I’ve been covering closed-end funds (CEFs) for more than a decade. Through that time (and still today!) I’ve been shocked at how many people sleepwalk right past these incredible income plays, and the big dividends (and upside) they offer.

CEFs are publicly traded and highly regulated, like mutual funds or ETFs. The key difference? Big dividends! The 500 or so CEFs out there yield 8.4% on average, and they’ve historically have yielded 7%+.

They work by investing in the kinds of assets most of us own already—stocks, bonds and real estate mostly. They then hand out the resulting profits as dividends. CEFs can maintain their large income streams—and even grow them—as long as their returns in the market match their payouts. This happens a lot.

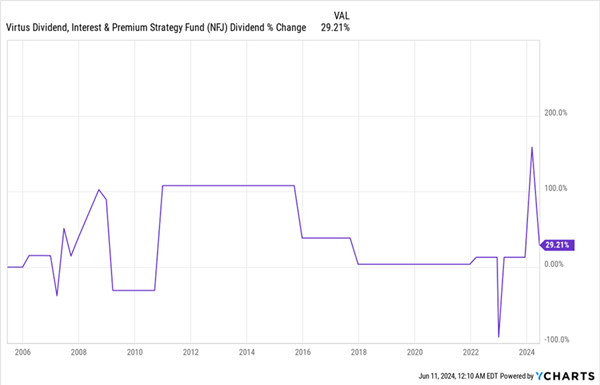

NFJ’s Growing Payouts

One example: An equity-focused CEF called the Virtus Dividend Value Fund (NFJ), which, as you can see above, has grown its payout since its launch over a decade ago. The fund, which yields 9% today, has done this by “translating” its portfolio profits into income by taking profits on its stocks at the right times (which is why the line in the chart above floats a bit). It’s also offered special dividends (the spikes and dips in the chart).

This essentially means you can use an equity fund like NFJ to stay fully invested in the stock market while collecting a sizable income stream along the way.

The fund holds a diversified portfolio and focuses on well-known companies like Bank of America (BAC) and Florida-based utility (and renewable-power giant) NextEra Energy (NEE).

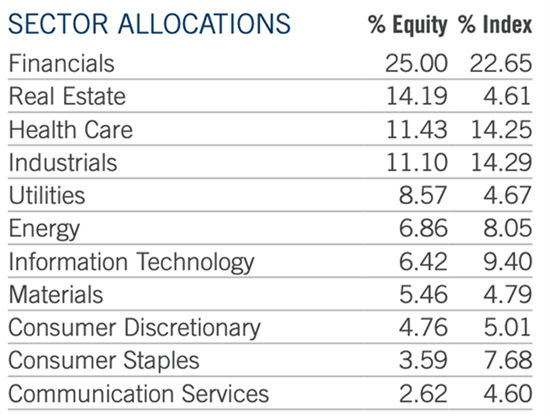

Source: Virtus Funds

In other words, CEFs like NFJ offer something a lot of people think is impossible: high income and diversified stock holdings.

As I said off the top, it’s surprising how few income investors know about CEFs—and how this can lead those “on the outside” to invest in some far lesser alternatives.

I’d put master limited partnerships (MLPs) on that list of “far lesser alternatives.” MLPs mainly store and transport oil, gas and other fuels. If you buy them individually on the stock market, they give you a complicated K-1 package for reporting dividend income, as opposed to a simple Form 1099. That’s a big headache for you or your tax-preparer.

Moreover, MLPs tend to underperform more diversified funds when held over the long run, due to the cyclical nature of energy markets (which is why we, as longer-term income investors, have avoided energy CEFs in my CEF Insider service for years).

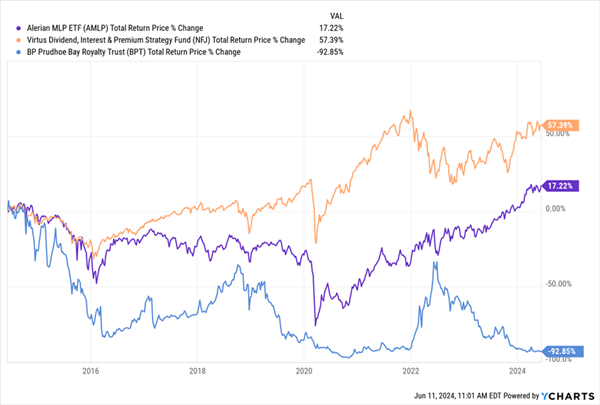

NFJ Outruns MLPs and Royalty Trusts

You’ll note that the above chart also includes the largest royalty trust in America, the BP Prudhoe Bay Royalty Trust (BPT), in blue. BPT is another income-generating asset a lot of retail investors gravitate to. Trouble is, royalty trusts are notoriously poor investments, as you can see in BPT’s stunning 93% decline (including dividends!).

