This market’s insistence on falling—even though earnings are soaring—has opened up a strong buying opportunity for us dividend investors.

And we’re going to tap it to grab a rare “double discount” on an 8%-yielding closed-end fund (CEF) that no one’s noticed. This income-and-growth machine has soared 260% since inception and has the potential to crush stocks this year, thanks to its undeserved markdown.

More on that below. First, let’s talk about this stock-market disconnect, because recent declines have yanked the S&P 500’s price-to-earnings ratio down to 23.8. That may not sound cheap, but it’s far below last year at this time, when valuations hit a nosebleed 43.7.

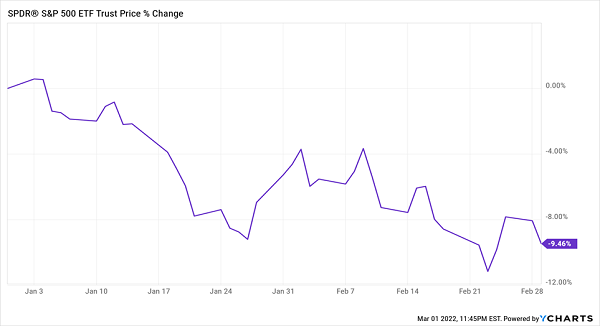

Stocks’ Tumble Is Part 1 of Our Discount Story …

That’s a complete disconnect from the earnings trend, which is spectacular:

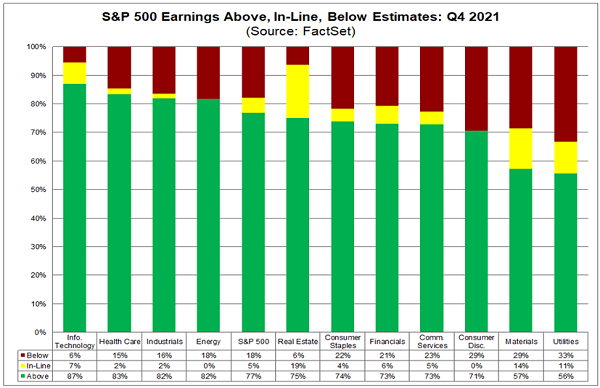

… Soaring Earnings Are Part 2

This chart tracks the earnings for S&P 500 companies in the fourth quarter of 2021, and what we’re seeing is one of the best quarters on record. A whopping 77% of firms have seen earnings per share above expectations, with profits 8.6% above where S&P 500 companies projected for the end of 2021.

That’s just continuing a trend we saw all throughout 2021.

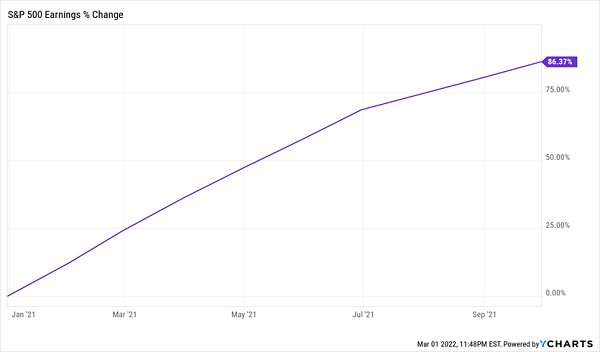

An Earnings Bonanza

Overall, earnings rose nearly 90% in 2021. While a lot of that is because 2020 was a terrible year, the fact is that earnings growth is expected to continue, with firms projecting a 5.5% increase for the first half of 2022. Economists expect GDP growth of over 3% for the entire year.

The Fear Factory

With so many strong economic indicators and a lot of earnings growth behind us, stocks should be going up. So why aren’t they?

While geopolitical chaos is definitely a drag in the short term, stocks began falling before the Ukraine crisis, as investors weighed the risks of inflation to the broader economy. That risk was augmented in article after article in the press saying that skyrocketing prices for food and gas were driving more people into economic stress.

The only problem? This isn’t exactly true.

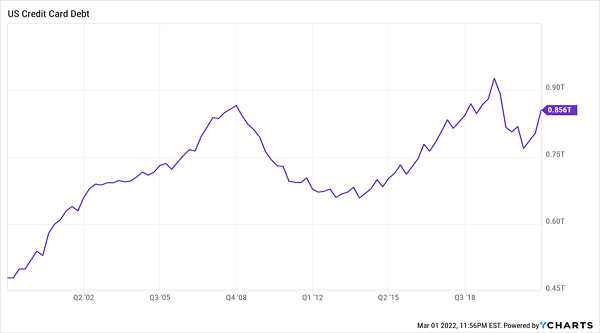

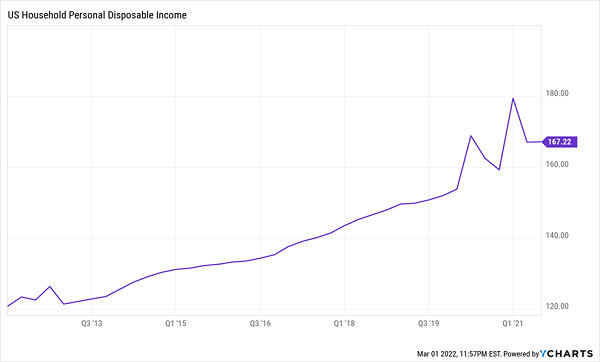

Consumers Shrug Off Inflation Fears

One surefire way to look at whether Americans are struggling is to see if they’re taking out a lot of debt to survive. And while credit card debt has risen in the last year, it’s nowhere near where it was pre-COVID and isn’t even where it was in 2008, when fewer Americans had credit cards and consumer prices were much lower.

