Even with the S&P 500 back on the rise, we still have a shot at serious upside. And we’ll double up our dividends in short order, too. We’ll do it by snagging some of the fastest-growing payouts on the planet.

That’s not all—we’ll also buffer our payouts against the next crash by stocking up on companies with “fortress” balance sheets, specifically firms whose cash holdings dwarf their debt. Dividend-payers like these—I’ve got four examples for you below—will (eventually) dole out their cash to us in three ways:

- Investing in the business,through R&D spending and capital expenditures, fueling their earnings per share (EPS) and, by extension, their share prices.

- Buying back shares, which cuts the number of outstanding shares and grows EPS as a consequence. You and I both know that where EPS goes, share prices follow. Buybacks also make a company’s dividend safer, because it’s left with fewer shares on which to pay out.

- Boosting their dividends! This is my favorite approach because a rising dividend acts like a magnet on the share price, pulling it higher with every hike (we’ll see some examples of this below). You also build your yield on cost fast, with each payout increase boosting the yield on a buy you make today.

You may not realize it, but cash-rich companies are more common than ever. That’s because during the onset of this crisis, many firms (like many of us) stashed away cash, to the tune of $340 billion through the first half of the year. As of June 30, S&P 500 firms were sitting on a record $1.9 trillion.

As we move toward the other side of this mess, that cash will spill into investors’ pockets through the three channels I mentioned above. These four companies are primed to turn on the spigot:

Best Buy (BBY)

Dividend yield: 1.9%

5-year dividend growth: 96%

Cash on hand (minus long-term debt): $4 billion

The retail landscape is riddled with yield traps like fallen department-store king Macy’s (M), which tempted folks with its 7%+ yield (due to a monumental drop in its share price!) for months before tossing its payout over the side in March.

Don’t count Best Buy among that bunch—it has two lures its brick-and-mortar cousins can only dream of. The first is its solid online operation, which is the third-biggest electronics peddler on the Internet, behind only Amazon.com (AMZN) and Apple (AAPL). Best Buy’s stores play a role here, as 40% of its online buyers opt to pick up their order at the nearest outlet, giving Best Buy a nice upsell opportunity.

Source: Best Buy 2019 annual report

Best Buy’s second advantage is its Geek Squad service, which is a lifeline for anyone triggered by the “blue screen of death” in these days of working from home. And if you’re heading to Best Buy to resuscitate your old computer, you might just be tempted to buy a new one instead (along with a new monitor, desk chair or whatever else you need to make your workspace comfortable).

Best Buy’s $4 billion in net cash supports its dividend, but to be honest, the payout doesn’t need the help; it amounts to just 11% of free cash flow. In other words, Best Buy could boost its dividend fivefold tomorrow and it would still be safe. Add in its solid dividend-growth record and the 1.9% yield on a buy today won’t stay at that level for long.

Microsoft (MSFT)

Dividend yield: 1.1%

5-year dividend growth: 55.6%

Cash on hand (minus long-term debt): $73.2 billion

Microsoft shares were the definition of dead money under former CEO Steve Ballmer. In fact, they were worse, dropping 30% over Ballmer’s 14-year term!

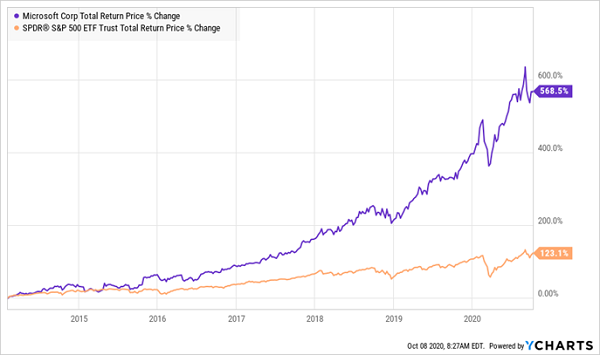

That changed fast when Satya Nadella took over in February 2014 and steered a hard left away from hardware (where Microsoft was thoroughly outgunned by Apple) and toward software and the cloud. Anyone who bought the day he took over has beaten the S&P 500 five times over.

Not Your Parents’ Microsoft

Nadella’s moves have nicely positioned Microsoft for the work-from-home shift. Its Azure cloud service now provides a third of its revenue, and its Microsoft Office suite is thriving as a subscription service, with Office 365’s subscriber count jumping 23% in the latest quarter, to 42.7 million. The service’s revenue rose 19%.

Microsoft pays us through its rising dividend, its rising share price and its share buybacks (it’s among the few firms to keep up its buybacks through the crisis). Nadella and Co. can easily keep paying us in all three ways for decades to come, thanks to Microsoft’s safe payout ratio (33.5% of free cash flow, well below my 50% safety zone) and massive cash hoard.

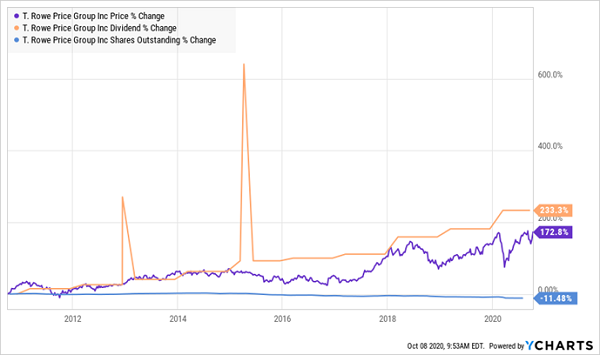

Rowe Price Group (TROW)

Dividend yield: 2.6%

5-year dividend growth: 73.1%

Cash on hand: $2.0 billion (and no debt)

Rowe Price Group was founded in 1937, in the middle of the Great Depression, and the asset manager’s conservative investment strategy reflects that heritage. So does its aversion to debt: it’s one of a very few S&P 500 firms that can boast of having no debt at all.

