If you’ve sat out oil stocks until now, it’s easy to think you missed the boat. After all, oil’s big run has sent shares of producers (and pipeline operators) soaring. That’s meant lower dividend yields—and higher valuations—for folks who decide to tiptoe in now.

But there’s a way we can “turn back the clock” and squeeze 8.1%, 8.7% and even 8.9% dividends out of energy stocks. (These are the actual yields on three overlooked funds I’ll show you in a moment.)

Those are the kinds of yields you could only get back in April 2020, in the teeth of the COVID crisis, when oil stocks were on their backs, their depressed prices sending their yields soaring. These days, folks who buy these stocks independently or through an exchange-traded fund (ETF) have to settle for a lot less income.

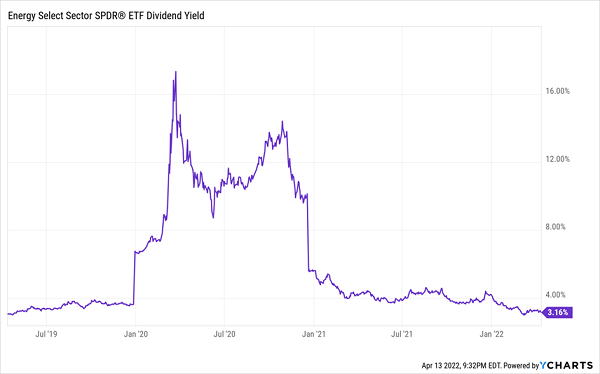

Consider the benchmark ETF for the space, the SPDR Energy Select ETF (XLE), which holds shares of major producers like ExxonMobil (XOM), Chevron (CVX) and ConocoPhillips (COP). Back in March 2020, its yield spiked north of 15%! But (no) thanks to the energy rally, it pays just over 3% today:

XLE Only Offers a Decent Yield in Heart-Stopping Plunges

I’m not telling you this to put you off buying energy stocks now. Far from it! I’m writing to tell you that we can still get big yields from energy without having to buy in a selloff, and at a discount to today’s prices. The key? My favorite investments: high-yield closed-end funds (CEFs).

Let’s talk tickers, with those three energy-focused CEFs (yielding 8%+) I mentioned a second ago:

Energy CEF No. 1: An 8.1% Payer That Crushes Its Benchmark

Let’s start with the lowest yielding of our trio, the “mere” 8.1%-paying Tortoise Energy Infrastructure Fund (TYG), which still pays well over double what XLE gets you.

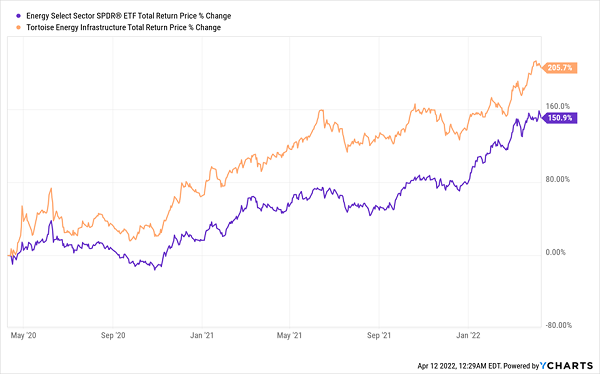

As the name suggests, TYG invests in the companies involved in the basic infrastructure of producing and distributing energy, which is why Williams Companies (WMB), NextEra Energy Partners (NEP) and ONEOK (OKE) are top holdings. These stocks have helped TYG far outperform even the record-beating two years the broader energy sector has put in.

TYG Outruns a Hot Oil Market

TYG also trades at the largest discount of our trio, with a market price 17.6% below the actual liquidation of its portfolio. This discount to net asset value (NAV, or the value of the stocks in TYG’s portfolio) means we’re essentially paying 82 cents for every dollar of TYG’s assets.

Energy CEF No. 2: An 8.7% Payer With Upside Ahead

Next up, the Kayne Anderson MLP Fund (KYN) similarly trades at a 15.3% discount to NAV while offering a slightly higher yield of 8.7%.

That’s because of its focus on master limited partnerships (MLPs), which exist to pass through income from energy projects directly to investors in the form of dividends. Leading MLPs like MPLX (MPLX), Enterprise Products Partners (EPD) and Energy Transfer LP (ET) are its biggest holdings.

