Let’s be honest: despite today’s high interest rates, it’s still an income desert out there.

The 10-year Treasury yields 3.6%. That’s all right—much better than the 1% or so it dribbled out a couple years back. But it’s still not enough to really boost our investment income.

Which is why I’m urging all investors to take a close look at closed-end funds (CEF). You might’ve heard of these income plays. The key takeaway is that they offer much bigger dividends than stocks, ETFs or Treasuries: payouts north of 8% are common with CEFs. (The three we’ll get into below pay up to 10.4%, for example.)

But if you haven’t heard of CEFs—or haven’t considered them—that’s understandable. They’re a small corner of the market (there are only about 500 CEFs out there), so they don’t draw much interest from Wall Street. And journalists shun them because they think they’re too complicated.

Nothing could be further from the truth.

Fact is, buying a CEF is simple: they trade on the market, just like stocks. And they hold many of the S&P 500 stocks you probably own now (that’s a nice side benefit of CEFs: you can get into them and draw their big—and often monthly—payouts without selling the holdings you already have).

So what do we look for in a winning CEF? There are plenty of things (we talk strategy all the time in my CEF Insider service, whose portfolio throws off an average yield of 9.8% as of this writing). But you can tilt the odds seriously in your favor if you look for CEFs with three key strengths:

- Unusually large discounts to net asset value (NAV): CEFs, unlike ETFs, tend to have roughly the same number of shares for their entire lives. As a result, they can trade at different levels in relation to their net asset value—or the value of their underlying portfolio. Look for a CEF with an unusually large discount and you can grab some nice upside as that discount reverts to its normal level.

- Big yields—obviously! We ideally want to see a high (ideally 6% or greater) dividend that’s consistent over time. Bonus points if that payout comes our way monthly (and our odds are good here—the majority of CEFs pay monthly, rather than quarterly).

- Strong performance—we at least want to see a CEF deliver a total return that’s equal to its yield, so we don’t give up our dividends in price declines. But when we buy well-run, deep-discounted CEFs like the three below, we can do much better than this.

What’s more, the best CEFs have strict mandates to keep them investing in real, safe assets, like stocks, bonds and real estate. They’re also mandated to pass on almost all of their profits to shareholders as dividends, which is why these funds are beloved by high-net-worth investors around the world.

In good times, finding CEFs with all three of these strengths is hard. Market enthusiasm drives prices up, so if you’re not already in a CEF, you’ll miss out on huge profits from buying discounted assets.

But with the market still struggling to fully recover from 2022’s overdone pessimism, we’ve got a much richer hunting ground in front of us. So let’s go ahead and dive into three CEFs that would be perfect fits for any investor’s portfolio today.

Deep-Discounted CEF No. 1: A Smartly Run Bond Fund With a 10.4% Payout

The Virtus Equity & Convertible Income Fund (NIE) has a lot going on: it holds around 60% of its portfolio in blue-chip stocks—current holdings include Microsoft (MSFT), Alphabet (GOOGL) and Mastercard (MA).

It goes further by holding about 37% of its portfolio in convertible securities, typically bonds that give the fund income and can be converted to stocks when certain benchmarks are met, setting up a shot at gains, too. Finally, NIE sells call options on its portfolio, which generate extra income (particularly in volatile markets) management uses to help fund the CEF’s outsized 10.4% dividend.

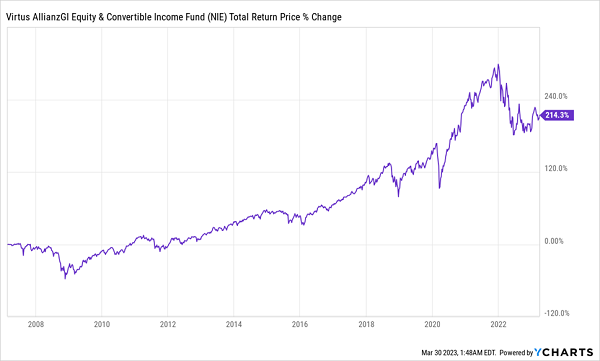

It’s all translated into strong total returns for NIE shareholders: since inception in 2007, NIE has more than tripled their money:

NIE Delivers in All Market Weather

This is impressive because this period includes the 2008/’09 financial crisis, the pandemic and last year’s market crash. Even so, NIE is in the bargain bin, with an 11.1% discount to NAV—so we’re essentially getting some of America’s best companies, plus the expertise of NIE’s managers, for 89 cents on the dollar. That’s one of the best bargains going, inside CEFs or out.

