It’s Tax Day—the perfect time to talk about one of our favorite income plays: municipal bonds.

Don’t listen to anyone who tells you “munis” are boring. They’re anything but: It’s easy to grab 5%+ yields from them. And because munis’ income is tax-free for most Americans, that 5% is worth more—in some cases a lot more—to us.

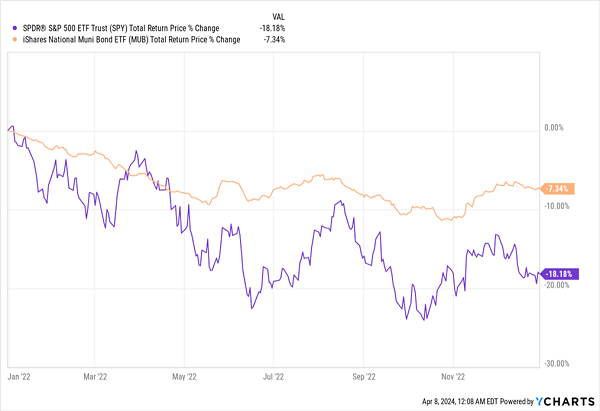

They’re stable, too. Consider how much better you’d have slept at night if you held munis during the 2022 nightmare, when they held up much better than stocks:

2022 Put Muni Bonds’ “Crash Resistance” on Display

Truth is, yearly declines of any sort are unusual for munis, which tend to deliver 5% to 6% annual total returns in the long run—and that’s before their tax benefits, which are, quite frankly, game-changing.

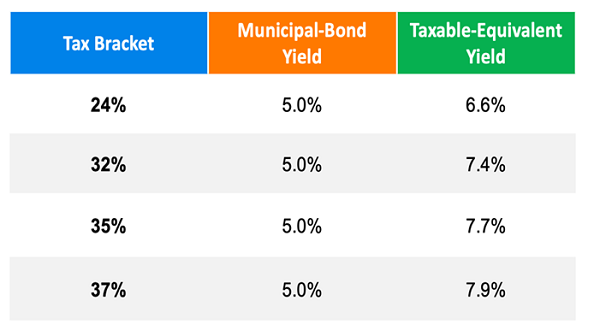

Munis’ Wealth-Building Tax “Hack”

To see how much of a difference munis’ tax breaks could make, we need to consider the consequences of being taxed up to 37% on profits from other investments, like stocks. In other words, how much do we need from stocks to match a 5% muni-bond yield that’s federally tax free? This chart provides a breakdown:

As you can see, for the highest tax bracket, a 5% muni yield is worth 7.9%, or nearly the same as stocks’ long-term return. But can we actually get a 5%-yielding muni bond?

Yes. In fact, it’s gotten a lot easier thanks to the Federal Reserve, whose rate hikes have pushed up yields on muni-bond CEFs. Right now, over a third of muni-bond CEFs pay more than 5%. Before the pandemic, only around 10% did so.

And these CEFs aren’t taking on higher risks, since most muni bonds are backed by governments or the revenue from projects the bonds funded. For example, in America, new toll bridges are typically financed through muni bonds. The bond holders, in turn, get a portion of those tolls, and they get that income without having to pay taxes on it.

Sounds like a good deal, right?

It is, which is why millionaires and billionaires rely on munis more than any other asset class; I get more questions on munis from wealthy individuals than any other topic.

And thanks to CEFs, which trade on the market, like stocks, anyone can access a professionally managed muni-bond portfolio. What’s more, CEFs typically outperform the index (in the long run, well over 70% of CEFs have beaten the muni-bond market).

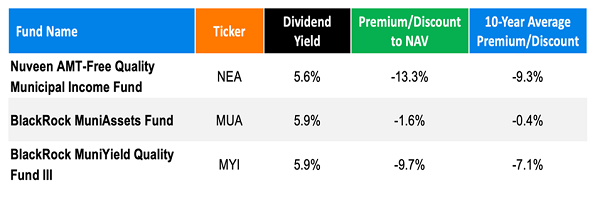

Now let’s go shopping. Here are three muni-bond CEFs that are bargains now.

Let’s start at the top, with the Nuveen AMT-Free Quality Municipal Income Fund (NEA), the largest muni-bond CEF out there, with over $3 billion in assets.

NEA’s 5.6% yield translates to 9.2% on a taxable-equivalent basis for those in the highest tax bracket. And I know I don’t have to tell you that 9.2% annual returns aren’t easy to find. Even the high-flying, tech-heavy NASDAQ only has an 8.5% long-term annualized total return.

Yet even so, NEA has a 13.3% discount to net asset value (NAV, or the value of its underlying portfolio), so we can buy its assets for around 86.7 cents on the dollar. This makes no sense at all.