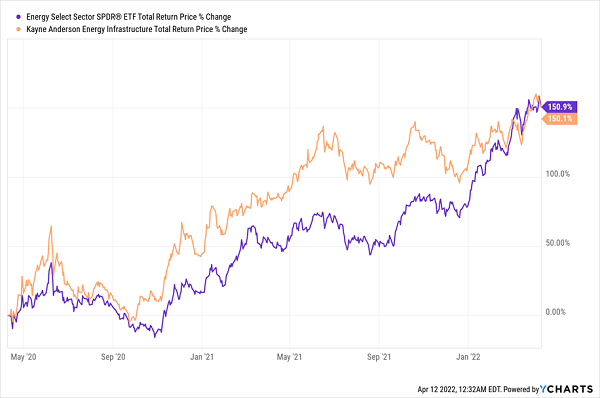

Matching the Market

KYN’s recent return, matching the energy market, isn’t as impressive as that of TYG, but that also means there’s more room for KYN’s assets to climb if oil prices continue to rise (or even hold steady).

The fund also has less exposure to producers, and with MLPs more geared to income-seekers, it hasn’t been bid to the levels TYG has. That explains KYN’s higher dividend and opens the door to further upside as investors look to hedge on the always-unpredictable energy sector by getting more of their return in cash.

Another thing you may have heard about MLPs is that they send you a complicated K-1 package for reporting the income you get from these investments. But you don’t have to worry about that when you buy your MLPs through KYN. The fund sends you a simple Form 1099 at tax time.

Energy CEF No. 3: The Ultimate Inflation Hedge

Finally, there’s the GAMCO Global Gold, Natural Resources & Income Fund (GGN), which is priced at a narrower 6% discount to NAV. Part of that might be because of its high yield, at 8.9%. Another part is likely because GGN is one of the few funds that lets you buy both gold stocks and energy stocks—both proven inflation hedges—in a single buy.

And GGN holds leading companies in both areas, including Exxon, Chevron and Shell plc (SHEL) on the energy side and leading gold miners such as Newmont Corporation (NEM), Barrick Gold (GOLD) and Franco-Nevada (FNV).

There’s another reason to consider GGN: its recent performance gives it room to run.

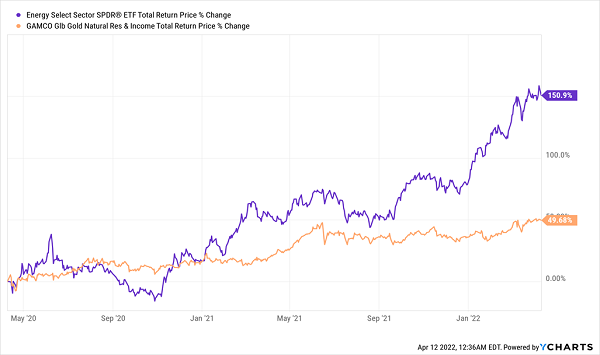

A Modest Two Years

The relatively low returns for GGN over the last two years make sense; in 2020 and the first half of 2021, inflation wasn’t a top-of-mind concern, but rising inflation worries helped bump up the fund’s returns in the middle of last year.

But the fund has since leveled off, even though inflation expectations remain heightened, setting it up for another upside bounce. While you wait for that to happen, you’ll be pocketing the fund’s rich 8.9% yield.

Income Alert: These 4 CEFs Yield 7.5% (and Are Primed to Pop 20%+)

Grabbing funds at big discounts like these is the key to pocketing big profits in CEFs. Here’s how it works:

- Step 1: Buy a CEF trading at an unusual discount and begin collecting its outsized dividend payout (as mentioned, 7%+ dividends are common among CEFs).

- Step 2: Wait for your unusual discount to disappear, catapulting the price higher as it does.

- Step 3: Collect your 7%+ dividends the entire time!

I’ve uncovered 4 CEFs trading at such deep (and frankly bizarre) discounts that I’m expecting these markdowns to vanish quickly, flinging these funds’ share prices upwards.

My forecast? 20%+ gains for each of these funds over the next 12 months.

Your average dividend yield: 7.5%. And ALL of these funds pay you monthly, right in line with your bills. The names of all 4 are waiting for you now. Click here to learn more about my CEF investing strategy—and get access to these 4 smartly run income funds now.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report