While vanilla investors worry along with the herd, we contrarians are buying. And oh, the yields we have available!

As I write to you today, I’m staring at no less than 29 income funds that yield more than 8%. Twenty-nine paying more than eight!

For retirees with a million-dollar portfolio, this is $80,000 per year in dividend income. Actually, more, because some of these funds pay up to 13%.

Why would we sell when this is the best time to buy in years? I explained this while yapping with Moe Ansari on his Market Wrap program. Moe asked me: “We hear all the ‘Doom and Gloomers’ out there. Why would you buy something now with the market on its back?”

Because the time to sell and hide was earlier this year. If you’re a premium subscriber of mine, you’ll appreciate that is exactly what we’ve done. We are sitting on large cash positions around 50% in each of our portfolios.

(Note: Catch my full interview with Moe here.)

This is the time to shop, or a minimum, add to our dividend wish list. We recently discussed a who’s who of dividend-growth stocks—today, we’ll focus on big dividends. Between 8% and 13% yields.

These are the meaningful yields we need to retire on dividends. This 8% baseline, which would generate $80,000 annually on a $1 million nest egg, and a still-generous annual “salary” even on more modest investment sums.

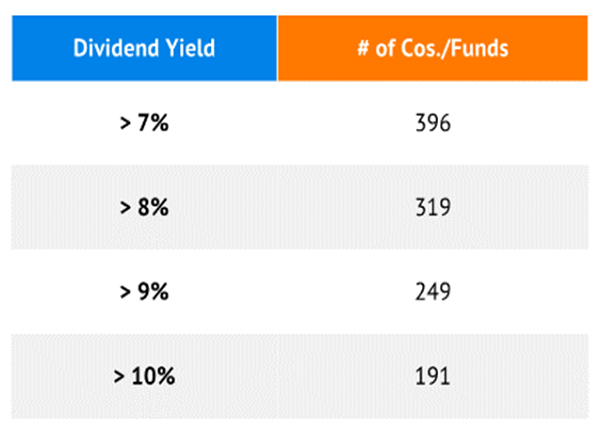

And there are plenty of stocks and funds that yield more than 7% and 8% right now:

Nearly 400 Monster Yields Right Now

Note: U.S.-listed companies and funds with market capitalizations or AUM greater than $300 million. Source: S&P Global Market Intelligence

What’s truly remarkable is how many diversified funds are offering flat-out excellent yields right now. Specifically, there are 29 closed-end funds (CEFs) that not only dish out more than 8%—well above the baseline yield I suggest to subscribers seeking out high, sustainable retirement income—but also trade at a discount to their net asset value (NAV).

That means in many cases, buying those assets through a CEF is cheaper than going out and buying those holdings on your own! And these funds would generate anywhere between $80,000 and $132,000 on a million-dollar nest egg.

Let’s look at the full list, then I’ll zoom into a few names to give you an idea of what you can get—and what red flags to watch for—from investments that yield this much.

29 Jaw-Dropping Dividend Funds

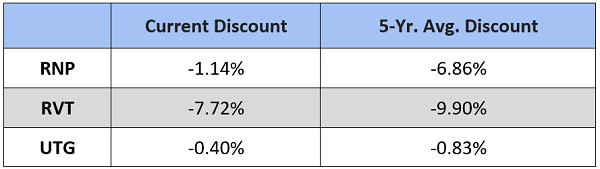

First off, you’ll notice that several funds that deal in traditional yield-and-safety pockets of the market are indeed discounted.

But perhaps not as much as you’d think.

Consider the Cohen & Steers REIT and Preferred and Income Fund (RNP, 8.2% yield), Reaves Utility Income Fund (UTG, 8.9% yield) and Royce Value Trust (RVT, 10.0% yield). Here we have real estate, utilities and value stocks—often popular shelters from the stock market’s storms.

All three are trading at much narrower discounts than their longer-term averages.

One of the most noteworthy discounts is the fresh-faced BlackRock ESG Capital Allocation Trust (ECAT, 9.3% yield), which trades at a fat 19% discount to NAV, meaning you’re getting its holdings for 81 cents on the dollar.

As the name would suggest, ECAT—which started trading during fall 2021—holds investments that meet certain environmental, social and governance (ESG) criteria. And as the “allocation” part of its monitor would suggest, it’s not just stocks; this BlackRock CEF can hold both stocks and debt securities. At the moment, it has a fairly conservative 53%-47% stock-bond blend.

Yes, bonds have had a rough year, too, but still haven’t suffered losses quite as deep as stocks. In theory, then, ECAT should be out ahead of the broader market, as many allocation funds are.

It’s Not.

ECAT’s massive discount is even cheaper than its one-year average of 13%.

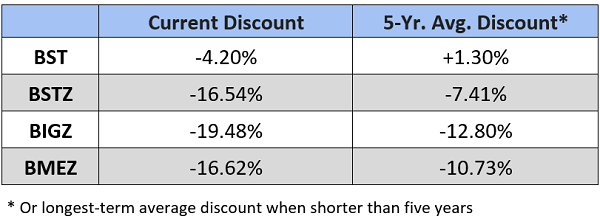

The most noteworthy combination of big yields and wide discounts comes from funds holding the most cutting-edge companies in the stock market:

- BlackRock Science and Technology Trust (BST, 10.2% yield)

- BlackRock Innovation and Growth Trust (BIGZ, 11.7% yield)

- BlackRock Health Sciences Trust II (BMEZ, 11.8% yield)

- BlackRock Science and Technology Trust II (BSTZ, 13.2% yield)

Technology. Communications. Biotech. Medical devices. These are among the biggest growth drivers of the past decade.

All four are trading at much deeper discounts than their longer-term averages.

How to Lock Up $76K in Annual Income

If you do decide to take a flyer on those cutting-edge funds, buckle up and hold for the very long term—because it’s very likely that, in the short term, the current volatility and bear market have a lot more nausea in store for shareholders.

Me? I prefer a smoother path to retirement riches.

And the only way to do that is to value high quality every bit as much as high yields.

That’s why I feel comfortable with the 13 high-quality stocks in my Contrarian Income Report portfolio, which yield an average of 7.6%. In other words, this baker’s dozen is spinning off $76,000 for every million dollars invested.

Not a bad cash companion!

And you don’t have to be a millionaire to take advantage of this strategy. A $500K nest egg will create $38,000 in annual income. Or $200K will generate $15,200 in yearly dividend income. And that’s hard to find.

The important thing is that these yields are safe, which creates stability for the stock (and fund) prices attached to them. We want our income, with our principal intact. It’s really the only way to retire comfortably, without having to stare at stock tickers all day, every day. Sound good?

Best of all, many of my favorite dividends are paid monthly. So, we’re talking about $3,000+ in dividends every month on that $500K. Or $6,000+ per month in income on the seven-figure accounts that Fidelity brags about in its ads.

Click here and I’ll share my favorite 7%+ dividends—dividends that are being paid monthly to boot!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report