By now you’ve likely heard that September is the worst month for stocks. It’s all over the media! But September is also a great time to buy a unique type of dividend fund that cashes in when volatility rears up (these funds will pay you blockbuster yields north of 7%, too!).

I’m talking about a special type of closed-end fund (CEF) called a covered-call fund, which makes more money every time the market panics. They then turn that cash over to us in the form of a dividend that crushes anything you’d get on a blue-chip stock or Treasury.

Don’t let the jargon-y name throw you. All you need to know about covered-call funds is that they sell the right for investors to buy the stocks they hold at some future date, at a fixed price. If the stock hits that price, the option buyer purchases it. If not, they don’t. Either way, covered-call funds keep the money they charge option buyers for this right (called a “premium” in option-speak).

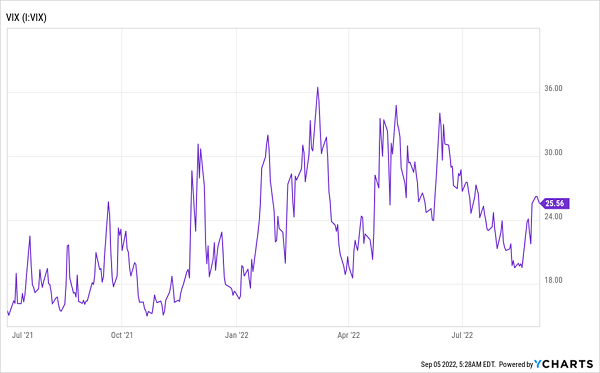

This strategy does well in times of volatility, and we know we’ve had plenty of that this year. The VIX, the market’s so-called “fear gauge,” has been, er, over-caffeinated, to say the least.

Higher VIX = Higher Income for SPXX

Ironically, these premiums also help hedge the fund against volatility, as the additional cash in its portfolio naturally dampens the movements of the stocks it owns.

This Covered-Call Fund Looks Like an ETF—but With an Outsized 7.5% Payout

All of this makes covered-call funds preferable to stocks or index funds, especially in rough markets. And with the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), you get another advantage: it holds all the stocks in the S&P 500—giants like Apple (AAPL), Microsoft (MSFT) and Visa (V)—many of which you likely already own. So when you buy SPXX, you won’t have to change your holdings to get the fund’s lower volatility and (much) higher payouts!

That’s why SPXX is the go-to covered-call CEF. And thanks to its covered-call sales, SPXX sports lower volatility and, of course, that 7.5% payout.

SPXX’s lower volatility and high dividend are why it trades at a premium to net asset value (NAV, or the value of the stocks in its portfolio) today. But that doesn’t mean it’s overpriced! At just 1.3%, SPXX’s premium is small compared to the 10% premium it sported in early 2018, another time when investors were worried about rising rates. SPXX’s premium will likely hit that level again if volatility keeps rising, taking its price along for the ride.

Revealed: 4 Ignored (for Now!) CEFs Paying $8,500 a Year on Every $100K Invested

Covered-call funds are far from the only CEFs we contrarians should have on our buy lists this month.

I’m also pounding the table on 4 other CEFs throwing off an even bigger payout: 8.5%, on average. These 4 funds hold “megatrend” healthcare stocks (whose offerings will be in demand for decades to come as the population ages), top-quality corporate bonds, utilities and blue chip dividend payers with strong cash flows and ironclad balance sheets.

Best of all, these 4 safe dividend payers trade at deep discounts to NAV today, setting us up for double-digit gains to go along with our 8.5% dividends as these discounts (inevitably) vanish. Don’t miss this opportunity. Click here and I’ll give you instant access to these 4 CEFs’ names, tickers, current yields and discounts, and all of my research on each one.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.