I always laugh when I hear investors say you can’t time the market. Truth is, you can—my readers and I have done it many times! I’m going to show you my favorite way to time the market for big upside (and dividends) today.

The best way is to let you see my system in action. So let’s do that.

Think back to October 2020 for a second. With the market mess that is 2022 dominating the headlines now, you may not remember that we faced a big pullback then—just north of 10%.

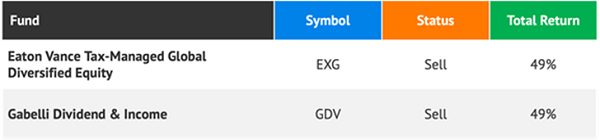

It set the stage for us to “swing trade” for payouts north of 7%, and quick 49% upside, too.

The Forgotten Correction of 2020

At my Contrarian Income Report high-yield investing service, we jumped in with two closed-end funds (CEFs): the Gabelli Dividend & Income Trust (GDV) and the Eaton Vance Tax-Managed Global Diversified Equity Fund (EXG).

Fifteen months later, we “swung out” of those trades, having successfully timed the market for a pair of matching 49% returns.

How did we do it?

Aside from moving in when stocks pulled back (a correction that was clearly overdone, given the trillions being pumped into the economy by Fed Chair Jay Powell’s printing press), we decided to go with GDV and EXG above, which are CEFs—not the individual S&P 500 stocks or ETFs most folks buy.

That’s a critical difference, for two reasons:

- CEFs offer outsized dividend payouts—GDV and EXG, for example, yielded 7.3% and 10%, respectively, when we bought. Big cash streams like that lure investors when markets take a header.

- CEFs let us buy stocks at a discount through their discounts to net asset value (NAV). Thanks to these deals (which only exist with CEFs), we can buy for much less than if we purchased these funds’ holdings ourselves. GDV and EXG were cheap in October 2020, trading at 16% and 12% below NAV, respectively.

What’s more, GDV and EXG hold the blue-chip dividend payers most of us own anyway, like Mastercard (MA), Microsoft (MSFT) and Honeywell (HON), so we don’t even have to switch stocks to buy them.

To be sure, funds like these don’t always return 49% in 15 months; in fact, EXG and GDV have returned 75% and 56%, respectively, in the last five years; we successfully timed the market to grab similar gains in a lot less time.

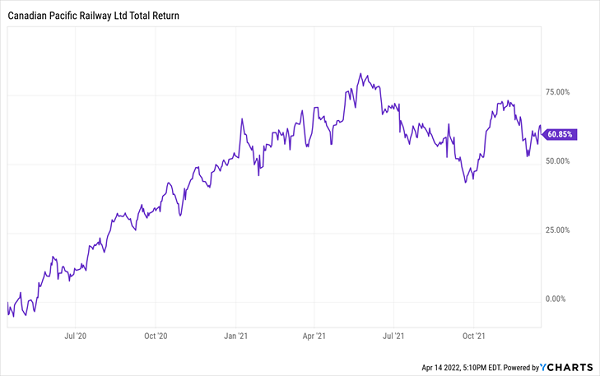

Our “dividend swing trades” aren’t limited to CEFs, either: at my Hidden Yields advisory, we worked the biggest crash in more than a decade to pull off a 62% gain in a little less than two years on Canadian Pacific Railway (CP).

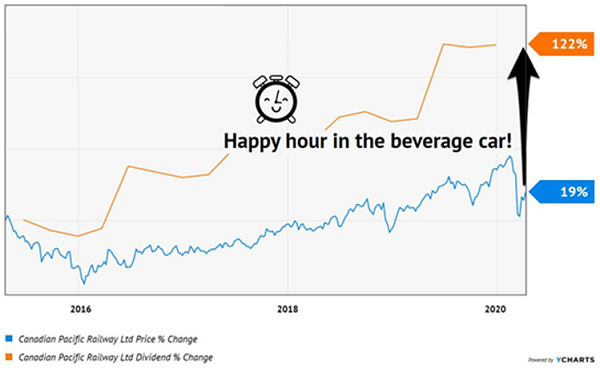

In the couple of years leading up to April 2020, money had been moving away from transport stocks on recession fears. So when the recession landed (with a thud!) in March 2020, we followed our contrarian rule of “selling the recession rumors and buying the headline news” and bought CP.

There was value waiting to be unlocked in the stock itself, too, according to another dividend-powered buy indicator that’s paid off for us many times in the past:

No Love for a Dividend Double

As you may know if you read my columns on Contrarian Outlook, it’s unusual for a company’s share price to trail its dividend growth by such a wide margin—shares usually follow dividends higher. When a gap opens up, it’s often a buying opportunity (note that fluctuations in the company’s dividend above are due to exchange rates, not changes in its actual payout).

So we bought—and rode along as CPs shares reeled in its dividend (with an assist from massive demand for goods in the pandemic, of course!):

CP “Reels in” Its Dividend—and We Walk Off With a Fast Gain

Finally, the real key with “dividend swing trades” is knowing when to take money off the table. Consider Concentrix (CNCX), an IT services firm we Hidden Yielders received as a spinoff of Synnex Corp., which itself was an 83% winner for us.

CNCX was better than any cash dividend, soaring over 112% in the year we held it!

But by December 2021, with rates headed up and tech stocks likely to come under pressure as a result, we decided there was no reason to give back our gain, so we sold. Once again, our instincts were on the money: Concentrix has slid 10% since.

How We’ll “Swing Trade” for More Big Dividends and Upside

While we’re always happy to take them, swift gains like these aren’t what we normally see in our Contrarian Income Report and Hidden Yields services, which tend to be longer-term in their holding times. Which is why I asked my publisher to let me launch my Dividend Swing Trader service.

In DST, our holding periods tend to be measured in weeks and months, rather than years. To pull off these fast gains, we look to indicators like discounts to NAV and dividend growth, along with “relative strength,” or how fast a stock is growing relative to its peers.

Macro indicators are also critical. For example, I keep a watchful eye on the number of stocks hitting one-month lows versus one-month highs (a higher number of lows in a rising market suggests the market is being powered by a handful of stocks, for example—a time we need to be wary).

The best part is that my DST system works great in a stock-picker’s market like the one we’ve seen in 2022: we “swing” from dividend to dividend, grabbing gains and cash payouts the entire time, while constantly shifting our portfolio away from losing sectors and toward tomorrow’s growth plays.

That gives us a huge advantage over “buy-and-hold” types, who are stuck watching stock after stock fall off track as the market shifts.

An Invitation to Discover My System—and Get My Next Dividend Swing Trade

I’ve put together a Special Investor Report that gives you insider access to my Dividend Swing Trader system, which has already handed investors fast gains, like 73% in 8 months and 20% in 9 months from secure dividend payers.

We DON’T wager on profitless tech stocks. And we DON’T go anywhere near the crypto casino.

Just as we saw with GDV, EXG, CP Rail and Concentrix above, we bagged these gains from safe and secure payers. And I believe strong dividend stocks will soar as Jay Powell raises rates, putting the screws to crypto and other risky bets.

Join us as we set ourselves up for these big “dividend-powered” gains. Click here and I’ll tell you all about my Dividend Swing Trader system and give you access to my next “dividend swing trade” which is due out just days from now.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report