Investing in the financial markets can seem daunting for beginners, with many options and complex terminologies to decipher.

However, one of the most accessible and popular avenues for new and intermediate investors is stock mutual funds. So, what are mutual funds and how do they work?

Mutual funds offer an excellent opportunity to pool resources with other investors and access a diversified portfolio managed by professionals. You might ask, are mutual funds secure and are mutual funds safe? Let’s take some time to demystify the world of investment mutual funds and empower you to take your first steps into how to invest in mutual funds. Knowing how mutual funds work and what funds to buy now is essential if you want to build wealth for the future, save for retirement, or achieve specific financial goals.

What is a mutual fund? Imagine that you are a part-owner of a well-diversified investment portfolio managed by teams of seasoned professionals, with you barely having to lift a finger. That is the magic of mutual funds at work! Mutual funds offer a blend of simplicity and sophistication, making them the go-to choice for many investors.

How Do Mutual Funds Work?

Do you want to learn how to buy mutual funds? Let’s start by discussing a mutual funds definition as the starting point on our journey. Then we will discuss finding mutual funds to invest in that meet your investment goals.

A mutual fund is an investment vehicle that pools money from multiple investors to create a diversified portfolio of stocks, bonds or other securities. Professional fund managers oversee the mutual fund and make investment decisions on behalf of the investors.

Each investor in the mutual fund owns shares, representing a portion of the overall holdings in the fund. The value of these shares, also known as the net asset value (NAV), fluctuates with changes in the fund's underlying assets. Mutual funds offer individual investors the opportunity to participate in the financial markets with the benefit of professional management and diversification, making them a popular choice for both beginner and experienced investors seeking to grow their wealth over time.

How Does Your Money Grow in a Mutual Fund?

Your money grows in a mutual fund through two primary mechanisms: capital gains and dividends. Capital gains occur when the value of the fund's underlying assets, such as stocks or bonds, increases over time. When the fund manager sells these assets at a higher price, the resulting profit is distributed among the fund's shareholders through capital gains. Additionally, some mutual funds invest in dividend-paying stocks, and when these companies distribute dividends, the fund manager passes on the income to the shareholders.

Mutual Fund Pricing

Its net asset value (NAV) determines the price of a mutual fund. You can calculate a mutual fund's NAV value by dividing the total worth of the fund's assets by the number of outstanding shares. The NAV value is calculated only once daily, typically at the end of the trading day. As a result, you can buy or sell shares at this daily price, and you will not have to manage fluctuating prices throughout the day, as seen with individual stocks and ETFs.

Calculating Returns

Measuring mutual fund returns is a vital aspect of evaluating the performance and potential of an investment. Mutual fund returns come from two primary sources, each contributing to the overall gains and losses experienced by shareholders.

The first source of returns stems from capital gains, when the value of the fund's underlying assets, such as stocks or bonds, appreciates over time. The fund's portfolio manager continuously analyzes and manages the assets to identify growth opportunities and capitalize on favorable market conditions. When an asset is sold at a higher price than initially paid, the resulting profit is distributed among the fund's shareholders as capital gains. This allows investors to reap the benefits of the fund's strategic investment decisions, potentially leading to increased value and enhanced returns.

On the other hand, certain mutual funds focus on investing in dividend-paying stocks. When these companies generate profits, they often distribute a portion of these earnings as dividends to their shareholders. In turn, mutual fund managers pass this dividend income to the fund's shareholders. Dividend distributions provide investors with a regular income stream, serving as an attractive feature for those seeking consistent returns and a steady source of cash flow.

The combination of capital gains and dividend distributions culminates in what is known as the total return for the mutual fund. This comprehensive measure encompasses both forms of returns and reflects the overall gain or loss experienced by investors over a specific period. It is essential to recognize that the total return is not limited to a single point in time. The total return considers the fluctuations and changes within the market and the fund's underlying assets over an extended period.

Assessing a mutual fund's potential requires a thorough approach that researches beyond short-term fluctuations. The focus should be on the fund's long-term performance and consistently delivering satisfactory returns. A fund's historical total return provides valuable insights into its ability to navigate various market conditions and demonstrates how it may contribute to investors' financial goals over time.

