There’s no doubt inflation is eating into our wealth, but luckily we have a solution—closed-end funds (CEFs)!

These unheralded income-and-growth plays are the answer to the wave of inflation we’re all living through, with 6.9%+ payouts that outrun surging consumer prices and crush the typical stock’s paltry 1.3% yield, too.

Members of my CEF Insider service know this well: that 6.9% figure is exactly what our 17-fund portfolio yields today, with the highest payer of the bunch throwing off an outsized 8.1% payout as I write this.

And that’s before we even talk about gains! Investors who’ve been with us since launch in early 2017 have enjoyed a tidy 11.9% annualized return (with dividends reinvested), a gain that consistently leaves inflation in the dust. (See below for an opportunity to get instant access to this portfolio with no obligation whatsoever.)

We’ve done it by being laser-focused on two critical things:

- Dividends! But we don’t just stop at the current yields everyone sees in fund screeners—we delve into each CEF’s dividend history and policies to ensure our payouts are predictable.

- Discounts! This is the real key to successful CEF investing, as grabbing a CEF trading at a discount to net asset value (NAV, or the value of its underlying portfolio) and riding along as it rockets to par—and a premium—is one of the most exciting things about buying these funds. These discounts only exist with CEFs, and you can find the discount to NAV on any CEF screener worth its salt.

The trouble with No. 2, of course, is that these days, it’s tough to find cheap CEFs—or cheap anything, for that matter. That means we have to dig into deeper corners of the already-small CEF market to find funds with strong upside.

One place that’s worth looking is among newly issued CEFs. That’s because the CEF market is so thinly covered that new funds only get a fraction of the attention that, say, stock IPOs do. What’s more, new CEFs can underperform in the first few months after launch as they find their groove. But if they’ve got strong management teams, we can use that underperformance to our advantage and grab new CEFs at discounts.

With that in mind, let’s dive into three of the newest funds in CEF-land and see if they’re worth our attention—and investment dollars.

New CEF #1: A 6.4% Dividend for 9% Off

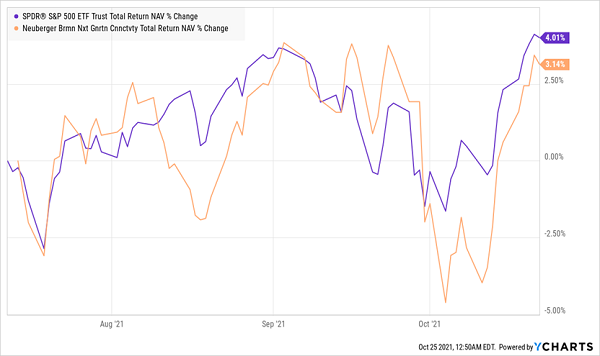

The Neuberger Berman Next Generation Connectivity Fund (NBXG) has a nice 6.4% dividend yield and an even nicer 9.3% discount to NAV. That discount exists in part because the fund has slightly lagged the S&P 500 since its IPO.

NBXG Lags, Creating an Opportunity

That doesn’t faze us, though, because this fund was released in May 2021, and five months is simply not enough time to lay down a reliable performance history. Meanwhile, its holdings are an interesting mix of tech firms that are well positioned to profit from our ever-increasing dependence on mobile technology—companies like Thoughtworks (TWKS), Monolithic Power Systems (MPWR), Marvell Technology (MRVL) and HubSpot (HUBS).

This makes for an interesting mix of high-tech firms you can buy for a 9% discount now and collect a nice income stream while you wait for that discount to close. Note that almost every other tech-focused CEF trades at a premium these days, so this big discount will likely disappear, too, setting up a good buy window now.