When we look at Americans’ earnings, things look brighter than ever.

Workers Richer Than They Were Pre-COVID

While income did dip briefly because of COVID-19, it remains at its highest level in history, save for the spike in late 2020 from stimulus checks.

And while the data doesn’t show Americans are as rich as that one-off made them, it does show that they are richer than they were before COVID-19—and by a wide margin. Throw in a historically low unemployment rate of 4% and I think you’ll agree that we have an economic picture that’s much rosier than the media lead us to believe.

How to Buy in at a Big “Double Discount”

With such strong economic fundamentals in the US, it’s pretty obvious that the recent market selloff is way overdone.

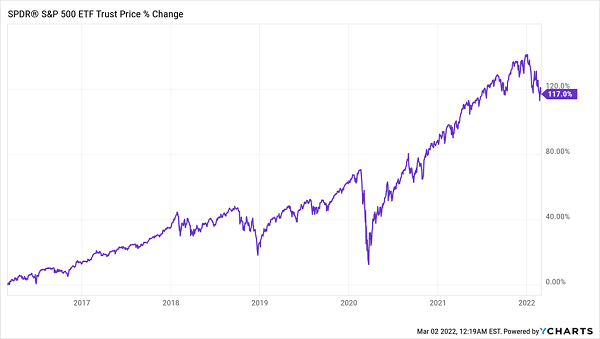

We can look to history for a hint of how a selloff like this one could turn out: there was a similar decline back in early 2016, in a similar economic climate (just like then, markets are bracing for the Fed to start raising rates as the economy recovers following many generous bouts of quantitative easing). And stocks have soared since.

2016’s Panic Selloff Was a Great Buying Opportunity

Bargain-Priced CEF Gives Us a Second Discount Deal

Now, you could just buy the S&P 500 through an index fund like the SPDR S&P 500 ETF (SPY) and be done with it. But why do that when you can get many of the same stocks even cheaper—and with a dividend six times what SPY pays?

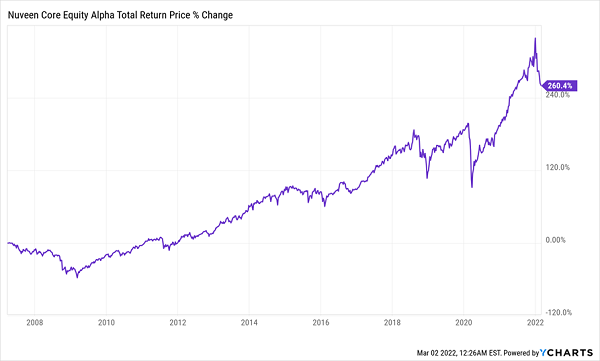

With a CEF like the Nuveen Core Equity Alpha Fund (JCE), you get both of those things, thanks to its 8% dividend yield and its discount to net asset value, or NAV.

This is a discount that only exists with CEFs (ETFs, for their part, always trade at par). And in JCE’s case, it amounts to a “bonus” 5% off deal: while JCE’s portfolio could be liquidated for about $250 million today, shares in JCE are actually valued at around $238 million. So with JCE, you’re getting great stocks like Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN) and other well-established S&P 500 names, but you’re paying less than if you’d bought these companies outright!

What’s more, JCE recently hiked its dividend by 30%, thanks to its outsized gains in recent years. Go back further and you see it has an amazing track record behind it: even after the recent selloff, JCE is up over 260% in the last 15 years.

JCE Soars, With Most of Its Gain in Dividend Cash

I think you’ll agree that JCE, with its double discount and 8% dividend that grows, is a much better way to go than buying an ETF, particularly in today’s uncertain market.

5 More “Double Discounted” CEFs Yielding 7.4%+ (Paid Monthly)

The great thing about CEFs is that their discounts are easy to spot: you can find each fund’s discount to NAV on any screener worth its salt. And many CEFs trade at discounts even deeper than 5% while offering dividends just as high—or even higher—than JCE’s 8% payout.

Better still, many CEFs pay dividends monthly, too!

I’m ready to share my top 5 CEF picks with you now in the 5-fund “mini-portfolio” I’ve assembled. It’s perfectly suited to volatile markets, with a yield of 7.4%, on average. The highest payer of the bunch delivers a retirement-changing 8.4% payout! What’s more, three of these funds pay dividends every month, helping smooth out your income stream.

Plus, these funds are well diversified, increasing your safety even more: they give you exposure to the best pharma stocks for the post-COVID world, real estate investment trusts best-positioned to profit as economies reopen; sturdy municipal bonds to give our portfolio an additional anchor; and tech stocks tapping into the surging artificial intelligence trend.

Don’t miss out on this 7.4%-paying “mini-portfolio.” Click here now and I’ll give you everything you need to know about the 5 CEFs inside, including names, tickers, current yields, discounts and more.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report