Few folks know it, but there’s a way to tap the surging AI trend for a growing 10% dividend. Better still, this monster “AI-powered payout” comes our way monthly.

That’s a far sight better than what most folks are doing these days: focusing on a handful of dividend paying blue chip tech stocks like Microsoft (MSFT).

There’s nothing wrong with Microsoft, of course. But it does yield just 0.8%, or about half what the typical S&P 500 stock pays. It makes up for some of that with a dividend that’s growing like a weed—up just shy of 200% in the last decade—but what if you want a decent yield now?

Well, that’s where the savvy 10%-paying AI play we’re going to break down today comes in. Its yield is more more than 12 times what Microsoft pays. And how’s this for dividend consistency?

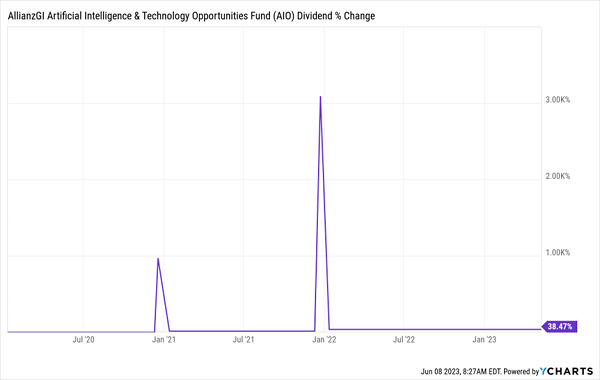

Little-Known AI Fund Pays Monthly, Raises Div, Drops Special Payouts

The dividend play in question here is the AllianzGI Artificial Intelligence & Technology Opportunities Fund (AIO), a closed-end fund (CEF) that, as you can see above, has raised its dividend since inception and held it steady through the pandemic. Plus it dropped two special payouts during those dark days.

Then there’s the portfolio, which includes tech mainstays like Microsoft and Apple (AAPL), alongside other key tech firms like Meta Platforms (META), NXP Semiconductors (NXPI), Motorola (MSI) and Oracle (ORCL). All of these firms stand to gain as AI, which is still in its early days, picks up steam.

Better still, thanks to AIO’s high yield, we’re getting a huge dividend from these stocks, many of which pay low (or no) dividends themselves.

And there’s more to this unique fund than tech: in addition to major stocks from that sector, it also holds deep-value stocks in other industries, like AstraZeneca (AZN), Hilton Worldwide Holdings (HLT) and Deere & Co. (DE).

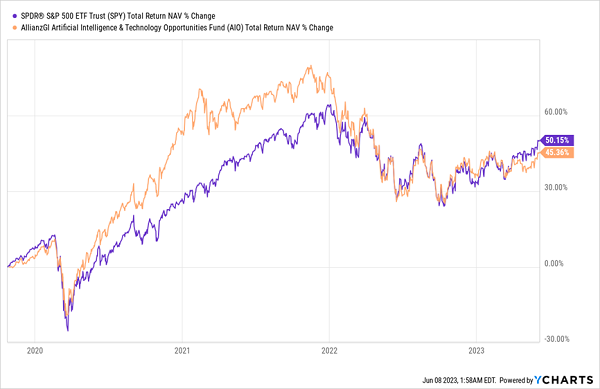

The result, as you can see below, is that AIO’s underlying portfolio (its net asset value, or NAV, in other words—more on this in a second), shown in orange, outran the S&P 500 when tech soared in 2020 and 2021, while simply matching the index’s return in 2022, a tough year for tech:

