If you watch cable TV or visit financial websites, you no doubt hear about “overpriced” stocks and funds all the time.

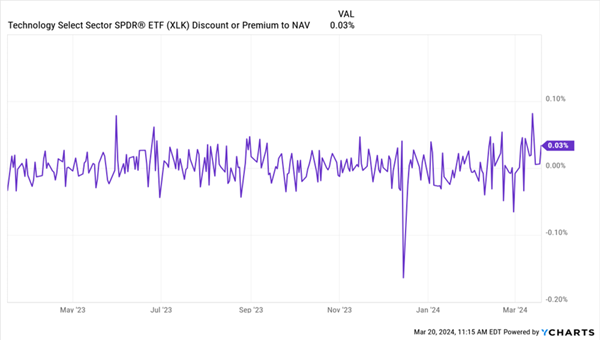

A pundit will jump on TV and say something like “Tech is overvalued.” So, by extension, a tech ETF like the Technology Select Sector SPDR Fund (XLK) is overpriced, right?

Not so—at least in a technical sense. An ETF like XLK can be overpriced, but ETFs rarely are.

A fund like XLK collects money from investors and socks it away in stocks. In XLK’s case, we’re talking about big-name techs like Microsoft (MSFT), NVIDIA (NVDA) and Apple (AAPL). But with ETFs, the price you pay tends to be close to how much it would cost to buy all of those stocks separately. Big Wall Street firms work daily to make sure that happens, which is why XLK is almost never discounted.

No Deals on XLK

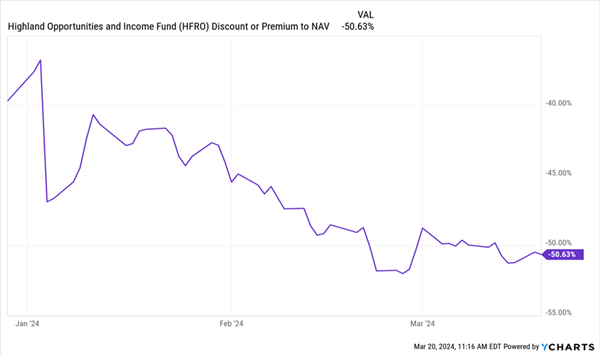

Compare that to a fund we discussed in a March 14 article, the Highland Opportunities Income Fund (HFRO), which trades at a 50%+ discount as I write this!

A Real Discounted Fund

That’s because HFRO is a closed-end fund (CEF), which is different from an ETF. HFRO’s share count is mostly fixed, meaning a big investor can’t throw a billion dollars at HFRO and make the fund bigger (with ETFs, big investors can do this, and they do it all the time).

This helps CEFs focus on their individual mandates, which are usually much more specific than the typical ETF mandate of, say, buying all the tech stocks in the S&P 500. It also means CEFs often trade for less than their portfolios would actually be worth if management were to liquidate the fund.

In HFRO’s case, the fund’s big discount means you can buy $10 of shares and get over $20 back if the fund were to liquidate.

Most discounts aren’t this extreme, and HFRO has some problems, as we discussed in that March 14 piece. But there are many other good CEFs trading at big discounts, meaning you can buy their assets for less than they trade for on the market.

There’s an added advantage to this. CEFs pay an average 8% yield as I write this, with many high-quality funds yielding 9%+. Imagine getting $7,500 per month in passive income on a million-dollar investment! That’s the kind of income CEFs can generate.

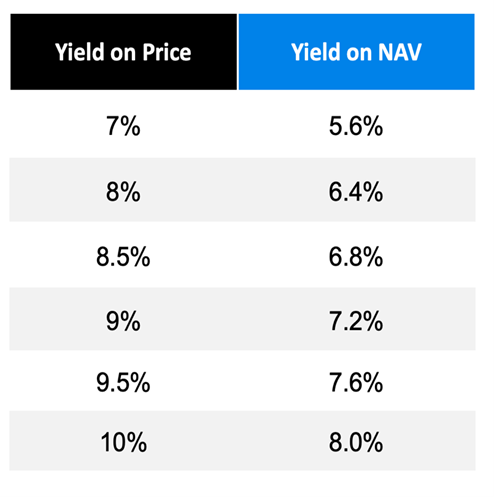

Plus, discounted CEFs have an added edge: safer dividends. When a CEF is discounted, it makes it easier for the fund to pay its distributions to shareholders. Think of it this way: You buy a CEF yielding 8% and each share costs $10. But the actual portfolio (if the fund were liquidated) is worth $12.50. That means CEF managers need to get a return of just 6.4% (that’s eight divided by 12.5) to maintain an 8% yield to you.

This is known as a “yield on NAV” calculation, and it’s very important.

