Too many folks are letting so-called “safe” yields on Treasuries distract them from the real action these days: 10 “stealth” bond plays yielding way more—I’m talking 9%+ payouts here—that Jay Powell just put on sale.

These deals won’t last: As the Fed pauses rate hikes, bond yields will roll over, driving up prices—and our chance will be gone.

These 10 Bond Deals (Yielding 9%+) Crush Treasuries

These 10 picks, which we’ll get into below, are bond-focused closed-end funds (CEFs), and they’re miles ahead of 2-year Treasuries on every count.

Dividends? These funds yield twice (and more) the 4.7% that 2-year Treasuries pay. That’s critical now, because with 4% inflation, you’re only getting a 0.7% “real” return from a 2-year Treasury. Oh, and our bond “10 pack” pays dividends monthly, too.

Upside? Forget about it with the 2-year. Sure, your principal is guaranteed, but inflation’s cut could amount to 7% or more in the next two years. Our bond CEFs, on the other hand, give us capital gains as bond yields fall, driving bond prices higher. And that’s just the start.

CEFs Have 3 Ways to Pay Us

In addition to portfolio growth, our bond CEFs pay us through their closing discounts to NAV (which propel their market prices higher as they vanish) and, of course, their massive monthly payouts.

To see this total-return “triple play” in action, consider the PIMCO Dynamic Income Fund (PDI), whose forerunner, the PIMCO Dynamic Mortgage & Income Fund, we bought in my Contrarian Income Report service in May 2016 (PCI merged with another PIMCO fund and PDI in late 2021). It’s nicely doubled our money since.

PIMCO is the Apple of the CEF world—a brand CEF fans revere—so its funds rarely trade at discounts. When they do, it’s time to snap them up, as the profits can be stupendous as a PIMCO CEF flips back to the premiums at which it normally trades.

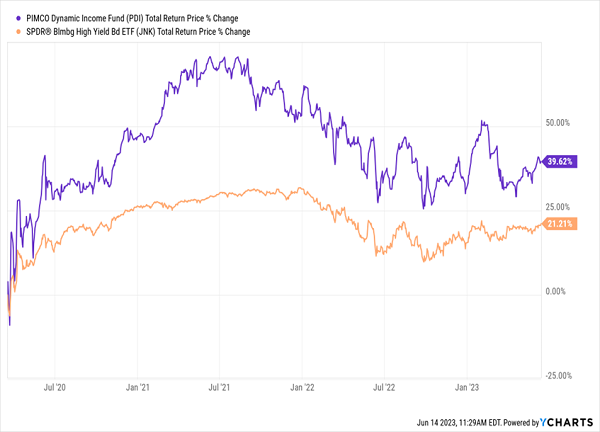

Let’s say you bought PDI during the March 2020 selloff. Back then, it traded at an unheard-of (for a PIMCO fund) 12% discount. Since then, that discount has flipped to a 5.5% premium—driving a sweet 40% return that dusted the benchmark SPDR Bloomberg High-Yield Bond ETF (JNK).

PDI’s Discount-Powered Price Tear Crushes Its Benchmark

No way a Treasury can match that. And through it all, PDI paid its monthly dividend—current yield 14.5%!—even dropping a special dividend in late 2022. This is why PDI still holds a place in our portfolio. (You can get my full analysis of PDI when you take a trial subscription to Contrarian Income Report below.)

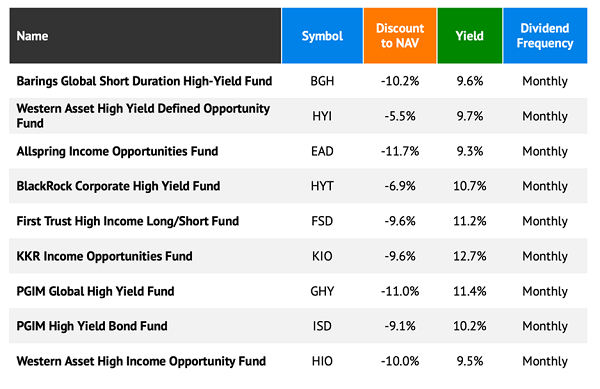

Which brings me to the 10 other Treasury-crushing bond CEFs we’re targeting today. As mentioned, they yield north of 9%. Plus they sport discounts greater than 5% and market caps above $200 million, so they’re plenty liquid for us—but not so big that they’re on the big players’ radar.

Here’s the full menu. Below, I’ll spotlight one of these funds that I see as a particularly interesting standout.

Let’s go ahead and cherry-pick the PGIM High-Yield Bond Fund (ISD), and its 10.2% yield, from the above list.

The fund holds 619 bonds, mainly from US firms. Credit quality is mostly in the B to BB range, just outside the investment-grade line. That’s where the best bond bargains lie, as most big players are limited to investment-grade paper.

Moreover, ISD’s 10% payout has grown—leaping higher twice in 2019, for a combined 24% hike, before holding steady through the ensuing three-year dumpster fire.

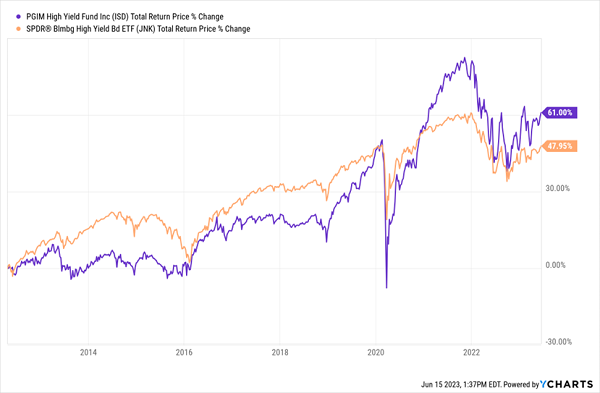

The fund is run by Prudential, a mainstay of the financial world, so you know management gets the call when new bonds are issued. Connections count in bond-land, which is why many bond-fund managers regularly beat their benchmarks.

That, by the way, is the case with ISD, which has soared past the benchmark SPDR Bloomberg High Yield Bond ETF (JNK) since inception in 2012:

ISD’s Human Managers Get the Job Done

Finally, we’re getting a 9.1% discount on ISD. This one sported a discount less than half that in late 2021, so we can look forward to upside as Powell’s rate-rising parade comes to a halt and the discount shrinks, pushing ISD’s price higher.

4 Unsung Funds Whose HUGE Yields Could Pay Your Bills—Starting Today

As I mentioned a second ago, you can get my latest buy/sell advice on PDI, which delivered that outstanding return to my Contrarian Income Report subscribers, with a no-risk trial to the service.

Plus you get my top 4 bond-CEF picks (with yields ranging from 10% to 14.5%), too!

Simply click the link below and I’ll reveal how my dividend-investing strategy could help you pay your bills with your dividends—with as little as $500K invested! I’ll also tell you how to get a free Special Report listing the stocks and funds you’ll need to make this life-changing $500K retirement happen.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report