Many investors know the importance of having a base of dividend stocks. These stocks provide investors with a regular source of passive income. And long-term investors who don’t need the income from dividends immediately can reinvest their dividends. Not only does this make dividend stocks a proven way for investors to build wealth. It also provides a form of inflation protection.

In this article, we’ll provide tips for how investors can evaluate dividend stocks so they can choose the best dividend stocks for their investing goals.

How to Understand Three Common Dividend Terms

To understand how to select the top dividend stocks, you’ll need to be familiar with some commonly used terms. If you’re new to dividend investing, here’s a brief explanation of what those terms mean.

Dividend Yield – This is a ratio of the stock’s annual dividend divided by the current stock price. So a stock that pays out $4.00 annually and has a stock price of $100 has a dividend yield of 4%. However, stock prices move up and down on a daily basis. This means that the dividend yield may change frequently making dividend yield alone an imperfect measure for evaluating the quality of a dividend stock.

Annual Payout – This is the amount of a company’s earnings that they will pay out as a dividend. This is listed on a per share basis for the year. So if a company has an annual payout of $2.00 and pays a quarterly dividend, shareholders will receive 50 cents per share every quarter. For investors who are relying on dividend payments as a way to generate income, knowing the quarterly payout is a critical factor in determining what dividend stocks to buy.

Payout Ratio – This tells investors how much of a company’s earnings goes towards the dividend. A higher number means that a company is applying more of its earnings towards its dividend. Payout ratios are also an imperfect measurement because while a higher number is generally better, the more of a company’s earnings that go towards a dividend is less money that can go towards growth.

How to Pick the Best Dividend Stocks

To properly evaluate individual stocks, investors need to take a look at the company’s financials to make sure it is financially sound. This is because investors want certainty that a company can maintain and perhaps even grow its dividend even if its overall financial conditions weaken.

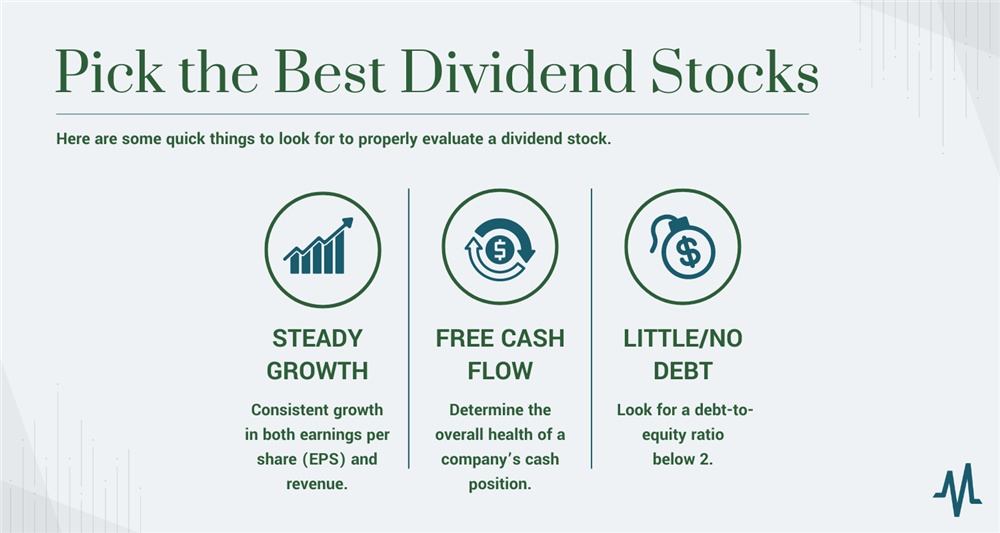

The good news is that you don’t have to have a finance background to do the research you need to evaluate a dividend stock. Here are some quick things to look for.

- Steady Growth – A growing company shows consistent growth in both earnings per share (EPS) and revenue. This is about consistency and having realistic expectations about past performance. Even the best companies will have a bad quarter. However, many financially weak companies will pull out an occasional good quarter. What you want to see is a consistent pattern of earnings growth and revenue on both a quarterly (sequential) and a year-over-year (YOY) basis.

However, you should also look for sustainable growth. Companies that are paying dividends are generally in mature industries. That means, compared to growth stocks, these stocks tend to have a lower percentage growth in revenue and earnings. This may make their share price less attractive when the economy is going well. But, these stocks will tend to outperform when the economy is slowing down.

- Exceptional Free Cash Flow - Along with growth in revenue and earnings, investors will want to see companies that have a healthy cash flow. Investors should look at a company’s free cash flow (FCF) as a good metric to determine the overall health of a company’s cash position.

- Little or No Debt - Just like in your personal finances, too much debt is bad for business. Or in this case, it can be bad for a company’s dividend. This is because when a company has too much debt, they will tend to allocate earnings towards paying off the debt and away from its dividend. For most companies, it’s easy to find a number called its debt-to-equity ratio. Ideally, investors should look for a ratio that’s below 2.00.

How to Avoid Making False Comparisons with Dividend Stocks

When comparing dividend stocks, investors need to avoid making false comparisons. Not all dividend stocks are the same. That’s one problem with ratios and percentages. They can create a false comparison between two companies.

For example, a real estate investment trust (REIT) is required to pay out up to 90% of its earnings as a dividend. As a result, these stocks have some of the highest dividend yields available. You’ll want to make sure you compare companies that are in similar sectors (financials, consumer durables, healthcare, etc.).

This brings me to another point. At any given time, one sector may be performing better than others. However, even with an underperforming sector investors may be able to find a quality dividend stock.

MarketBeat provides a Dividend Screener tool as a comparison service for investors. For example, investors can screen for stocks in a particular sector or industry. They can also screen for specific fundamental metrics like dividend yield or payout ratio.

Some Final Thoughts on Choosing the Best Dividend Stocks

The list of companies that pay dividends is long. In fact, over 400 of companies in the S&P 500 Index pay dividends. To help focus your thinking, you can choose to look at the Dividend Aristocrats. This is a select group of companies that have increased their dividend for at least 25 consecutive years. As of July 1, 2022, there are only 63 stocks on this list which can make it easier to narrow down a search.

One final point about dividend stocks is that to truly get the most from them requires having a long-term focus. Buying and holding these stocks over time and reinvesting the dividends gives investors the benefits of compounding. So make sure that the stocks you own are companies that are in defensive sectors that can deliver solid results no matter what is happening in the broader economy.