Trump 2.0 will feature Wall Street-approved suit Scott Bessent as Treasury secretary. Bessent will advocate for financial deregulation and increased lending. Easier and faster money. Which will be a boon for private equity (PE) firms and business development companies (BDCs).

Today we’ll discuss seven BDCs yielding between 11.1% and 14.2%. They operate like PE shops—both will benefit from a friendly deal-making environment.

For our income investing purposes, we pick BDCs because it is easier to buy them.

We can buy BDCs individually as we would any stock. And BDCs can avoid taxes at the federal level by paying out at least 90% of their taxable earnings to shareholders in the form of dividends.

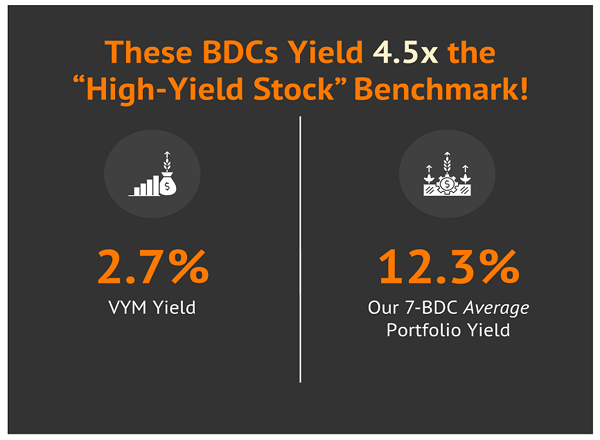

And these dividends are typically massive—in some cases several times higher than what we’d get from a real estate investment trust (REIT) or other high yield stocks:

Consider a million-dollar nest egg. That’s $123,000 in annual retirement income! Even if we had half of that to invest (so, a cool $500,000), we’d still bring home $61,500 in annual “salary.”

But 12% and 13% yields are not always safe, so we do need to ensure their underlying businesses hold up to scrutiny. Let’s take a closer look at these BDCs.

Blue Owl Capital Corp. (OBDC, 11.1% yield) is a year and a half removed from a rebrand (from Owl Rock Capital Corporation). Blue Owl originates, executes, and manages debt and equity investments in American middle-market companies, typically with annual EBITDA of between $10 million and $250 million, and/or annual revenue of $50 million to $2.5 billion at the time of investment.

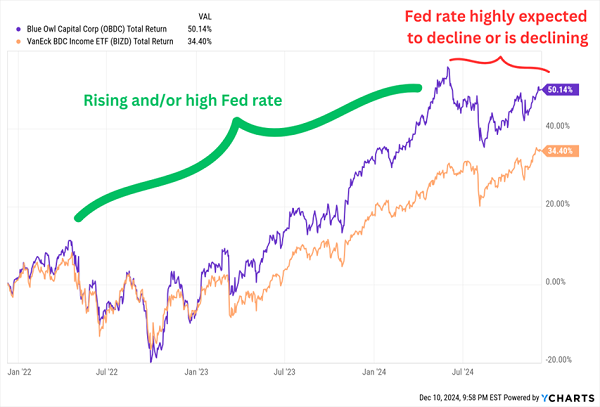

Blue Owl’s 219-company portfolio leans toward non-cyclical companies, with deals typically higher up in the capital structure. 81% of its loans are senior secured, 76% are first lien, and the portfolio is predominantly (96%) floating-rate in nature. It was built for a rising-rate environment, then, but ever since this summer, OBDC’s composition has increasingly weighed on shares as Wall Street anticipated (and finally got) Fed rate cuts:

OBDC Was a Leading BDC—Until This Year

This is still a well-run BDC with strong competitive positioning, excellent credit quality, and positive cash flow. It also has raised its regular dividend (which accounts for 9.6% worth of yield) multiple times over the past few years, and augmented the payout with supplemental dividends (an additional 1.5% worth of yield across the trailing 12 months) for nine consecutive quarters.

But its variable-rate portfolio, combined with the added uncertainty of a merger with sister entity Blue Owl Capital Corporation III (OBDE), expected to close in Q1 2025, might give some would-be buyers pause.

Given that OBDC trades at a tiny 1% premium to NAV right now, they can afford to wait.

