We income investors like REITs (real estate investment trusts) because they are obligated to dish most of their profits to us as dividends. Today we’ll discuss five with fat yields between 8.3% and 9.3%.

When to buy REITs can be tricky. Generally speaking, we don’t want to buy them before rate hikes. Higher rates make money more expensive. REITs thrive on cheap money. So, the recent rate hiking cycle has been bad for REITs-at-large.

Rates and REITs Moved in Opposite Directions

Rate hikes appear done, which usually means it is time to buy REITs. After all, the Fed’s next move is likely to be a cut. Cheaper money for REITs.

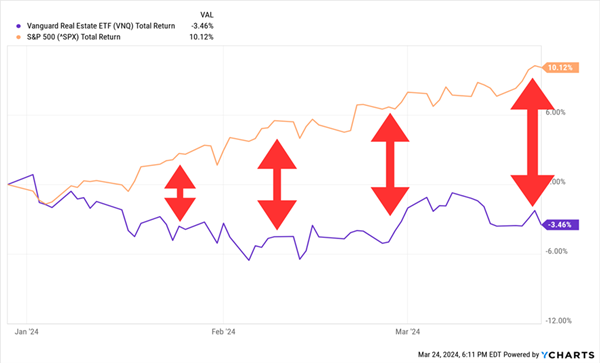

But few REIT investors are front running these rate cuts. While the market is up year-to-date, the real estate sector is down:

Rates Steady, REITs Static

REITs are behaving a bit like bonds. They seem to be waiting for an actual cut to rally.

As contrarian investors, we act ahead of the herd. We’re looking for recession-resistant income that will benefit from rate cuts. Broadly speaking, REITs fit the bill.

That said, these landlords vary quite a bit. It’s an interesting time to own property. And we are not looking for excitement—we are looking for boring. Dullness is delightful when it comes to dividends.

Let’s walk through a five-pack of REITs yielding 8.7% on average. We’ll start in healthcare with Healthcare Realty Trust (HR, 8.8% yield). This REIT specializes in medical outpatient buildings, owning and operating roughly 690 properties totaling 40 million square feet across 35 states. That scale is relatively recent—the company closed on a massive merger with Healthcare Trust of America in summer 2022.

When we last looked at HR, it wasn’t a screaming value. The price certainly looks better (9x AFFO estimates now vs. 11x back in November—but only because shares keep shedding ground, not because the business case looks any better. Ever since the merger with HTA, occupancy has roughly stayed level at 87.5%, and the company has remained highly levered. Worse, expectations for 2024 funds available for distribution (FAD) are for less than what HR would be expected to pay out this year. Would lower interest rates help? Sure—but they wouldn’t solve most of Healthcare Realty’s myriad issues.

Sabra Health Care REIT (SBRA, 8.3%) is a predominantly senior-focused healthcare play. More than half of Sabra’s portfolio is in skilled nursing and transitional care facilities, though it also has large allocations to managed senior housing (16%), behavioral health (15%) and leased senior housing (10%).

Sabra isn’t “there” yet, but in some ways, it at least looks healthier than HR.

Yes, the company recently missed estimates for both quarterly earnings and 2024 guidance. But even giving 2024 guidance is a big step forward for Sabra, which provided no outlook at the same point last year—a sign that the business has at least found some footing. Skilled nursing and senior housing occupancy improved.

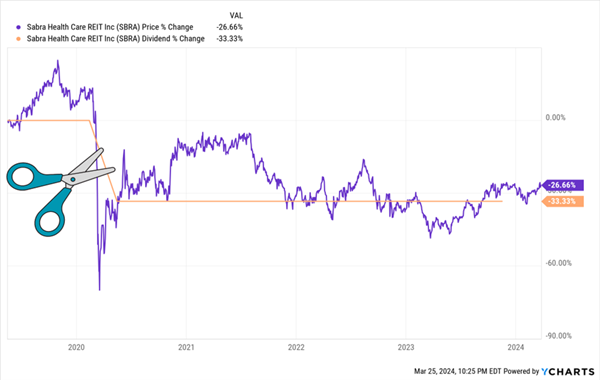

That said, earnings-growth estimates are modest. SBRA shares aren’t as cheap as HR, at a little more than 10 times AFFO estimates. The yield, while high, isn’t quite as nice as HR—due in part to a drastic 33% dividend cut in 2020 that it still hasn’t begun to claw back. Though to be fair, there are no coverage concerns here.

SBRA Healthier After Payout Cut, But We Need to See a Comeback

Competitor Omega Healthcare Investors (OHI, 8.6% yield) is a triple-net REIT that provides financing and capital solutions to skilled nursing facility and assisted living facility partners. Like Sabra, Omega was pummeled during COVID, but shares—while not improving materially—have at least stabilized over the past few years.

