Today we’ll discuss five monthly dividends with yields between 7.3% and 16.7%. But let’s be careful—market participants are showing signs of greed right now.

Source: CNN

Monthly dividend stocks can help settle down a seasick portfolio. First, they pay every 30 days. What a concept! Their payments line up with our bills. Brilliant.

Quarterly payers aren’t as nice. Let’s look at a $500,000 portfolio split evenly among a group of five mega-cap dividend payers. This is a set of wildly popular blue chips you can find in the top 10 or top 20 holdings of just about every major large-cap fund—and despite this, they deliver a downright miserly sub-1% yield!

I Don’t Know What’s Worse: The Lumpy Dividends or the Lousy Yield

Source: Income Calendar

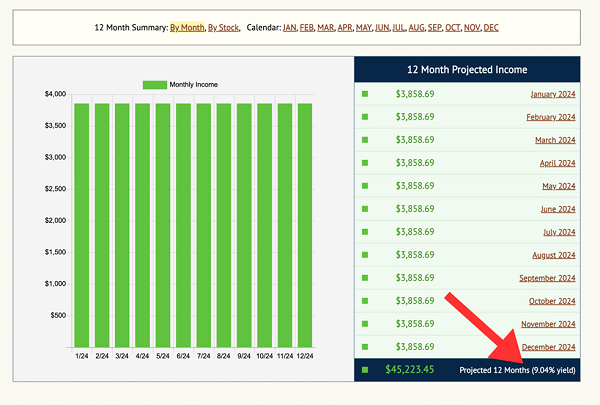

Now look at what happens when we sock the same amount into the five-pack of monthly dividends I’ll look at today (which average more than 9% among them, and that’s before including any special dividends!):

Smooth, Substantial Dividend Income

Source: Income Calendar

But we shouldn’t just buy indiscriminately—even if we’re getting a monthly paycheck, and even if that monthly paycheck is 3x, 4x, even 5x what the market offers. We want to make sure we’re buying at the right price. Otherwise, we’re sacrificing upside and potentially getting less yield than we could by being patient!

So let’s take a look at a few monthly dividend-paying candidates and see if this overblown market has left us any values.

EPR Properties (EPR)

Dividend Yield: 7.3%

We’ll start with EPR Properties (EPR), which I’m pleased to report is the lowest yield on this list—at a plump 7%-plus.

EPR Properties is an “experiential” real estate investment trust (REIT) that focus not on consuming, but doing. The REIT’s nearly 360 locations, spanning some 200-plus tenants in 44 states and Canada, span just about every kind of entertainment venue you could want—theatres (39% of “EBITDAre,” or EBITDA for real estate) and eat-and-play (24%) make up the majority of properties, but EPR boasts everything from ski resorts and fitness clubs to casinos and museums. EPR also has an educational component, with 7% of EBITDAre coming from properties related to early childhood education and private schools.

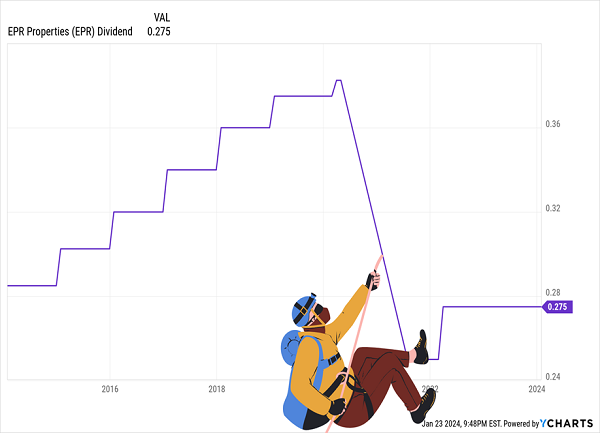

EPR was something of a darling in the REIT arena for years, routinely raising its monthly dividend—right until it fell victim to the COVID buzzsaw. EPR promptly suspended its payout in spring 2020, then resumed it near the end of 2021 at about 65% of its pre-COVID levels. It has since raised it just once, early on in 2022.

Can EPR Start Climbing the Hill Again?

EPR has understandably maintained a cautious stance. While the end of the lockdowns were generally positive for its properties, theaters have been slow to recover, and the recent Hollywood strikes caused still more turbulence in the business. In fact, last summer, EPR announced a comprehensive restructuring agreement with Regal Cinemas for 41 of the 57 properties leased to the theater firm—one that also saw EPR announce plans to reduce its theater footprint.

This is a pockmarked REIT—one that still needs theaters to keep bouncing back, reduced footprint or not. But you could make an argument on the value front. EPR’s 7%-plus dividend occupies less than 70% of adjusted funds from operations (AFFO), and shares trade at just 9 times AFFO estimates for next year.

