Don’t fall into the trap of thinking you can’t beat the market. It’s total nonsense—and that goes double if you look outside stocks, to other assets.

Consider preferred stocks for example—they’re “bond-stock” hybrids that trade on an exchange, like stocks. But like bonds, they trade around a par value.

The best part is the income. Our favorite way to buy preferreds—through actively managed (we’ll come back to that in a second) closed-end funds (CEFs)—gets us yields of 7%+.

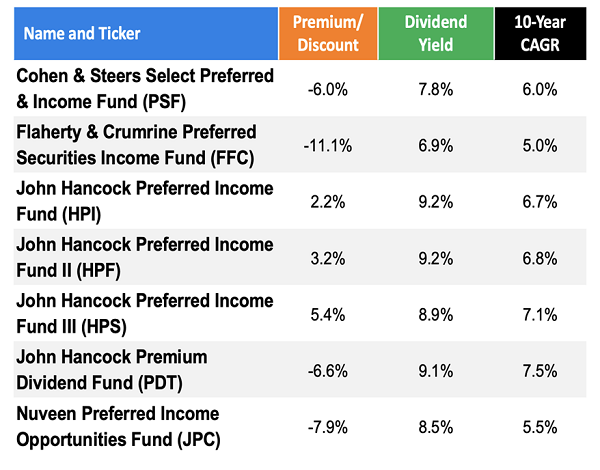

And select preferred-stock CEFs trade below their net asset value (NAV, or the value of their portfolios) today—with some of those discounts reaching well into double-digits.

Finally, preferred stock CEFs beat their benchmarks all the time, a fact we’ll see in action momentarily.

Preferred-Stock CEFs: Proven Benchmark Beaters (With Big Yields, Too)

Academics call the idea that you can’t beat the market the “efficient market hypothesis.” In 2013, Eugene F. Fama, the economist who first made the hypothesis in its modern form, won the Nobel prize for his work on this theory. He won it alongside Lars Peter Hansen, who did a lot of the heavy math supporting Fama’s hypothesis.

Here’s where this story gets weird. Fama and Hansen shared the Nobel prize with a third winner that year, Robert Schiller, the Yale economics professor who has argued markets are not efficient and often create bubbles, as we saw during the dot-com crash of the 1990s and the subprime-mortgage crisis of the 2000s.

How can economists who ardently disagree with each other win the same esteemed prize in the same year?

It shows just how messy investing can be. In fact, markets aren’t fully efficient, and we often see fund managers beat their benchmarks for a long period of time. Preferred-stock CEFs are a perfect example of this.

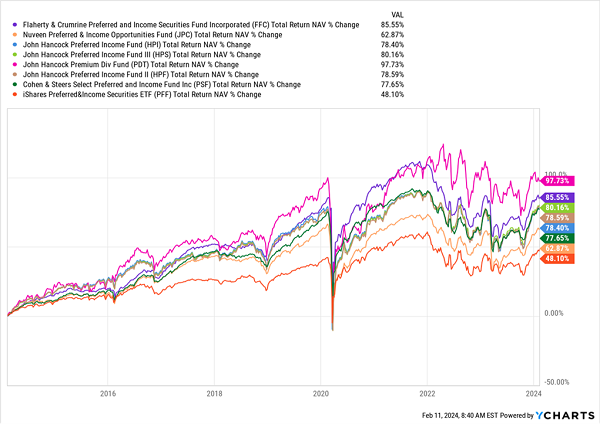

If we look at those that have had a lifespan of a decade or more, they’ve all beaten the passive iShares Preferred & Income Securities ETF (PFF), shown in red at the bottom of the chart below, in the past decade:

Crushing the Index

I know there’s a lot going on in this chart, but we can see that PFF, at the bottom, is far behind even the worst-performing of the preferred-focused actively managed CEFs, the Nuveen Preferred & Income Opportunities Fund (JPC), which had a much greater 62.9% return.

At the top end, the John Hancock Premium Dividend Fund (PDT) nearly doubled the index’s performance.

Also, it’s worth reiterating the massive income streams these funds offer, with yields of 8.5% on average, versus PFF’s 6.5%. And then there are those discounts—another inefficiency we contrarians can exploit.

