The internet has been a boon to investors in many ways. Not only does it provide a way for individual investors to get a wealth of information about particular securities, but it spawned the ability of individual investors to trade their stocks in real time.

Another benefit for investors who use the internet as a research tool is its ability to give you an organized experience customized to the securities in your investment portfolio.

One tool that does so is Google Finance. Google Finance is a searchable tab within Google.com that lets you track the performance of your securities. Google Finance is an update to the original version of Google Finance which resided on its own portal. In this article, we’ll walk you through a way to track the stocks in your portfolio using Google Finance and attempt to answer some questions that you might have.

Getting started with Google Finance

All you need to get access to Google Finance is an active Google account. From your account, you can access Google Finance in one of two ways.

- Visit google.com, and then enter the company name or stock symbol in the search bar. When you get to the results page, click on Finance which is found under the “More” tab. This will take you to a Market Summary page which shows the current price of the stock, stock prices of select competitors, the company’s most recent quarterly results, recent news stories about the company, a summary of the major stock indices (Dow Jones, NASDAQ, S&P 500, etc.) and general market news. Underneath the company name and stock symbol in the upper left corner, you can click the Follow button to begin tracking the stock.

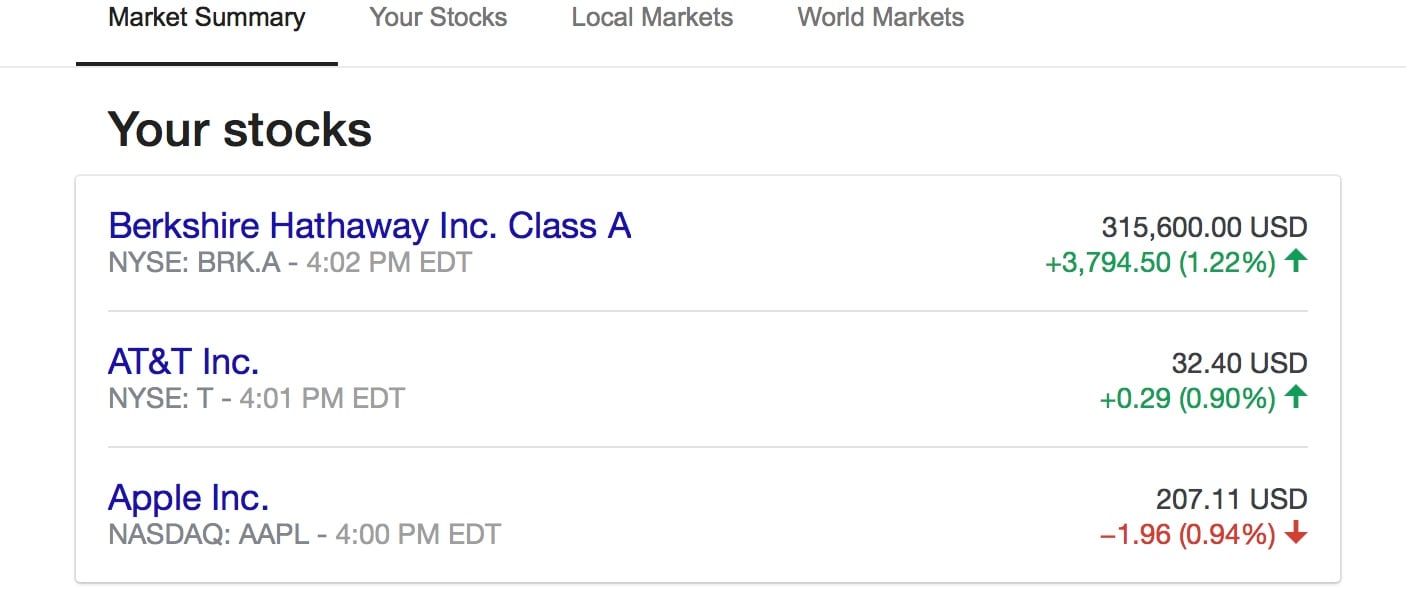

- Another way to access Google Finance is by visiting google.com/finance. This will direct you to what can be summarized as your personal dashboard. It contains the same information that you get on the Market Summary page you get to from google.com, but you have a section called “Your Stocks”. This will show all the stocks that were in your portfolio if you had been using a previous version of Google Finance. If you are a new user, you may see some stocks that are related to recent searches you’ve done (this is Google after all).