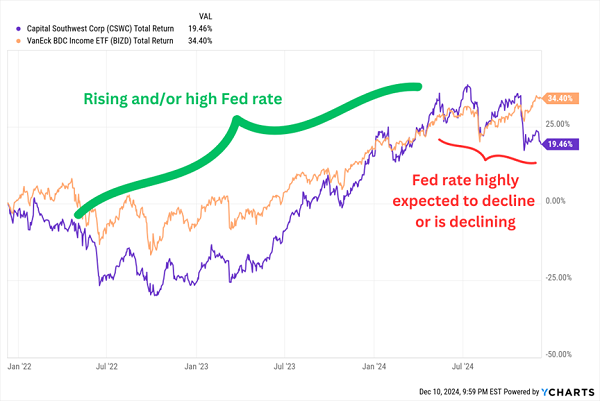

Capital Southwest Corp. (CSWC, 11.1% yield) offers a similar yield and a similar blend of regular dividends (10.2% worth of yield) and supplementals (0.9% TTM). It also has been hiking the regular payout aggressively—six times since the start of 2022!

CSWC serves companies with EBITDA of between $3 million and $25 million. Its current portfolio stands at 118 firms—roughly 89% of its deals are first-lien loans, 9% are equity, and the rest are a sprinkling of second-lien and subordinated debt. Virtually all of its debt investments are floating-rate, so its trajectory of the past few years, and its prospects going forward, are somewhat similar to OBDC’s.

CWSC Has Gone From Leading Industry Shares to Trailing Them

On the upside, CSWC has plenty of room to add leverage and spur growth. But credit quality could be better—it has six investments on non-accrual at 3.5% of fair value, which is a significant step up from 1.9% a quarter prior. Of course, anything less than perfect is disqualifying given an outrageous 38% premium to NAV.

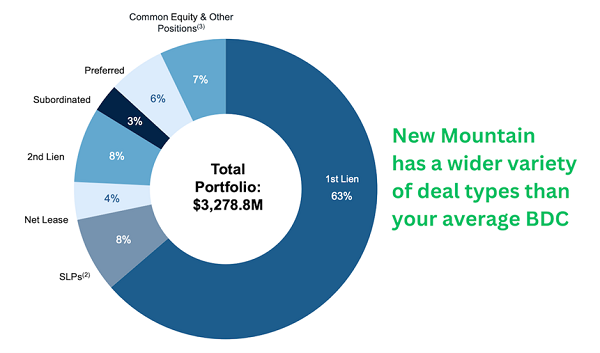

New Mountain Finance Corp. (NMFC, 11.5% yield) invests in a wide range of U.S. middle market businesses (EBITDA between $10 million and $200 million). It prefers companies that are acyclical, have high barriers to competitive entry, collect recurring revenues and produce strong free cash flow, among other features. Its 128 portfolio companies are spread across a couple dozen industries, and a wide variety of financing types—first lien is the primary deal type at 63%, but it also has second lien, subordinated, preferred, common equity and net lease deals.

Source: New Mountain Finance Corp. Q4 2024 Earnings Presentation

New Mountain is coming off a rough fourth quarter that included a 60-basis-point decline in portfolio yield. Supplementals have waned from 4 cents per share in Q1 to just a penny for the fourth quarter. Dividend coverage isn’t yet an emergency situation, if only because NMFC says it will waive some incentive fees to cover the base. Also, New Mountain’s leverage situation is nearly the opposite of Capital Southwest—its leverage is fairly high, so it doesn’t have much wiggle room to grow their portfolio much from here.

Shares are barely positive in 2024 even after factoring in its double-digit dividend. So while a 6% discount to NAV might seem appealing, it might simply be deserved given NMFC’s relative weakness right now.

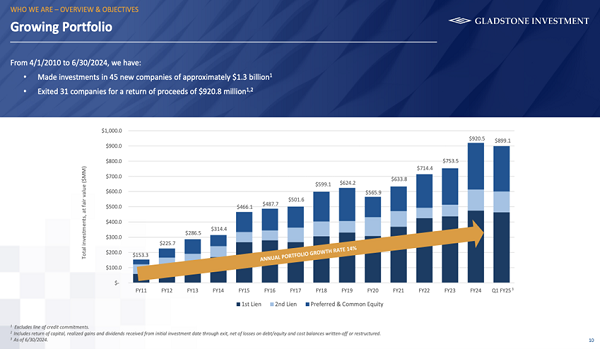

Gladstone Investment Corp. (GAIN, 12.0% yield) is part of the Gladstone family of businesses that also includes Gladstone Commercial (GOOD), Gladstone Capital Corporation (GLAD) and Gladstone Land Corporation (LAND). Its target portfolio company will generate $4 million to $15 million in annual EBITDA, have a proven business model, stable cash flows and minimal market or technology risk.

