The market volatility we contrarians have been waiting for is finally starting to show up—and we’re going to play it with a cheap energy fund paying a sweet 9.1% dividend.

These days, most investors think energy is played out. But the truth is, we’ve seen a “slow-mo” selloff, with crude tumbling about 10% from back in early April.

And we’ve got Uncle Sam on our side here, too.

This is an election year after all, and last week we got word the Biden Administration will empty the Northeast Gasoline Supply Reserve, set up to provide an emergency supply after Superstorm Sandy in 2014.

That’ll drop a million barrels of gas into the market—just in time for summer driving season. (To be fair, the sale is mandated by law—but the government does control the timing.)

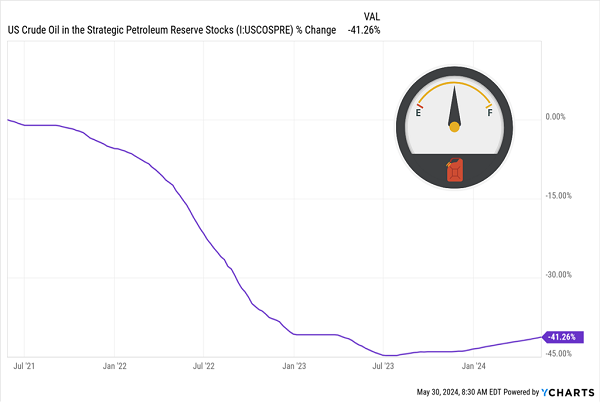

That fits with the administration’s drawdown of the Strategic Petroleum Reserve, which it’s been using to artificially pin down oil prices for a couple years now.

SPR Down to Nearly a Half-Tank—With Nowhere to Go But Up

Unlike the Northeast Gas Reserve, the SPR will have to be refilled (you can see that starting to happen on the right of the chart above), but you and I both know the administration won’t get serious about that—and risk higher gas prices—before November.

The bigger picture here, then, is that after the election, Uncle Sam will likely be a buyer. And we know what that means: higher oil prices!

That makes now, with the SPR ever-so-slightly starting to nudge higher, a smart time to buy. We can give ourselves a “double discount” on tapped-out oil when we buy through a closed-end fund (CEF) like the Kayne Anderson Energy Infrastructure Fund (KYN).

Right now, KYN sports a 15% discount to net asset value (NAV, or the value of its underlying portfolio). That’s another way of saying we can get its oil and gas shippers and storers, like Williams Companies (WMB), Energy Transfer LP (ET) and Enterprise Products Partners (EPD), for less than what we’d pay if we bought them “direct” on the market.

These discounts only exist with CEFs, and they give us an idea of our upside: In mid-2021, for example, before the Fed’s rate hikes, KYN’s discount shrank as low as 7%, so we can look forward to some discount-driven upside as rates normalize.

And that’s before any gains in KYN’s portfolio holdings themselves.

The firms KYN owns are “toll bridges” that will benefit as Uncle Sam restocks and consumers, with more spending power as rates fall, travel more.

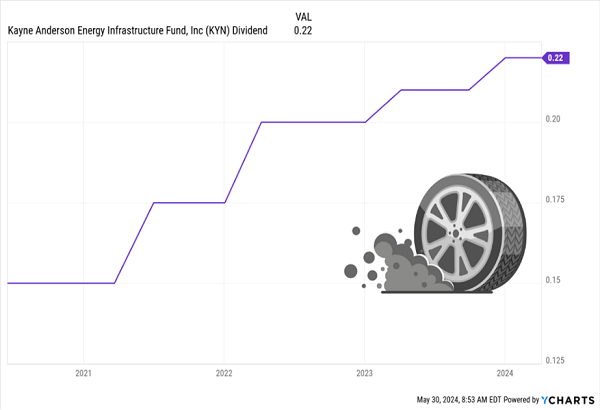

The other nice thing about KYN is that we get the vast majority of our return in dividends, thanks to the fund’s 9.2% payout. And that high dividend has actually grown since it bottomed when the world closed down in early 2020:

A 9.2% Payout That Grows

Finally, many of KYN’s holdings are master limited partnerships (MLPs), which send out a complicated K-1 package at tax time. But if you buy through KYN, you don’t have to worry about that: You get a simple Form 1099 instead.

