A company’s profit margin is essential to its current outlook and long-term sustainability. Most novice investors know that calculating profit and loss and distilling this information into an overall profit margin is a crucial skill to employ when evaluating investments. But did you know that there are multiple types of profit margins?

The four major types of profit margins are net, gross, operating and pretax profit margins. While the calculation of each type of profit margin is similar, comparing multiple types of profit margins can give you a more complete picture of corporate profits before investing. Read on to learn about the major types of profit margins, what they represent and how to calculate a profit margin from raw data.

What is Profit Margin?

Profit margin is a percentage figure that describes how profitable a business is after you deduct all of the business’s qualifying expenses. For example, a business might boast a profit margin of 30%; this means that for every $1 the business earns, about 30 cents in profit. The remaining 70 cents goes towards a wide range of operating costs, including employee salaries, customer outreach and marketing.

A company’s profit margin can tell you important details about its profitability and sustainability. A higher profit margin generally indicates that a company generates more profit than its revenue, meaning it’s more likely to maintain sufficient cash flow to finance upcoming projects and manage debt. Effective cost management and competitive market pricing can also improve profit margins, enhancing corporate sustainability.

Four Types of Profit Margin

When learning how to calculate profit margin and calculate profit and loss, it’s important to remember that there are multiple ways that you can create this figure. The following are the four major types of profit margin, as well as how to calculate profit margins using raw corporate data with each formula.

Net Profit Margin

Net profit margin is the easiest type to understand, representing the percentage of each dollar that goes back to the business in terms of profit. The net profit margin formula equals total revenue minus operating expenses, multiplied by 100 to create a percentage figure.

When considering how to calculate net profit margin, remember to include all sources of revenue the business has coming in. Income sources usually included in net profit margin calculation include:

- Revenue from the sales of goods and services

- Income from investments

- Interest on cash reserves

- Other income from secondary operations and projects

Generally, a higher net profit margin indicates that the company is well-managed in controlling costs and maximizing income. For investors, a company with a strong net profit margin signals effective ongoing management, which can positively indicate future financial stability. Sticking to companies with solid net profit margins overall can be a way to limit risk when selecting investments for your portfolio.

Gross Profit Margin

Gross profit margin is a way to measure a company’s profitability before considering taxes. The gross profit rate formula is as follows:

- Gross profit margin = (Gross profit / Total revenue) x 100

Gross profit margin measures the profitability of a company's core business operations before considering other expenses, such as operating expenses and taxes. The gross profit figure only includes the direct cost of manufacturing and distributing the goods and services the business sells and does not account for outside influences that play a role in a company’s total bottom line.

After learning how to calculate gross profit margin, you’ll likely notice that this figure is higher than the net profit margin. While the net profit margin gives you a more robust understanding of a company’s overall financial trajectory, comparing the gross and net profit margins can offer a unique perspective on internal efficiency.

Operating Profit Margin

Operating margin is another metric you can use to gauge the long-term sustainability of a business by calculating profit margin after deducting only business operating expenses. Like the gross margin calculation, the operating profit margin does not account for taxes or other one-time expenses (like lawsuit settlements) that are unlikely to be ongoing. However, it includes operating expenses, providing a more complete picture of company operations.

The operating profit margin formula is as follows:

- Operating profit margin = ([Gross profit - company operating expenses] / Total revenue) x 100

In this definition, “company operating expenses” includes all the costs incurred after creating the product to market and sell it. This figure may include corporate rent, advertising expenses, employee salaries and research and development. It does not usually include corporate taxes and investment income.

Pretax Profit Margin

If you’re looking for a pure profit figure that doesn’t include the shifting interference of government taxes, consider looking at a company’s pretax profit margin. The pretax profit margin, also known as the earnings before taxes (EBT) margin, is a financial metric that measures a company's profitability before accounting for income taxes.