Ellington Financial (EFC)

Dividend Yield: 13.9%

You can typically get a lot more yield out of mortgage real estate investment trusts (mREITs), and that’s definitely the case with Ellington Financial (EFC) and its nearly 14% yield.

Ellington Financial invests in a wide variety of “paper” real estate, including residential mortgage loans, agency and non-agency residential mortgage-backed securities (RMBSs), commercial mortgage-backed securities (CMBSs), consumer loans, even debt and equity investments in loan originators.

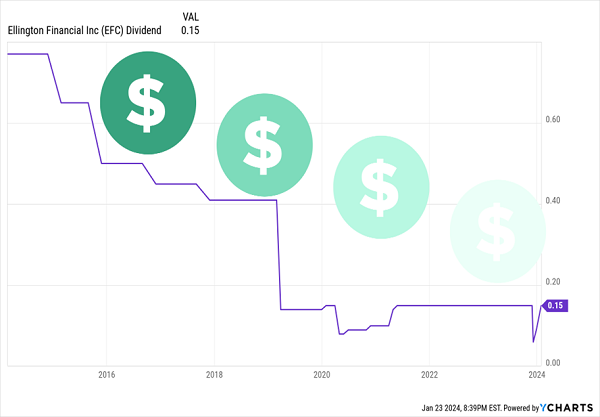

The past decade has been brutal for mREITs; rising mortgage rates mean new loans pay more, which shrinks the value of existing loans. That has resulted in a dreary dividend history for EFC, which has reduced the payout on several occasions.

Can You Believe in This Disappearing Dividend?

The complicating factor—potentially for the better—is the recently completed merger with fellow mortgage REIT Arlington Asset Investment Corp., which will add scale to EFC’s existing operations. Ellington kept the dividend level immediately following the close—upcoming earnings reports will give us a better idea of dividend coverage.

If earnings accretion from Arlington does come in as or better than expected, EFC’s generous dividend should be in better shape—and shares would be positioned for growth to boot.

Gladstone Investment Corporation (GAIN)

Dividend Yield: 16.7%*

Another place to scout out high yields is among business development companies (BDCs). Remember: BDCs allow the average Joe to invest like VCs, providing diversified exposure to small businesses through regular shares you can buy in a brokerage.

One BDC of note is Gladstone Investment Corporation (GAIN), brought to you by the Gladstone family of public investment vehicles that also includes Gladstone Commercial (GOOD), Gladstone Capital Corporation (GLAD) and Gladstone Land Corporation (LAND).

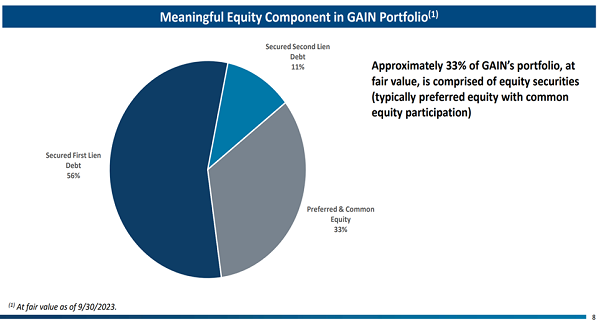

GAIN provides both debt and equity investments, though it leans on the former. Target portfolio companies have $4 million to $15 million in EBITDA, proven business models, predictable and stable cash flows, consistent earnings, and minimal market or technology risk.

Source: Gladstone Investment Fiscal Q2 Earnings Presentation

Gladstone Investment is coming off a decent quarter that saw net asset value (NAV) improve by 5% year-over-year. It also features below-average balance sheet leverage, which would be of value in any sort of downturn.

Income investors will love Gladstone’s dedication to squeezing every last penny of dividend from its earnings. The nearly 17% dividend reflects both a good regular payout that’s around 6.6% currently, as well as exceptional special dividends—Gladstone has made four special payouts over the past four quarters, combining for another 10.1 percentage points’ worth of yield.

The price could be better though, with GAIN shares trading at about 3% above NAV right now.

Calamos Strategic Total Return (CSQ)

Distribution Yield: 8.1%

Closed-end funds (CEFs) are a tiny fraction of the investment fund market—their assets are next to nothing compared to mutual funds and ETFs. But they can deliver life-changing dividends that dwarf their bigger brothers.

Among CEFs, Calamos Strategic Total Return (CSQ) is a modest yielder at “only” 8%. But that’s quite the haul for what effectively boils down to an allocation fund.

CSQ’s management is expected to invest at least 50% of assets in equities, with the rest invested in various debt instruments “deemed beneficial during periods of high volatility.” Right now, though, the split is 66% stocks/34% debt.

