This article will introduce you to the MarketBeat dividend payout ratio calculator. But first, you'll learn more about the dividend payout ratio, including the payout ratio formula and how to calculate the dividend payout ratio yourself.

What is a Dividend Payout Ratio?

What is dividend payout ratio, exactly?

Before defining the "dividend payout ratio," let's take a step back to ensure everyone understands the word "dividend." A dividend is a portion of a company's earnings that it pays to shareholders regularly, typically quarterly. Earnings show up as net income on a company's balance sheet.

How are dividends calculated? Fortunately, most investors don't have to know this. Most companies will declare their dividend, which becomes a part of the public information for the company. Investors can find the company's past and expected dividend payments on MarketBeat.com.

You can calculate a company's dividend from its balance sheet by using the following formula:

Dividends Paid = Annual Net Income - Net Change in Retained Earnings

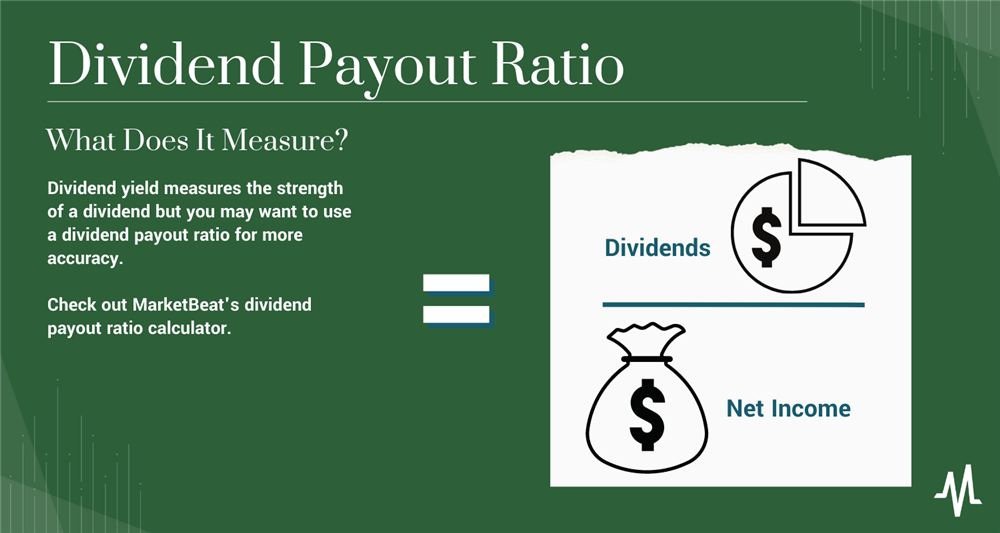

The dividend payout ratio is the amount a company pays from its net income expressed as a percentage. The most straightforward example of how to calculate dividend payout uses the dividend payout ratio formula.

What is the dividend payment ratio? The dividend payout ratio is the annual dividend per share divided by the annual earnings per share (EPS).

Here is the dividend payout ratio formula:

Dividend Payout Ratio = Dividends Paid/Earnings per Share

How to Calculate Dividend Payout Ratio

You only need to have two data points to calculate the dividend payout ratio. The first is the amount a company pays as a dividend per share annually (i.e., the dividend payout). The second is the company's annual earnings per share.

MarketBeat makes it easy for investors to find the dividend payout ratio for any publicly traded company. All you have to do is look at the dividend payout ratio on each stock's dividend page.

What Does Dividend Payout Ratio Tell You?

In its simplest form, the dividend payout ratio tells you how much of a company's profits pay out in the form of a dividend. When you compare one company's dividend payout ratio to its current and projected earnings, you can see how sustainable the dividend payout is over time.

Dividend payout ratio is typically measured in the following ways:

- Trailing 12 months of earnings: The trailing 12 months of earnings refers to the dividend payout ratio used by the dividend payout and earnings per share information from the last four quarters a company has reported earnings.

- This year's estimates: Many companies give analysts an estimate of their projected earnings for the coming year. Investors can use this and the estimated dividend to calculate the dividend payout ratio.

- Next year's estimates: Some companies will also project earnings into the future. Analysts almost certainly provide this information if a company doesn't do this. Calculating the expected dividend payout is an excellent way to assess the sustainability of a company's dividend.

- Cash flow: Cash flow calculates the dividend payout ratio based on the company's cash flow.

What is a Good Dividend Payout Ratio?

A good dividend payout ratio will be different for different companies. For companies still in a growth phase, it's common to see low dividend payout ratios. Many of these companies may not issue dividends at all.

For example, at the beginning of 2023, Apple Inc. (NASDAQ: AAPL) has a dividend payout ratio of around 15%. But Apple and its shareholders still view the company as "growing." Therefore, the company plans to grow in many areas that will provide shareholder value outside of issuing dividends.

Apple is also known for generating a high amount of free cash flow (FCF). When that's the case, investors want to see at least a small dividend as a reward for holding onto shares.

By contrast, Duke Energy Corporation (NYSE: DUK) has a payout ratio of around 80%. You may question whether this is sustainable. In the case of Duke Power, the company is a highly regulated utility. That puts a limit on the company's earnings and share price growth. That makes it imperative for them to offer a dividend that rewards investors.