The most important difference between the operating profit margin and the gross profit margin is the inclusion of additional revenue streams outside sales revenue. On the other hand, the difference between the pretax profit margin and net profit margin calculation includes tax and accounting costs. Taxes are included in the pretax profit calculation and excluded from the net profit margin calculation.

What is a Good Profit Margin?

What constitutes a good profit margin? It might vary depending on the industry, consistency and current economic conditions. A report from New York University found that the average overall market gross profit margin is 33.19%, while the average market net profit margin is about 7.77%. However, this figure varies widely by industry; for example, the average restaurant or dining company had a net profit margin of 9.28%, while the industry average for air travel was -1.71%.

Example of Profit Margin

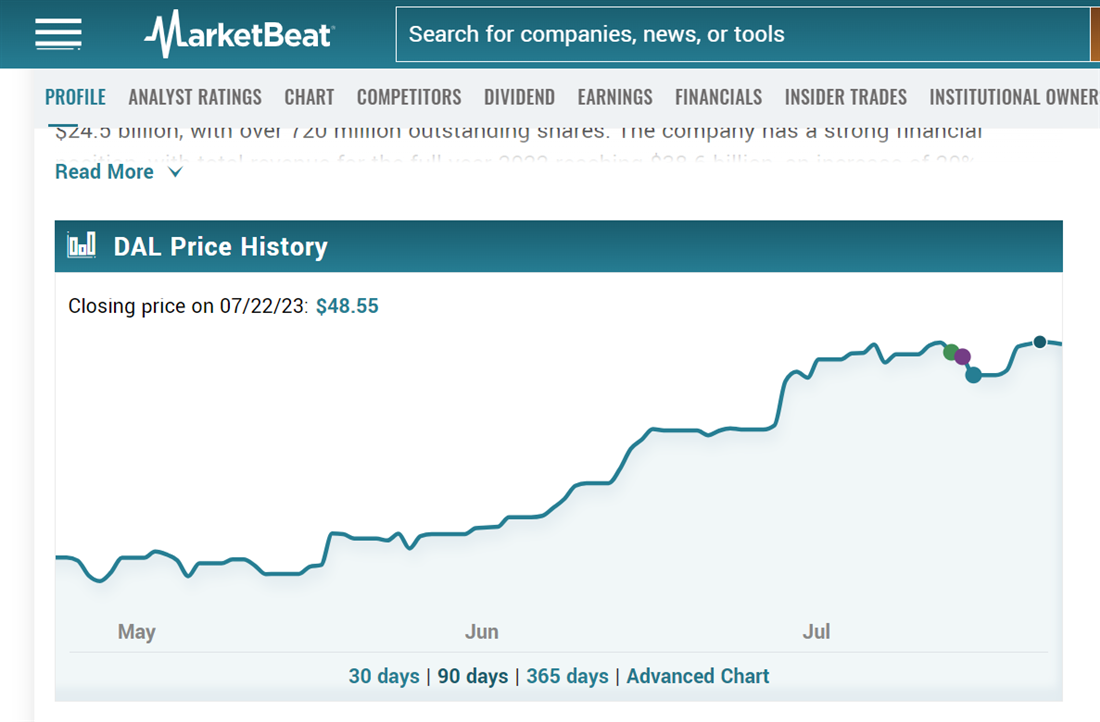

To take a closer look at profit margin calculation, let’s take a few examples from the airline industry. Delta Air Lines NYSE: DAL had a net margin of 5.36%, making it stronger than the overall industry average of -1.71%. This is reflected in its share price changes over time, which has shown a consistent upward recovery since the onset of the COVID-19 pandemic.

Meanwhile, budget airline Spirit Airlines NYSE: SAVE has seen more trouble recovering, even during the post-COVID travel boom. Spirit Airlines currently showcases a net profit margin of -8.50%, which is comparatively worse than the industry average. This is shown partially in Spirit’s rocky stock price recovery, which has been more inconsistent when compared to Delta.

