This market has reached a once-in-two-year turning point. And it’s made our favorite income investments—closed-end funds (CEFs)—terrific contrarian buys.

That’s because the best of these funds pay high dividends, usually on the order of 7%+ yields, that can get us through a market downdraft. The vast majority of CEFs pay dividends monthly, too.

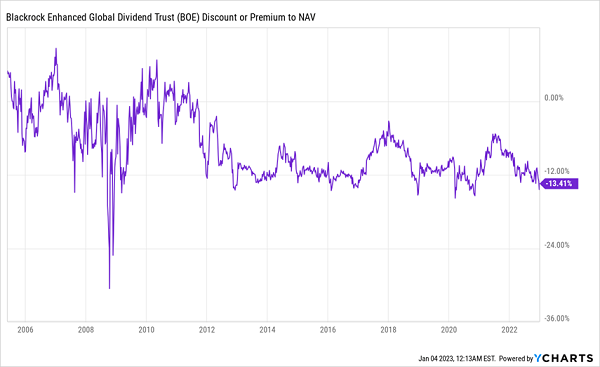

Then, when markets bounce, our CEFs’ discounts to net asset value (NAV, or the value of the stocks in their portfolios) snap shut, giving their prices an extra shove higher. The 7.9%-yielding CEF we’ll talk about in a second is a perfect example: its discount rises and falls in a predictable cycle, and that discount is now sitting near once-in-two-year lows.

Translation: now is the time to buy this fund for its “dividend trifecta”: a high yield, a monthly payout and a discount that’s almost “hardwired” to disappear.

Overwrought Fears Are Setting Up Our Next Big Profit Opportunity

Before we get to that fund, though, I understand if you might be hesitant to buy now. After all, recession worries are running high, and many people fear the market could be about to take another leg down.

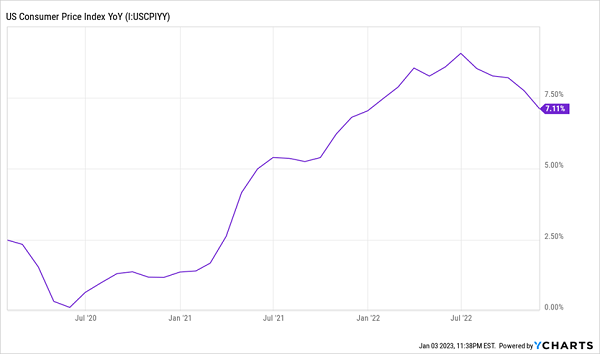

But strange as it sounds, that gloominess is working in our favor. First up, despite inflation fears, the increase in consumer prices we’ve been living through is decelerating. And any faster-than-expected acceleration in this trend in 2023 will likely ignite stocks—and by extension equity-focused CEFs:

Receding Inflation Is Bullish for CEFs

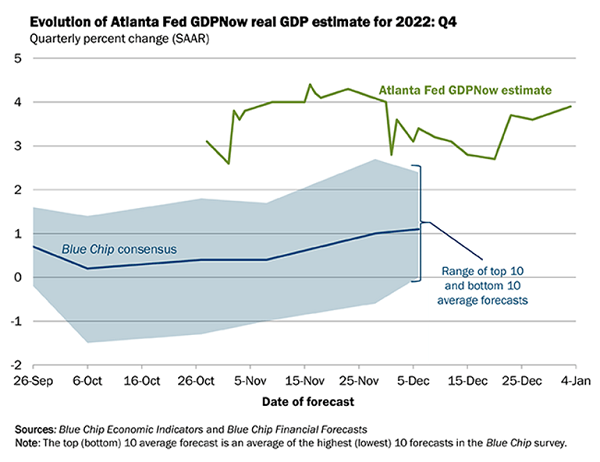

And despite fears of a recession, the Atlanta Fed’s GDPNow model, which attempts to estimate future GDP growth, indicates near 4% growth in the fourth quarter of this year.

Even so, many permabears on Wall Street continue to bang the recession drum, and they succeeded in driving the narrative in 2022. And the truth is, they may succeed in 2023, too.