Upside With Tech Bulls, Limited Downside With Tech Bears

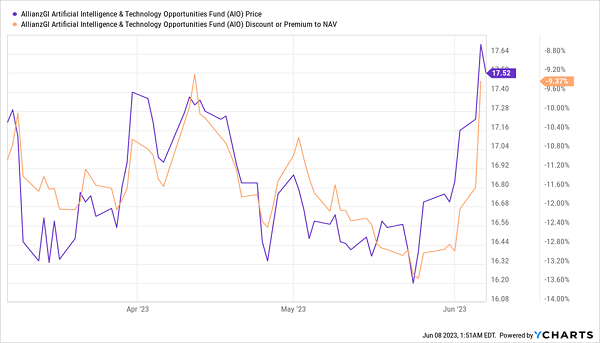

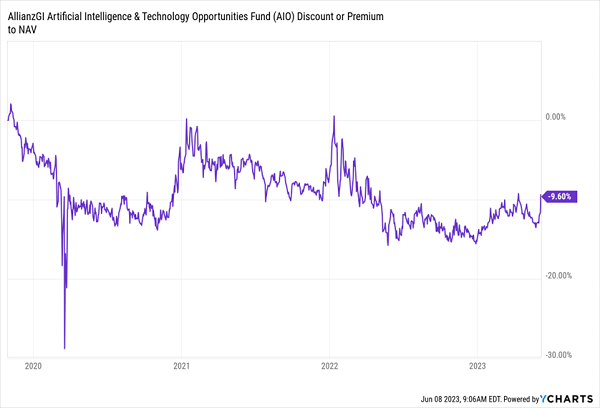

That brings me to the next reason why AIO is on our buy list now: its discount to NAV, or the gap between its per-share NAV and its (discounted) market price. You only get these markdowns with CEFs, and they stem from the fact that a CEF, once launched, can’t issue new shares to new investors. This creates a disconnect that results in a different NAV and market price.

And when we buy at a discount, we set ourselves up for some nice additional upside as those markdowns disappear. Right now, AIO trades at a 9% discount—a good deal on its own. But it gets better when you consider the momentum behind that discount:

AIO’s Discount Narrows, Taking Its Price Along for the Ride

This is when we love to buy CEFs in my CEF Insider service: when a fund’s discount is trending up but is still historically wide. And as we can see in the chart below, AIO has traded at premiums in the not-so-distant past:

AIO’s “Discount Momentum” Is a Great Sign for Us

If the market gets fully bullish on tech again, AIO’s returns will likely eclipse those of the S&P 500, like they did in 2021. The key difference here is that back then, tech was driven by the crypto bubble and the Fed’s easy monetary policy. Those were unsustainable tailwinds, while AI is a real technology that’s producing real gains for many firms—and it’s just getting started.

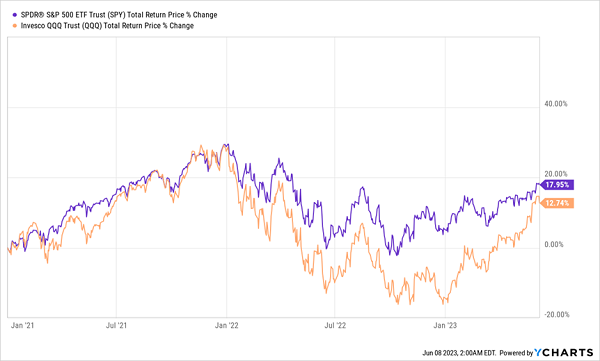

So why, you might ask, hasn’t AIO’s NAV return already started to outrun that of the broader market in 2023, given the tech-heavy NASDAQ’s 30% year-to-date gains? Part of the reason is that AIO’s discount hasn’t entirely evaporated. But more importantly, despite its recent gain, the NASDAQ (shown by the performance of its benchmark index fund in the orange line below) still lags the performance of the S&P 500 (purple line) over the longer term:

Tech’s Hidden Bear Market

In other words, we aren’t really in a bull market for tech, which is up just 12.7% since the start of 2021. This, in turn, means there’s still time for AIO’s price to rise, as its portfolio appreciates and its discount continues to disappear. Those potential gains are in addition to the 10.3% dividend we’ll collect by buying now.

5 “Must-Own” Monthly Paying CEFs Dishing Monstrous 9% Dividends

One of the best things about CEF investing is that most of these funds, like AIO above, pay dividends monthly.

That, of course, is a terrific feature for us, because our payouts match up with our bills. If you’re reinvesting your dividends, great—monthly payouts let you do it faster.

With more investors clamoring for monthly payouts—and basically none to be found outside the CEF world—I’ve assembled a portfolio of 5 monthly paying CEFs that give us two things we always demand in any CEF:

- High yields, to the tune of 9%, on average.

- Deep discounts: Each of these 5 funds is so cheap I’m calling for 20%+ price upside in the next 12 months!

Click here for more about the monthly dividend opportunities in CEFs and a chance to download a free Special Report naming my top 5 monthly payers.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report