While the pundits continue to (unsuccessfully) try to call the bottom of this Fed-spooked market, we CEF investors are doing what we always do: collecting our 7%+ dividends as we patiently move through to brighter days.

In fact, we’re doing more than that: we’re making some careful long-term buys as our fellow CEF investors—a conservative lot if there ever was one—toss out funds that are actually well suited to the higher-rate world we’re moving into.

I want to talk about one such fund today: it does something that has a lot of appeal in a market like this—it keeps you invested in the S&P 500, but with a twist: it hands you an outsized income stream that actually grows more stable as volatility picks up.

A Unique CEF That Crushes Index Funds—Especially in Wild Markets

Of course, we CEF investors know the value of our funds’ high payouts: they let us weather a market storm without having to sell shares to supplement our income, a desperate move that we all know shrivels our nest eggs and our income streams.

Pathetically low yields are the main problem plaguing index funds, including the most popular index fund of all, the SPDR S&P 500 ETF Trust (SPY), with its miserly 1.5% yield. Luckily for us, there’s a CEF specifically designed to address SPY this problem: the 7.9%-yielding Nuveen S&P 500 Dynamic Overwrite Fund (SPXX).

SPXX is always worth keeping on your watch list and considering buying in volatile times. It holds the same stuff as SPY, so you get S&P 500 stalwarts like Apple (AAPL), Amazon.com (AMZN) and UnitedHealth Group (UNH), but with a couple key differences.

The first? A dividend that your typical S&P 500 investor can only dream of: SPXX yields 7.9% as of this writing.

The other difference comes in how SPXX generates that payout: it sells covered-call options, a strategy that’s most effective during market volatility. Covered calls give the buyer the right, but not the obligation, to buy the seller’s stock at a fixed price at a predetermined future date. If the stock fails to hit that price, the seller holds onto it. But no matter how these trades play out, the seller keeps the fee charged to the buyer for this right. These fees enhance SPXX’s dividend.

Since the amount of cash SPXX gets for its call options is tied to volatility, more fear in the market means a larger income stream that SPXX can hand over.

Of course, other investors are aware of this, which is why this fund trades at essentially par—a 0.6% discount to net asset value (NAV, or the value of its portfolio) as I write this. But if you think markets are likely to get more volatile before they settle (a good bet, in my view), this could be a good opening for a buy, as another sharp selloff or two could turn the fund’s discount into a premium.

That leads us to the question everyone is asking: when will this volatility settle out? Of course, no one can predict that, but let’s take a look at what some key gauges tell us:

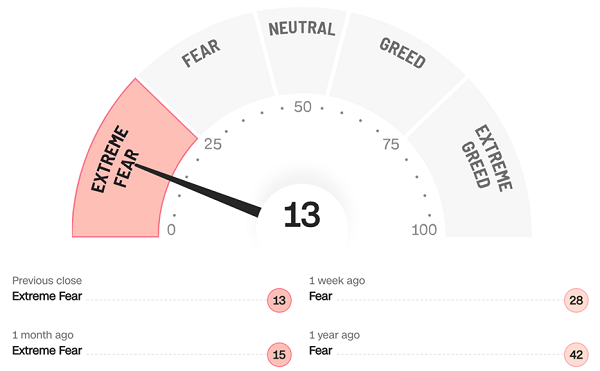

Source: CNN

CNN’s closely followed indicator of market fear is at 13—on a scale of 0 to 100! While I’ve seen it slightly lower for brief moments, it’s about as close to 0 as it ever gets, meaning the market has priced in a very bad environment indeed.

Which is pretty much always the time to buy—especially when there are hundreds of CEFs out there giving out reliable income streams yielding 8% or more, like SPXX.

What About the Rest of the Market?

Next up, let’s look to the pacesetter in all this: the Federal Reserve.

Right now, the market is in a panic because the Fed announced a 75-basis-point rate hike, the highest in nearly 30 years and more than investors expected a few weeks ago. The Fed also suggested that more aggressive rate hikes are coming.

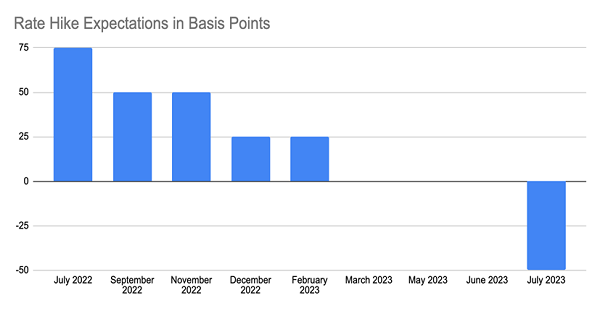

It’s my view that stocks have priced that in, and more. If we look at the futures market, we can see that it’s expecting a similarly large rate hike in July, then two 50-basis-point hikes in September and November, followed by smaller ones in December and February.

Sources: CEF Insider, CBOE FedWatch

But if we look out further, we see a possible light at the end of the tunnel. The Fed’s rate hikes are set to end in March 2023, again according to the futures market, and by the middle of next year, the chart above suggests that rate cuts are possible.

This makes sense because next year’s inflation will be compared to 2022—a year of massive price increases. That would make it harder for inflation to look as bad in 2023 as it does today, even if prices do keep rising. This would be a relief for markets.

That, by the way, does not mean you should wait to buy stocks until March 2023. Remember that the market is forward looking, so March will probably be too late. But what about later this year? That could be the time to buy—or the market could realize the worst-case scenario is already priced in and start recovering next week.

As I said off the top, calling the bottom is impossible (anyone who says they can do so is lying). Which brings us back to SPXX. The fund can keep investors in the market for that recovery while giving them a big income stream to tide them over (and that income stream is bolstered by the fund’s income-generating options strategy).

5 More CEFs Built to Weather the Selloff (and Rip Higher on the Other Side)

I’ve uncovered 5 other CEFs delivering reliable 8.6% yields and trading at huge discounts—far bigger discounts than the one SPXX offers us.

And when the market waters calm (as they inevitably will), I expect these 5 funds’ discounts to vanish, slingshotting their prices higher: I’m talking forecast 20%+ price upside here.

And they’ll pay us that huge 8.6% payout (in cash) the entire time!

Go here and I’ll reveal the “crisis-resistant” strategy we’re using to buy CEFs now, for huge “lifetime” dividends. I’ll also show you how to access a Special Investor Report naming all 5 of these bargain-priced (for now!) 8.6% payers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report