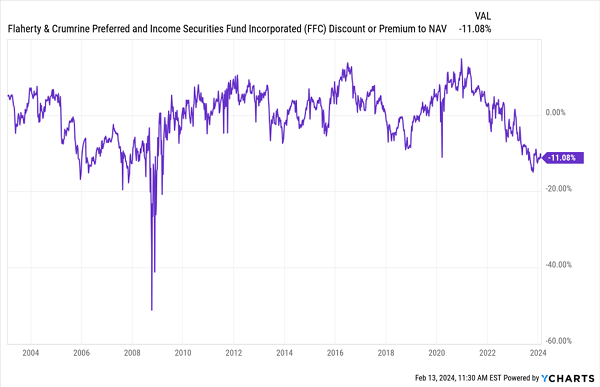

Of these preferred-stock focused CEFs, over half sport discounts, and the Flaherty & Crumrine Preferred Securities Income Fund (FFC) has the deepest discount of them all, with a market price over 11% below its portfolio value.

That’s probably because of its relatively low (for a CEF) 6.9% dividend yield. But it also means investors who buy now and wait for the market inefficiency to end can earn some capital gains on top of that impressive income stream.

And don’t think FFC won’t trade at a premium eventually: it has done so many times in its more than 20-year history. As recently as 2021, the fund was trading for more than its assets were worth.

FFC’s Premium Backstory

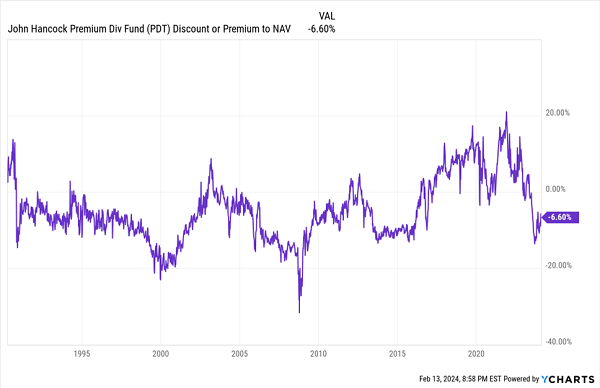

For a bigger yield, look to the John Hancock Premium Dividend Fund (PDT) and its incredible 9.1% payout, which also trades at a rare discount.

PDT’s Huge Premiums of the Past

PDT once traded at a more than 20% premium, and double-digit premiums haven’t been unheard of in recent years. The recent selloff has driven it to its deepest discount range in a decade, and we can see in the chart above that this discount is narrowing.

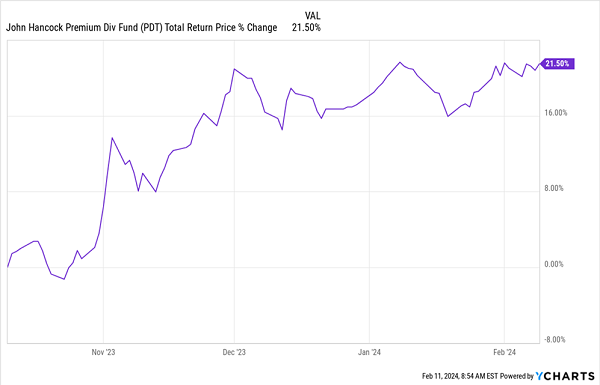

Of course, we’ve seen head fakes before, like at the end of 2023, so PDT may revert back to a double-digit discount again. But that would be a reason to buy more. Just look at what would’ve happened if you’d bought four months ago, the last time PDT’s discount fell to double digits:

Huge Returns in No Time

All of this while collecting a 9.1% dividend yield! If that’s not reason to go from passive to active, then I don’t know what is.

4 Bargain CEFs That “Translate” Your Price Gains Into CASH

I don’t know about you, but when it comes to investing, I prefer to get as much of my gain as possible in safe dividend cash.

Price gains? They’re great, of course, but the trouble is they can disappear tomorrow.

Not so with dividends—and this is the biggest strength of CEFs: these funds literally take the price gains their portfolios generate and “convert” them to 7%+ dividends for us!

The result? A huge—often double-digit—dividend flowing to us in a predictable stream, in addition to gains in the fund’s market price. Many CEFs pay us every single month, to boot.

My top 4 CEFs to buy for 2024 (current yield: 10.2%) are ripe for buying now. Click here and I’ll share more details on each of them with you, as well as our complete CEF-buying strategy.

You’ll also get to download a FREE Special Report naming all four of these funds, including their tickers, current yields, discounts and everything else you need to get in on them now, while they’re still cheap.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report