Mr. and Ms. Market are manic. Always have been, always will be. My fellow contrarian, they reminded us of this fact yet again.

Fortunately we were zigging while the broader crowd was zagging.

The herd’s “FOMO panic” last week pushed many of our stocks higher. Vanilla investors covered their ill-timed short positions and scrambled to buy bargains. Like the dividend deals we bought in October!

Did you miss out? Have cash suddenly burning a hole in your pocket? If so, no worries, a few select dividend deals remain.

I’m talking about yields up to 12.3% and discounts up to—get this—46%. Nope, that’s no typo. We’ll talk specifics and top five bargains on the board in a moment.

How’d we get here? Just five weeks ago, we chatted about the optimal time to panic—and concluded it would be later:

Please, take that finger off the Sell button.

This is the best buying opportunity since the bank failure panic in March. Vanilla investors are giving away perfectly good dividends.

Let’s grab the bargains.

We specifically highlighted business development company Barings BDC (BBDC). The stock traded for just 79% of its book value. Which meant it was essentially 21% off.

Barings was in the bargain bin because interest rates were spiking. However, we didn’t foresee rates going to the moon. So far, so good on that call.

On cue, investors realized last week that the Federal Reserve was finished with rate hikes. They scrambled to cover ill-timed shorts. BBDC promptly rallied. If you bought shares then, congratulations on your fast 4% gain. Plus, that elite 11.9% yield-on-cost you locked in!

Gabelli Dividend & Income Trust (GDV), meanwhile, has already gained 2%since we called it out three weeks ago. At the time, the 6.8% dividend payer traded at a 17% discount to its net asset value (NAV). That NAV is made up of blue-chip dividend payers and growers such as Mastercard (MA), Microsoft (MSFT) and Honeywell (HON)—which were likewise on the clearance rack.

We win three ways with GDV:

- We collect our monthly dividend payment of $0.11. Again, we’ve locked in a 6.8% yearly yield.

- GDV’s NAV gains as MA, MSFT, HON, and most of the other positions the fund owns rally off of their fall lows.

- As GDV’s discount window narrows from 17%, the price of the fund will gain.

We can think of GDV as the “breakfast beer” of CEFs. There’s a time and a place. We want to imbibe at market lows and refrain when mainstream investors are cheery.

