One of the most difficult things for me in 2022 was that, with all the doom and gloom in the air, I heard about a lot of people giving up on the dream of financial independence.

The worst part was that they were doing so at exactly the wrong time—right when the market decline had driven the yields on our favorite closed-end funds (CEFs) way up. Even now, after the S&P 500 has posted roughly 15% gains in 2023, as of this writing, plenty of CEFs yield 10%+, including nine in the portfolio of our CEF Insider service.

Worse, these folks were doing it because they’d bought into the media’s false narrative that a recession was looming, a trap I regularly warned about falling into here on Contrarian Outlook and in the pages of CEF Insider.

Now it looks like the financial world is finally coming around to our point of view.

To see what I mean, check out the article “The economy’s doomsday clock has been reset: Wall Street’s Fearmongers were totally wrong about a recession” from Business Insider, which basically admits that economists are essentially making it up as they go along these days:

“Over the past year, Wall Street pessimists’ reasons for an approaching recession have shifted. First it was the spike in food and energy prices, then it was the housing market, and now it’s ‘long and variable lags’ from rate hikes that many of the same people said the economy couldn’t handle in the first place.”

How We’ve Responded—and Where We’re Heading

Instead of selling in an environment like we saw last year, it was the time to be buying, especially when the market fell on extreme fear. Stocks are a smart play in times like these—but we of course prefer CEFs, as their discounts, and dividends, grow when the market panics. And as you know if you’re a CEF Insider member, we added funds on the dips through 2022, locking in deep discounts and high yields as we did.

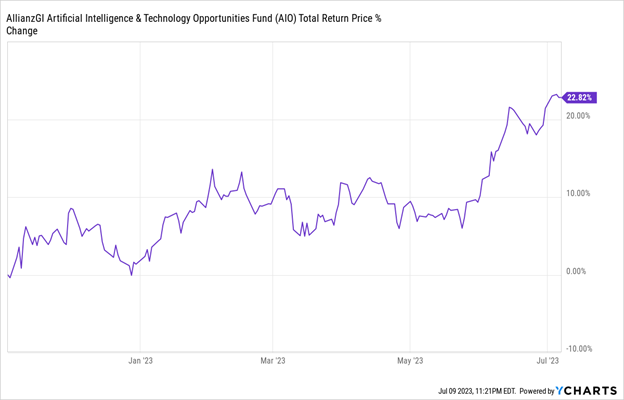

Last November, for example, I spotlighted portfolio holding the Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) in the regular weekly column I send to CEF Insider members. At the time, the tech-focused fund sported a 15.3% discount to net asset value (NAV) and yielded 11%. It’s popped nicely since, propelled by interest in artificial intelligence.

Steeply Undervalued AIO Soars

You may recall that AIO taps into the AI trend through both blue chip techs and other companies that benefit from AI-powered productivity gains, like equipment maker Deere & Co. (DE) and insurer UnitedHealth Group (UNH).

Of course, CEF Insider members have been in the know about AIO for a while now, and have booked a bigger return—up 30%, as of this writing, since our recommendation in September 2020, including the fund’s high dividend (it yields 9.7% today).

The takeaway here is clear—investing according to the headlines (and the opinions of economists) is risky. You’re often better to do the opposite of what they predict. Which brings us to today, and our plan for what comes next, as recession fears fade in the media and on Wall Street.

“Economists Place 70% Chance for US recession in 2023” Bloomberg loudly proclaimed on December 20, 2022. Then in February 2023 the New York Times asked “What Recession? Some Economists See Chances of a Growth Rebound”. That went from “some” to “most” in the last five months. As a result, as you’ve no doubt noticed, capital markets are at their calmest since 2023.

All this calmness emboldens the Fed to raise interest rates—and the Fed wants to raise rates for a number of reasons. The biggest is that it gives them more leverage to anticipate a future recession.

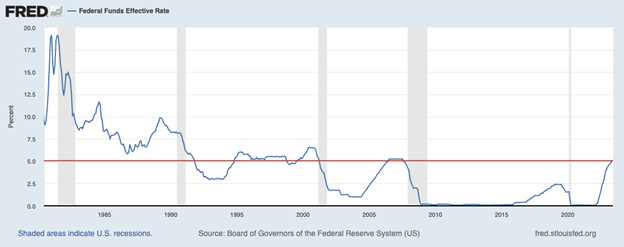

These days, we might think 5% interest rates are high, and they are in the context of the last decade. But if we go way back, we see that rates were once a lot higher, which is partly how the Fed was able to get the country out of the financial crises of the late 1970s and early 1980s.

Of course, Jay Powell can’t return us to 1980s-style 20% rates. In reality we’ll probably get one or two more hikes this year and that’s it. If we don’t, stocks will probably go up a little, but not too much given the runup we’ve seen so far. If stocks go down, they likely won’t go down by much because, as we’ve seen in the last few weeks, new rate hikes don’t affect stocks as much as they did last year, as rates are already high compared to where they were. A-25-basis point hike isn’t as meaningful when rates are 5.25% versus when they’re zero.

