We’ve seen more choppiness in the markets in the last couple of weeks. That once again highlights why we should—dare I say need to—own one of the lowest-volatility, highest-paying investments I know of.

I’m talking about closed-end funds (CEFs) that sell call options on their portfolios. I know that sounds a bit out there (maybe even risky to some folks!) but it’s anything but. These terrific income plays give us exposure to stocks, like any ETF, but with less volatility and more income!

I mean, really, who doesn’t want that? Let’s dive into our options here.

Covered-Call Funds Give Us Stocks With Less Drama (and High Income)

Imagine a fund that holds all the S&P 500 stocks, but with a twist: This fund gets paid by investors who would love to buy its shares in the future. These “options” to buy mean purchasers of this right will buy those stocks from the fund at a future date at a fixed price.

The fund accepts this guarantee and receives a cash payment for doing so. That, in turn, cuts the fund’s volatility (because it’s receiving more of its return in cash) and boosts its income stream, with payouts of 7%+ (and even higher, as we’ll see in a second) not uncommon.

This is how a group of funds called covered-call funds operate. They’ve soared in popularity, with some firms, like Rex Shares, releasing new kinds of covered-call ETFs to meet investor demand, especially for income.

The firm’s Rex FANG & Innovation Equity Premium Income ETF (FEPI) offers the kind of yield that would stop most people in their tracks: It yields 25.2% (not a typo!) as I write this.

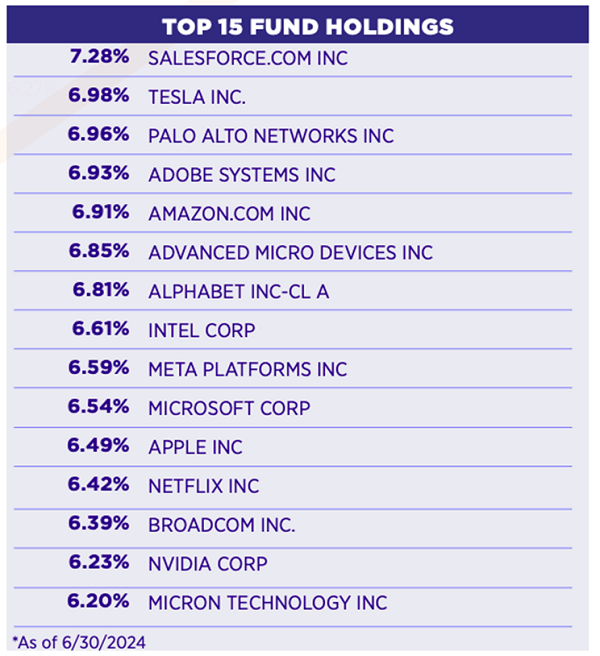

That’s obviously unsustainable, and the main risk with a fund like FEPI is that its portfolio consists entirely of 15 tech stocks, including Tesla (TSLA), Salesforce.com (CRM) and Amazon.com (AMZN).

Source: REX FANG & Innovation Equity Premium Income ETF

We, of course, want a much more diversified portfolio than that—which is why we hold a variety of CEFs in our CEF Insider portfolio, from corporate- and municipal-bond funds to equity funds and funds that hold real estate investment trusts (REITs).

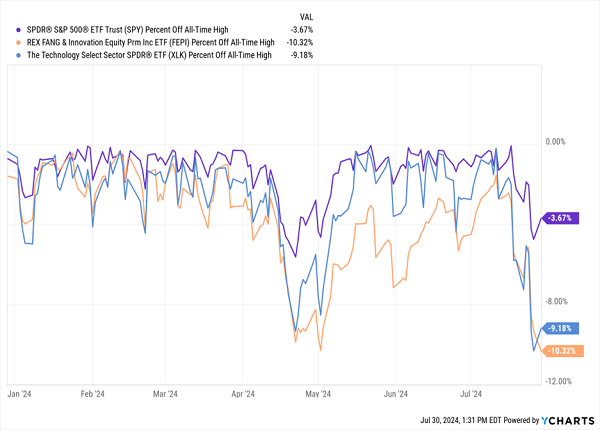

The value of diversification is being demonstrated now, with tech—and by extension FEPI—seeing more selling pressure recently. As you can see below, FEPI (in orange) is further off its year-to-date highs than the S&P 500 (in purple) and the benchmark Technology Select Sector SPDR ETF (XLK), in blue.

