There’s no sugarcoating it: As I write this, our favorite high-yielding income plays—closed-end funds (CEFs)—are lagging behind “regular” stocks.

But that doesn’t mean I’m opening this article on a sour note. Truth is, this underperformance is good news for us, as these unloved (and cheap!) 8%-payers are long overdue for a “snap back” to normal.

The result is a (likely short-lived) buying opportunity we’re going to break down now—especially as it relates to the 6.7%-paying Adams Diversified Equity Fund (ADX), a core holding (and buy recommendation) of my CEF Insider service.

But let’s start with that performance lag.

CEFs Get Caught in Stocks’ Wake

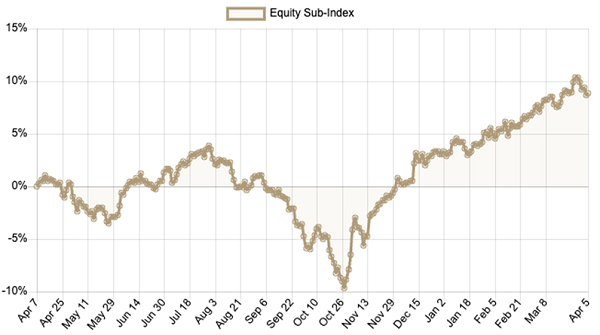

Source: CEF Insider

Over the last year, CEFs focusing on stocks (measured by the performance of our proprietary CEF Insider Equity Sub-Index) have returned 8.9% as of this writing, well below the stock market’s 28.5%. This sub-index usually runs close to the S&P 500. And a lag, when it happens, usually only lasts a few months, then flips to outperformance to revert to the mean. A year of much lower returns is, to put it mildly, weird.

So what’s going on here?

The CEFs Vs. Stocks State of Play, Starting With Dividends

CEFs, of course, are mainly income vehicles, so that’s where we need to start when we talk about their performance. While the benchmark S&P 500 index fund, the SPDR S&P 500 ETF Trust (SPY), yields 1.3%, the average CEF now yields 8%, well above the long-run average of 7.3% from CEFs tracked by CEF Insider.

This is often underappreciated, but it has a lot of value—something Wall Street types call a “liquidity premium.” In other words, the high income that CEFs deliver, often paid monthly, means these funds are more valuable than the assets they hold. But most CEFs trade at a discount to their net asset value (NAV). More on this shortly.

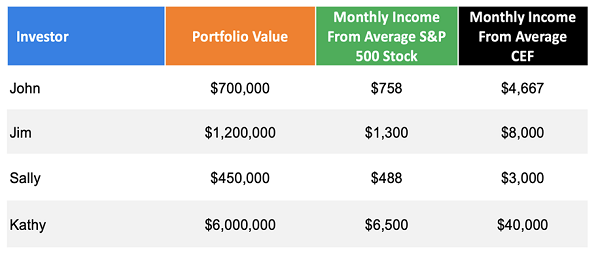

First, to get a sense of the difference, on an income basis, between investing in CEFs and regular stocks, consider this:

Above we have four hypothetical investors who want to maximize their income streams to attain financial freedom faster.

The average income in America is about $5,900 per month. Only one of our four investors—Kathy, with $6 million in assets—can top that by investing in an S&P 500 index fund.

With CEFs, however, only Sally is far from the mark. John’s nest egg will grow to provide that $5,900 average income in three years if the market matches its long-term average return (and he reinvests his payouts). Both Jim and Kathy have a large amount of income left to reinvest elsewhere if they want.

CEFs make this possible by translating the market’s gains into income that investors can use. In a world where retirement is getting harder to achieve for more people due to the failures of 401(k) accounts and other retirement vehicles, CEFs should be priced at premiums for providing this service.

And some do get that premium treatment.

Investors Underestimated This Bond CEF—Then Realized Their Error

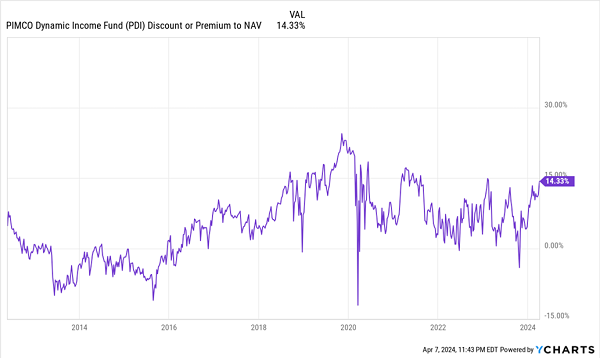

Consider the PIMCO Dynamic income Fund (PDI), a CEF that invests in US corporate bonds, as well as other debt (like government-agency bonds, mortgage bonds and overseas bonds).

As we can see above, PDI’s premium has stayed high for nearly a decade following a couple years of discounts after its IPO. That undervaluation was a mistake, as PDI’s income stream has grown throughout its lifetime. The fund pays an outsized 13.4% and has posted a 228% return, entirely in dividends, since its launch.

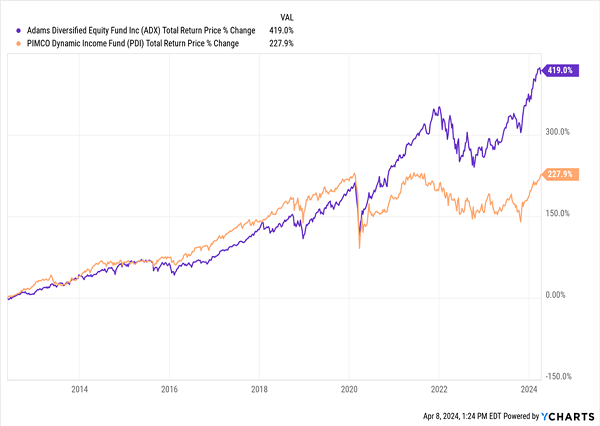

For an even better performance, consider the Adams Diversified Equity Fund, which I mentioned a second ago. (ADX pays its dividend in the form of a one-time, year-end payout that aims to deliver all of the annual gains and dividends its portfolio generates to shareholders as dividends.)

