Think back just a couple weeks: The “yen carry trade” had investors running scared, and we had a terrific opportunity to buy stocks—better still our favorite income plays on stocks: closed-end funds (CEFs) yielding 8%+.

But wow, was that window brief! Stocks have more than recovered since, and are what I’d call highly valued, with a price-to-earnings ratio of around 27.5.

Let me be clear: I’m not saying stocks are overvalued: They’re likely to keep posting good returns because earnings are rising, and the economy is still dodging the recession we’ve been warned about for three years now. However, there is a greater risk of volatility kicking up again.

We now know that the August 5 crash had little to do with Japan and a lot to do with pent-up investor anxiety. Such irrational selloffs are likely to come our way again.

But not to worry—we’ve got a plan for that: When the market pulls back, we’re going to put more emphasis on stocks (and stock-focused CEFs). But when the market fully recovers, like it has now, it’s time to buy something many people overlook: high-yield corporate bonds.

Think CEF, Not ETF, When Buying High-Yield Corporates

The way most people would employ this strategy is to pick up (or add more of) a bond index fund when stocks recover from a crash, but this is an imperfect solution.

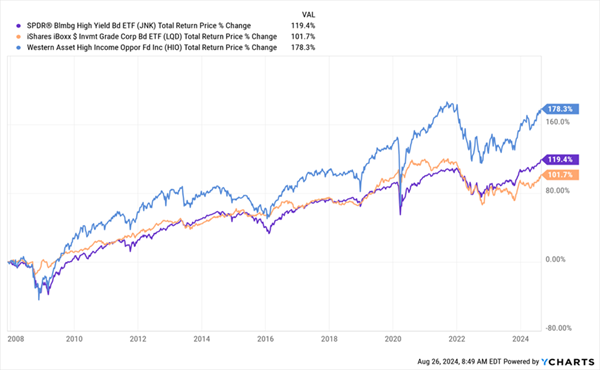

To demonstrate why, let’s compare two popular corporate-bond ETFs—the SPDR Bloomberg High Yield Bond ETF (JNK) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)—to a CEF focusing on corporate bonds, the Western Asset High Income Opportunity Fund (HIO).

HIO is a recommendation of my CEF Insider service that’s done exactly what we wanted it to do when we bought it in February 2023: return a tidy 14.3%, with that gain coming entirely in dividend cash (the price has more or less held steady):

HIO Delivers

I say that return has been entirely in dividend cash because HIO, which has been around since the 1990s, yields 10.9% and pays dividends monthly. That’s a far more generous payout than JNK, which yields 6.5%, and LQD, with a 4.3% yield.

HIO has also handily beaten JNK and LQD since JNK’s inception in 2007:

HIO Outruns the Index Funds

With strong outperformance and payouts far higher than the index funds, despite being in essentially the same asset class, it’s clear that a CEF like HIO is the best way to go when diversifying your bond holdings.

Moreover, as I write this, HIO trades at a 6.5% discount to net asset value (NAV, or the value of its bond portfolio), even with the gains the fund (and corporate bonds generally) has posted lately.

Those discounts are only available with CEFs. And in HIO’s case, the discount suggests more upside ahead. Or at the very least greater price stability in a downturn, which would allow us to collect the fund’s monthly 10.9% payout in peace.

Those are just a few reasons why corporate-bond CEFs are a better buy than ETFs. I’ll throw in one more: Almost all bond CEFs offer higher yield, with an average of 8.5% across the space. Monthly payouts are common in CEF land, too. And getting more of your return in cash is something all of us can appreciate, especially in a downturn.

5 More High-Yielding CEFs to Buy (for 8.7% Payouts) Before the Next Dip

It’s only a matter of time before the stock market takes another dip. When it does, you do not want to be caught without the big steady dividends the best high-yield bond CEFs offer.

Because as stocks dive, safety-conscious investors will pour into HIO and other corporate-bond CEFs, shrinking their discounts and their yields! That’s the absolute worst time to buy in.

The right time? Now, with stocks on a sugar high and high-yield bond CEFs out in the cold.

I’ve just put together a Special Report naming the 5 CEF bargains you need to know about now, which yield 8.7% on average. These 5 funds are diversified, holding stocks, bonds, preferred stocks, real estate investment trusts and more.

Click here and I’ll tell you more about them, as well as why CEFs have been off the radar for so long (even though that’s changing fast). You’ll also get to download your own copy of this unique report revealing these 5 CEFs’ names and tickers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Market volatility creates opportunity. Our analysts have pinpointed 10 stocks perfectly positioned for exceptional growth this spring, even amid economic uncertainty. Don't miss your chance to access this timely research and invest with confidence.

Get This Free Report