New CEF #2: A Diversified Bond Play With a 7.4% Payout

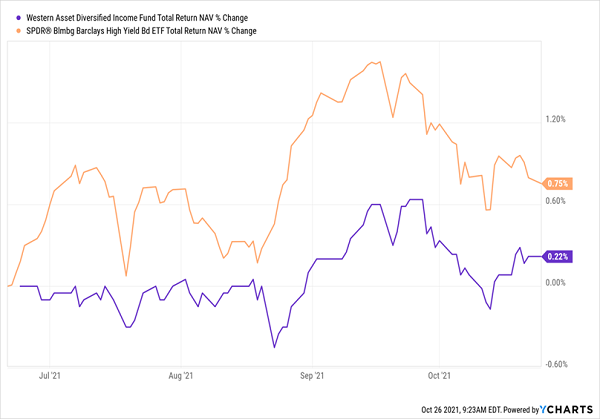

Franklin Templeton’s Western Asset funds are a conservative bunch, and the newest addition, launched in June 2021, is no exception. The Western Asset Diversified Income Fund (WDI) has a mix of municipal bonds, corporate bonds and other debt instruments that deliver the fund’s investors a 7.4% dividend that looks sustainable for the foreseeable future.

But here again, other investors have missed this dividend opportunity and are mostly ignoring this fund, handing it a totally undeserved 4.1% discount to NAV.

Bad Timing Makes for Great Pricing

With a flat performance since its launch in mid-June, WDI has trailed the SPDR Bloomberg Barclays High Yield Bond ETF (JNK). While some investors may dismiss WDI due to its slow start, the gap is narrow, and four months is too short a time to base any expectations on.

What’s more, the fund’s municipal-bond holdings, which it holds to provide additional stability, are responsible for some of that underperformance. But therein lies a big advantage for income investors: this ultra-stable bond fund lets them enjoy their 7.4% dividends in peace. That makes WDI a good hedge against any volatility in the stock market.

New CEF #3: A Stock/Bond Hybrid That Gives Management a Free Hand

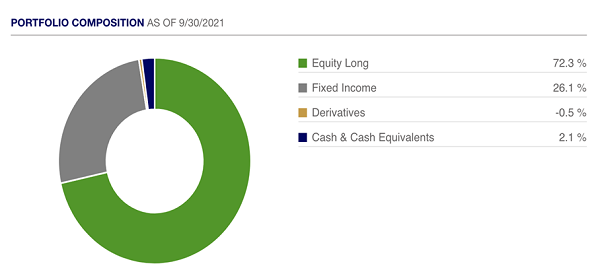

The Thornburg Income Builder Opportunities Trust (TBLD) pays out a 6.3% dividend that, admittedly, is a bit low compared to those of WDI and NBXG. But this fund, just released in July, is still interesting because of its portfolio and its mandate.

While TBLD buys stocks and bonds, it has the freedom to go between the two as its management team sees fit. That’s a big advantage over a lot of funds, which limit the talent they hire by restricting them to one area—tech stocks, say, or utilities.

Right now, TBLD is slanted toward equities, which is letting it ride higher in the current stock-market boom. It’s also slanted toward two of the fastest-growing corners of the market, with healthcare names like AstraZeneca PLC (AZN) and AbbVie (ABBV) and tech plays like Microsoft (MSFT) among its top holdings.

TBLD does trade at a narrow 1.5% discount as I write this. But that doesn’t mean it isn’t worth considering: its portfolio and flexible mandate have a lot of appeal to CEF investors, so it’s not hard to imagine this fund swinging to a premium in the near term.

Yours Now: Instant Access to My 17-Fund CEF Portfolio (Huge Yields Up to 8.1%)

As I mentioned a second ago, I’d like to offer you the opportunity to “road test” CEF Insider and get instant access to its 17-fund portfolio, which boasts an average yield of 6.9% (with the highest payer of the bunch yielding an outsized 8.1%).

These 17 funds are the answer to safeguarding your portfolio from inflation and funding the retirement you want. Best of all, 12 of these high-yielding funds pay dividends monthly, so your income will perfectly line up with your bills!

And now you can dip a toe into this potent collection of income plays with no risk and no obligation whatsoever.

That’s not all—I’ll also give you a FREE special report outlining my top 5 CEFs to buy now. They boast huge dividends up to 7.9% and they sport incredible discounts, too, so much so that I’m calling for 20%+ price upside from each of them in the next 12 months!

This complete wealth-building package is waiting for you now. Click here to get your trial to CEF Insider and your FREE report revealing my top 5 CEFs to buy for dividends up to 7.9% (with 20% upside, too)!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report