This market bounce is strangling the payouts on everybody’s favorite ETFs. But it’s also given us a sweet setup to grab another group of funds kicking out big payouts, to the tune of 8%+ yields.

Even better, many of these funds—wallflowers to “popular-kid” ETFs—were left off the invite list for the 2023 market party. That means they’re (still) cheap today.

I know an 8% payout has a lot of appeal to most folks, with Treasury yields now yielding around 4.3%. That’s not bad, but it doesn’t leave you much after you account for still-elevated inflation.

And if your cash is stuck in an ETF, you’re getting a lame payout, well, almost all the time, but especially if you buy now: the SPDR S&P 500 ETF Trust (SPY)—which, as the name says, holds the entire S&P 500 index—yields a sorry 1.3% as I write this.

A further market rise would only grind that sad yield down further.

Even so-called “high-yield” ETFs miss the mark: the go-to corporate bond ETF, the SPDR Bloomberg High-Yield Bond ETF (JNK), pays 6.4%. That’s not bad, but it’s 50% below what we could get from a corporate-bond fund that’s one level up from an ETF: a closed-end fund (CEF) we’ll get to in a sec.

I bring up CEFs now because, as mentioned, many of these 500 or so income plays still offer high payouts, and many trade at big discounts to net asset value (NAV), too. So it’s critical to dump any low-paying ETFs you’re sitting on and pivot to their CEF “cousins”—and not just for the “deals and yields” CEFs offer, either.

Why High Yields Are Crucial Today

It’s also critical to grab high-paying CEFs now because interest rates are still high, but we all know they’re about fall. As they do, they’ll inflate the prices of bonds and stocks, pushing these assets’ dividend yields down as they do.

It’s already starting to happen.

Bottom line is we need to “lock in” these big dividends while we can still get them at a bargain. But we do need to be careful: with the mainstream crowd’s optimism running hot, we have to pick our spots, focusing on the most ignored corners of the CEF market.

Here are three such corners—and specific CEF tickers—that are high on our list:

Corporate Bonds: Roll With DLY, Kick JNK to the Curb

With a nice window set up for us to buy bonds, we’re going to shuffle past JNK’s 6.4% payout and move into the 8.9% on the DoubleLine Yield Opportunities Fund (DLY) instead.

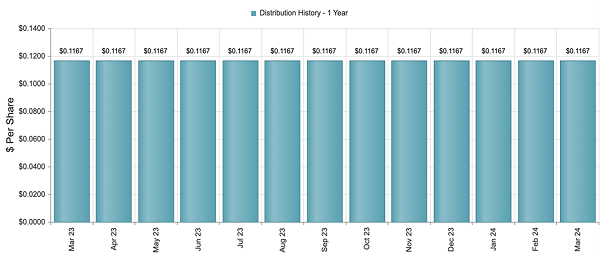

Not only is DLY’s yield nearly 40% larger than that of the index fund, it also comes your way monthly. That’s something no ETF (that I’ve seen, anyway) can match:

DLY’s Monthly Hit of Dividend Cash Keeps Rolling In

Source: CEF Connect

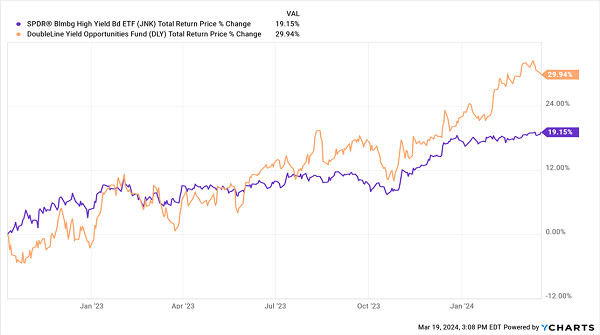

When it comes to performance, there’s no comparison. DLY—and DoubleLine—are run by Jeffrey Gundlach, the so called “Bond God,” who’s as well-connected as they come.

DLY had the misfortune of launching in February 2020, weeks before the societal dumpster fire that was about to ensue. That let it buy the dips in February and March 2020, while the world went into lockdown.

And since bonds started to get up off the mat in October 2022, DLY has routed JNK, as always happens with expertly run CEFs like this one. I expect the gap between the purple and orange lines below to keep widening:

The “Bond God” Grabs an Extra Jump in the Rebound

Even so, we can still grab DLY at a 2.7% discount to NAV. That’s a sweet deal, but it is just a bit below par, which shows that while DLY is a good pickup for income, the trade is starting to get a bit crowded. But that’s far from the case with our next pick.

Municipal Bonds: MUB Is a Dud; NEA Is Our North Star

While the corporate-bond “bar car” is filling up, it’s still crickets over in “muni” land, where plenty of CEFs sport double-digit discounts and “headline” yields of 5%+.

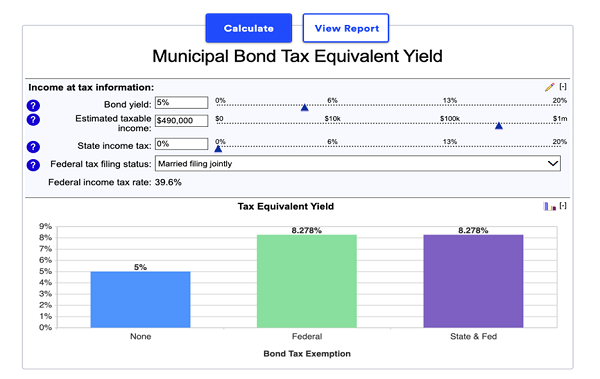

I’ve got “headline” in quotes because you’re almost certainly going to bank more than that, as payouts on municipal bonds—issued by local and state governments to fund vital infrastructure—are tax-free for most Americans. With Tax Day coming up, these funds will be your accountant’s best friend.