But what stands out about GAIN is its willingness to deal in equity. Look at the chart below. What’s most noteworthy isn’t the portfolio growth, but how much of the portfolio (33%!) that’s invested in equities.

GAIN Is Still Primarily a Debt Dealer, But Its Equity Share Is Huge

This is essential to GAIN’s “buyout” strategy, in which it typically provides most (if not all) of the debt capital along with a majority of the equity capital. Its debt investments allow it to pay out a still-high dividend, but then it also pays out (extremely variable) supplemental payouts when they realize gains on equity investments. To wit, GAIN’s regular monthly dividend accounts for just 7% worth of yield—and a massive 70-cent dividend paid in October adds another 5% in the TTM.

As I’ve said before, this is a well-run BDC, but we have to set realistic expectations for this dividend. On the one hand, our base income will be a lot less than the industry standard; on the other, the regular dividend is paid monthly, and specials, albeit unpredictable, can make up all of that ground (and then some). An 11% premium to NAV isn’t ideal, however.

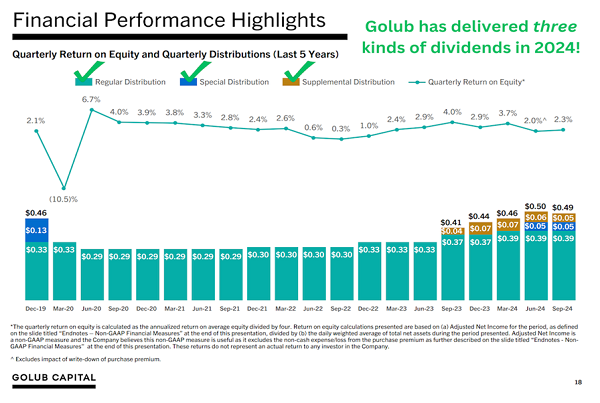

Golub Capital BDC’s (GBDC, 12.8% yield) massive portfolio of 381 companies has a median annual EBITDA of $63.7 million and are spread across several dozen industries. Its deals predominantly involve first lien senior secured debt (92%), but it also has some exposure to equity financing (7%) and trace amounts of junior debt.

GBDC’s focus on senior debt has typically resulted in an extremely high portfolio quality. To wit, while Golub had 11 portfolio companies on non-accrual, the fair value of those deals represents just 1.1% of the portfolio. It also boasts extremely low operating expenses and fees—two factors that often serve as headwinds to other BDCs’ financial performance.

Those fees were recently helped by a reduction coming off its announcement that it would merge with sister entity GBDC III—a deal that closed in June. That deal also, in a way, made Golub the king of special dividends, at least in 2024. GBDC has paid not just a high regular dividend (10.3%), but also supplemental dividends (1.5% TTM), as well as announced a trio of merger-linked specials (1.0% TTM), with the last to be paid in December.

Source: Golub Capital Fiscal Q4 2024 Earnings Presentation

But investors keep waiting for something to unleash GBDC shares. I said more than a year ago that the BDC’s regular dividend raise and fresh supplemental-dividend program, as well as another earlier fee reduction, might just be those catalysts. Unfortunately, shares have still only managed to track the industry since then. The uber-patient can buy in at a thin 1% discount to NAV.

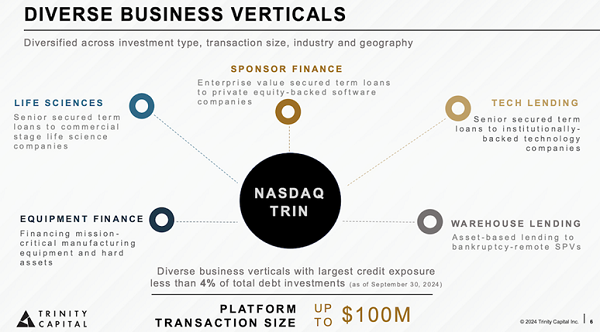

Trinity Capital (TRIN, 14.2% yield) is a different breed of BDC—a venture-debt firm that focuses almost exclusively on growth-stage companies. And it breaks its deals down into five categories:

Source: Trinity Capital Q3 2024 Earnings Presentation

The end result of this is a portfolio that’s 75% loans, 18% equipment financing and 7% equity.