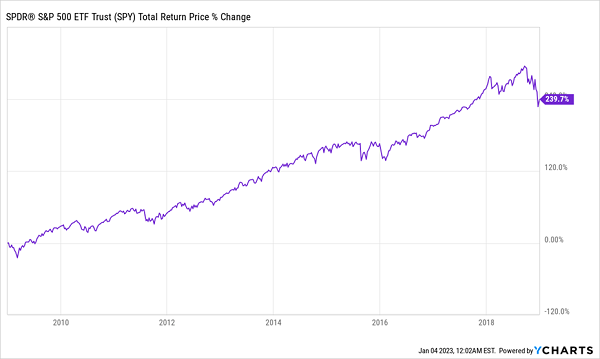

But to be honest, that’s unlikely, because it’s rare that bears dominate market sentiment for two years in a row when the data goes against them. The last time they did was back in 2008 and 2009, when the financial crisis sent many folks fleeing for the exits. But anyone who fought back emotion and took the plunge in that second year saw strong long-term gains indeed:

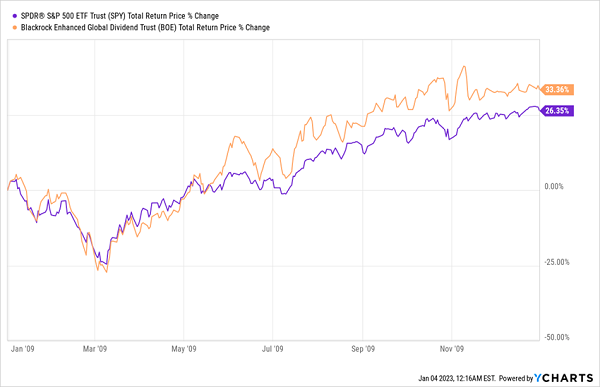

The Permabears’ Huge Profit Gift

In other words, contrarians who bought in 2009, the second straight year when permabears dominated the conversation in the press, saw a 13% annualized return over the next decade, just from an S&P 500 index fund. That’s nearly double the index’s long-term return.

Obviously, if we’re facing another year of gloominess in 2023, we don’t want to get caught in a possible early-year downdraft, but we also want the exposure for another possible decade of 13% annualized gains. And perhaps most important, we want to keep a high dividend stream coming in, even if the permabears win and the market’s eventual recovery takes more than a few months.

This 7.9%-Yielding CEF Is Built for This “Transitional” Market

This is where CEFs come in. They’re a group of high-yielding funds that offer higher yields than pretty well any ETF: the average CEF yields 7.2%, with many high-quality funds yielding more. And these days, many CEFs trade at steep, and highly abnormal, discounts to NAV, so we’re getting their holdings for less than their true market value.

Take, for instance, the BlackRock Enhanced Global Dividend Trust (BOE), a 7.9% yielder that pays dividends every month. It holds many global value stocks boasting strong cash flows, such as Sanofi SA (SNY), Zurich Insurance Group AG, AstraZeneca PLC (AZN) and Unilever PLC (UL). Not only is BOE trading at a deep discount now—it’s also near the bottom of a repetitive “discount cycle” we can take advantage of:

A Clear—and Profitable—Discount Pattern

As you can see above, demand for the fund is cyclical, with the discount rising and falling in clear waves. We’re currently at the trough of the latest wave, with the crest due in perhaps two years. But the crest has also been coming faster as BOE’s cycles get shorter.

My estimate: just on its closing discount alone, BOE could see double-digit gains, on top of its near 8% yield. And that doesn’t include appreciation in the fund’s portfolio, which would drive its market price higher still. We saw this same dynamic unfold back in ’09, and BOE beat the broader market.

Permabear Fear Drove BOE Ahead of the S&P 500 in ’09

If 2023 turns out to be another 2009, equity CEFs, including BOE, will take off as their discounts close and their high dividends draw in more income-focused investors. That would make now a good time to make a contrarian buy.

These 9.5%-Yielding CEFs Are Top 2023 Buys (With Soon-to-Vanish Discounts)

BOE is a great option for these early days of 2023, when the bulls and bears are duking it out for investors’ attention—but it’s far from the only one. I’ve found 4 other CEFs that give us an even higher monthly income stream, thanks to their 9.5% average dividend.

That’s far higher than BOE’s 7.9% yield, and in these days of high inflation, we need the highest dividends we can get! Plus, these 4 funds all trade at discounts that are tracking historical lows, positioning us for 20%+ upside as those markdowns (inevitably) vanish.

Click here and I’ll give you my full CEF-picking strategy and access to an exclusive Special Report that names these 4 CEFs and provides all of my research on each one, including their tickers, dividend yields, discounts and more.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report