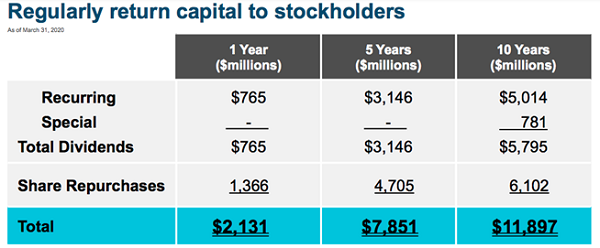

No wonder Price has returned nearly $12 billion to shareholders in the last decade—and it’s lined their pockets in four ways: a rising regular dividend (it’s a Dividend Aristocrat, with 34 years—and counting—of consecutive payout growth), share buybacks, a rising share price and the odd special dividend, too!

Source: T. Rowe Price Group Annual Meeting of Shareholders

As you can see below, the company’s share buybacks (in blue) and rising dividend—including special payouts—(in orange) have nicely inflated the share price (in purple) over the last decade.

Rising Payout, Falling Share Count Boost Price’s Stock

What you see here is a classic “dividend magnet” at work (with an assist from Price’s share buybacks). The rising payout propels the price upward almost point for point, with the gap between the dividend and the share price representing our upside here—it’s only a matter of time until the price “catches up” to the payout.

I’ll leave you with one more catalyst: Price quietly launched its first ETFs in August, and the move looks perfectly timed, with the Fed likely to keep rates low for years. With 10-year Treasuries paying out a meager 0.7%, there’s simply no alternative to stocks—and that will juice interest in Price’s blue chip–focused ETFs.

Costco Wholesale (COST)

Dividend yield: 0.8%

5-year dividend growth: 75%

Cash on hand (minus long-term debt): $5.7 billion

If you missed buying Costco during the toilet paper wars in March, don’t worry—you still have a shot. With a second wave and colder weather around the corner in many parts of the US, Costco is set to post stronger sales for months to come.

It’s already started, with sales jumping 17% in the five weeks ended October 5, 2020, from a year earlier. Those gains should continue as shoppers stock up and Costco faces lower comparable numbers from year-earlier, pre-pandemic times.

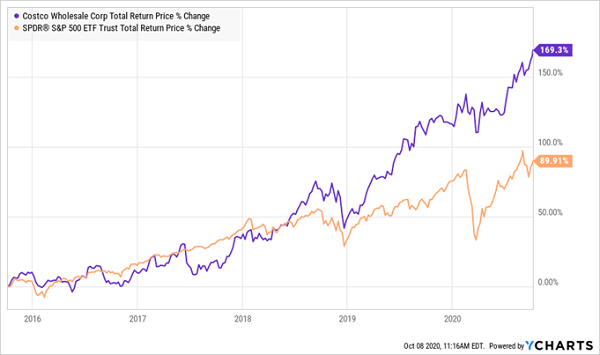

Another thing I like about the stock is that you can buy it anytime and be relatively assured of no-drama gains: Costco sports a five-year beta rating of 0.68, meaning it’s 32% less volatile than the S&P 500. It’s also crushed the index over any timeline you can think of, including a near-doubling of the market’s return in the past five years:

Gains in Bulk for Costco Investors

There are only two issues that might weigh on your returns here: one is the low 0.8% yield, which means if you buy now you’ll be a long time getting your income stream above the 1.7% the typical S&P 500 stock yields right now, even with Costco’s strong payout growth.

The other is that the stock’s share-price growth has outrun its dividend growth, with the price up 145% in the last five years, compared to the payout’s 75% rise. This is the opposite of the “dividend magnet” we just saw with T. Rowe Price.

I can overlook a pattern like that in a company like Microsoft, which is repurchasing shares hand over fist and boasts a $74-billion cash stash (net of debt). But it’s likely to drag on the upside of Costco, which has a smaller cash hoard, few buybacks and a valuation of 37.7-times forward earnings.

None of this is a deal-breaker, in light of the strong trends working in Costco’s favor; it just means the stock may not have as much near-term upside as our other three cash hoarders.

15% Yearly Returns (Forever!)—These 7 Amazing Stocks Get You There.

The four stocks above perfectly demonstrate the returns a surging dividend and well-timed buybacks can give you.

But as strong as they are—particularly Microsoft, Best Buy, and T. Rowe Price Group—they don’t quite make my list of the top 7 dividend growers to buy now.

7 “Hidden Yield” Stocks to Double Your Money in 5 Years

My top 7 dividend-growth picks are so far off the radar I’ve dubbed them “hidden yield” stocks. They all have one thing in common: they’re quietly handing investors growing income streams plus annual returns of 15%, 17.3%, 20.8% or more.

These 7 buys are perfectly positioned to post steady gains through the rest of this crisis and double when we get to the other side. All 7 boast rising free cash flow, deep order backlogs and “fortress” balance sheets—a trifecta of strengths no pandemic, financial crisis or trade war can breach.

I’m calling for 15%+ annualized returns from these 7 “crisis-resistant” dividend plays. That’s enough to double your nest egg every 5 years!

Full details on these 7 standout buys are waiting for you now. Click here to get my complete research: names, tickers, dividend histories and a full breakdown of their operations—everything you need to buy with confidence.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report