Mutual Fund Costs

So, what’s a mutual fund cost? Understanding the costs involved in mutual fund investments is paramount for an investor. These expenses can significantly impact your overall returns and influence the effectiveness of your portfolio. The expense ratio is an annual fee the mutual fund company charges to cover operating expenses, management fees and administrative costs. This fee is typically expressed as a percentage of the fund's total assets and directly deducts from investors' returns. While seemingly minor, even slight differences in expense ratios can accumulate over time and erode the overall value of your investment. Therefore, keeping a close eye on expense ratios is critical to maximizing the potential gains from your mutual fund investment.

Certain mutual funds impose a front-end load, commonly known as a sales load, when purchasing shares. This fee is deducted upfront from the initial investment amount, reducing the number of shares you acquire. Front-end loads are a commission paid to the broker or salesperson to facilitate your investment. As a result, a higher percentage of your money goes towards covering the sales charge rather than directly contributing to your investment. While front-end loads can vary, they often result in an immediate reduction in the overall value of your investment. Carefully consider such fees before making your investment decision.

Instead of charging a fee during the purchase, certain mutual funds may implement a back-end load when selling shares, known as a deferred sales charge. This fee is typically applied if you sell your shares within a specified period after purchasing them. The longer you hold onto your investment, the lower the back-end load typically becomes, aiming to encourage long-term investment strategies. Awareness of these charges is essential, as they can significantly impact your decision to hold or sell your mutual fund shares.

To discourage short-term trading and protect the interests of long-term investors, some mutual funds impose redemption fees when shareholders sell their shares within a specific holding period. This fee incentivizes investors to maintain their positions in the fund for extended periods, contributing to fund stability and a reduced likelihood of rapid asset turnover.

Understanding mutual funds' mechanics, pricing, returns and costs empowers you to make informed decisions while selecting funds that align with your financial goals and risk tolerance. Investing in mutual funds allows you to access diversified portfolios managed by professionals, potentially helping you achieve long-term financial objectives.

As with any investment, thorough research, considering individual financial circumstances and seeking advice from a financial advisor are essential to successful investing. Being mindful of costs and their impact on your investment journey can pave the way toward building a solid and prosperous financial future.

How Do You Make Money from a Mutual Fund?

As an investor, it's essential to understand how you can make money from a mutual fund, especially if you're new to investing or at an intermediate level. When you invest in a mutual fund, you become a part-owner of a professionally managed portfolio that includes various stocks, bonds or other securities. But how do you ultimately make money off of your investment?

One of the primary ways you can make money from a mutual fund is through capital gains. This happens when the value of the fund's underlying assets, like stocks or bonds, increases over time. The mutual fund manager monitors the portfolio and makes strategic decisions on buying and selling assets to capitalize on growth opportunities. When an asset is sold at a higher price than its purchase price, the profit distributes among the fund's shareholders as capital gains.

As an investor, this means the value of your investment increases and you potentially earn more money. It's important to know that capital gains can be realized and unrealized. Realized capital gains occur when the fund manager sells a security at a profit and distributes the profits to shareholders. On the other hand, unrealized capital gains represent the increase in the value of the fund's assets that have yet to be sold. These gains contribute to the overall growth potential of the mutual fund.

Many mutual funds invest in dividend-paying stocks. But how do mutual fund dividends work? When these companies generate profits, they may distribute a portion of those earnings as dividends to their shareholders. As a mutual fund shareholder, you'll receive your share of these dividends from the fund manager. Dividend distributions can be attractive for investors seeking regular income from their investments.

A mutual fund earns interest income if it invests in fixed-income securities, such as bonds.

How do bond mutual funds work? When the bond issuers make interest payments, the mutual fund collects them and passes them on to its shareholders. Interest income can add to the overall return of the mutual fund and contribute to your potential earnings.

Reinvestment is another way to make money from a mutual fund. You can reinvest these earnings into the fund instead of receiving dividends or capital gains in cash. You'll purchase additional mutual fund shares by reinvesting, increasing your ownership stake. Reinvesting dividends and capital gains can compound the growth of your investment over time, potentially leading to more significant returns in the long run.

