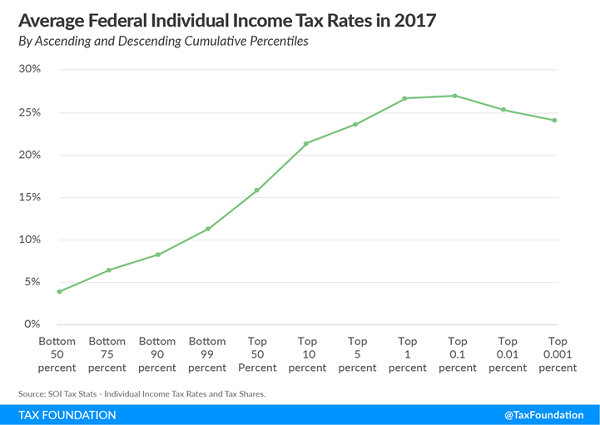

Then there’s the tax side: consider that the average American household pays a 20.8% federal tax rate, according to the Tax Policy Center. That’s not including other levies like state taxes, property taxes, school taxes, sales taxes and so on.

And that 20.8% rate itself is misleading because of the many Americans who pay no income taxes at all. Looking at the top income earners, the average goes up to 25%—again, before we consider the other taxes out there.

This chart is from 2017, but the situation is broadly the same today. In the most extreme cases, you might find nearly half your income going to the tax man. Which brings me back to the investments we’ll dive into today (hang tight, names and tickers are on the way).

High Dividends, Zero Taxes, Incredible Stability: Our Unbeatable Muni-Bond Trifecta

I’m talking about municipal bonds.

Called munis for short, municipal bonds are loans that agencies and local governments take out from the public through rounds of fundraising. In exchange, investors get interest income from these agencies and governments. This is where our tax “gift” comes in, because for most Americans, this income stream is 100% tax-free.

That’s a big deal because it means you can get a passive income stream through muni bonds without pushing yourself into a higher tax bracket or raising your tax burden. Plus, muni bonds are a very low-risk place to put your money.

Steady Wealth Preservation

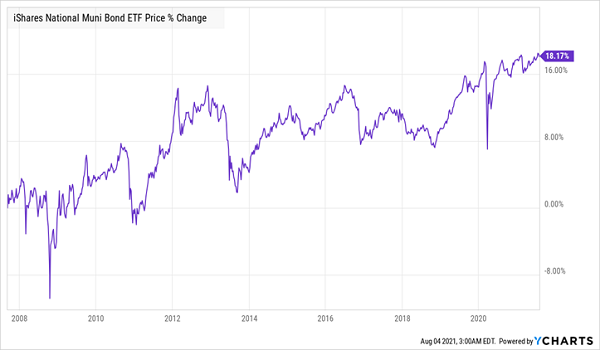

Here you see the price return (not including dividends) of the muni-bond market since 2007, before the subprime-mortgage crisis. Throughout that time, muni bonds stayed above their initial value, except for a brief period in 2009 and again for a bit when US Congress flirted with defaulting on government debt in 2011.

That has given muni investors a nice “base” from which to collect their tax-free dividends (which, again, can run up past 7% for you, depending on your tax bracket).

Otherwise, muni bonds have been a great store of wealth for years, while providing tax-free income at a higher rate than any savings account.

So muni bonds are the way to preserve your wealth, get tax-free income and lower your tax burden. And while you can go to a municipal-bond broker and buy bonds individually, a fund of municipal bonds is a much better option.

That way you’ll cut your risk through diversification and get access to better-quality bonds than the ones brokers typically offer individual investors (big players like BlackRock, with its $9 trillion in assets under management, get access to the best muni bonds long before retail investors are invited in).

But what muni-bond fund should you get? Read on as I show you three options to legally avoid taxes and get a tax-free income stream. And yes, they’re ranked in order of appeal, according to benchmarks like dividend yields, past performance and management quality.