Real estate investment trusts (REITs) and master limited partnerships (MLPs) present investors with a special case. The business model for these companies requires that they pay a significant percentage of their earnings back to shareholders as a dividend. For example, REITs must pay at least 90% of their profits as dividends. This can make these compelling investments for income-oriented investors.

Where to Find Dividend Payout Ratio Numbers

The easiest place to find the numbers that go into a dividend payout ratio formula is on a company's profile page on MarketBeat.com. You'll get the company's current dividend payout ratio when you go to the "dividend tab." You'll also get the current dividend payout per share and the current dividend yield.

By going to the earnings tab, you can see a company's earnings for the last several quarters. You'll often also see what analysts expect for earnings in the next 12 months, which can be helpful information in deciding if a company's dividend payout will be sustainable.

Alternatively, you can find net income as a line item on a company's balance sheet on MarketBeat.com.

Retention Ratio vs. Dividend Payout Ratio

The dividend payout ratio tells you what percentage of a company's earnings pay out as a dividend. The retention ratio tells you the percentage of that company's profits being retained or reinvested in the company.

Dividend Yield vs. Dividend Payout Ratio

Many investors and analysts cite dividend yield as a measure of how strong a company's dividend is. But dividend yield is distinctly different from the dividend payout ratio. The dividend yield tells investors how much a company has paid out in dividends annually as a percentage of its share price.

The formula for dividend yield is:

Dividend Yield = Annual Dividends per Share/Share Price

The dividend yield tells you how much of a return you will get per dollar invested in the form of a dividend. In practical terms, if a company pays out $5 per share on an annual basis ($1.25 per share every quarter) and the stock trades for $80 per share, the dividend yield would be:

$5/$80 = 0.06, or 6%

However, as the formula shows, the denominator for the dividend yield formula is a company's share price. Many companies that pay dividends tend to have less volatile stock prices, but any increase in share price will reduce the dividend yield percentage and vice versa.

In our example above, if the company pays out $5 per share in annual dividends but the stock price drops by 20% to $64, the new yield would be:

$5/$64 = 0.07 or 7%

Conversely, if the stock rises by 10% to $88, the new yield would be:

$5/$88 = 0.05 or 5%

This focus on share price can make dividend yield an imperfect measure of dividend health for many investors.

Why Dividend Payout Ratio is Important

One of the worst things that can happen for an investor is to receive a generous dividend for owning a stock only to have the dividend cut dramatically or even suspended the following year.

There are times when this happens for reasons that investors cannot foresee. For example, at the onset of the COVID-19 pandemic, many companies, such as The Walt Disney Company (NYSE: DIS), suspended their dividends due to drastically lowered revenue and earnings estimates.

But there are times when a company's dividend is not sustainable. The dividend payout ratio can give investors one clue about a company's dividend sustainability.

One way is to compare its dividend to other companies in its sector. Suppose the company has a significantly higher ratio but does not have the earnings growth to sustain it. That may indicate that the dividend growth and payout ratio will decline in subsequent years.

Example of Using the Dividend Payout Ratio with the MarketBeat Calculator

A company's dividend payout ratio is dynamic. The ratio will differ depending on the period. For example, many investors prefer to consider a dividend payout ratio based on the earnings the company has already posted.

That may be true for some companies, but for others, consider a more accurate dividend payout ratio based on estimates for future growth. For example, a technology company like Apple will see its earnings go up and down with the broader economy. On the other hand, a company like American Electric Power Co. Inc. (NASDAQ: AEP) is a regulated utility. As such, investors can count on its earnings to be relatively stable and predictable.

The MarketBeat dividend payout ratio calculator will calculate the dividend payout ratio when you enter the annual per share amount a company pays as a dividend and the company's earnings per share over a period of time.

If you find tools like this useful, you can sample our free calculators with other fundamental metrics:

Now that you understand the significance of the dividend payout ratio and what the dividend payout formula is you have a good foundation for choosing a dividend stock. But depending on your investment objective, a stock's dividend payout ratio may not be your most important consideration.

It's always a good idea to take a holistic approach to dividends, including the dividend yield, the annual amount per share paid as a dividend, and the company's track record for paying and/or increasing its dividend.

FAQs

Let's take a look at some frequently asked questions about the dividend payout ratio.

The dividend payout ratio is the annual dividend per share divided by the annual earnings per share (EPS).

Here is the dividend payout ratio formula:

Dividend Payout Ratio = Dividends Paid/Earnings per Share

What is a normal dividend payout ratio?

The definition of a "normal" dividend payout ratio will be different based on a company's industry. Many mature companies generate large amounts of free cash in addition to their planned capital expenditures. These companies generally pay a larger dividend than growth companies that put most of their profits back into the company.

How do you calculate dividend payout on a balance sheet?

To calculate dividend payout ratio based on a company's balance sheet you'll have to use the company's net income number. Then use the dividend payout ratio formula:

Dividend Payout Ratio = Dividends Paid/Earnings per Share