It's crucial to remember that while mutual funds offer the potential for attractive returns, they also carry inherent risks. The value of mutual fund shares can fluctuate based on market conditions and the performance of the fund's underlying assets. Therefore, there is no guarantee that you will profit and may even experience a loss on your investment. To maximize your potential for earning money from a mutual fund, consider your investment objectives, risk tolerance and time horizon. Diversifying your investment portfolio, staying informed about the fund's performance and seeking advice from financial professionals can all contribute to a well-informed and successful investment journey.

Can You Really Make Money with Mutual Funds?

Yes, and the minimum investment for mutual fund entry is low, depending on your broker or brokerage platform. So it is a great place to start on your stock market journey. Mutual funds offer the opportunity for investors to participate in the financial markets and benefit from the growth and income generated by the fund's underlying assets. However, it's important to note that all investments carry some level of risk, and the value of mutual funds can fluctuate with market conditions. The key to successful investing is carefully assessing your investment goals and risk tolerance and choosing funds that align with your financial objectives. Taking a long-term approach and staying committed to your investment strategy increases your chances of achieving financial growth with mutual funds.

Example of How Mutual Funds Work

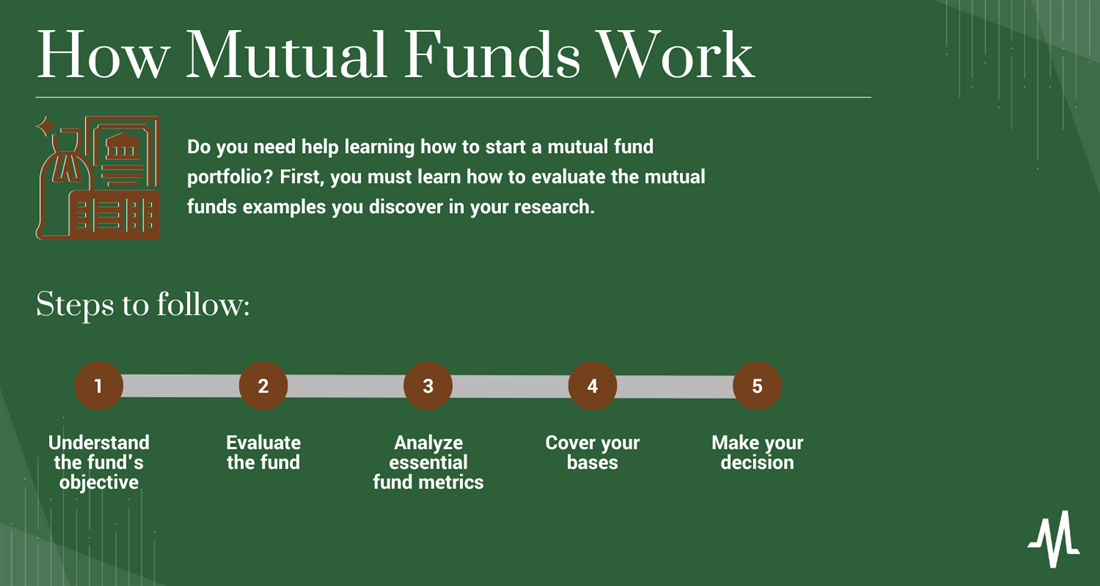

Do you need help learning how to start a mutual fund portfolio? First, you must learn how to evaluate the mutual funds examples you discover in your research.

So let's take a moment to assess a mutual fund so that you can observe firsthand how mutual fund investing can grow your portfolio. For this particular example, we will review the evaluation and selection process of the Vanguard 500 Index Fund MUTF: VFIAX, one of the most well-known and popular index funds in the investment landscape. You must thoroughly assess a mutual fund to make informed decisions that align with your financial goals and risk tolerance. By dissecting the Vanguard 500 Index Fund, we will explore a step-by-step guide to evaluating its performance, expense ratios, holdings, tax efficiency and other essential factors.

Step 1: Understand the fund's objective.