Deep-Discounted CEF No. 2: A “Tried-and-True” Pick With an 8.7% Payout

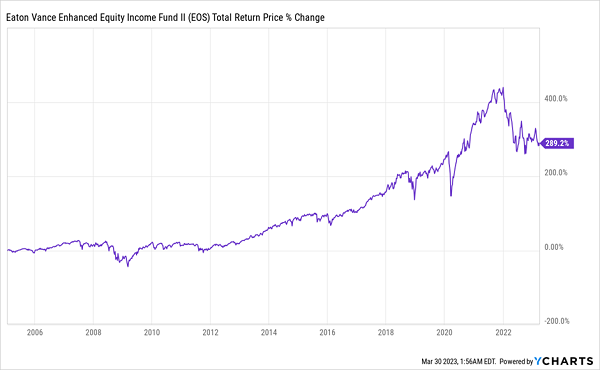

The Eaton Vance Enhanced Equity Income Fund II (EOS) operates on a simple and effective principle: hold high-cash-flow firms like Apple (AAPL), Visa (V) and Coca-Cola (KO) and translate the resulting gains (and dividends) into high monthly payouts for its shareholders. The result has been a return that’s almost tripled investors’ money since inception in 2005.

EOS Rides Its Proven Formula to Strong Gains

With a 5.3% discount to NAV, EOS is worth buying just to collect its 8.7% dividend and wait for that markdown to swing back to a premium, where it was as recently as last year.

Deep-Discounted CEF No. 3: A 7.8% Payer With an Eye for Value

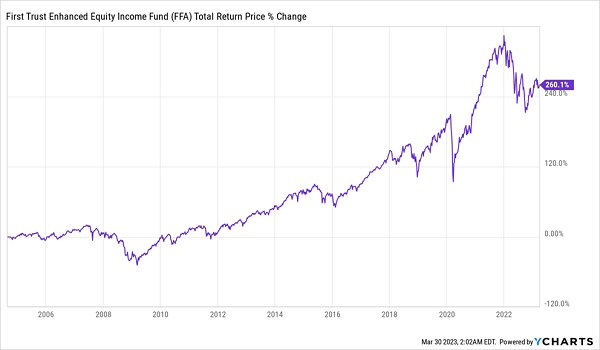

The First Trust Enhanced Equity Income Fund (FFA) sounds a lot like EOS, and that’s a good thing. This 6%-discounted fund also holds blue chip stocks with strong cash flows, and it’s pivoted toward bargain-priced finance stocks like JPMorgan Chase & Co. (JPM), now its fourth-largest holding.

That’s a hint to what makes FFA special: with a focus on undervalued companies with strong profitability and a wide moat, it’s a value investor’s dream. Its track record is great, too:

Add a 7.8% dividend and you see why FFA is a smart CEF pickup. Not only will it get you a strong income stream you can rely on for years—as its long history demonstrates—but you can then flip FFA for a profit when it trades at a premium, which it has done several times in the last decade.

Conclusion

Put these three CEFs together and you have a high-yielding “mini-portfolio” that delivers extremely high income, diversification across hundreds of assets and a history of reliable profitability. I think you’ll agree that this is an attractive package, especially in today’s market.

Urgent: Get My Top 5 Monthly Paying CEFs Now—While They’re Still Cheap

Here at Contrarian Outlook, we know income investors love their monthly dividends—they write in to tell us as much on the regular!

It’s just so much simpler to get paid every month if you’re leaning on your portfolio to pay your bills. And if you’re reinvesting your payouts, you can do so much quicker with monthlies than quarterlies.

With all that in mind, I’ve crafted a 5-fund portfolio containing my very best picks among monthly paying CEF picks. This unique collection of bargain-priced funds yields a sturdy 9.4% now and is highly diversified. I can’t wait to show it to you.

Click here and I’ll tell you more about these 5 retirement-changing monthly payers and show you how to download a free Special Report that spills the beans on all 5 of them (revealing their tickers, names, current yields and more).

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report