Raise your hand if you want to actively work for income in 2024.

(Please note your dividend strategist already has his pointer finger in the tip of his nose. Not it!)

Here at Contrarian Outlook, we prefer passive dividend income to active income, thank you very much. Because trading hours for dollars is, let’s just say it, such a drag.

A job? Tired. Dividends, meanwhile, are wired. Since ‘tis the season for resolutions, let’s discuss my top four to retire on dividends in 2024.

Dividend Resolution #1: Project Our Income

If you’re a serious dividend investor, I hope you took my advice last week and grabbed your risk-free trial to Income Calendar. This is a tool created by our team specifically for income investors like you and me.

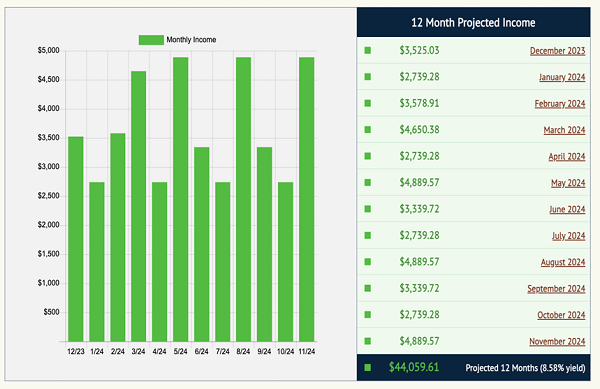

Check this out—12 months’ worth of dividend projections, down to the penny!

12 Months of Projected Dividends

Source: Income Calendar

IC is like having our very own personal assistant—or AI tool—track and project our dividend income. Except IC is better because it understands the nuances of dividend payments.

There is no artificial intelligence that can simulate what we built in IC using actual intelligence and dividend investing experience. If you’re a serious dividend investor, Income Calendar is a “must have” for 2024.

Dividend Resolution #2: Buy Energy Stocks on Dips

Energy dividends are likely to remain a healthy portion of our income portfolios in 2024. After a mega-rally in nearly everything since October, energy stocks may be the only thing investors still loathe.

But the Federal Reserve’s recent pivot could be very bullish for oil prices. So much so that the Fed may regret its latest Wall Street pillow talk as the year progresses. If the economy accelerates and inflation reignites, crude oil prices could boom.

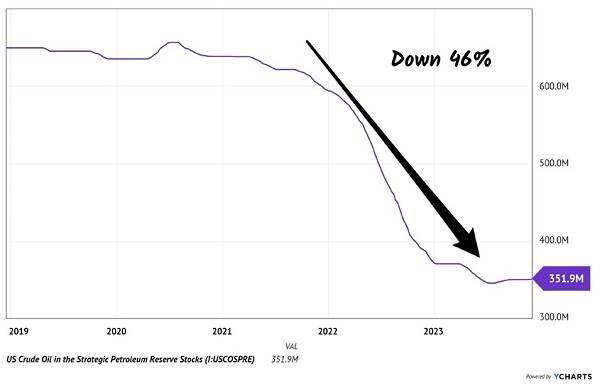

If that happens, the “rainy day” stockpile of oil, called the US Strategic Petroleum Reserve (SPR), won’t be available for any future inflation rescue. We’ve already burned through 46% of these barrels in recent years (yikes). America began cooking through supply as fast as your editor tosses logs into his backyard Solo Stove:

SPR Now Light on the Reserve Part

Since 2021, we’ve swallowed 300+ million barrels of oil. The “emergency” was inflation. I suppose it worked, but our rainy-day Texas Tea fund is down by nearly half.

If we saved for two rainy days, we have one left! In theory, the government is supposed to replace the barrels they’ve burned. And now, with oil cheap, our elected officials can buy low.

In practice, I’d be shocked if that happened in an election year. Uncle Sam as a buyer drives up the price. No bueno for voters.

Still, the SPR is more or less tapped out for the time being. Uncle Sam can’t keep withdrawing. This is supposed to be an emergency fund.

With SPR supply coming off the market, crude has a catalyst for higher prices. Supply is down, so… (fill in the Econ 101 blanks!)