Are mutual funds a good investment? When you invest in a mutual fund, start by understanding the Vanguard 500 Index Fund's investment objective. Utilizing a trusted information tool review the Vanguard 500 Index Fund profile page, and you will find that this fund tracks the performance of the S&P 500 index. The S&P 500 index represents the 500 largest U.S. companies and is a widely accepted and monitored benchmark of the U.S. stock market.

The objective is to provide investors with broad exposure to the U.S. stock market and its relevant market sectors, potentially achieving returns similar to the overall market's performance.

Step 2: Evaluate the fund.

Review the fund's prospectus and annual reports to understand better its investment strategy, risks and management approach. Pay attention to the fund's investment philosophy and any recent changes in its structure.

Evaluate the fund's expense ratio, representing the annual fees charged to investors for managing the fund. Vanguard is known for its low-cost index funds, and the Vanguard 500 Index Fund is no exception. It’s easy to find this information on the MarketBeat profile page for each ETF. Compare its expense ratio with similar market funds to ensure you get a cost-effective investment option.

Explore the fund's holdings to understand which companies and sectors it invests in. The Vanguard 500 Index Fund’s holdings aim to replicate the S&P 500 index's composition, but slight variations may exist. Ensure the fund's allocation aligns with your investment objectives and risk tolerance.

Step 3: Analyze essential fund metrics.

Examine the Vanguard 500 Index Fund historical performance over various timeframes, such as one year, three years, five years and 10 years. Look for consistent returns and compare the fund's performance against the S&P 500 index or other relevant benchmarks. Remember that past performance does not guarantee future results but can provide insights into the fund's ability to track the index effectively.

Consider the fund's size and total assets under management. A larger fund with substantial AUM may indicate strong investor confidence and demand. However, due to liquidity constraints, large funds may face challenges in efficiently managing their assets or tracking the index. Evaluate the fund's tracking error, which measures how closely the fund's returns follow the underlying index's returns. A low tracking error is desirable as it indicates that the fund closely mirrors the performance of the S&P 500 index.

Step 4: Cover your bases.

Index funds are generally tax-efficient due to their buy-and-hold strategy. However, examining the fund's distribution history for potential capital gains distributions that may have tax implications is essential.

Compare the Vanguard 500 Index Fund with similar index funds tracking the S&P 500 index. Look for variations in expense ratios, tracking errors and historical performance to find the most suitable option for your investment goals.

Step 5: Make your decision.

After completing the steps to evaluate and choose the Vanguard 500 Index Fund, it's time to make a crucial decision regarding your investment journey. You now have all the essential information about this fund, its historical performance, expense ratios, holdings and tax efficiency. Take a moment to assess whether the Vanguard 500 Index Fund aligns with your investment goals, risk tolerance and overall financial plan.

If you believe the Vanguard 500 Index Fund fits your portfolio, it's time to pull the trigger and invest. You can initiate the investment process by contacting your preferred brokerage platform or financial institution and following their instructions to purchase fund shares. Consider setting up automatic investments to regularly contribute to your investment and benefit from dollar-cost averaging, reducing the impact of market fluctuations.

Once you've invested, remember to continue monitoring your investment. Check the fund's performance regularly, align it with your long-term objectives and rebalance your portfolio if necessary to maintain diversification. Investing is a long-term endeavor, and remaining patient and committed to your financial goals is crucial.

However, if, after careful consideration, you decide that the Vanguard 500 Index Fund doesn't meet your investment criteria or preferences, it's okay to hold off on pulling the trigger. Finding the right investment that suits your circumstances and aligns with your goals is essential. Feel free to explore other investment options or consult a financial advisor to tailor a portfolio that best suits your needs.

Remember, investing in any mutual fund, including the Vanguard 500 Index Fund, should be based on your thorough understanding of the fund, its objectives, risks and how it fits into your overall financial strategy. Informed choices should drive your investment journey, as should careful planning and a long-term perspective.

Mutual funds offer a powerful tool for diversification, allowing even beginner investors to access professionally managed portfolios and navigate the complexities of the financial markets.

Through careful evaluation and research, you can identify funds that suit your risk tolerance and investment objectives, putting you on a path toward potential long-term success.

As you venture into mutual funds, remember that patience and discipline are vital in investing. Regularly monitor your investments and be prepared to make adjustments as your financial circumstances evolve.