Closed-end funds (CEFs) are ready to climb after a two-month decline. In preparation for this pop, select vanilla investors are buying this 11.1% dividend with its 14% downside.

Wait, what?!

Everyone hates bonds today. Yet, somehow, these bonds are selling for $1.14 on the dollar.

I sure wouldn’t do it. I’d favor the fixed income that everyone hates. (More on these discounted dividends in a moment.)

Who is this “I’ll pay a premium” belle of the basic income ball? Convertible bonds. Convertibles pay regular interest. In this way, they act like bonds. You buy them and “lock in” regular coupon payments.

But convertibles are also like stock options in that they can be “converted” from a bond to a share of stock by the holder. So, you can think of them as bonds with some stock-like upside.

You may think few people are paying up for equity upside today. If so, well, you’d be mistaken. Fear dominates the financial markets today, but convertibles are (for whatever reason) still drawing quite the crowd!

Let’s start with the SPDR Barclays Capital Convertible Bond ETF (CWB), the most popular mainstream (read: widely marketed) vehicle to purchase convertibles. CWB yields just 2.2%, but many investors and money managers choose it because it’s easy.

But that 2.2% really insults true convertible connoisseurs. So, these guys and gals are piling into the closed-end fund (CEF) Calamos Convertible and High Income Fund (CHY). CHY has a headline yield of 11.1% and also boasts “convertible” in its name, so why not!

This dividend “alpha” over CWB, however, is about all we have on the resume. CHY and CWB have performed in-line over the past 10 years, so they’re the same, right?

Unfortunately, no. Not today, at least. CHY is fetching a 14% premium to the value of its underlying holdings. Investors are paying $1.14 for a dollar of its convertibles (while CWB buyers pay only $1).

It wasn’t always this way. Just three years ago, we discussed CHY because it was trading at an 11% discount to its net asset value (NAV). It was selling for just 89 cents on the dollar!

That was a good deal. Over the next year, CHY soared by 54% including dividends. Reminding us contrarians, once again, why we always demand discounts.

With CHY trading at a premium, it’s now poised to underperform. Avoid.

A better bet is Nuveen AMT-Free Municipal Credit (NVG). Next to US Treasuries, muni bonds are the safest bonds in America. And lately, munis have been comparative darlings! No debt drama for these boring payers.

When it comes to bonds, boring is good.

Munis are usually so mundane and reliable that they rarely go on sale. And here’s a great thing about municipalities, at least for us investors: when they need money, they issue bonds. The writers of muni bonds are not interest rate sensitive.

(Taxpayers, cover your ears!)

Which means muni funds are the place to be right now. Or at least soon. But you wouldn’t know it from their valuations. In contrast to convertible-powered CHY, boring ‘ol NVG trades at a 16% discount to its NAV today.

A 16% Discount Window, Wide Open

Yup! This well-run muni fund is on sale for 84 cents on the dollar. Buy the stock for under $10, receive $1.85 in NAV for free.

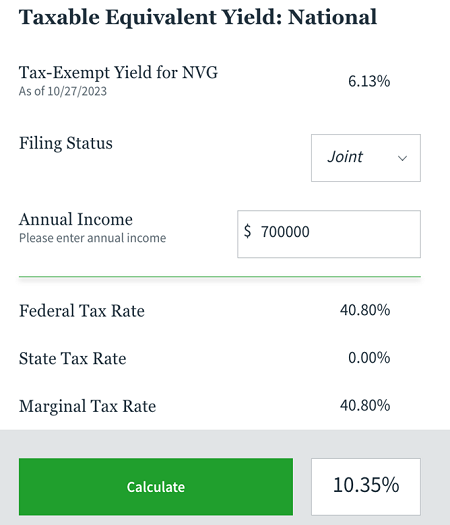

And oh by the way, the fund just raised its monthly payout by 19%! The fund dishes 6.1% and on a tax-exempt basis—they are tax exempt, remember—it’s even better. For my top tax-bracket ballers, this is a tax equivalent yield of nearly 10.4%:

Meanwhile, this tax-advantaged dividend comes with not one but two margins of safety:

- The 16% markdown. As this discount narrows, the fund will enjoy price upside.

- Plus, NAV gains are likely when interest rates settle down.

Yes, NVG is positioned to be a special taxpayer trifecta. The US economy is slowing down en route to an eventual recession. Which means long rates will eventually trend lower.

That move will push cheap munis like these much higher. Not bad for supposedly boring bonds! It’s a great time to hop aboard the slow, steady and dirt-cheap muni train—before our income friends park their high-flying, overpriced convertibles and head this way.

We’ll talk more munis and best income buys this Friday, in the November edition of Contrarian Income Report. This is a great time to deploy capital. Chat in a couple of days.

Unfortunately, I’m showing that your CIR subscription isn’t current! No problem, we can fix that with a couple of clicks.

Please read on here, so that you receive my best dividend ideas and learn how to sidestep the unfolding inflation retirement storm on a risk-free basis.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report