Thanks to those tax breaks, those “real” yields can be a lot higher than what you see on your favorite fund screener. According to Bankrate’s taxable-equivalent yield calculator, a 5% muni-bond yield translates into a juicy 8.3% for a top-bracket filer:

Source: Bankrate.com

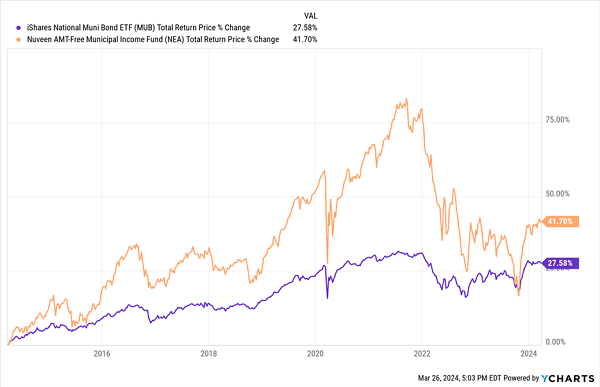

But to make the most of muni funds, you simply must dodge the go-to ETF, the iShares National Municipal Bond ETF (MUB) and its lame 2.7% yield. Instead, “swap in” the Nuveen AMT-Free Quality Municipal Income Fund (NEA).

Right away, you’re winning on the yield front, with NEA giving you a “starter” payout of 5.5%, more than double MUB’s yield, and that’s before the tax benefits. And as with DLY—and perhaps even more so—an active manager is critical, as the muni-bond market is even smaller than the corporate-bond space, making a deeply connected manager a “must have.”

“Robotic” MUB can never match that edge—even if they turn it over to an AI chatbot! As you can see below, NEA has only fallen behind MUB for a few “blink-and-you-miss-it” periods in the last decade before catapulting ahead:

“Payout-Powered” NEA Thumps MUB

A rise in bond prices (and corresponding fall in yields) should widen that gap over the coming months. NEA also stands to grab an “assist” from its big discount: a ridiculous 13.8%, far below its five-year average of 9.1%.

Stocks: Flip the “Y” in “SPY” for “XX”—and Bank 7.6% Payouts

Let’s wrap with an ETF-CEF swap that doesn’t even require most of us to sell our shares: we’re dumping popular kid SPY for its “black sheep” cousin, the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX).

The tickers are nearly the same for good reason: like SPY, SPXX holds the stocks in the S&P 500, like Apple (AAPL), Microsoft (MSFT), Visa (V) and Johnson & Johnson (JNJ). But instead of SPY’s 1.3% dividend, you get SPXX’s sweet 7.6%.

Why the difference? SPXX sells call options on 35% to 75% of its portfolio, depending on what the market’s doing. These options, which give the option buyer the right to buy SPXX’s stocks at a fixed future date and price, generate extra income because SPXX keeps the “premiums” these option buyers pay—and uses them to fund our payouts.

That strategy can cap upside, as some of SPXX’s holdings get “called away,” but it helps cap volatility, too, thanks in large part to the fact that we get most of our return as dividends. Finally, this strategy does better in a volatile market, so if you see some short-term turbulence ahead for stocks—reasonable in light of today’s optimism—this fund is a savvy pickup.

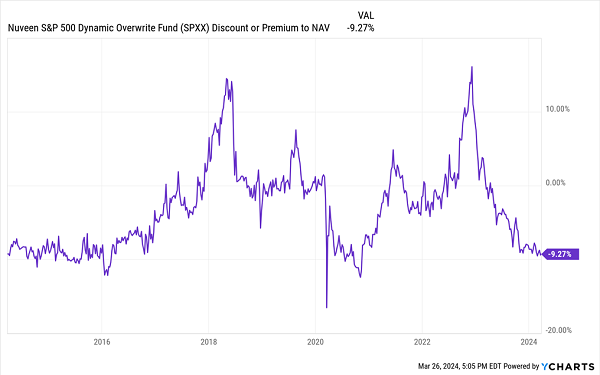

Buoyant 2023/24 Market Puts SPXX on Sale

That optimism, by the way, has dropped volatility-loving SPXX’s discount to a bit over 9%, well below the 2% average discount over the last five years and the lowest it’s been since the worst of the COVID crisis. That’s obviously overdone, and a good entry point.

A Growing 14% Dividend? That’s Exactly What You Get With This Top Pick

Sure, CEF dividends can be big—but some can be absolutely legendary, like our top pick among these incredible income plays now.

This off-the-radar fund throws off a life-changing 14% current yield. Plus it pays dividends monthly, grows its payout and boasts a history of special dividends, too!

A “Once-in-a-Generation” 14% Dividend Opportunity

Source: CEF Connect

When it comes to taking care of shareholders, this fund is unequalled. I’ve simply never seen an investment that puts dividends so far up its priority list.

These payouts are safe, too—delivered by a manager whom Morningstar previously named Fixed Income Manager of the Year. He’s also been inducted into the Fixed Income Analysts Society Hall of Fame.

To say he knows the bond world is an understatement—and now we can get him working for us, just in time to help us navigate the shifting winds we’ll no doubt encounter in the year ahead.

Don’t miss this opportunity, which I’m urging ALL investors to take advantage of now. Click here to learn more about this 14%-yielding income play and get a free Special Report revealing my latest research on it.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report