You’ll also see an additional section on your dashboard called “You may be interested in.” This section provides suggestions of other companies you may want to research based on the stocks that are already in your portfolio.

How do I add stocks that are not currently shown?

Simply type the name of the company or stock symbol in the search bar. The search tool features predictive analysis so it will give you suggestions as you start to enter the name or symbol. Once you arrive at the page, you follow or unfollow the stock by clicking on the box beneath the stock symbol. It’s the same user experience as “Following” or “Unfollowing” someone on social media.

Once you click or tap on a specific company, you’ll be taken to another page with four tabs:

Overview – essentially this is your dashboard page, but reformatted and made specifically for just the stock you want to see. It's like going from a news feed to a specific post. At the very top of the page, you’ll see the current stock price and a chart that lets you see price movement in certain time increments (1-day, 5-day, 1-month, 1-year, 5-year (if applicable) and Max (if applicable).

The overview page also provides information specific to that stock, such as what price the stock opened at and the high and low prices for the day. The information is intended to be a snapshot of the basic information investors use in measuring a stock’s performance.

News – this tab breaks out just the news related to that stock and general headlines about the market. One caveat: the news stories that you see are pulled just from the major publishing sites, but may not provide stories from niche sources that an investor may prefer.

Compare– one of the tools that investors may find valuable is to compare the performance of an individual security with others in its sector and to the broader market. This tab provides that information in a very curated way. Additionally, the tab provides information about stocks that are on your watch list. If you want to compare a stock that is not listed, simply type the name of the company or symbol in the search bar titled “Compare custom stock or index” to add it.

Financials– this allows a user to get a deeper dive on the company by looking at information from their last quarterly filing. While not a full balance sheet, it does give the user data about how much revenue they are generating, their operating income and their cash on hand. A nice feature is the ability to look at the last three-quarters worth of data. Investing is never done in a vacuum. This information allows investors to get a better view of the stock’s performance over time. This is information that advocates of fundamental analysis will appreciate.

There is currently no way to track your personal portfolio as far as day to day performance for the individual investor within Google Finance. Many investors are asking for this information. Google has suggested that there will be future updates but has not commented on whether they plan to include a way for users to input specific data from their stock portfolio (i.e. shares owned and the price paid).

Prior to the launch, a spokeswoman stated that Google elected to make the changes to increase the global exposure of their Finance product. By integrating the function into Google's Search tool, it will allow the company to reach a larger audience that wants this information.

One workaround within the Google platform is to use Google Sheets.

Google Sheets allows you to populate individual fields within the spreadsheet with information pulled directly from Google Finance. Once you add this information it will automatically refresh from the latest information available in Google Finance. As a user, you would have to input information from your specific portfolio, but once you have input the data, the spreadsheet will continually update the calculations on your portfolio’s performance based on the latest information in Google Finance. One of the interesting things about using Google Sheets is that this is a way for you to get additional information about the stock that you don’t get on Google Finance. For example, you can find the number of outstanding shares and the average daily trading volume.

I used to use the older version of Google Finance; why did they take away the My Portfolio feature?

Google has never given a direct response to why they removed the My Portfolio feature, but they have expressed an interest in making financial and stock news available to a broader audience. They may have plans to add this information in the future, but we just don’t know right now.

I manage my aging parents’ portfolio, how can I keep this information separate?

The easiest way to do this would be to set up a separate Google account with their name. Then simply log in with that account and then populate Google Finance with the securities in their portfolio.

I’m an active trader, will Google Finance help me?

If you’re an active trader, you probably rely on technical analysis. If that’s the case, Google Finance is probably not robust enough for you. You can certainly use Google Finance as a news tracking device for stocks that you may want to keep a closer eye on. But for seeing the real-time stock movement that active traders need to enter and exit positions quickly, you may want to look at our MarketBeat All Access service, which gives you access to our suite of web-based research tools, our library of premium reports, our full database of 500,000 stock ratings, our real-time news feed, our portfolio management tool, and our premium daily newsletter.

Google Finance is a good, if perhaps flawed, a tool that is useful for investors who are looking to get a snapshot of how the stocks in their portfolio are performing. The interface gives them a curated experience that they can use to create watch lists, news alerts and other information customized to their portfolio.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.