Let's look at how to invest in index funds and how to make money off of index funds.

The index funds definition shows that index funds invest in a group of stocks aiming to replicate the performance of a specific market index. Unlike actively managed funds, which rely on the expertise of fund managers to select individual stocks, index funds take a passive approach. They aim to mirror the performance of an entire index by holding a diversified portfolio of stocks that match the composition and weightage of the index they track.

Investing in index funds allows individuals to gain exposure to a broad range of stocks within a given index, such as the S&P 500 or a global market index.

When you invest in an index fund, your money is pooled with other investors' funds and used to purchase the underlying stocks that make up the index. As the index value fluctuates, so does the value of the index fund, meaning that if the index experiences growth, your investment in the index fund will also increase in value.

In this article, we will cover everything to know about index funds, from the average return on index funds to understanding the definition and meaning and exploring average returns.

What is an Index Fund?

What are index funds, exactly? An index fund is a type of investment vehicle designed to replicate the performance of a specific market index, such as S&P 500 index funds or global market index funds. It allows investors to gain exposure to a diversified portfolio of stocks that closely mirror the composition and weightage of the index they track.

Let’s go beyond the index fund meaning. What is an index fund in physical form? Let's break down its key elements. First, an index represents a particular market segment or a broader market comprising a predefined set of stocks. The S&P 500, for instance, includes 500 large-cap U.S. companies. By investing in S&P 500 index funds, you essentially become a partial owner of those 500 companies in proportion to their weight in the index.

Index funds operate on the principle of passively tracking an index rather than actively managing a portfolio. This passive index fund approach eliminates the need to buy and sell stocks, reducing costs constantly. Consequently, index funds tend to have lower expense ratios than actively managed funds.

The term "index account" is often used interchangeably with "index fund" to describe the investment account or fund that holds the index's assets. When you invest in an index fund, you essentially open an index account, contributing your capital and other investors' funds. These pooled funds purchase the stocks that make up the index.

When considering the best index funds 2023, assessing their historical performance, expense ratios and the index they track is essential. Index funds may prioritize specific investment goals like growth, income, or sector-specific exposure. Evaluating these factors can help you choose the best index funds to invest your money into that align with your investment objectives.

Furthermore, index funds are an excellent option for investors looking to build a passive investment strategy. Investors can achieve the passive investment strategy by investing in a passive index fund, meaning a fund that aims to replicate the performance of an index without active management decisions. The passive approach reduces the reliance on market timing or stock selection, providing a more straightforward and cost-effective investment avenue.

Many index funds are known for their cost efficiency, making them attractive to investors seeking low-cost options. These funds often have low expense ratios, which represent the annual fees charged by the fund for managing the index account. Low-cost index funds can enhance long-term investment returns by minimizing management fees and transaction costs.

How Index Funds Work

How do index funds work? Index funds are investment vehicles that operate by replicating the performance of a specific market index. They provide investors with a passive approach to investing, allowing them to gain exposure to a diversified portfolio of stocks that closely mirror the composition and weightage of the index they track. Let’s explore how to make an index fund so we can better understand how they work.

The average investor cannot make an index fund on their own. However, large brokerage firms and asset management companies begin by selecting the market index to track to create an index fund. This broad index can represent the overall market or focus on specific sectors, regions, or investment themes. Examples of market indexes include the S&P 500, Dow Jones Industrial Average, the consumer staples index or FTSE 100.

Once the index is selected, the fund's managers determine the composition of the index. This involves identifying the stocks that comprise the index and their respective weightings. This information is typically publicly available and used as a guideline for constructing the index fund's portfolio. The portfolio matches the composition of the index closely. The number of stocks and their weightings in the portfolio are proportional to their representation in the index. The goal is to create a diversified portfolio that accurately reflects the index's performance.

As time passes, the index's composition may change due to factors such as stock performance or corporate actions like mergers or acquisitions. The index fund's portfolio requires periodic rebalancing to maintain alignment with the index, which involves adjusting the holdings to reflect the changes in the index, ensuring that the fund continues to replicate the index's performance.

When you invest in an index fund, your money pools with other investors' funds. These pooled funds purchase index stocks. The value of the index fund fluctuates based on the performance of the underlying index. If the index experiences growth, the value of the index fund also increases.

Index funds are known for their passive management style. Unlike actively managed funds, where fund managers decide which stocks to buy and sell, index funds do not rely on such active decision-making. Instead, they passively track the performance of the selected index.

Index funds also tend to have lower expense ratios than actively managed funds, and many examples of low-cost index funds are available today. The expense ratio represents the annual fees charged by the fund for managing the index account. The lower expense ratios of index funds are primarily due to the reduced costs associated with the passive management approach.

