Today I want to show you how to build a “three-click” income portfolio that gives us three things every income investor craves, especially these days:

- Big discounts on our investments.

- Big dividends, with a 10.6% yield averaged out across three funds.

- Wide diversification, with investments from across the economy.

Put the three closed-end funds (CEFs) I’ll show you below together into their own “mini-portfolio” and you could pull $10,600 in dividends from a $100K investment; $53,000 from $500K and a six-figure income stream—$106,000—from a million.

Let me introduce these three high-yielding CEFs to you now.

CEF #1: Tapping the Energy Boom for a 7.1% Payout

The ClearBridge Energy MLP Total Return Fund (CTR) yields 7.1% as I write and comes to us at a 20.3% discount to net asset value (NAV, or the per-share value of its portfolio). So right off the bat, we’re buying the fund’s high-yielding master limited partnerships (MLPs) for 80 cents on the dollar. (MLPs are the toll bridges of the energy sector, charging oil and gas producers to ship their products down their pipelines, then passing the bulk of these funds over to us as dividends).

This discount also helps support CTR’s dividend because management only needs to earn a return on its NAV, rather than the discounted market price, to cover its payout. In CTR’s case, they need to get a 5.8% return on assets to sustain the 7.1% yield on market price, which is the yield you and I get. They’ve had no trouble doing that:

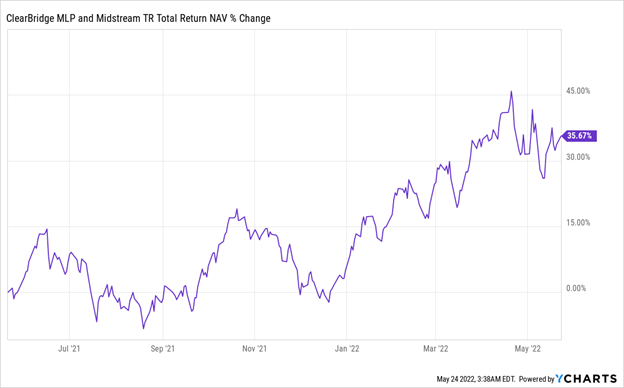

CTR Soars in a Bear Market

Even as the S&P 500 sinks, CTR’s focus on MLPs has helped management bag a 35.7% total return on their investments over the last year, enough to cover payouts for the next six years! The fund is also a good way to buy MLPs without the hassle of the complicated K-1 forms you get at tax time if you buy MLPs individually. Buy them through CTR and you can skip that hassle and just get a simple Form 1099 instead.

CEF #2: A Ridiculously Discounted 14.8% Payout

Next let’s look at the 14.8%-yielding BlackRock Innovation and Growth Trust (BIGZ), a tech fund holding firms like Bill.com (BILL), Entegris (ENTG), Five9 (FIVE) and Bio-Techne (TECH).

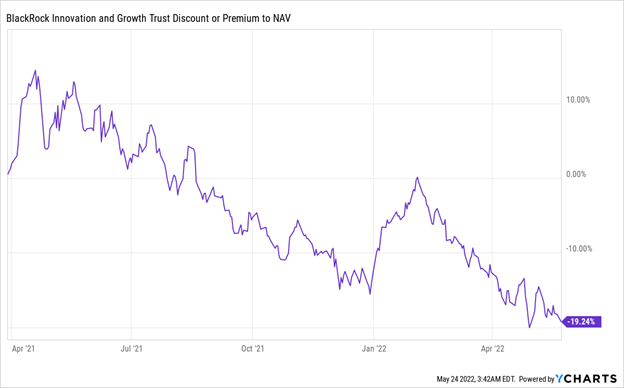

BIGZ, which is less than a year old, trades at a 19% discount to NAV, as the market has sold off the sector in the last few months. That’s the lowest discount of any BlackRock fund trading on public markets.

A Cheap Fund Gets Really Cheap

As a result of that discount (and the accompanying drop in BIGZ’s share price), the fund’s yield has soared to its current high level. And it’s sustainable because management just needs to get just an 11.9% return on their investments to keep the payout going.

