As we income investors roll into Trump 2.0, it’s time for us to “flip the script” on the trades that have worked for us over the past two years. Things have the potential to get wild. Fortunes made; retirements lost.

Let’s re-calibrate to make sure we own the stocks that will benefit most from the Trump 2.0 presidency.

Yes, I emphasized equities intentionally. Fifteen months ago, we contrarians started the bond bandwagon. It’s hard to believe now, but back then, the financial suits hated fixed income. We faded their fears, bought bonds and benefited.

Now, however, the fixed income trade is a bit tired. Bonds will likely be under pressure for four years as inflationary pressures ultimately force rates higher again.

The wired trade for the next administration? Dividend growth.

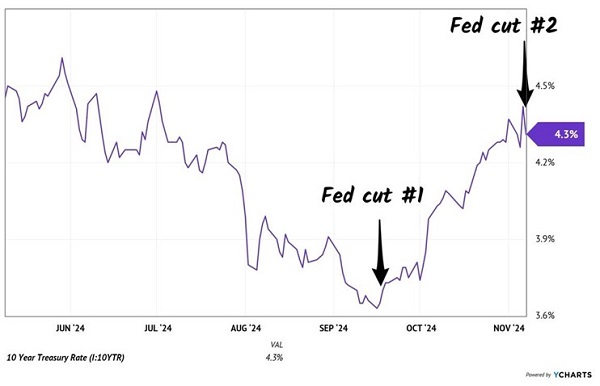

Why? For the same reason I’m now cautious on bonds. The 10-year Treasury yield has been on a tear since Jay Powell first cut the Fed Funds Rate.

Bond Vigilantes Scoff at Powell’s Rate Cuts

You can’t make this stuff up. On September 18, Powell cut rates by 50 basis points. However, this was only the “short end” of the yield curve. The 10-year yield meanwhile (the “long end”) popped from 3.7% to 4.4% in a matter of weeks!

Oh, the irony! The bond vigilantes returned from a multi-decade hiatus. They put Powell on notice that inflation is not dead yet. So, did Powell take the hint? Nope—he cut rates again last week!

The S&P 500 loved it, of course. Woohoo, free money!

If it sounds like Powell is like a desperate poker player on tilt, well, it gets worse. The Fed Chair is aware, as we all are, that Trump dislikes him. Powell has already said he will not resign if asked by the President-elect.

Which is a funny question because Powell does not report to the President. Perhaps even funnier that he answered it.

Net-net we should look for Powell to keep his punch bowl flowing to ease the political pressure on him. He’s already been conducting quiet QE. Why not keep loosening money?

Liquidity is bullish for stocks, which increases consumers’ spending power and the prices of what they buy. Meanwhile, we have three pillars of Trump 2.0: economic growth, tariffs and lower immigration. Three more boosts for higher prices.

Which means bonds, especially the vanilla kind issued by the US Treasury, are not the most appealing place to stash money for 10 years. Would you want to lend to Uncle Sam for a decade at just 4.3% annually given the backdrop we just discussed?

Rate-sensitive stocks, such as indebted utilities, become hot potatoes in this environment. These “bond proxies” not only lose some luster as rates rise, but their leveraged balance sheets are a minus when debt becomes more expensive. So, let’s not only be careful with fixed income but also with stocks that act like bonds.

But why pigeonhole ourselves in bonds and their proxies?

Why not ride the upcoming growth trend to stay ahead of inflation and, to be blunt, make a boatload of cash?

A boom is coming. We have been prepping for a “no landing” economic scenario here at Contrarian Outlook before it was cool. The election results cemented our theory and reminded us that we must stay ahead of inflation, which is coming back and bringing higher rates.