Which brings me to the BlackRock MuniAssets Fund (MUA), our second fund above, and its juicy 5.9% yield.

That amounts to 9.8% on a taxable-equivalent basis for those in the highest bracket, topping NEA’s implied long-term return and that of tech stocks, too. So it’s no surprise that MUA’s discount has shrunk and now stands at 1.6%. There are plenty of reasons for that, though.

For one, with $431 million of assets under management, MUA is much smaller than NEA, so it doesn’t take as many buys to shrink its discount.

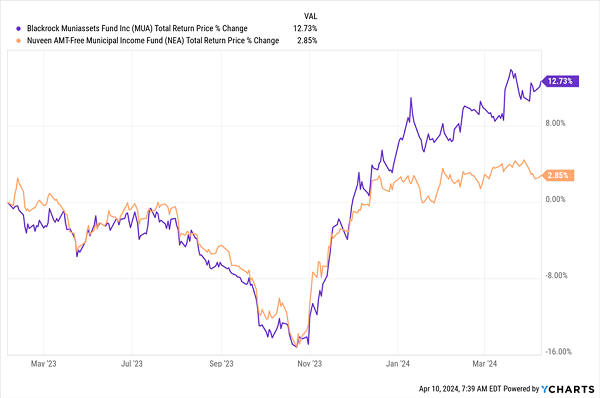

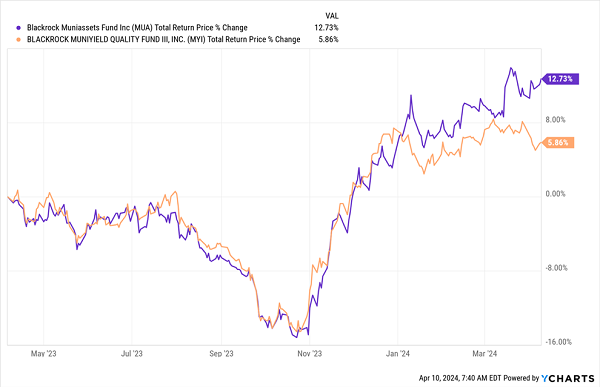

“Pip-Squeak” Muni-Bond Fund Outruns Goliath

Moreover, as you can see, MUA (in purple) has crushed NEA (in orange) over the last year because its portfolio has grown in value, attracting more investors. Thus, despite its smaller discount, MUA is a better pick than NEA, as management has proven itself through its fast recovery from the 2022 pullback.

So where does that leave the third fund in the table above, the BlackRock MuniYield Quality III Fund (MYI)? It has the same yield and management as MUA, so shouldn’t it see a similar return? Well, not exactly.

MYI: The Underdog Winner

While MUA has demanded a lot more attention from investors, driving up its market price more than MYI, both funds have had very similar investment returns over the last year, with MUA’s total NAV return at 3.4%, versus 2.5% for MYI. This is no surprise, given their similarities, and it suggests that MYI, with its much lower total-price return, has not yet fully priced in its potential.

That makes MYI the best of these three muni-bond funds.

Market dynamics also suggest that MYI’s discount, currently 9.7%, is way too big and should catch up with MUA’s 1.6%. But what caused that discrepancy in the first place if these two funds are so similar?

While MUA has about $431 million in assets, MYI is much bigger, at $753 million, so it will take more momentum for its market-price-based return to match that of MUA. But since the momentum is already here and going strong, it seems likely that MYI will catch up quickly.

Folks who buy before that happens will get a fund with a strong historical return without the tax consequences. And when MYI starts trading at a smaller discount (or a premium), you can sell it for a profit—or keep it and continue to collect its tax-free income stream.

These 4 CEFs (With Monster 10.2% Payouts) Fit Perfectly With Our Muni Funds

Muni-bond funds are the biggest part of the CEF space (at 108 funds in all), which is no surprise, really. The muni-bond market is tough for individuals to get into, so it makes sense that CEFs would step in to provide that access, considering the huge tax breaks on offer here.

And CEFs hold far more than just munis. There are plenty that give us access to other assets, like blue chip stocks, real estate investment trusts (REITs), corporate bonds, healthcare stocks, you name it. The upshot here is that we can build a diversified portfolio—and grab outsized yields of 8%+—by purchasing just a few CEFs.

In fact, I’ve gone ahead and done that for you, constructing a unique 4-CEF portfolio that’s broadly diversified (containing real estate, blue chip stocks, corporate bonds and a basket of other fixed-income assets, too).

Together, these 4 funds yield an amazing 10.2% today—and they pay dividends monthly, too!

I want to give you access to this “one-stop” 10.2% income portfolio now. Click here and I’ll tell you more about it and give you the opportunity to download a free Special Report naming all 4 CEFs inside.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report