A lot of investors have gravitated towards these kinds of assets because they just don’t know about CEFs, or appreciate their income-generating potential.

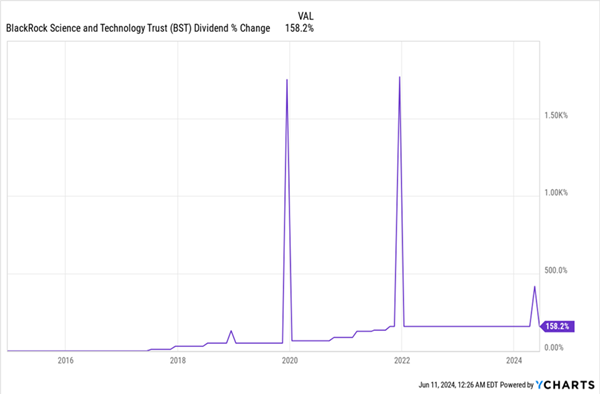

And CEFs convert gains into dividends with all kinds of stocks. You can even get strong income out of high-flying tech stocks like NVIDIA (NVDA)—nobody’s idea of an income investment—through a fund like the BlackRock Science and Technology Trust (BST).

This CEF yields 8% now and holds well-known techs like NVIDIA, Microsoft (MSFT) and Apple (AAPL). The fund has raised its payout by over 150% since inception nearly a decade ago. It’s also paid a number of special dividends (the spikes in the chart below).

BST Turns Tech Gains Into Income

BST and NFJ are just the start. There are hundreds of CEFs out there, with managers who turn their portfolio profits into income for us without us needing to sell a single share. That protects our income in the future, too.

Now here’s the real cherry on top.

Because of their “closed” structure, CEFs can’t issue new shares willy-nilly, like mutual funds and ETFs can. That means CEFs’ market prices can fall below the value of their assets. This happens a lot, and when CEFs are priced at a discount to net asset value (NAV) like this, investors can make money buying when the market is fearful, then selling later, when greed returns and discounts are smaller.

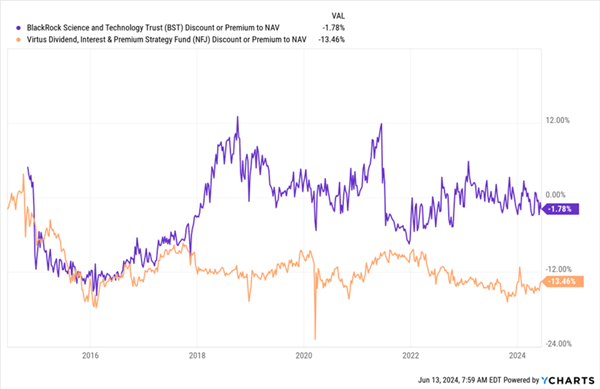

BST and NFJ Both Trade at Undeserved Discounts

With a 13.5% discount, NFJ (in orange above) is obviously cheaper on a comparable basis than BST (in purple), though BST’s 1.8% discount is deeper than it seems: This one should trade at a healthy premium given its tech (and specifically AI) exposure.

NFJ, for its part, looks a bit like BST back in the mid-2010s, when it traded at a hefty discount, then swung to a big premium. A similar move for NFJ could result in strong profits for investors who buy in now.

4 Urgent Buys That “Translate” AI’s Explosive Growth Into Huge Dividends

If you’re looking to tap the rapid adoption of AI into big dividends, BST, not NFJ, is the better buy: As mentioned, it has exposure to top AI stocks, which makes it a smart play on this fast-changing tech.

BST is just the opening act here: I’ve built a whole portfolio of high-yielding AI CEFs (average yield: 8.1%) that let you grab big dividends from AI stocks. And all of these funds trade at unusual discounts, so we can look forward to some solid price upside as those markdowns “snap back” to normal.

Of course, AI is growing exponentially, so this opportunity won’t be around for long. Click here to learn more about our “AI-Powered” income strategy and download a free Special Report revealing all 4 of these 8.1%-paying AI CEFs.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report