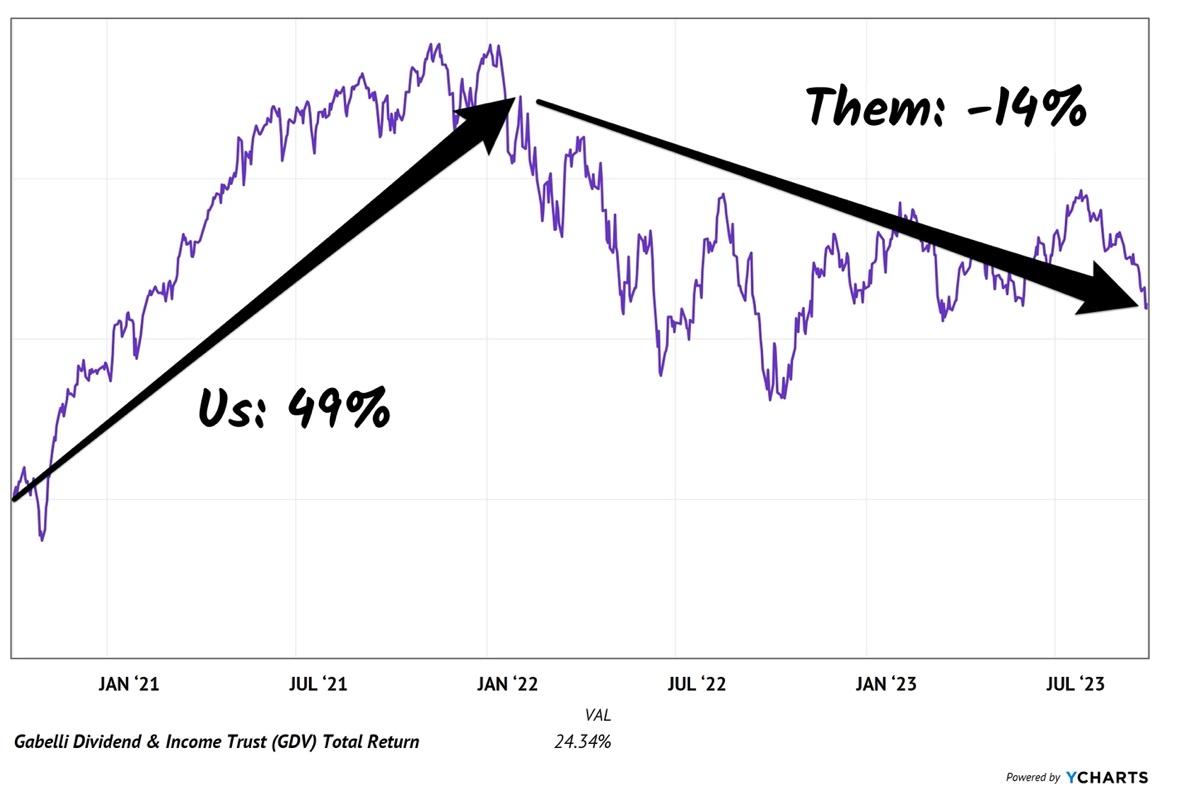

When we last held GDV in our Contrarian Income Report Portfolio from October 2020 until February 2022 it rewarded us with 49% returns in just 14 months. Between the time we sold then and reunited with GDV recently, it meandered through a meaningless existence, losing 14%:

A Time and a Place for GDV

GDV, by the way, paid its dividend every month as promised while dropping 14% in our breakup period. Payout safety was not the issue. The fund declined because the stocks it held dropped in value. This is why we buy GDV at market bottoms only, when nobody else wants the thing.

BBDC and GDV are already rewarding contrarian investors who held their noses and bought. If you missed these winners, then I have a couple pieces of advice for you.

First, wake up. It’s already November. The best month on the calendar (October) to buy stocks has come and gone. Don’t say we didn’t discuss this here, here, here… and here!

Second, don’t chase. Markets are pendulums. The scene flipped from fear to FOMO in a short week! This rally, while it may indeed have legs, won’t move in a straight line. Be patient. Buy pullbacks.

Which dividends should we buy on these dips? Look for the laggards. For example, closed-end funds (CEFs) with discount windows that are still wide open. This is the closest thing to a free lunch that Wall Street ever offers us.

Markdowns to NAV are a feature unique to CEFs. In a perfectly efficient market, they wouldn’t exist. Fortunately, CEFland gets a little looney during panics. Discount windows swing open and are slow to shut.

