I have a pop payout quiz for you, my contrarian friend. Can you tell me how much dividend income you earned last week?

And if so, can you tell me how much you earned each day?

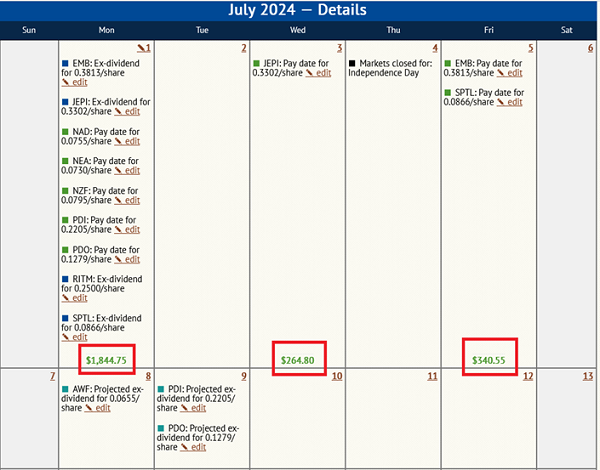

These details are now available in Income Calendar, the dividend tracking tool that we created in-house here at Contrarian Outlook. IC’s ability to project divvies down to the day tells us that:

- We collected $1,844.75 last Monday.

- Another $264.80 in divvies followed on Wednesday.

- And our holiday week was capped off with $340.55 in income on Friday.

The tool took my newsletter portfolio as input—with tickers and sample share counts—and did the rest of the work. Pretty cool stuff.

Project Dividend Income Down to the Day with IC

Of course, you can make Income Calendar your own personal dividend assistant. It’s better than any AI tool because IC can actually connect with your online brokerage account to pull the inputs for you.

Last time I wrote to you about IC, we had integrations for everyone except Fidelity users. We do this via a platform called Plaid, which works with every other major broker in the world.

Fear not, Fidelity users, I have some good news for you. We are now able to connect to your account via Snaptrade, a secure third-party platform that does work with Fidelity. You’ll see this option now when creating a portfolio in Income Calendar, and you can use it to quickly import your tickers and share counts from Fidelity:

Once done, the calculations within IC will be done for you. Nothing else to do, and no need to sync again! Set it and forget it.

Many of you have asked how often the linked accounts update. Every day. Make a trade today and your IC dividend projections will be updated automatically by tomorrow morning. Easy.

How do we obtain such precise projections? By fiddling with a spreadsheet for hours on end?

Much to the relief of subscriber Peter B. from New Hampshire, nope.

“I don’t have to make and update my goofy spreadsheets anymore!” writes Peter B.

No sir, our developers have you covered, Peter! Everything is automated. Which means no more goofy spreadsheets—for Peter or any of us!

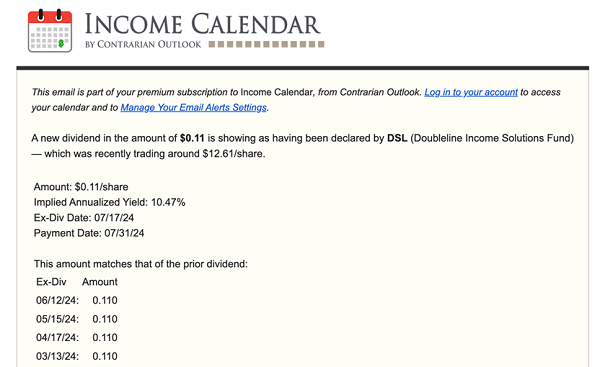

And check this out. Each time we collect a dividend, IC can send us an email heads-up. For example, DoubleLine Income Solutions (DSL) recently declared its quarterly dividend on July 1. So I received this timely and welcome email from IC:

Dividend “Heads Up” Email via IC

The email reminds me that DSL’s implied annual yield is 10.5%. This is a sweet income stream to lock in with interest rates on their way down.

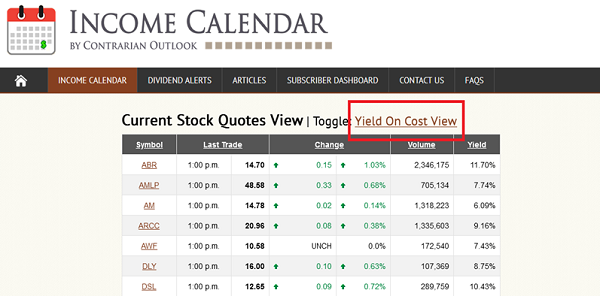

I realize many of you bought DSL when it paid more. Some of you secured yields of 12.8%! Will Income Calendar reflect your prescience and superior yield on cost?

Thanks to our new Yield On Cost View, yes. And IC is even smart enough to calculate your yield on cost from your brokerage buy info. Another reason to take advantage of these integrations!

New Yield On Cost View

I could go on and on but honestly this tool is really easy to use. I set up the Contrarian Income Report Portfolio in a few minutes and my Schwab holdings in a few minutes more. You’ll have this tool setup in no time, too.

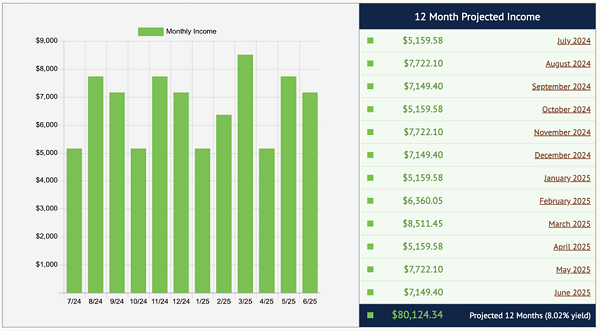

Speaking of CIR, our portfolio pays 8%+ again. A million-dollar equal weight portfolio is spinning off $80,124.34 in straight cash, homey!

CIR Projected Income per Income Calendar

As always, this is dividend income that does not require selling any shares. When we retire on dividends, we keep our principal intact!

If you’re not using Income Calendar yet, you can try it risk-free for 60 days here. We are always improving our product. Don’t miss the next feature—add IC to your account here.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.