Tech Volatility Adds Risks

That’s not surprising. A fund like FEPI isn’t meant to be bought and held for long periods. But its massive yield might tempt some investors who see it as a secure way to a fast retirement.

FEPI is still doing better than tech stocks, however. So it seems that the fund is providing some protection against downturns.

A Better Way to Manage Downturn Risk (and Grow Your Income)

Luckily, the CEF world gives us better options than FEPI (or any ETF, for that matter) to help hedge against a downturn and increase our income.

A good example is the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), which sells call options on its portfolio, like FEPI. But as the name says, it does this for the entire S&P 500.

The benchmark index’s lower volatility and higher diversification make for a fund that’s less likely to fall as far as tech alone, or FEPI, in a fearful market. To be sure, that diversification comes with a cost: SPXX yields less than FEPI—7.3% as I write this—but that’s still more than five times the S&P 500’s average yield.

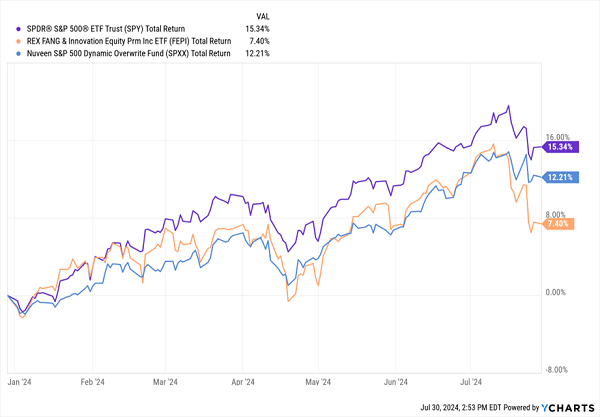

This also translates into better total performance, with SPXX (in blue below) outrunning FEPI (in orange) but still a bit behind the S&P 500 (in purple) this year.

SPXX Less Risky than FEPI

SPXX underperformed the broader market by a bit because of its covered-call strategy: In rising markets, its best performers are sold to those option buyers. In exchange, SPXX holders get smaller drawdowns than those who simply hold the index, as you can see on the right side of the chart above. And, of course, they get more income than the S&P 500 delivers, too.

Thus, if the S&P 500 falls further from here, SPXX is a place to get secure 7.3% dividends and some exposure to this fearful market—but not full exposure. And if the market recovers, SPXX will, too, allowing us to sell it and go back to full stock exposure.

These 4 Buys Cut Through the AI Hype, Drop HUGE 8.1% Dividends

Now that we’ve talked volatility, let’s swing over to another topic that remains hot today: artificial intelligence (AI).

Most people have totally missed the point on AI—they think it will lead to mass layoffs, or some apocalyptic Terminator-style future.

Nothing could be further from the truth. What’s (finally!) starting to dawn on the pundits and corporate C-suites—including at Apple, the biggest tech trendsetter of them all—is that AI will be a tool to make our economy more efficient—and supercharge its productivity.

Just look at what Tim Cook announced in June: Apple will use AI to make its Siri voice-assistant better, make images more searchable and other, similar improvements to the apps the firm already has.

The managers of 4 “AI-Powered” CEFs I’m pounding the table on today know this—and they’ve purpose-built their portfolios to profit from it. What’s more, these 4 funds pay big dividends—bigger than any tech stock I know of—with an 8.1% average yield between them.

These 4 AI income plays are cheap now, but that won’t last. Click here to learn more about them. You’ll also get to download a free research report naming each one and clearly explaining why each is a “must-buy” now for gains and 8.1%+ dividends.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report