The nature of Trinity’s business provides a better growth profile than most other BDCs, even if performance has largely tracked the industry over the past few years. We could blame a fairly high price-to-NAV that currently sits at a 9% premium, though that’s relatively “cheap” compared to other prominent internally managed BDCs, including the aforementioned Capital Southwest (38% premium), as well as Hercules Capital (HTGC, 72%), and Main Street Capital Corp. (MAIN, 80%).

Also, unlike the rest of the names on this list, Trinity’s high yield is completely based on its regular dividend. TRIN has paid supplementals in the past, just not in the past year—so we could squeeze even more yield out of the stock during bumper times. That said, Trinity’s quarterly dividend coverage is tight, at 105%, so we’d almost need to see some growth to keep from worrying about an income rug-pull.

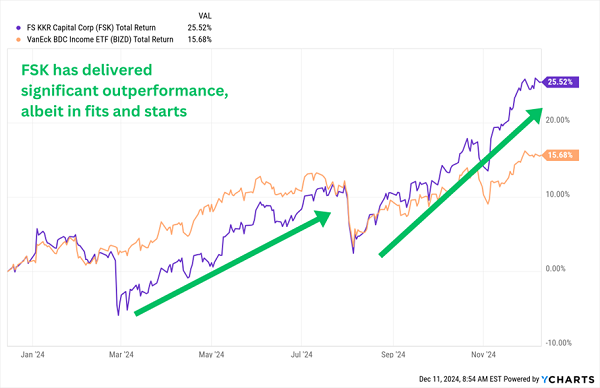

In 2023, I said this about FS KKR Capital Corp. (FSK, 13.5% yield):

“FSK hasn’t historically given investors much to cheer about, but there are several things to like. A double-digit yield, sure, but also a healthy, well-covered payout, a growing streak of bottom-line beats, and a comically deep 21% discount to NAV.”

The stock has rallied since:

FSK: 2 Rallies Since We Discussed in 2023

FS KKR Capital currently provides financing to 217 private middle-market companies spread across two dozen industries, including double-digit exposure to software and services, commercial and professional services, capital goods, and health care equipment and services.

FSK primarily invests in senior secured debt (60%), though it also has significant weightings in asset-based finance (12%) and second lien senior secured loans (8%), as well as nearly 10% of exposure to Credit Opportunities Partners JV, a joint venture with South Carolina Retirement Systems Group Trust that invests capital across a range of investments.

Like most of the BDCs above, the lion’s share of its loans are floating-rate, but at a hair less than 90%, that’s a decent 10%-plus in fixed-rate loans that should help FSK somewhat in a declining-rate environment.

FSK isn’t as attractive as it was at this time last year, but there are still reasons to give it a once-over. Dividend coverage is still fine—FSK’s regular accounts for 11.9% worth of yield, with specials accounting for the remaining 1.6% over the TTM—though any base-rate contraction next year could make shareholders sweat. It spent the year making progress on getting out from underneath non-accruals, which now sit at a decent 1.7% at fair value. And FSK’s discount to NAV has narrowed considerably, albeit to a still-deep 10%.

The One 11% Dividend to Own in 2025

While I’m keeping several of these high-yielding BDCs on my radar heading into the coming year, I am laser-focused on One 11% Dividend to Own Now.

We’ve only seen a handful of Washington “clean sweeps” in American history, and each one was followed with some of the nation’s most sweeping policy changes.

Does that mean growth? Possibly.

Does that mean uncertainty? Certainly.

The ultimate safety net for times like these are secure dividends—cash in your pocket, right here, and right now, no matter whether your tickers are flashing green or red.

So just imagine what kind of protection against volatility you could get from a 11% dividend.

My One 11% Dividend to Own Now is a rare machine capable of generating a simply ludicrous amount of cash. A 11% yield, in the most practical terms, is:

- Nearly $1,000 a month from a mere $100,000 investment

- $55,000 a year—a proper salary in many parts of the U.S.—from a mere $500,000 nest egg

- A wild $110,000 annually if you have a million bucks to put to work

Paid out for sitting around and doing nothing but waiting.

That kind of money doesn’t just buy you things.

It buys you comfort. It buys you peace of mind. It buys you a regular good night’s sleep—where you stop wondering and worrying about which way the market’s winds will blow next.

It could even buy you the ability to live off of dividends alone, without ever laying a finger on your nest egg.

But you don’t have much time. If you miss the deadline to get on the list now, in a few days, you could be leaving money on the table—and might not be able to lock in this 11% when the next distribution comes around.

Click here, and I’ll tell you more about this monster 11% yield, its growing payout, and its special dividends!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report