How to Improve Profit Margin

How to Improve Profit Margin

Companies that have lower comparative profit margins might take steps to rectify poorer profit margins. The following are some of the major steps a company could go through to improve profit margin calculation before releasing quarterly earnings reports to potential investors.

- Changing pricing strategies: Companies with lower profit margins may need to adjust their pricing strategies to compete with market changes. For example, a makeup company that was previously able to market its product at a premium rate years ago may now have to deal with market “copycats” flooding the market at lower price points. Market research endeavors can be crucial in determining the best price point for a product or service with a low profit margin.

- Supply chain operations: Supply chain and product availability changes can cause major changes to profit margin. For example, recent changes in oil prices and price volatility have impacted multiple industries, requiring companies to shift operations to maintain margins. Changing suppliers for major product components can sometimes improve profit margins.

- Marketing and sales tactics: Sometimes, a marketing budget or strategy change can influence profit margins. For example, a new product that isn't’ sufficiently marketed using a medium that the target audience consumes may have artificially low sales. Conversely, an overmarketed product could see a larger percentage of potential profit taken up by a bloated budget, taking resources away from new endeavors.

If a company in your portfolio shows consistently low profit margins compared to industry averages, it can be worth reviewing recent press releases and products to see what management is doing differently to course-correct. If no viable plan is in place and reduced margins don’t seem to have a cause related to the economic cycle, it might be time to reduce your holdings.

Limitations of Profit Margin

Profit margin figures are only one of many different financial metrics that investing experts look at to determine whether a stock is a buy. Some limitations of using price margin as your only form of stock and fund evaluation can include the following:

- Ignores other financial metrics: While profit margin is important, it doesn’t tell the whole story of a company’s finances. Profit margin percentage does not include other important financial factors influencing your return, including debt levels and liquidity.

- Variations in accounting methods: Depending on the company, different accounting methods can be used to calculate a company’s profit margin. Differences in the definition of multiple income streams can cause variations in profit margin calculation between different companies and industries.

- Inclusion of non-operating items and expenses: Some types of profit margin include operating and non-operating items. Non-operating items, such as interest income or tax expenses, can distort profit margins, especially when comparing companies with different financing strategies.

Ultimately, it’s important to consider profit margin alongside other financial data points before deciding which companies to add to your portfolio. Considering multiple aspects of a company’s finances gives you a complete picture of sustainability and potential future returns.

Paying Attention to Profit Margins

Why even bother to have multiple ways to calculate profit margin if most figures include the same basic info? Multiple profit margin calculations exist because each type focuses on different aspects of a company's financial performance, providing multiple insights to stakeholders.

For example, gross profit margin emphasizes the efficiency of core operations by measuring profit after deducting direct production costs. In contrast, pretax profit margin gives a closer insight into how other income streams affect overall revenue. Consider multiple profit margin formulas when narrowing down your investment choices.

FAQs

Now that you know how to calculate profit margin using multiple methods, you can compare multiple companies within the same sector based on recent profits. The following are some last-minute questions you might have about profit margin calculation.

The “best” profit margin can vary depending on the specific figure you want to calculate when evaluating companies. However, the most commonly used profit margin is net profit margin calculation, as it’s the most encompassing of most regular operations and deductions. An online profit margin calculator can make calculating and comparing multiple profit margins easier.

What is a profit margin percentage?

A profit margin percentage is a financial metric expressed as a percentage that represents the proportion of profit a company earns relative to its revenue or sales. It measures the efficiency of a company's operations by indicating how much profit is generated from each dollar of revenue. A higher profit margin percentage is generally preferred as it indicates that a company effectively manages its costs and maximizes its profitability.

The most useful profit margin formula might vary depending on why you’re calculating profit margin in the first place. For example, the gross profit margin could be helpful if you were interested in the basic income a company receives from selling and distributing products and services. The operating profit margin could be more helpful if you’re looking to judge operational bloat.