ADX Routs PDI, With Help From Its Big Special Dividends

As you can see, ADX has crushed PDI on a total-return basis since the latter’s IPO. But ADX trades at a discount of 15.1%, versus PDI’s 14.3% premium.

To be sure, this isn’t a direct comparison, as ADX focuses on equities and PDI on corporate bonds (and similar assets). But even so, ADX’s big income stream and outperformance mean it should be priced at least at PDI’s premium, but it isn’t. That’s a central reason why ADX is rated a buy in our CEF Insider portfolio, especially with the CEF market lagging.

But why is the market lagging?

The Problem With Averages

In 2008, Warren Buffett and Ted Seides, founder of hedge fund Protege Partners, made a bet that index funds would beat hedge funds in the next decade. Buffett won by a mile: By year nine, Seides’ funds had returned 0.9% annualized versus Buffett’s 11.9%.

At the time, many saw this as a victory for index funds, but it’s really more of a loss for hedge funds.

Let me explain.

Seides bet on five “funds of funds,” which, as the name suggests, are funds that invest in hedge funds. While returns were somewhat hurt by fund fees from the funds of funds themselves and the funds they held, it seems like an averaging problem really weighed on returns.

Consider this: You have one hedge fund that’s bullish on Coca-Cola Co. (KO) and bearish on PepsiCo (PEP), so it goes long KO and short PEP. Another is bullish on PEP and bearish on KO, so it takes the opposite side of the bet. If I invest in both, I probably won’t see any return—I’ll lose money on the fees, and the gains from the right play will be canceled out by the wrong one.

This is an issue with hedge funds. If you put them all together, they start canceling each other out. In other words, the bet didn’t really show that hedge funds underperformed, it showed that investing in many hedge funds at once drags down returns.

This is one issue with analyzing all equity CEFs, as some will combine foreign and domestic assets (foreign stocks have been doing poorly relative to the US), which makes standout funds like ADX stand out all the more.

But it also means that the performance of these funds together—which is how I built our CEF Insider Equity Sub-Index—will be dragged down by the outlying laggards holding lower-quality assets.

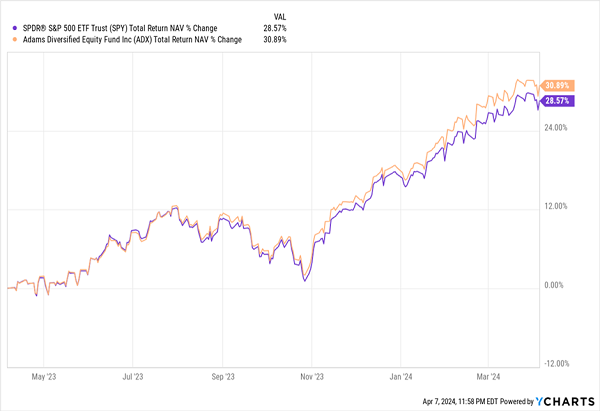

High performers like ADX, however, are beating the S&P 500:

ADX Is a Hidden Gem That Regularly Outruns Stocks

Considering the S&P 500’s 28.6% return over the last year, ADX’s run is even more impressive.

The Problem With the Fed

This isn’t the only issue that makes CEFs look like underperformers. There’s also the Fed, whose massive rate increases left many income investors on the sidelines, happy to get 4% to 5% from Treasuries.

But that won’t last.

The Fed has published its plans to cut interest rates twice in 2024, three or four times in 2025, two or three more in 2026, and more after that. In other words, income investors will see their Treasury income slip, and that, in turn, will drive them back to CEFs.

Even before that, we’ll see hedge funds and wealth managers trying to front-run them.

When that happens, outperforming, high-yielding CEFs like ADX will see their discounts dwindle. Funds like PDI may see their premiums grow, and the best asset managers will take advantage of the fall in yields (since prices and yields move in opposite directions) to make a profit.

That’s exactly what PDI did in the mid-2010s, when it outperformed and attracted loads of investors, bringing its discount to a premium. The Fed is teeing up a repeat of history.

5 Monthly Dividend CEFs (Yielding 9.2%) the Fed Is About to Send Soaring

Few folks realize it, but CEFs have another critical benefit besides their outsized 8%+ dividends: Many of these funds pay dividends monthly.

That amplifies our returns in the long run, as monthly payouts mean we can reinvest our dividends faster. And if you’re drawing income from your portfolio, great! Monthly payers give you a much less “lumpy” income stream than you’d get with regular stocks.

Your dividends and your bills arrive in perfect sync!

And now, thanks to the Fed, we can buy the best of these monthly dividend payers for cheap—a chance I don’t expect to last long.

To help you take advantage, I’ve built a 5-CEF “Monthly Payer Portfolio” I’m recommending to all income investors. The 5 funds inside yield 9.2%, pay dividends monthly (of course!) and are ripe for buying, thanks to their bargain valuations (and the Fed!).

Click here and I’ll tell you more about this 9.2%-paying monthly dividend portfolio and give you the opportunity to download a free Special Report revealing the names and tickers on each of these 5 monthly paying funds.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report