Vanilla energy bulls stare at XLE. So basic.

Meanwhile, we “second-level” contrarians consider NRGX as a high-yield play on higher oil prices.

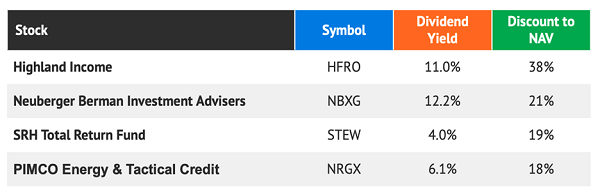

What’s the difference? Well, PIMCO Energy & Tactical Credit (NRGX) yields 6.1% while first-level favorite Energy Select Sector SPDR Fund (XLE) yields 4%.

So we bank 50% more dividend when we look past the popular ETF for a little-known CEF (closed-end fund).

But wait, there’s more. XLE always sells for fair value. It holds blue-chip producers like Exxon Mobil (XOM) and Chevron (CVX). Fair enough. But we’re paying $1 for a dollar in assets.

That’s OK. But not exactly a dividend deal.

NRGX, meanwhile, trades at an 18% discount to its net asset value (NAV) as I write. For my fellow math geeks, that is just 82 cents on the dollar.

Why? Don’t ask me, my friend. NRGX owns a blended basket of income-producing stocks and bonds that benefit from high energy prices. It’s the same big-picture play as XLE.

With a larger yield, and a cheaper price.

As the energy bull market rolls along, energy CEFs in this sector could eventually flip to premiums. Sounds crazy until we consider that many PIMCO funds trade for more than the value of their underlying assets.

Discounted CEFs like NRGX provide unique dividend deals. Unlike their mutual fund and ETF cousins, CEFs have fixed pools of shares. Which means they can trade at premiums and, most interestingly, discounts to their net asset values (NAVs).

When we scoop CEFs from the bargain bin, we win two ways:

- We collect a fat dividend…

- While we wait for the discount window to narrow (because the price goes up).

Is NRGX the cheapest CEF today? Nah bro. Believe it or not, it is only the fourth-biggest bargain on the board!

(Note: We’re talking $500 million or more in assets.)

Our coupon-clipped hero Highland Income Fund (HFRO) takes the top spot, literally trades for dimes on the dollar. Get this: an 11% yield fetching a 38% discount to its net asset value (NAV). Thirty-eight!

Why the Benjamin Graham bargain bin? Is HFRO poorly run? Anything but. Manager Jim Dondero is a savvy income investor with a contrarian mindset.

It’s simple. Jim runs a smaller fund that can’t absorb big bucks. Which puts HFRO’s price at the whims of individual investors who, in year two of a bear market, are skittish to say the least.

I love what Jim is doing at HFRO. Years ago, he realized that meaningful income in public investments was tough to come by. So, he pivoted his approach to focus on private firms.

Basic investors don’t know HFRO. Yet it’s arguably the cheapest CEF on the planet! Its unheard-of 38% discount to NAV means shares sell for a giveaway 62 cents on the dollar.

I get it. CEFs like HFRO typically do not venture into private investments. But it’s a savvy strategy practiced by a master. (We contrarians don’t do “typical” anyway!)

The big shops like BlackRock and Eaton Vance snare the best private credit deals, apply some leverage, and kick out a big dividend. Small fry like HFRO must fight over credit scraps.

HFRO’s private company investment edge is paying (big) dividends. Since January 2020, HFRO’s NAV has held steady. Which is really all we ask of a CEF. Especially during disasters like March 2020 and, well, all of 2022.

Meanwhile, HFRO has dished its generous dividend every single month. Dividends reduce NAV, so the stable NAV means HFRO’s cash flow keeps on flowing.

This fund is still dirt-cheap because vanilla investors (and “first-level” money managers) don’t understand it. But just wait until the Fed reverses course and starts cutting rates! When that happens, HFRO could easily return 20% or more in a few months.

And GET THIS: If the fund’s price pops by 20%, it will still be heavily discounted!

Longtime readers may recall the time I scored an exclusive 51-minute interview with an HFRO executive. At the time, the fund was attempting to convert itself to a holding fund.

Management eventually decided against the conversion, because of opposition from investors who were in love with HFRO’s dividend and wanted the fund to keep on trucking, paying them monthly.

Well, here we are on the other side of that financial drama: HFRO still pays its monthly dividend, still grows NAV, and trades for just 62 cents on the dollar!

Will the fund ever get respect? Who knows and, for our selfish dividend motivations, who cares? We’ll keep collecting the 11%—in month-sized pieces—while HFRO’s price grinds higher.

Publisher’s Note: HFRO is an exciting opportunity right now, but Brett has even more monthly-paying CEFs at the top of his “buy” list right now.

If you’re looking to accelerate your wealth with steady, consistent payouts, then Brett’s “8% Monthly Payer Portfolio” could be the special report for you.

He has personally hand-picked and double-checked this unique portfolio from every angle for maximum safety. The bottom line is that these funds are so cheap that they’ll easily hold their own in the next pullback…

And we’ll soak up their huge payouts the whole time!

Now is the time to get in, while you can still do so at a bargain. Click here to unlock all the details.

–Kevin Wallen, Publisher, CEF Insider and Contrarian Outlook

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report