…bullish for oil! Meanwhile the black goo is 20% off its recent highs and it’s one of the most despised assets on the planet because, well, it’s down. (Talk about circular reasoning!)

We contrarians like low. That’s where the money is made.

Remember this time last year when I suggested we book profits on Exxon Mobil (XOM)? That was a good time to sell, as XOM has indeed pulled back with oil. The stock has underperformed the S&P 500 by more than 25% since we kicked it to the curb. This is a nice time to buy XOM back.

Dividend Resolution #3: Demand Discounts from Bonds

For the first time in a decade, bonds actually pay.

But which bonds do we buy? Not the popular ones!

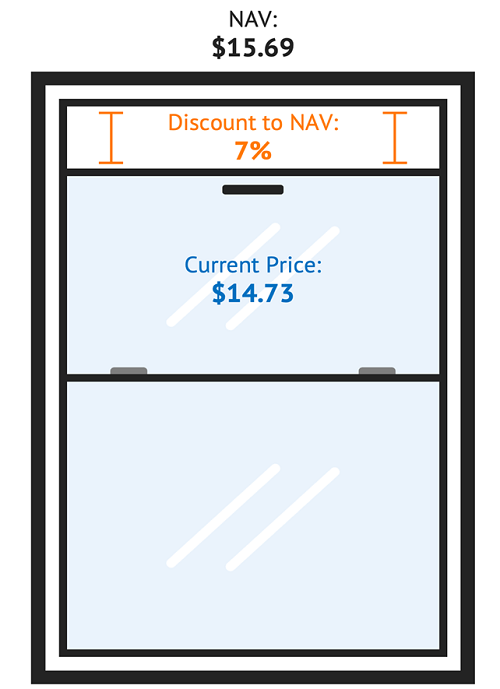

Industry benchmark iShares Core US Aggregate Bond ETF (AGG) trades for fair value and yields 4.3%. It always trades around fair value because, as an ETF, iShares will simply issue more shares when investors demand AGG. No deals here.

DoubleLine Yield Opportunities Fund (DLY), meanwhile, trades at a 7% discount to its net asset value (NAV) as I write. Plus, it pays 9.6%.

Why the discount? You got me. The “Bond God” Jeffrey Gundlach runs the portfolio at DLY. He’s as good as it gets. Yet this fund trades for just 93 cents on the dollar today:

Strange things can happen in the world of closed-end funds. Let’s take advantage of them.

Dividend Resolution #4: Pursue Monthly Dividend Payers

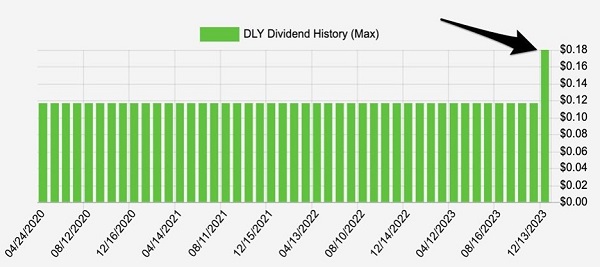

Another great feature of DLY is that it pays monthly. Check out this steady dividend history:

The “holiday payment” at the end is a special dividend declared by DLY. This isn’t officially counted in the fund’s 9.6% yield. Think of it as a bonus—and another reason why DLY is the maraschino cherry of bond funds.

Bonus Dividend Resolution #5: Try Income Calendar Risk-Free

Let me know if this morning routine sounds familiar, in no particular order…

- Stumble out of bed…

- Pour a glass of water…

- Measure out our “wake up” dose of pills and/or supplements…

- Check the financial markets.

I’m currently taking heaping doses of Vitamin C and turmeric to help with my Achilles tendon rehab. But I don’t take those until breakfast–with food.

My point here is that no matter your routine, you and I have enough to keep track of. Which is why we designed the Income Calendar tool to automatically track and project our future dividends.

It’s a new year, which is the perfect time for you and me to begin new routines. Health is great and all, but let’s talk wealth. Dial in your 2024 dividends with your risk-free trial to Income Calendar here.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report