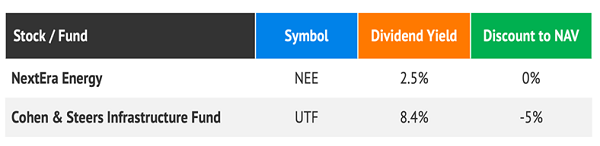

Let’s talk about legitimate financial engineering today. An easy, real and (honestly) no-brainer move to boost a timid 2.5% yield into an 8.4% dividend.

Just type this ticker, not that ticker, and we’ve got it. An 8.4% dividend. Pay up, Wall Street—and give us a 5% discount to boot!

The Wolf of Wall Street would term this type of move fugayzi. Slang for BS. The suits ripping off the little guy.

This reverse fugayzi is our revenge. The wolves are scavenging for this 2.5% yield. We’ll buy the same stock, at a discount, and boost our dividend to an elite 8.4%.

Simply by typing a different three-digit ticker.

The first ticker, admittedly, is no slouch. NextEra Energy (NEE) is the largest developer of renewable energy in North America. Chief Financial Officer Kirk Crews is a dividend hero of mine because he’s the fastest pay raiser in the utility space.

Most “ute” dividends are safe, but their stock prices never move. They are so boring. Which would be OK if they paid more.

Southern Company (SO), for example, yields 4%. If we buy a million dollars’ worth of SO, we’ll collect $40,000 per year in dividend income. That doesn’t quite do it for me.

SO raises its payout about 3% per year. Back in the “good ol’ 2010s” we’d have cheered about this. But a stinkin’ three percent doesn’t even keep up with inflation today. Sad, but true. So, we must demand more than SO.

Which is why I prefer NEE. Sure, on the surface, its 2.5% yield isn’t up to our (admittedly lofty) yield standards. But we’re talking 10% yearly dividend growth with NEE.

With such generous raises, we could imagine that it’s only a matter of time before NEE’s yield climbs to more than 4%. Except we’d be pondering for a while asking ourselves why NEE’s yield never seems to move higher. Year after year, it seems to pay between 2% and 3%.

The reason for the yield consistency is that NEE’s price moves higher along with its payout. That’s great for investors who bought the stock ten years ago because they are sitting on 383% total returns, including dividends.

But it’s like the parable about planting the tree. Yeah, the best time to sow the seed was ten years ago. For whatever reason we didn’t, and here we are today, and a 2.5% current yield isn’t going to cut it.

We need income now.

Well, my contrarian friend, Cohen & Steers Infrastructure Fund (UTF) has us covered. UTF is my “go to” utility play for because, as a closed-end fund (CEF), its mission in life is to dish us a generous dividend.

The fund’s top holding? You guessed it, NEE.

As a CEF, UTF often trades at a discount to its net asset value (NAV). Those assets being shares in stocks like NEE. Which doesn’t make much sense, but that’s the benefit of combing CEFland when the markets are as jittery as they are today.

We can either pay full price for NEE, or net shares for just 95 cents on the dollar by buying UTF instead.

But wait, there’s more. As a CEF, UTF is also allowed to use leverage to boost NEE’s payout. The fund yields 8.4%. Now we’re talking.

One reason UTF is so cheap is that its cost of money has increased with every Fed rate boost. But the Fed is just about finished hiking. Which means the bill for UTF’s 30% leverage won’t increase much from here.

And remember, when we officially enter a recession, the Fed will cut rates. UTF’s cost of capital will decline, its price should rise, and vanilla investors will wish they loaded up on UTF right now.

And there we have it. A 2.5% dividend turned into an elite 8.4% payout. At a discount to boot. Contrarian income fugayzi.

Under-the-radar income investments like UTF are the key to building a Secure 8% “No Withdrawal” Retirement Portfolio. With meaningful yields we can retire on dividend income alone, without ever touching our capital.

Think about it. UTF yields 8.4%, which means it will generate $84,000 in passive dividend income on a million-dollar investment.

Of course, I’m not suggesting we plow a million bucks into UTF. Diversify, diversify, diversify. There are other 8% dividends available today, thanks to this manic financial environment.

Rather than live in fear or FOMO, let’s be good contrarians and buy these elite 8% yields trading at discounts so that we can retire on dividends, OK? Click here so that I can share my current favorite dividends, including stock and fund names, tickers and target buy prices.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report