Hearing about a company being dual-listed gives the impression of a powerful and successful multinational corporation. This image is one of the reasons why companies decide to undergo dual listing on different stock exchanges. The global exposure enhances the brand's caliber.

While dual listings can come with their share of benefits, they also come with their share of negatives. This article will delve into the workings of dual listings, how do dual-listed stocks work, and what you need to know if you are considering investing in a dual-listed company.

What is a Dual Listing?

What is listing of a company? A dual listing is a stock listing where a company's stock is listed and publicly traded on two or more different stock exchanges. When a company adds a dual listing on a different stock exchange in the same country, such as the New York Stock Exchange (NYSE) and NASDAQ, it's called cross-listing.

When a company lists its stock in countries like the Frankfurt Stock Exchange (FSE) and the London Stock Exchange (LSE), it's called an international listing. It pays to know the listing of a company. Each exchange has its listing requirements that the company must meet to list and stay listed on the exchanges.

Why Do Companies Add a Dual Listing?

How do dual listings work? Companies that do a large amount of business in a foreign country may find it beneficial to list on that country's stock exchange. A dual listing provides exposure and prowess for a company in a region where business may grow.

It allows more investors to invest in the company through its local stock exchange, where they may feel more comfortable. Being listed in a country's stock exchange also gives it an air of notoriety and legitimacy, giving the impression that the company is not just a foreign entity but one that has "skin in the game" and takes an interest in the region. It can make consumers for its products also feel more comfortable purchasing its products and supports the business as listed companies tend to appear more trustworthy.

How a Dual Listing Works

For a publicly traded company to add a dual listing, it must apply to the stock market it wants to have a dual listing on. It has to meet the listing requirements and provide the required documentation. Many foreign companies that wish to add a dual listing in the U.S. stock markets can have a bank or financial institution issue advanced depositary receipts (ADRs).

ADRs are certificates that represent shares of a foreign company. Large banks will acquire many shares in a foreign company on its native stock exchange and deposit them in a foreign bank in the company's home country. The U.S. bank will then issue ADRs representing foreign stock shares. ADRs can be bought and sold like regular stocks. ADRs typically track the price of the foreign stock in its home country after adjusting to the ratio of ADRs to foreign stock. ADRs allow U.S. investors to invest in foreign companies without having to trade them on a foreign stock exchange. The over-the-counter (OTC) market known for penny stocks will also list some familiar international stock ADRs. This is one of the reasons not to completely write off penny stocks, as they may be ADRs of large foreign conglomerates.

On the flip side, U.S. companies that wish to dual list in another country can consider global depositary receipts (GDRs), which are the same as ADRs but just reversed countries. It's important to remember that foreign exchange can impact pricing. Additionally, foreign countries may have different governance, reporting and accounting rules. Knowing the rules of "How to do dual listings work?" is critical.

It's also important to check if the ADR is sponsored or unsponsored. Sponsored ADRs are ones where the foreign company has a formal agreement with the U.S. bank that issues the ADRs. Unsponsored ADRs have no such agreement and are riskier as the company has no accountability or obligation to provide financial information to the bank or U.S. shareholders.

Example of a Dual Listing

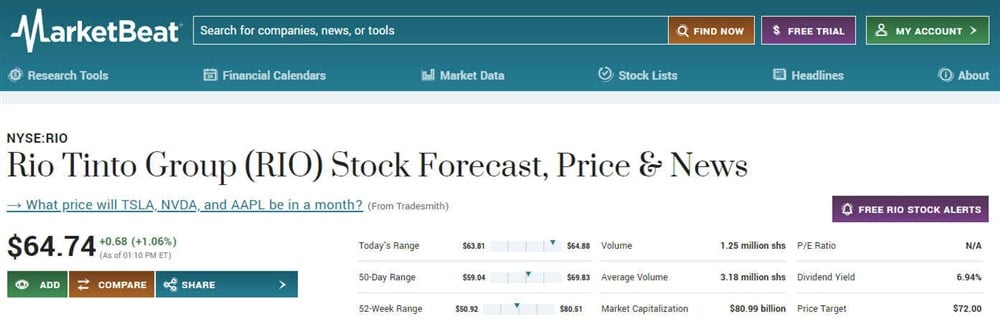

One of the largest dual-listed stocks is a multinational mining company and the second-largest miner in the world, Rio Tinto Group NYSE: RIO. RIO is listed on the NYSE, LSE and the Australian Stock Exchange (ASX). Here are the different listings for the same company.

The NYSE listing is an ADR under the symbol RIO. The price is in U.S. dollars.

The NYSE listing is an ADR under the symbol RIO. The price is in U.S. dollars.