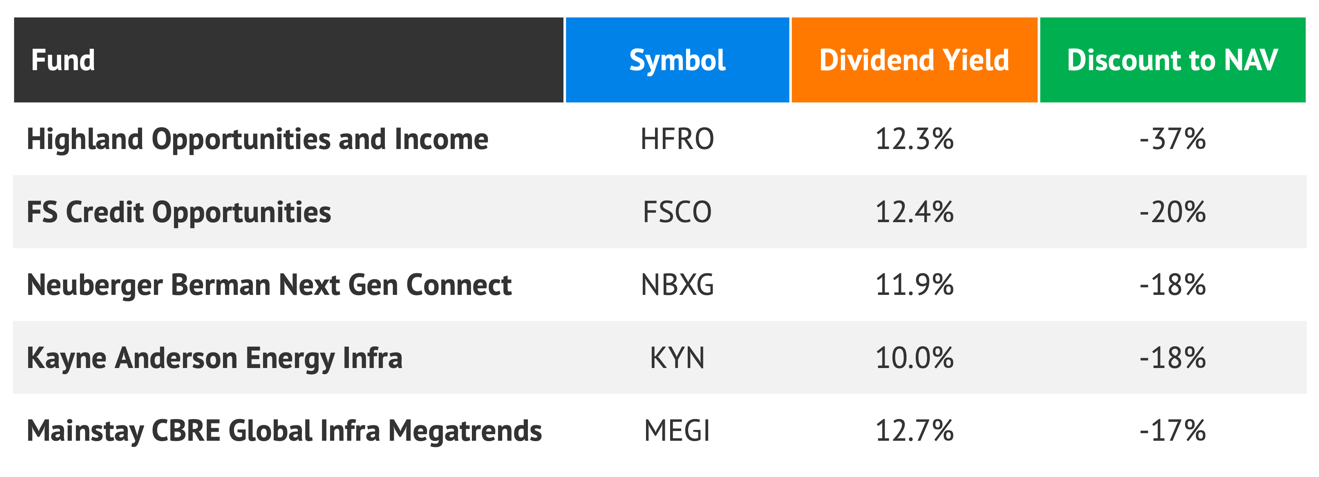

Here are the five biggest 10%+ blue-light specials today with market caps over $500 million:

Highland Opportunities and Income Fund (HFRO) literally trades for dimes on the dollar in the wake of the September and October selloff.

Get this: a 12.3% yield fetching a 37% discount to its net asset value (NAV). Thirty-seven!

Why the Benjamin Graham bargain bin? Is HFRO poorly run? Anything but. Manager Jim Dondero is a savvy income investor with a contrarian mindset.

It’s simple. Jim runs a smaller fund that can’t absorb big bucks. Which puts HFRO’s price at the whims of individual investors who, in year two of a bear market, are skittish to say the least.

Basic investors don’t know HFRO. Yet it’s arguably the cheapest CEF on the planet! Its unheard-of 37% discount to NAV means shares sell for a giveaway 63 cents on the dollar.

This fund is dirt-cheap because that’s what happens when vanilla investors (and “first-level” money managers) panic. Same goes for “newcomer” FS Credit Opportunities (FSCO) which has been around for a decade but only publicly traded for the past year. Hence the discount—CEF investors loathe newness.

FSCO lends to private companies. The fund recently raised its monthly dividend in July—a benefit of higher rates. If the credit markets can hold together, this is a screaming buy. We’ll keep this on our short list alongside HFRO.

Neuberger Berman Next Gen Connectivity (NBXG) acts like a tech mutual fund. NVIDIA Corp (NVDA) is the second-largest holding. NBXG rises and falls with the Nasdaq, though less focused on mega caps. The discount is appealing but we’d better be sure the direction of tech stocks is up before we buy.

Kayne Anderson Energy Infra (KYN) and Mainstay CBRE Global Infra Megatrends (MEGI) round out the top five. These two tend to trade higher and lower with the energy complex, for better or for worse. They are more short-term trading vehicles than long-term buy and holds.

We needn’t force our way into energy with a recession on the way. There are lots of dividend opportunities today, many that will do quite well as the economy slows.