Worst: The iShares National Muni Bond ETF (MUB)

The price chart I just showed you, on the performance of the muni-bond market as a whole, is for the benchmark ETF for munis, the iShares National Muni Bond ETF (MUB). It’s a go-to for most muni-bond investors, and as with many ETFs, its main appeal is its low management fee (a mere 0.07% of assets). MUB is an easy way to get broad exposure to the entire muni-bond market without having to think too hard about it.

The only problem? MUB’s dividend is just 2%. Sure, that goes up when you include the tax benefits, but I prefer to go with CEFs because they give us a higher starting yield (some, like the two will move on to next, boast headline yields more than twice as big as MUB’s).

CEFs almost always outperform MUB, too, due to that institutional advantage we discussed earlier: their managers get the first call when new muni bonds are issued, and they get the pick of the litter. An automated ETF like MUB can’t match that edge.

Better: The PIMCO Municipal Income Fund (PMF)

Our next pick, a muni-bond CEF from PIMCO (which, on a company-wide basis, is the second-largest bond buyer in the world) called the PIMCO Municipal Income Fund (PMF) does what it says on the tin: it invests in munis and works on getting you a big income stream.

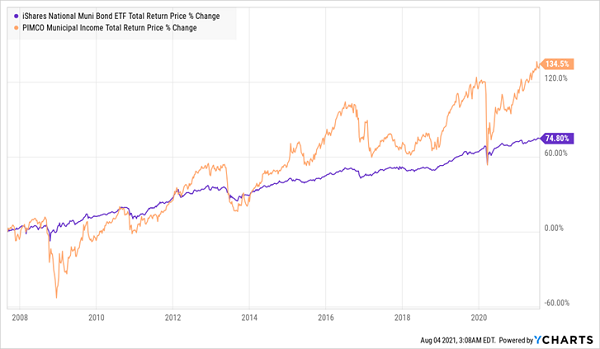

PMF beats MUB on income (its 4.3% yield is more than double MUB’s 2%). And its human edge is apparent in this chart of total returns, including dividends, since MUB’s inception:

PMF Crushes Its ETF Cousin

PMF has tapped PIMCO’s market access and expertise to buy into the best parts of the market, helping it sail past MUB. (And if you go back further, to PMF’s IPO in 2001, it’s more than doubled the return of the broader muni market).

Best: The Invesco Muni Opportunities Trust (VMO)

The only problem with PMF is that investors know it’s a strong fund. As a result, it trades at a 10.6% premium to the value of its portfolio (known as the net asset value, or NAV). In other words, you’re overpaying, to the tune of nearly $1.11 for every dollar of PMF’s assets!

That’s why a better play is the Invesco Muni Opportunities Trust (VMO).

VMO trades at a 1.5% discount to its NAV while paying a bit more than PMF: a 4.6% yield. And the two funds have virtually identical performance records since PMF’s inception in June 2001: a 258.5% total return for PMF and 250.4% for VMO. But VMO’s bargain valuation compared to PMF should give it a bit more upside pop in the months to come.

These 7.3% Dividends (With 20% Upside) Are URGENT Buys Now

As strong as VMO is, it isn’t one of my top CEF picks right now. To get those, I urge you to read the special investor report I’ve prepared on these high-income plays.

The 5 CEFs you’ll discover (including my top pick among muni-bond CEFs) throw off a 7.3% average dividend between them, with the highest payer of the bunch handing you an outsized 8.3 payout!

But the real eye-catcher is the gains on offer. These 5 funds are all trading at massive discounts now—so much so that I’ve got them pegged for 20%+ price upside in the next 12 months!

So let’s say you drop a $100K investment into this 5-fund “mini-portfolio” today. Fast forward to this time next year and you’d have collected $7,300 in dividends. Plus you could easily be looking at another $20,000 in price gains, too!

The time to buy is now, before these 5 funds’ bizarre discounts disappear.

Go right here and I’ll give you full details on all 5 of these 7.3%-paying funds—names, tickers, best-buy prices and everything else you need to know before you buy.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report