It’s also listed as RIO on the LSE or LON. The price is in GBX.

It’s listed as RIO on the ASX. Note that the prices are converted to the stock market country’s currency. The prices track evenly despite the market hours opening at different times.

Pros and Cons of a Dual Listing

There are many pros and cons when it comes to dual listing. It pays to be aware of them.

Pros

Here are some of the benefits of dual listing:

- Bolsters the brand visibility, credibility and reputation: Listing in multiple stock exchanges gives the aura of a successful international enterprise. It shows consumers in foreign countries that the company has "skin in the game" regarding their economy and having an economic footprint in the country.

- Diversifies the investor pool: Having dual-listed shares enables citizens of another nation to invest in the company easily and conveniently. It makes access easier since potential investors don't have to contend with a foreign stock market and keep track of currency conversions. Dual-listed stocks have a diverse base of investors.

- More access to capital: Companies can opt to raise capital in foreign markets. This enabled foreign financial institutions to take stakes they may not have otherwise considered if shares were only listed in their native country. A company may raise additional capital if double listed in a country with a stronger economy.

Cons

Here are some of the downsides when it comes to being double-listed:

- Increased costs and expenses: A dual listing doesn’t come cheap. Double listing can result in double the regulatory fees. There are fees to pay for listing on a second exchange. Professional fees are associated with accounting, legal and regulatory compliance, which can involve paying for accountants, securities lawyers and professionals operating in a foreign country. Investor relations departments may also need to be equipped with translation services to address shareholder inquiries, analyst ratings changes, earnings reports and conference call transcripts in a foreign language.

- Regulations: Different exchanges in different countries may have different regulations. While the U.S. Securities and Exchange Commission (SEC) has filing forms like the 10-K, 8-K reporting and Form-4 and Form-144 insider sales, other exchanges will have completely different forms that must be filed with the appropriate regulatory agencies. Getting these wrong can result in penalties and even lawsuits resulting in more legal fees. Blue chip stocks in other countries may appear as penny stocks in the OTC exchange.

- Potential confusion: Being dual-listed can confuse investors who aren't unaware or knowledgeable about dual listings. Small investors could get confused about the different stock prices or the impact of price gaps when the security moves an outsized price while the other stock exchange is closed. Suppose a foreign company listed on the U.S. exchange and its native country pays a dividend. In that case, it can be confusing based on the currency translation which could have a material effect. Other countries may have different market holidays, resulting in varying stock prices until the other exchange reopens. While the U.S. stock markets share many of the same holidays, it also has different market holidays than the stock exchange in the U.K. and Canada.

Dual Listing vs. Secondary Listing

The lingo of dual listing and secondary listing are often interchanged. Both terms describe a company's stock being listed on different stock exchanges. However, a dual listing is technically used when a company simultaneously lists on two stock exchanges. A company may simultaneously have an initial public offering (IPO) on the NYSE and the LSE. This doesn't happen very often.

The more common method is the secondary listing. This happens when a company already listed and trading on a stock market exchange decides to list on a second exchange. Adding a listing for an existing public company on another exchange is technically called a secondary listing. It’s easy and normal to call a secondary listing a dual listing.

Listing Fees and Share Price

Listing on any stock exchange incurs an initial listing fee and additional fees like an annual listing fee. Listing fees and listing requirements differ between exchanges. For the NYSE, check out the listing fees for companies with various market capitalizations:

- Up to $100 million: $295,000

- From $100 million to $200 million: $350,000

- From $200 million to $500 million: $400,000

- From $500 million to $1 billion: $450,000

- From $1 billion to $2 billion: $500,000.

- Over $2 billion: $550,000

An additional class of common stock costs $5,000. Annual fees range from $40,000 to $65,000. The share price of a stock and its outstanding share count determine the stock's market cap and which tier of listing fees the company will have to pay.

The NASDAQ Global Market listing fee is $500,000, with a $50,000 annual listing fee and a $0.0003 per share market data fee. Other stock exchanges will have their listing fees and regulations. Hiring staff fluent in the language and rules for foreign exchanges is an added expense of dual or secondary listing.

Mind the Gaps

When you have a dual-listed stock in your portfolio, you may occasionally want to check its price on the other exchange whenever material events happen overnight. The pricing in the open exchange can have an impact on the gap up or down for the pricing in the stock exchange that has yet to open.

Material events can range from geopolitical events, earnings releases, court rulings and acquisition rumors and news. If a stock gaps down 12% on the Frankfort Stock Exchange on news of a natural disaster at the company's production facilities, then chances are very high the shares will gap down when it opens on the U.S. stock exchange. Dual listings can help you gauge the level of a gap up or down for the stock to open up on the other stock exchange.

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.