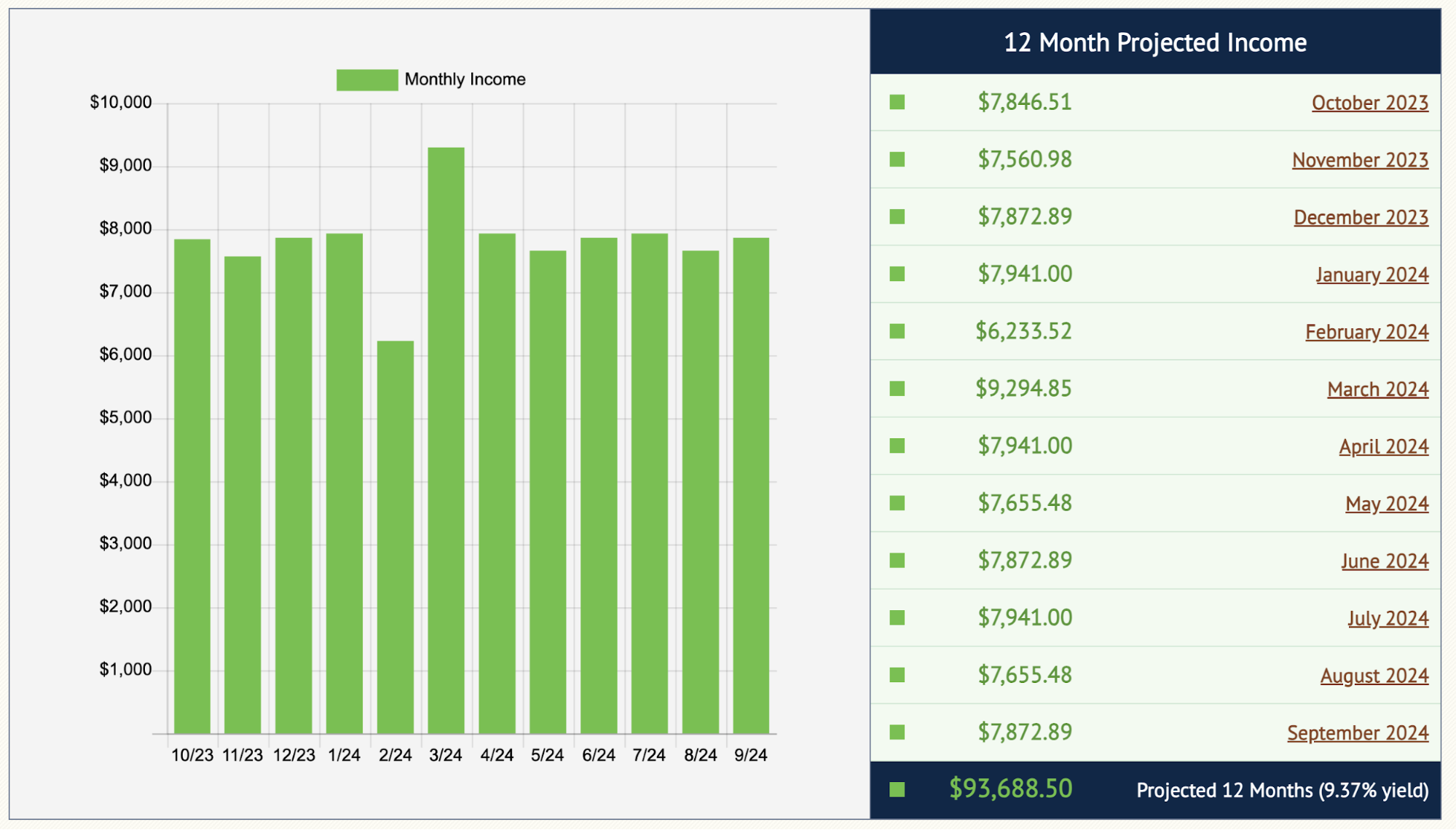

As I write, our Contrarian Income Report yields 9.37%! Dividends above 8% are elite. Above 9% (nine percent!) means we must buy.

Income Calendar: 9.37% Yield for CIR

(Try Income Calendar risk-free here.)

A million dollars invested in CIR stocks today will spin off a nifty $93,688.50 in dividend income alone. As always, principal stays intact. Heck, at these levels, price gains are likely.

In the November edition of CIR, we highlighted five best buys averaging 10.9% yields. Plus, we added a new monthly payer dishing a 7.9% dividend.

I’d love to send you these six picks, but my publisher doesn’t have you as a current CIR subscriber. Fortunately, you can join (or rejoin if you’re an alum) on a risk-free basis right here.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report