Omega is another case where lower rates will certainly help the business, but we’d like to see the actual business improve on its own, too. The balance sheet is healthy, and it hasn’t shoveled itself too deep in debt. But FAD has recently dropped below its quarterly distribution. And it’s still trying to restructure a deal with one of its major partners, LaVie Care Centers.

I’ll move away from healthcare plays and toward a—well, a “play” play.

EPR Properties (EPR, 8.1% yield) is a REIT that’s all about prioritizing experiences over products. Its portfolio of roughly 360 locations includes theaters, “eat and play” (like TopGolf and Andretti Karting), ski resorts, fitness clubs, gaming, driving ranges, even museums. This was a popular investment pre-COVID as Americans increasingly tilted away from normal product consumption and toward experiences—but the pandemic understandably kneecapped all of its momentum. That led EPR to briefly suspend its payout, then bring it back at 65% of pre-COVID levels.

EPR shareholders are spying just a little more light at the end of the tunnel, however. Since reviving its payout in 2021, EPR had only raised its monthly dividend once—in 2022—but it recently announced another hike, of 3.6%, to 28.5 cents per share. And the payout remains extremely well covered by AFFO.

The weight on EPR is the same one that’s been hindering it for years: its theater segment. Yes, EPR has been working to reduce its theater footprint, but the division still makes up its largest chunk of adjusted EBITDAre, at 37%. And expectations for a decline in box office in 2024 could mean continued pressure on EPR’s business.

There’s nothing playful about Easterly Government Properties (DEA, 9.3% yield). This REIT owns 90 properties that are leased out to U.S. government agencies such as Veterans Affairs (VA), the FBI, and—wouldn’t you know it—the Drug Enforcement Administration (DEA), through the U.S. General Services Administration. These properties include VA Outpatient facilities (26% of annual lease income), labs (9%), warehouses (9%), and even courthouses (5%), but the biggest chunk, at roughly half the portfolio, are government-leased offices.

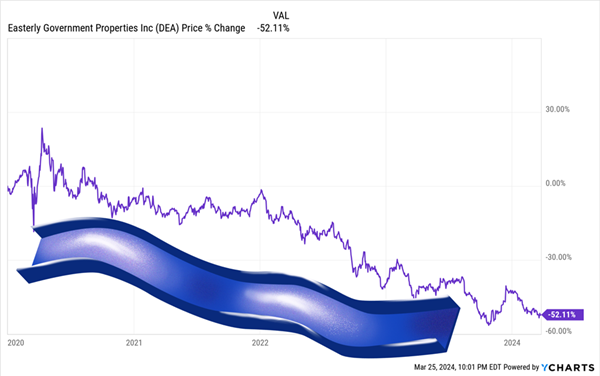

On the one hand, you can’t ask for a better tenant than the U.S. government. If nothing else, you certainly don’t have to worry about collections. But as you can see, that fact has hardly done anything for shareholders over the past few years.

DEA Has Been on a Steady Slide Since 2020

FFO has largely remained rangebound for the past few years. While the government is a dependable tenant, Easterly is largely stuck. Many of its properties are “build to suit”—the buildings are exactly what the government needs, but not exactly attractive to outside tenants, either. That means decent bargaining power for the government, and capped upside for Easterly.

Maybe the biggest reason not to buy this yearslong dip, however, is the state of the dividend. DEA’s payout has remained at 27 cents per share since mid-2021. Meanwhile, last year’s cash available for distribution (CAD) was $1.05 per share—3 cents short of covering its full-year obligation.

Earn a Reliable 9%+ in Retirement—Paid MONTHLY

Yes, we want big yields from our retirement holdings, but we also want big reliability, too.

You’re not going to get that from real estate plays waiting for a Federal Reserve interest-rate bailout.

But you will get that with the beautifully boring, high-yielding blue chips I hold in my “9%+ Monthly Payer Portfolio.”

The “9%+ Monthly Payer Portfolio,” as the name would imply, can clearly deliver high levels of yield.

But it’s not just about that—this portfolio is about earning high levels of yields by leveraging steady-Eddie holdings with the potential to deliver meaningful price upside, too.

That means no more reaching for the Pepto every time the S&P gets the jitters.

That means no stressing about nest-egg shrinkage in your 60s, 70s, 80s, and beyond, either. Because unlike many retirement plans that require you to bleed out your savings as you age, the income this portfolio can generate is so rich, it can sustain a retirement on dividends alone.

If you put this portfolio to work with a mere $500,000—less than half of what most financial gurus insist you need to retire—you’ll generate a $45,000 annual income stream.

That’s $3,750 every month in regular income checks!

It’s time to get serious about locking down our core retirement holdings. Click here to learn everything you need about these generous monthly dividend payers right now!

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report