You can choose from a variety of index funds available on the market. Index funds may cater to investment goals like growth, income or sector-specific exposure. When selecting the best index funds that align with your investment objectives, you must evaluate historical performance, expense ratios and the tracked index.

How Do You Make Money on Index Funds?

Learning how to make money in index funds primarily involves capital appreciation and dividend income. As the underlying index experiences growth, the value of the index fund increases, allowing you to profit from your investment. Additionally, some companies within the index may pay dividends to shareholders, and index funds pass these dividends on to their investors, providing an additional source of income.

Index Funds vs. Actively Managed Funds

When comparing index funds and actively managed funds, understand the differences in their investment strategies and approaches. Index funds replicate the performance of a specific market index, such as the S&P 500 or a global market index. They do this by holding a diversified portfolio of stocks that closely mirror the composition and weight of the index. Index funds are passive and do not rely on active stock selection or market timing. Instead, they aim to match the returns of the index they track.

Actively managed funds, on the other hand, involve a more hands-on approach. Fund managers or investment teams actively make investment decisions within the fund. They conduct research, analyze market trends and select individual securities to outperform the market or a designated benchmark. The objective of actively managed funds is to generate higher returns by making strategic investment choices.

One of the key differences between index funds and actively managed funds is the investment strategy. Index funds passively track the performance of an index, aiming to replicate its returns. Their goal is not to beat the market but to expose investors to its performance. In contrast, actively managed funds seek to outperform the market or a benchmark. Fund managers use their expertise and research to identify investment opportunities they believe will generate superior returns. They can deviate from the index composition, adjust portfolio holdings and make investment decisions based on their analysis.

Another important distinction is the cost structure. Index funds are known for their cost efficiency. Since they operate passively and do not require extensive research or active trading, they tend to have lower expense ratios than actively managed funds. This means that investors in index funds typically pay lower fees, which can contribute to higher net returns over the long term.

Performance consistency is another factor to consider. While some actively managed funds may achieve outperformance in certain periods, consistently beating the market over the long term is challenging. This is due to various factors, including the difficulty of consistently identifying winning stocks and the impact of higher expense ratios on overall returns.

On the other hand, index funds offer consistent performance in line with the underlying index. They provide investors with broad market exposure and can be an effective long-term wealth accumulation and diversification tool.

Ultimately, the choice between index funds and actively managed funds depends on your individual investment goals, risk tolerance and preferences. Investors seeking a passive, low-cost approach with consistent market returns often prefer index funds. Actively managed funds may be suitable for investors who believe in the potential for active management to outperform the market and are comfortable with the higher costs associated with these strategies.

How to Invest in Index Funds

Investing in index funds is a straightforward process that offers investors a passive approach to gain exposure to the stock market. Let’s look at the process you would typically take to invest in an index fund.

Step 1: Conduct research and select an index fund.

The first step in investing in index funds is to conduct thorough research and select the right fund for your investment goals. Consider factors such as the index the fund tracks, historical performance, expense ratio and overall strategy. Each fund tracks different indexes or market segments. Choose the fund that aligns best with your investment objectives and risk tolerance.

Once you've selected the index fund, the next step is to choose a suitable investment platform, such as a brokerage account, a robo-advisor or an investment app. Look for a platform that offers access to the specific index fund you want to invest in. Consider factors like brokerage account fees, user interface and customer support at the brokerage you intend to utilize.

Step 3: Open an investment account.

After choosing the investment platform, you'll need to open an investment account, which typically involves providing personal information and completing the necessary paperwork. Some platforms may require an initial deposit to fund your account, while others have no minimum investment requirements.

Step 4: Fund your account.

Once your investment account is open, you must fund it with the amount you wish to invest in the index fund. You can transfer money from your bank or investment accounts into your newly opened index fund account.

Step 5: Place your order.

With your account funded, you are ready to place your investment order. Go to the platform's interface, search for the specific index fund you want to invest and select the amount of money you want. Review your order details, including any fees or expenses, before confirming the investment.

Step 6: Monitor and rebalance.

After investing in the index fund, periodically monitoring your investment is essential. While index funds should track the underlying index passively, the index's composition may change over time. Periodic monitoring will ensure that your investment aligns with the intended index and objectives.

Additionally, as your financial situation or investment goals evolve, you may need to rebalance your investment portfolio. Rebalancing involves adjusting the allocation of your funds among different investments to maintain the desired risk level and target returns.