Source: Calamos Investments

CSQ also aims to provide consistent monthly distributions, which have risen four times since 2011—a welcome deviation from many CEFs that have only managed to keep them level or actually had to pull back.

Importantly, this CEF uses a generous amount of leverage (currently above 30%) to juice its performance. Which makes sense. It’s hard to imagine generating 8%-plus payouts from a portfolio with plain blue chips like top holdings Microsoft (MSFT), Apple (AAPL) and Amazon (AMZN).

Performance over the past decade or so is actually very close to the S&P 500—it’s just providing a much larger percentage of that performance via its monthly distributions.

You can still buy CSQ at a discount, though not much of one. The fund typically trades fractionally lower than NAV, and right now that discount is slightly deeper, at about 2%.

PIMCO Corporate & Income Opportunity Fund (PTY)

Distribution Yield: 10.4%

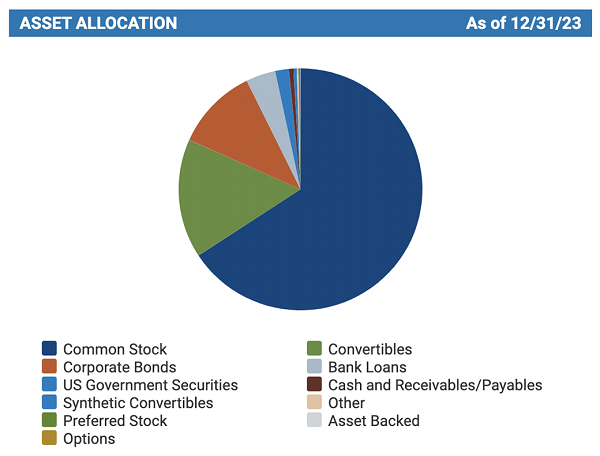

You can get above double digits with the debt-focused PIMCO Corporate & Income Opportunity Fund (PTY), which invests in a variety of debt. Currently, junk debt is tops at 30% of assets, followed by non-USD developed-market bonds (16%), mortgages (15%), investment-grade corporates (9%) and emerging-market debt (8%), with the rest of assets sprinkled across several other debt types.

In addition to harnessing debt with higher yields, debt leverage of nearly 25% helps squeeze more gains and income out of PTY’s holdings.

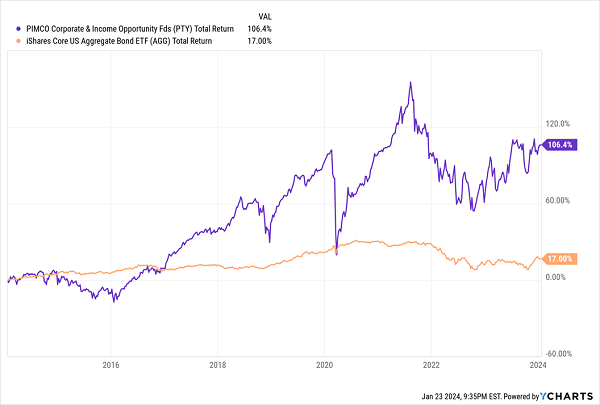

And as a strategy, it beats the pulp out of a plain-vanilla bond index.

PIMCO Lives Up To Its Name With PTY

As I’ve said before, though, I pity the fool that buys PTY.

Earn a Reliable 9%+ in Retirement—Paid MONTHLY

If an overheated market is unsettling to you, you’re going to be downright freaked out by PTY, which trades at a remarkable 21% premium to its net asset value (NAV).

To its credit, PTY has outperformed for years despite this pricing handicap.

But while we want a lot of “big” out of our monthly dividend payers—big yields, big security, big upside potential—the last thing we want is a big cloud looming over our heads, threatening to significantly handicap our returns going forward.

Fortunately, you won’t get that with the beautifully boring, high-yielding blue chips I hold in my “9%+ Monthly Payer Portfolio.”

The “9%+ Monthly Payer Portfolio,” as the name would imply, can clearly deliver high levels of yield.

But it’s not just about that—this portfolio is about earning high levels of yields by leveraging steady-Eddie holdings with the potential to deliver meaningful price upside, too.

That means no more reaching for the Pepto every time the S&P gets the jitters.

That means no stressing about nest-egg shrinkage in your 60s, 70s, 80s, and beyond, either. Because unlike many retirement plans that require you to bleed out your savings as you age, the income this portfolio can generate is so rich, it can sustain a retirement on dividends alone.

If you put this portfolio to work with a mere $500,000—less than half of what most financial gurus insist you need to retire—you’ll generate a $45,000 annual income stream.

That’s more than $3,700 every month in regular income checks!

As we turn the page from 2023 to 2024, it’s time to get serious about locking down our core retirement holdings. Don’t delay. Click here for more on these generous monthly dividend payers right now!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report