Retiring on dividends. It’s the income investors’ dream, right?

It sure beats working for the rest of our lives!

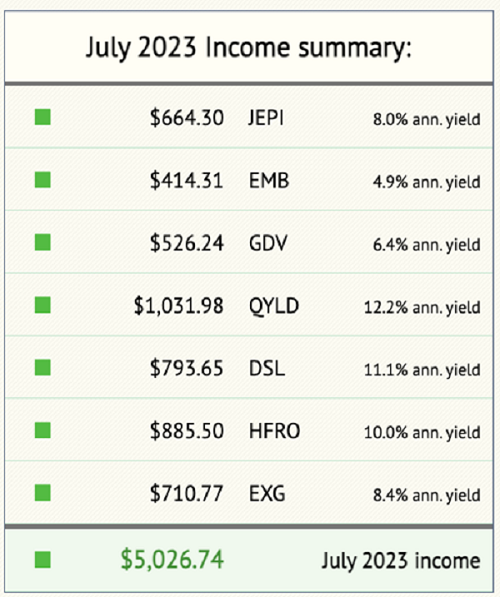

Check out this July 2023 income summary, courtesy of Income Calendar, a nifty tool we built to project dividend income. I loaded up a 10-stock portfolio, featuring popular payers we discuss in these pages:

Source: Income Calendar

This is an “equal opportunity” collection of both picks and pans. Please, don’t run out and buy Global X Nasdaq 100 Covered Call ETF (QYLD) just for its impressive 12.2% annualized yield. Let the Nasdaq bubble pop, at least!

QYLD buys the Nasdaq index and sells covered calls to generate income. Hence the 12.2% yield and the strong correlation with the price of the Nasdaq itself.

QYLD, bubble or not, is a noteworthy inclusion, on track to dish $1,031.98 in dividend income this July. That’s based on a $100K position.

Same goes for JP Morgan Equity Premium Income ETF (JEPI), which pays 8%. And sister fund JP Morgan USD Emerging Markets (EMB), yielding 4.9%. These funds will pay the first week of July:

Source: Income Calendar

The following week, Gabelli Dividend & Income Trust (GDV) and DoubleLine Income Solutions Fund (DSL)—currently yielding 6.4% and 11.1% respectively—check in with ex-dividend dates that second Friday in July. The big dividend wheel in the sky keeps on turning.

The secret to this stuffed Income Calendar? The majority of these stocks pay monthly dividends. Not quarterly. Not yearly. Monthly, baby!

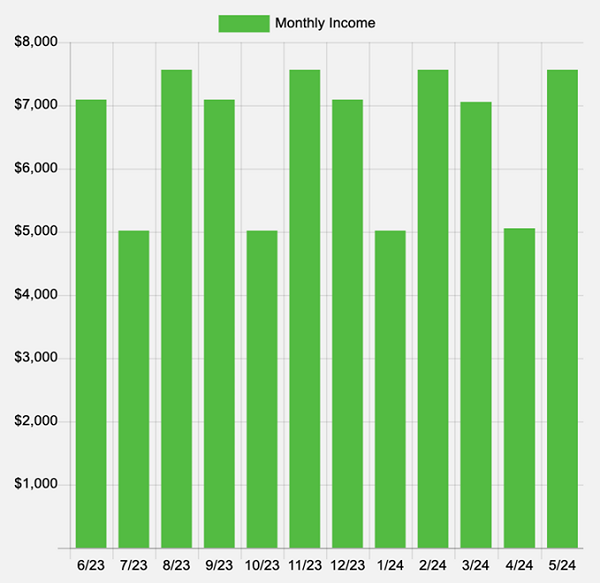

The result is a nice smooth income chart that looks like this. Would you believe that July is actually on the low end? We’re looking at projected income of $78,677.44 over the next 12 months, powered by a steady 7.9% yield:

Source: Income Calendar

These high-paying ETFs and CEFs (closed-end funds) are available to anyone who knows about them. They are tickers “hidden” in plain sight. Sure, the mainstream financial media don’t cover them much. Which is why we contrarian income seekers can have a field day.

Granted, I wouldn’t touch QYLD with the Nasdaq at nosebleed levels. If NVIDIA Corp (NVDA) and Alphabet (GOOG) retreat toward Planet Earth, then QYLD will drop too. Its covered call selling can only insulate against so much downside.

Same goes for a fund like GDV. Namesake Mario Gabelli is a famous value investor, but Mario can only do so much against a pullback. Blue-chip holdings like Microsoft (MSFT) and Alphabet (GOOGL) have been carrying the entire market higher. When they tire, GDV will correct, too.

That’s when we opportunistic contrarians will look to add!

In the meantime, let’s focus on the bond funds, which are still cheap. Last year was historically bad for bonds. Interest rates skyrocketed so bond prices—which trade opposite rates—crashed.

Even a “safe” fund such as iShares 20+ Year Treasury Bond ETF (TLT) was anything but. TLT plunged 31% in 2022!

Bad news for anyone who held it, but great news for folks like us trying to fill up our respective Income Calendars. Thanks to that crash—and the likelihood that long rates topped back in October—bonds are bargains again.

TLT pays 3.2% today. Not bad, but please, dish me that 11.1% from DSL all day long. DSL is managed by “Bond God” Jeffrey Gundlach and his all-star team in Los Angeles. He gets deals we never hear about.

If we’re patient, we can even buy DSL at a discount to its net asset value (NAV). This is a fun feature about CEFs. They are mostly held by individual investors, a fickle group that likes to buy high and panic low. Over the past three years, DSL has averaged a 4% discount, which means its bonds—high-quality stuff handpicked by Gundlach—were selling for 96 cents on the dollar.

But today isn’t average. DSL trades around NAV. So let me direct you to sister fund DoubleLine Yield Opportunities Fund (DLY), which does trade at a 4% discount to its NAV today.

Same management team. Same mandate. A nifty 9.7% yield. And selling for just 96 cents on the dollar. DLY (say it with me: “dilly”) all day, every day.

And DLY’s not alone! We have more big bond dividends trading at generous discounts today, too. Let me give you their tickers, current yields and buy-up-to prices.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report