Can you take money out of an index fund? Yes, you can withdraw your money from an index fund anytime. Like most mutual funds or exchange-traded funds (ETFs), index funds offer liquidity, allowing you to redeem shares and receive the corresponding value of your investment. However, be aware of any potential fees or tax implications associated with early withdrawals or selling shares.

Example of an Index Fund

So let’s take a moment to look at an example of an index fund. We chose SPDR S&P 500 ETF Trust NYSEARCA: SPY as an investment option. Let’s examine the process of choosing this index fund — several critical factors come into play.

The first step involves understanding our investment objectives and goals. SPDR S&P 500 ETF Trust tracks the performance of the S&P 500 index, comprising 500 large-cap U.S. companies. In this example, we aim to achieve long-term growth and gain exposure to the overall U.S. stock market.

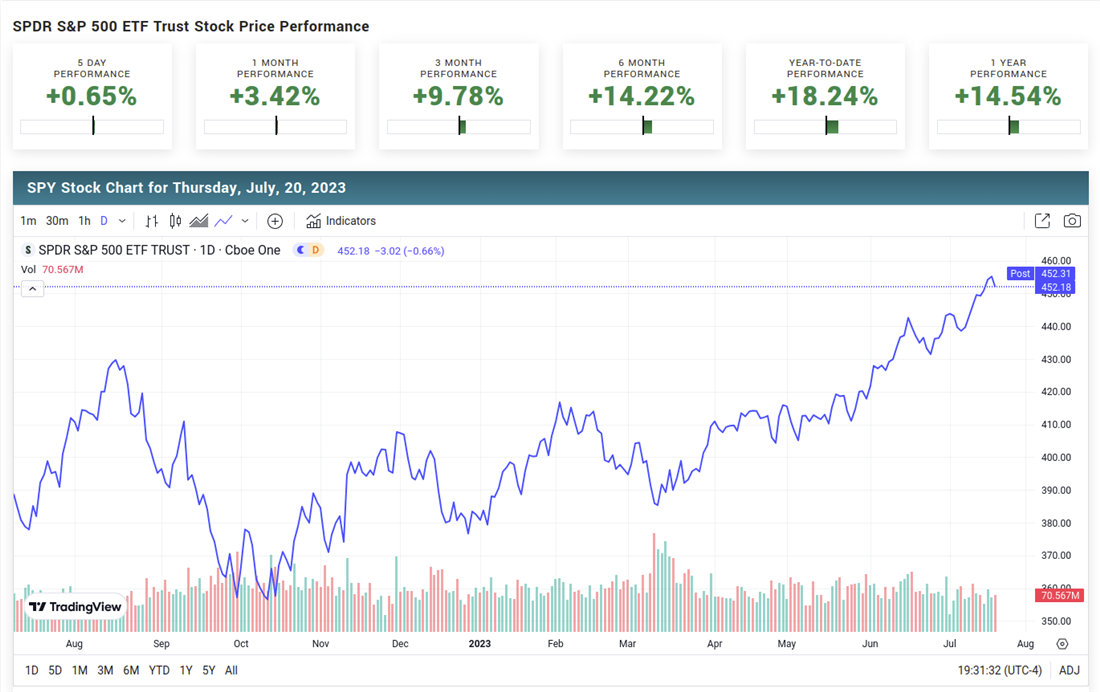

Next, we delve into comprehensive research about the fund. Analyzing SPDR S&P 500 ETF Trust historical performance over different time frames is crucial. We compare how closely SPDR S&P 500 ETF Trust has mirrored the S&P 500 index and assess its returns relative to the benchmark.

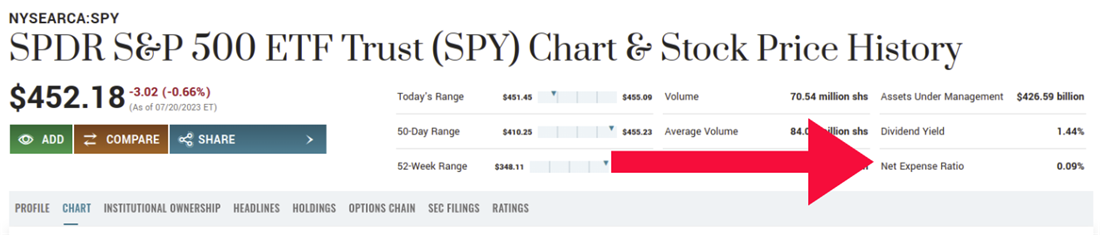

Another essential factor is evaluating the expense ratio. SPDR S&P 500 ETF Trust typically offers a lower expense ratio than actively managed funds. Lower expenses mean higher net returns for investors, enhancing its appeal as a cost-efficient investment option. MarketBeat makes the expense ratio easy to research by putting it on the header of the fund’s internal pages.