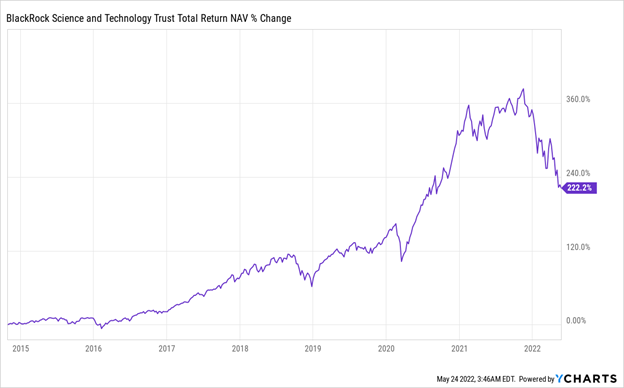

We know that’s doable because BIGZ’s older sister fund, the BlackRock Science and Technology Trust (BST), has done much better than that.

Strong Gains, Sustainable Payouts

Since its inception seven and a half years ago, BST has returned an annualized 17%, far above what BIGZ needs to pay out its dividends. And since these are both similar funds, focusing on tech and using BlackRock’s massive market access to pick winners, it seems that BIGZ is a way to get in on the ground floor.

CEF #3: Sustainable Payouts and an Oversold Fund

Finally, let’s move on to a corporate-bond CEF called the Western Asset Diversified Income Fund (WDI). It’s another new fund, having launched a bit less than a year ago, and currently trades at a 14.7% discount after many traders sold it with the Fed’s plan to raise interest rates.

Here’s why they were wrong to do so—and why nabbing that near 10% income stream at this low price is a great idea.

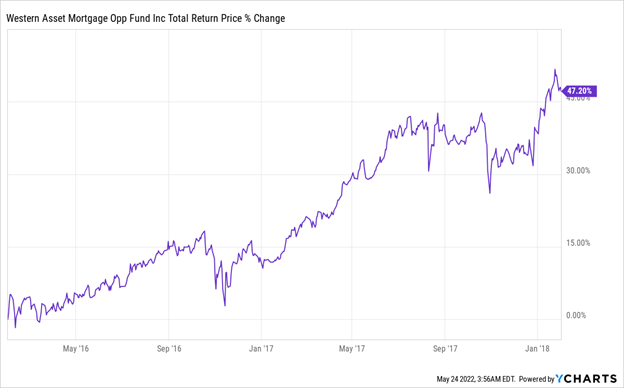

WDI’s sister fund, the Western Asset Mortgage Opportunities Fund (DMO), has a slightly different focus (on mortgage-backed bonds rather than a mix of mortgage-backed and corporate bonds), but a longer history. And DMO not only did fine the last time the Federal Reserve hiked interest rates in the mid-2010s, it posted an annualized total return of over 20% per year while sustaining payouts to investors.

WDI’s Older Sister Shrugged Off Rising Rates—I Expect WDI Will, Too

From late 2015 to mid-2019, the Federal Reserve raised interest rates 900% (more than economists expect the Fed to raise them now), and not only did DMO survive—it thrived. Savvy investors who bought when others were panicking about rising rates were rewarded with nearly a 50% return in just two years. I expect a similar outcome for buyers who pick up DMO today.

My 4 Top CEFs Are On Sale Now (but not for long!) and Yield 8.5% (Paid Monthly)

This selloff has dropped the discounts on many CEFs to levels we haven’t seen in years—and driven up their yields, too!

Take my 4 top CEFs I recommend now. They’re currently throwing off very sustainable yields of 8.5% and are trading at tremendous discounts today. Those discounts are key, because they help boost the fund’s price as more investors spot them and pile in. And in a falling market, they can lend some stability to a fund’s price.

No matter what, you’ll be collecting a rich 8.5% dividend on a buy made today. And these 4 funds all pay dividends monthly, too.

Click here and I’ll share my full CEF-investing strategy with you—and show you how to access the names, tickers and all of my research on these 4 overlooked (for now!) 8.5%-yielding funds.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report