I have to laugh when I hear a pundit say that individual investors can’t beat the S&P 500 (and you and I both know this is something we hear quite regularly!).

Truth is, it’s not that hard. Heck, you really only have to choose an ETF from a different sector, like real estate investment trusts (REITs)!

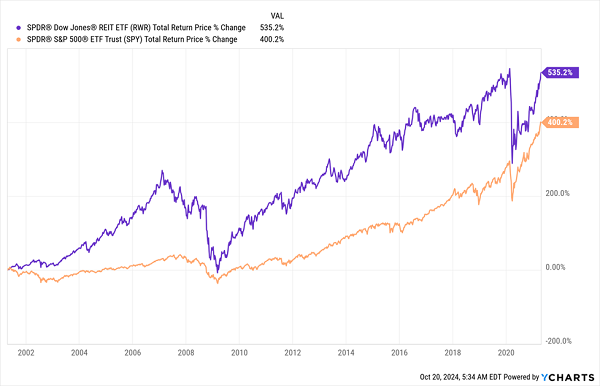

REITs Beat Stocks in the Long Run

As you can see, these “landlords”—shown by the performance of the benchmark SPDR Dow Jones REIT ETF (RWR) in purple above—have easily outpaced the S&P 500 for the 20 years following the ETF’s inception back in 2001.

That outperformance occurred even with the subprime-mortgage crisis (which was obviously real estate focused) and the pandemic selloff (which hit REITs particularly hard, shuttering malls, warehouses and offices across the world).

Now to be clear, I’m not saying you should abandon stocks and go “all-in” on REITs here. Far from it! There are periods (like the subprime crisis and the pandemic) where REITs take it on the chin far harder than stocks, and take longer to recover. Diversification, as always, is key.

But this does go to show that real estate is a great way to create long-term wealth, and a diversified fund containing REITs—which themselves invest in hundreds or sometimes thousands of properties—can get you a lot of real estate ownership at once.

Plus, there are higher dividend yields to be had in REITs than in many other corners of the market (RWR, for example, yields 3.3%, nearly triple the 1.2% yield on the typical S&P 500 stock and magnitudes higher than the average NASDAQ name).

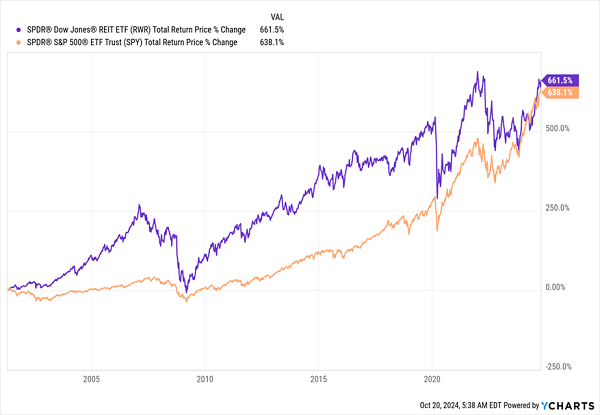

Which brings me back to the chart I showed you off the top, which, as noted, stops in 2021. It stops there for a reason: Since then, stocks have mostly caught up to REITs.

Stocks Narrow the Gap With REITs

Thanks to the big stock-market recovery in 2023/’24, the S&P 500 (again in orange) has far surpassed its previous high in 2021 and is now near RWR’s all-time performance (in purple), even though RWR is actually still below its all-time high.

In other words, stocks are priced highly, and RWR is not, but why? The answer: high interest rates. REITs borrow money to invest in properties they then rent out. And the fast rise in rates we’ve seen has lined up with RWR’s fall from its all-time high.

Rates Rise, REITs Drop

Now the tables have turned, with the Fed cutting rates and saying it will keep doing so. As rates fall, REITs’ borrowing costs will also, and their profitability will rise. That’s helped REITs recover some of their losses from the last two years, but not all.

In other words, future rate cuts aren’t fully priced into REITs, making them attractive now—especially with stocks soaring to new all-time highs on little economic news.

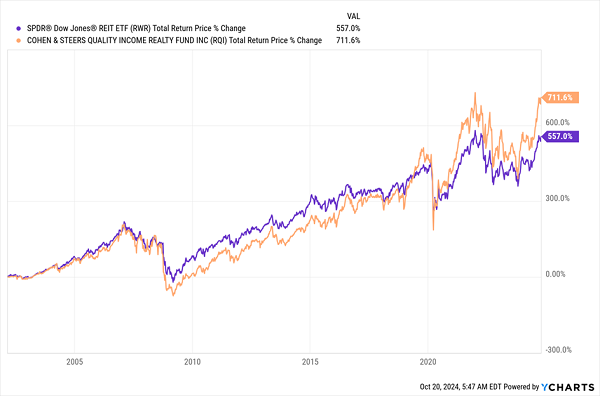

Choosing Your REIT Fund

RWR is a decent “vanilla” option to buy into REITs, but its 3.3% yield just isn’t good enough for us, especially when we can easily find higher-yielding closed-end funds (CEFs) that have outperformed it.

A good example is the Cohen & Steers Quality Income Realty Fund (RQI), a 7%-yielding CEF that yields twice as much as RWR and trades at a slight discount (currently 2.3%) to the market value of its assets. RWR, as is the case with pretty well all ETFs, trades around par. There’s a strong (to say the least!) historical performance to be considered here, too.

Discounted, Higher Yielding, Outperforming

Since the inception date of RQI (in orange above) in 2002, it’s outrun RWR (in purple), providing a 711% total return in that time, as of this writing. That strong performance looks set to continue as the Fed aims to keep cutting rates and the market hasn’t priced those cuts into REITs’ value as much as it has the S&P 500.

And finally, RQI’s small discount is likely to turn into a premium (taking the price higher as it does) as investors realize REITs are undervalued in relation to stocks. We don’t know when that will happen, of course. But we can say that lower rates are very likely to draw investors’ attention to the bargain on offer here.

Beyond REITs: 5 Monthly Paying CEFs (Yielding 10.5%) You Must Buy Now

RQI perfectly illustrates one of the key advantages of CEFs: These funds let us get into areas beyond stocks—like real estate, preferred shares and bonds—and draw a MASSIVE income stream from those assets, too!

Most CEFs yield 8% on average, but that’s just the average—many of these high-income funds pay A LOT more.

Case in point: The 5 monthly paying CEFs I urge all investors to buy now.

These 5 smartly run funds come from across the economy, including CEFs that hold bonds, blue chip stocks, tech stocks, REITs (of course!) and more. They yield an outsized 10.5% today and, as mentioned, they pay dividends monthly.

Now is the time to buy them and kickstart your monthly (and 10.5%-yielding) income stream right away.

Don’t miss out. Click here and I’ll tell you more about these 5 “monthly income wonders” and give you a FREE Special Report revealing their names and tickers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report