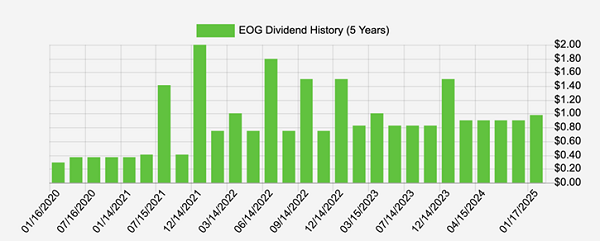

To hedge against inflation and make serious gains, we look to a high-octane play like EOG Resources (EOG). A hot economy will bring rising energy prices. EOG sports the largest drilling permit portfolio in the entire industry.

The “long view” of the permit king’s divvie is impressive. Since inception, EOG’s dividend has fattened 22% per year and oh by the way, just increased another 7% last Friday:

The Permit King’s 22% Per Year Payout Growth

Source: Income Calendar

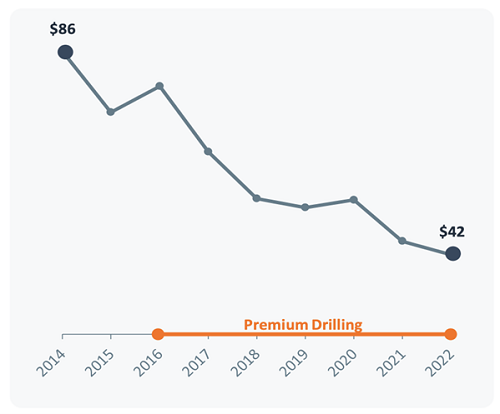

Since 2014, the oil price required by EOG to achieve 10% return on capital (ROC) has dropped from $86 per barrel to just $42 last year:

Oil Price EOG Needs for 10% ROC

Which means upside on oil is pure cash for EOG. The company returns roughly 75% of its cash flow to investors via regular and special dividends every year. This number will increase further with the price of energy. Last week, CEO Ezra Yacob confirmed that not only is EOG in position to exceed its usual commitment but also will be able to return all of its free cash flow to shareholders soon.

It’s good to be the permit king.

EOG is already up 8% since I called it a best buy last month. The stock’s dividend magnet is likely to drag it even higher from here.

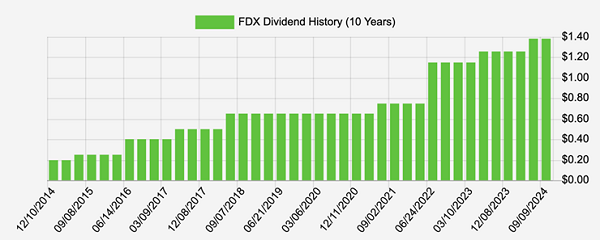

FedEx (FDX) is another pure play on higher growth. This is the type of stock I always watch, waiting for a pullback. It directly benefits from a megatrend, a bull market in e-commerce sales. The company’s cash flow and dividend always go one way—up:

Special Delivery Dividends

Source: Income Calendar

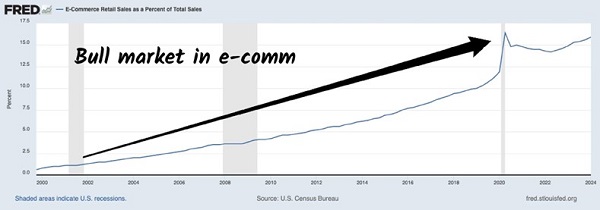

E-commerce as a percentage of retail sales gained for two decades and then spiked in 2020. After a respite, e-comm sales are taking out their previous highs:

E-Commerce Sales as $ of Total Retail Sales

FedEx delivered cautious guidance for 2025 and the stock pulled back. At the time I said the dip was a screaming buy because the right bet was the “over” on the sad guidance. This was solely based on the “no landing” economic scenario, and on cue FDX is up 7% since then.

But now we have no landing meeting Trump 2.0. It’s a bad time to be a bond, but a great moment to be a package carrier. The bull market in e-commerce just got another shot in the arm.

If you’re stuck holding sad bonds and “dead money” stocks, this is the time to trade them in for Trump 2.0 plays. My favorite plays are from my “3X Dividend Solution” which helps me identify big winners for the next administration. Click here and I’ll share my research on my five favorites.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report