This is one reason why I’m not really worried about a recession, per se. One is coming, sure, but it could take a couple years to show up, and when it does it’ll probably be shallow and mild (assuming, of course, nothing major happens in the next couple years!). This does set the stage for stocks to be more or less rangebound in the short term.

This environment, as I’ve mentioned in some of my recent Thursday articles, is great for buying CEFs that sell covered-call options. Covered calls give buyers the right to buy the CEF’s stocks at a fixed price and date in the future.

It’s a strategy that performs particularly well in tranquil markets like this one, as the stocks are more likely to fail to climb above the target—or “strike”—price. The result is the fund gets to keep the fee it charges for these sales (or the “premium”) and the stocks on which it sells the options—and it can use those premiums to pay bigger dividends to us.

Three popular covered-call CEFs are the 8.3%-yielding Nuveen Dow 30 Dynamic Overwrite Fund (DIAX), 7.6%-paying Nuveen S&P Dynamic Overwrite (SPXX) and the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX), which yields 6.8%.

None of these are fancy—they buy the stocks in the Dow Jones Industrial Average, S&P 500 and NASDAQ 100, respectively, and sell call options against those holdings.

Which one is your best play right now?

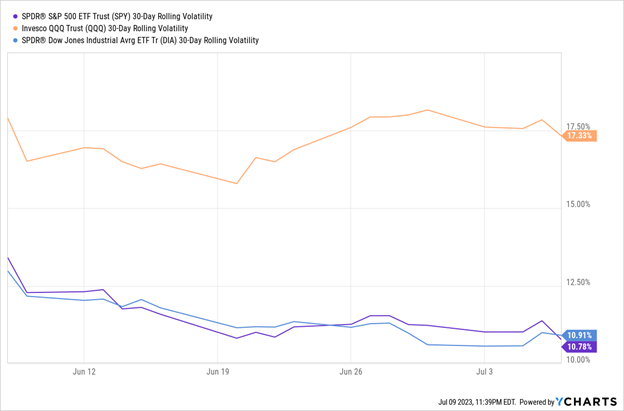

Historically, I’ve been a QQQX fan because of the NASDAQ’s greater volatility, which results in higher option premiums that make the fund’s dividend more sustainable. But spikes in relatively low-volatility indexes create even better dividend opportunities, which is why DIAX is particularly interesting.

Dow Jones Volatility Bottoms Out

Very recently we saw the Dow Jones (the benchmark ETF for which is marked in blue above) cross above the S&P 500 (in purple) in terms of volatility. That’s unusual; typically the Dow is less volatile, but it has seen the steep volatility declines of 2022 evaporate in recent days, despite the Dow’s disappointing 2023 performance.

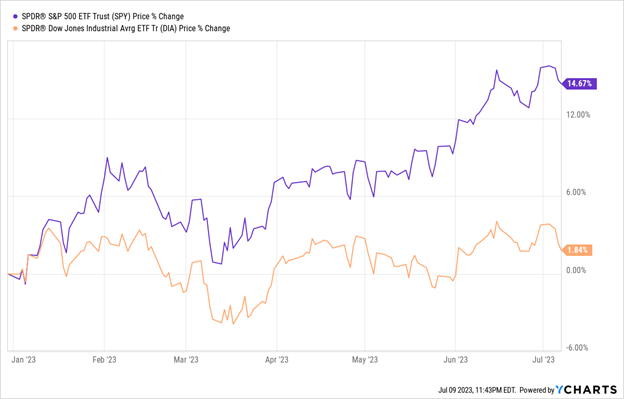

Dow and S&P 500 Part Ways in 2023

If you look at the right side of this chart, you can see that, despite the Dow’s weak performance this year, fear-averse investors have driven the index up in the last few weeks. This makes sense, as the Dow contains the largest of large cap stocks. Savvy investors will see that and respond by shorting the index when market weakness arises. That gives us an opportunity to see DIAX’s already sustainable 8.3% dividend grow, thanks to its covered-call strategy.

5 Buys Paying 10.2%, With 20% Upside, as the Media Comes Around to Our View

DIAX isn’t our only summer buying opportunity. We’ve got a wide range of other high-yielding CEFs available to us at ridiculous bargains—including my top 5 funds, which yield an incredible 10% (and pay dividends monthly).

Discounts? These 5 funds trade at such wide markdowns that I’m calling for 20%+ price upside in the coming year.

Now is the time to buy them. Click here and I’ll explain how CEFs really are a “hidden” world of high, safe dividends that most investors miss out on. And I’ll show you how to download a free Special Report naming my top 5 buys for 10.2% yields and fast 20% price upside.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report