So you’re not only getting a discount and a high (and growing) payout here—you’ll also save yourself (or whoever does your taxes) a major headache.

The Simple Way to Add KYN (or any Dividend Payer) to Your Portfolio

Now that we’ve tagged KYN as a smart dividend play on a bounce in energy, let’s take a step back and fit it into our overall portfolio.

Because as much as we love running across overlooked payers like this, there’s one thing many of us dread: merging them with our current stocks and seeing how they’ll affect our overall income stream.

Like most people, my bills come in every month. And I’m not cutting checks anymore; most of my expenses are on autopay. Which makes income tracking more important than ever. I need to make sure I have the money in the account before it gets dinged.

That’s where Income Calendar, a new toy whipped up by our IT team here at Contrarian Outlook comes in.

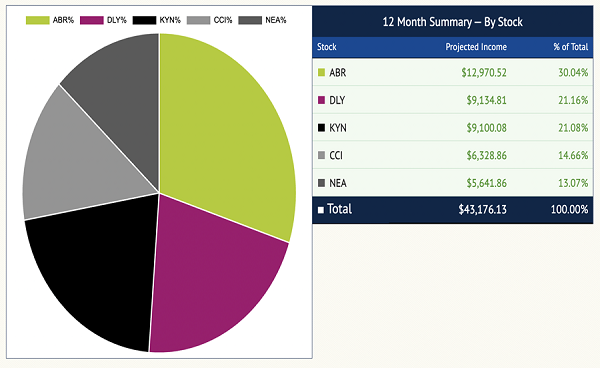

Let me show you how it works using five strong income plays (including KYN) that stand to gain interest rates move lower: the 9%-yielding DoubleLine Yield Opportunities Fund (DLY), run by “Bond God” Jeffrey Gundlach; real-estate lender Arbor Realty Trust (ABR)—current yield: 12.8%; cell-tower “landlord” Crown Castle International (CCI), with a 6.3% payout; and a municipal-bond fund, the 5.6%-paying Nuveen AMT-Free Quality Municipal Income Fund (NEA).

These five pay dividends both quarterly (KYN, CCI and ABR) and monthly (DLY, NEA). Let’s plug them into Income Calendar, allocating $100,000 to each one, for a $500,000 sample portfolio in total.

Right away, IC gives us the vitals:

On the left we’ve got an “at a glance” income forecast in an easy-to-read bar chart. On the right, Income Calendar gives us a dollars-and-cents monthly forecast, including our total projected income for the year of $43,176.13, good for an 8.6% yield. Not bad!

There’s more. Let’s dial up August 2024, a month in which we get paid by three of the five holdings in our “mini-portfolio.”

You can see that Income Calendar not only tracks our payouts but forecasts other key dates, like the ex-dividend date (or the date by which you need to be a shareholder to receive the next payout).

You also get a heads-up on expected earnings dates (there aren’t any of those in August, but they normally show up in red). And you can get a sweet breakout by stock, too (no surprise that Arbor is the star of the show here, thanks to its 12.8% yield):

Let’s see an Excel spreadsheet do all that! Income Calendar is a complete roadmap that makes sure you’re never caught short of dividend cash when you need it.

One final note—we’ve recently integrated IC with Plaid, a service that safely and securely links up to your brokerage account and imports all your tickers and share counts—so you don’t have to do any inputting at all.

We’ve built the entire service around convenience, with the idea of letting you, the user, play out any income scenario you want in just a few clicks. I’m sure you’ll love using it.

Your Next Step: Drop a Few Tickers Into Income Calendar Yourself

The summer, when most folks tend to step back a bit from their finances, is the perfect time to try Income Calendar. By doing so, you can instantly see how adding stocks you’re watching would change your income stream, month by month.

How you use Income Calendar is up to you. You can simply input your current portfolio or you can build separate ones consisting of “watch list” stocks you’d love to buy—but maybe you’re waiting for a lower price to do so.

There’s no cap on the number of portfolios you can build with IC, so the sky really is the limit here. But no matter how you use it, I think you’ll agree there’s no other dividend-forecasting tool like it.

And I’m inviting you to try it today with no obligation whatsoever.

Click here to see the investor briefing I’ve written on Income Calendar, including a quick video that demonstrate, step by step, exactly how to use it. You’ll also get to “road test” the service for 60 days. You’ve got nothing to lose here, so I encourage you to give it a shot.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report