The numbers on the left are the yields that a CEF offers based on its market price: the income stream you get, in other words. On the right is the yield on NAV, or the return the fund’s management has to earn to cover the yield on market price, assuming the fund is 20% discounted. You can see that the discount turns a 9%-yielding fund into a 7.2%-yielding fund on management’s end, which is less than many corporate bonds yield these days.

This is one trick to get more sustainable income out of CEFs. While a 10% yield seems impossible, getting an 8% return every year from a mixture of stocks and corporate bonds isn’t just possible, it’s lower than the S&P 500’s long-term average return of 8.5% (and that stretches back over several decades!).

The discounts CEFs offer are powerful, but like any powerful tool, there’s a dangerous side.

What Goes Down Also Goes Up

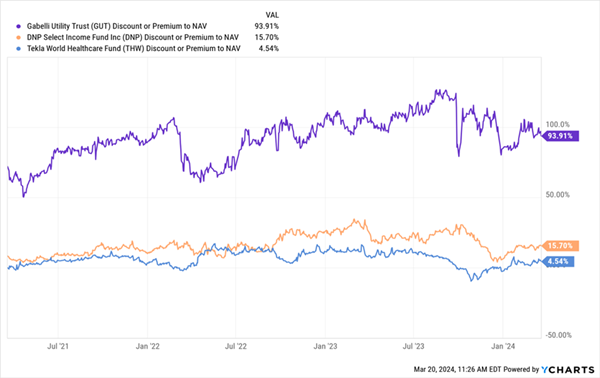

This chart shows the premiums to NAV on three CEFs: the Gabelli Utility Trust (GUT), with an 11.1% yield; DNP Select Income Fund (DNP), which yields 8.6%; and abrdn World Healthcare Fund (THW), a 10.9% payer. As you can see, DNP (in orange) and THW (in blue) have somewhat modest premiums compared to GUT, which is trading for nearly double what its assets are worth!

GUT: A “Meh” Fund Trading at a High Price

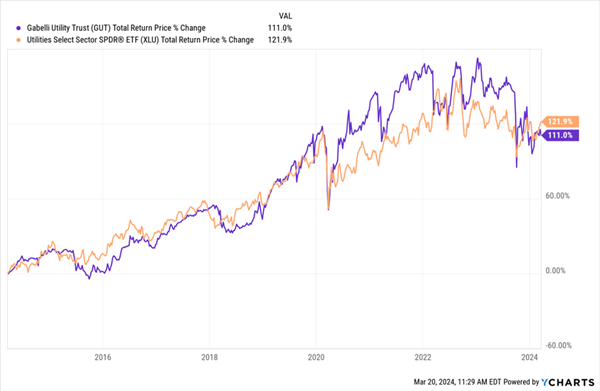

GUT has done what it should do: track the utilities index on a total-return basis over the past decade. Plus it yields much more, and its dividend hasn’t been cut in a decade. However, since the fund trades at an absurd premium, GUT’s managers need to maintain a 21.5% yield on NAV to maintain that 11.1% payout, and they can only do that by getting a 21.5% annualized return every year.

Not only is that not gonna happen, it hasn’t happened.

GUT has earned just a 6.3% annualized return over the last decade, which means it cannot maintain its current payout. Since GUT hasn’t cut in over a decade, the announcement will come as a shock, and GUT investors will see that premium fall.

If it were to drop to par, that would mean a 48.4% decline in the fund’s market price as of this writing, just from the premium eroding. But the dividend cut would also upset income investors, which could put GUT at a discount.

The bottom line here is that buying premium-priced funds is risky, and in GUT’s case, it’s incredibly risky. THW’s dividend is much more stable, but its 11.4% yield on NAV is still incredibly high, while DNP’s 10% yield on NAV, due to its big premium, looks relatively riskier, as its bigger market-price-based premium suggests the fund has more room to fall if there’s a dividend cut or sudden market panic.

These 5 Cheap (for now!) 8.6% Payers Are Top Buys for April

Now that we’ve talked about high-premium funds to avoid now (or sell if you own them), let’s dive into the high-paying “spring buy” CEFs we’re going to buy straight away.

Those would be 5 CEFs yielding a rich 8.6% on average now. And thanks to their deep discounts to NAV, their “yields on NAV”—or what management needs to make to cover their rich payouts, are even lower.

Those discounts are also why I’m calling for 20%+ price upside from these 5 stout funds, too.

I’ve written a full backgrounder on CEFs—and why you never hear about them in the financial press. I urge you to click right here to check it out. This investor bulletin will also give you the opportunity to download a FREE Special Report detailing all 5 of these bargain-priced 8.6%-paying CEFs so you can take advantage of them now, while they’re still cheap!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report