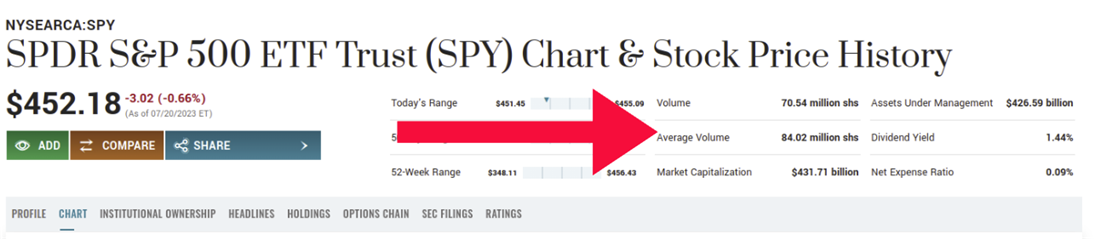

Liquidity is another key consideration. It is one of the largest and most liquid ETFs, ensuring ease of buying and selling shares at any time. This factor helps minimize bid-ask spreads and transaction costs, making it a desirable choice for liquidity investors. Checking liquidity can be done easily by looking at the fund's average daily volume in the header of each fund’s internal page.

Liquidity is another key consideration. It is one of the largest and most liquid ETFs, ensuring ease of buying and selling shares at any time. This factor helps minimize bid-ask spreads and transaction costs, making it a desirable choice for liquidity investors. Checking liquidity can be done easily by looking at the fund's average daily volume in the header of each fund’s internal page.

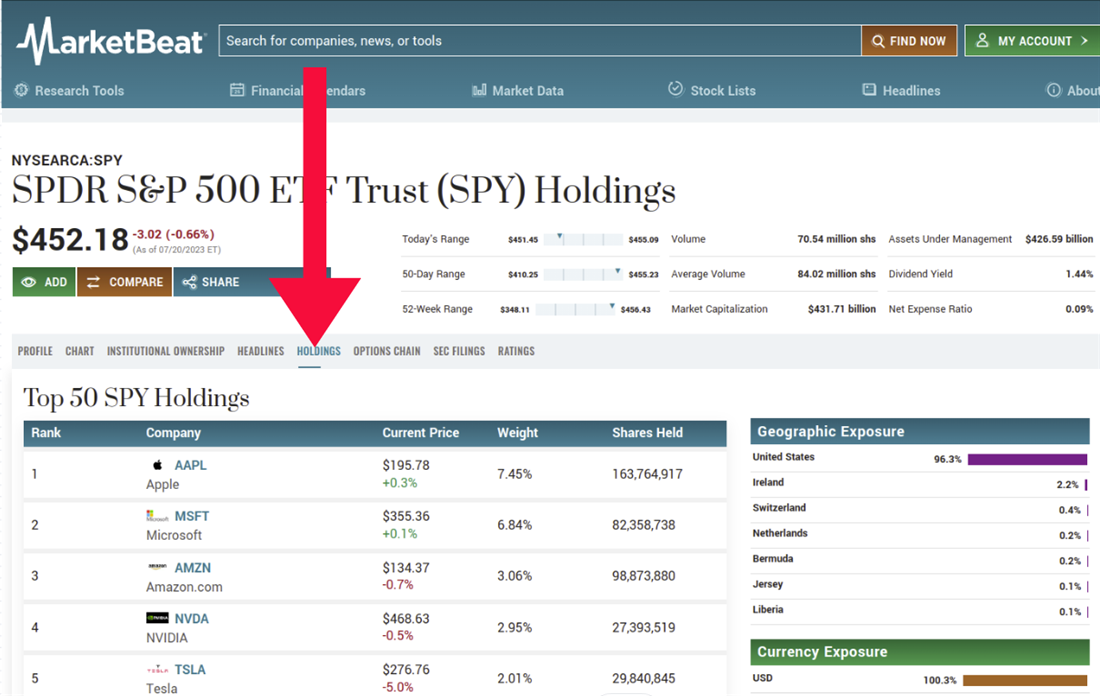

We also examine the portfolio holdings of SPDR. Since it tracks the S&P 500 index, it primarily holds large-cap U.S. stocks. If our investment strategy includes a desire for diversification or sector-specific exposure, we may explore other index funds to fulfill those requirements.

We also examine the portfolio holdings of SPDR. Since it tracks the S&P 500 index, it primarily holds large-cap U.S. stocks. If our investment strategy includes a desire for diversification or sector-specific exposure, we may explore other index funds to fulfill those requirements.

Tax efficiency is an important aspect of index funds, known for their tax advantages due to their passive management style and low turnover. Considering the fund's tax implications, especially if holding it in a taxable account, helps optimize overall after-tax returns.

Tax efficiency is an important aspect of index funds, known for their tax advantages due to their passive management style and low turnover. Considering the fund's tax implications, especially if holding it in a taxable account, helps optimize overall after-tax returns.

In addition to the fund itself, we consider the reputation and track record of the fund provider, State Street Global Advisors, to ensure it aligns with our interests.

Lastly, if there are uncertainties or specific financial goals, seeking advice from a qualified financial advisor can provide personalized guidance and ensure we make an informed decision aligned with our individual needs and risk tolerance.

By examining these critical factors and considering how well SPDR S&P 500 ETF Trust (SPY) aligns with our investment objectives, risk tolerance and preferences, we can decide whether to include it in our investment portfolio. Continuous monitoring of our investments ensures they align with our financial goals and adapt to changing market conditions over time.

Index Fund Fees

Index fund fees are essential to understand as they can significantly impact an investor's overall returns. These fees cover managing the fund and can vary between index funds.

Index funds generally have lower expense ratios compared to actively managed funds. The expense ratio represents the annual fees charged by the fund for managing the investment account. Since index funds operate passively and do not require extensive research or active trading, their management costs are typically lower.

One of the main reasons for the lower expense ratios of index funds is their passive management style. By tracking an index, the fund's managers do not need to engage in constant stock selection and trading, which reduces the associated costs. However, knowing other potential fees associated with index funds is essential. These fees may include transaction costs, account maintenance fees or front-end or back-end load fees. Investors should carefully review the fund's prospectus and fee structure to understand the costs involved.

While index fund fees are generally lower, evaluating the overall cost-effectiveness of investing in a particular index fund is crucial. Weigh factors such as the expense ratio, transaction costs and account fees against the fund's historical performance and risk profile.

Pros and Cons of Index Funds

Index funds present a compelling investment option for individuals seeking a simple, cost-effective way to participate in the stock market. However, like any investment vehicle, they come with advantages and disadvantages. It is essential for investors to carefully weigh these factors before deciding to include index funds in their investment portfolio.

Pros

The benefits of index funds include:

- Diversification: Index funds provide instant diversification, as they hold a broad range of stocks representing an entire market or a specific sector. This diversification helps spread risk and reduces the impact of individual stock performance on the overall investment.

- Lower expenses: Index funds typically have lower expense ratios than actively managed funds. The passive approach reduces the need for costly research and active trading, translating into cost savings for investors.

- Consistent performance: Index funds aim to replicate the performance of a specific market index. As a result, they offer consistent returns over the long term, closely tracking the performance of the underlying index.

- Simplicity: Investing in index funds is straightforward and requires minimal effort. You do not need to constantly monitor and make frequent investment decisions, making index funds an excellent option for passive investors.

Cons

The downsides include:

- Limited upside potential: While index funds provide consistent returns, they may not outperform the market or a benchmark index. The goal of index funds is to match the performance of the underlying index, which means investors may miss out on potentially higher returns achieved by actively managed funds.

- Inability to beat the market: Since index funds passively track the market, they cannot capitalize on investment opportunities that may arise due to market inefficiencies or strategic stock selection.

- Tracking error: Although index funds aim to replicate the index's performance, they may experience slight deviations due to factors such as transaction costs, changes in the index composition or fund expenses.

- Lack of customization: Index funds have predefined portfolios that mirror the index they track. As a result, investors cannot customize their holdings or exclude specific stocks they may want to avoid for ethical or personal reasons.

Is Investing in an Index Fund a Good Idea?

Investing in an index fund can be a wise choice for many investors, especially those seeking a passive and cost-effective approach to the stock market. Index funds offer diversification, consistency and lower expense ratios than actively managed funds. They are particularly suitable for individuals with long-term investment goals, as they aim to match the overall market's performance and reduce the impact of short-term market fluctuations.

Index funds are a compelling and efficient investment option for investors seeking simplicity, diversification and long-term growth potential. Their passive management approach, lower expenses and consistent performance make them an attractive choice no matter where you are in your investment journey.

By embracing index funds, you can build a strong foundation for your portfolio, benefit from cost efficiency and focus on long-term financial success. As with any investment decision, aligning index funds with your specific financial goals and risk tolerance can help you harness your full potential.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...