Let's explore the intricacies of limit orders, including "buy" limit orders and "sell" limit orders and shed light on their purpose and execution.

We'll also delve into "stop-limit" orders and their significance in managing risks. So, whether you're curious about the definition of a limit order or seeking to optimize your trading strategies, this article will equip you with the knowledge and insights you need to make successful trades and manage your risks.

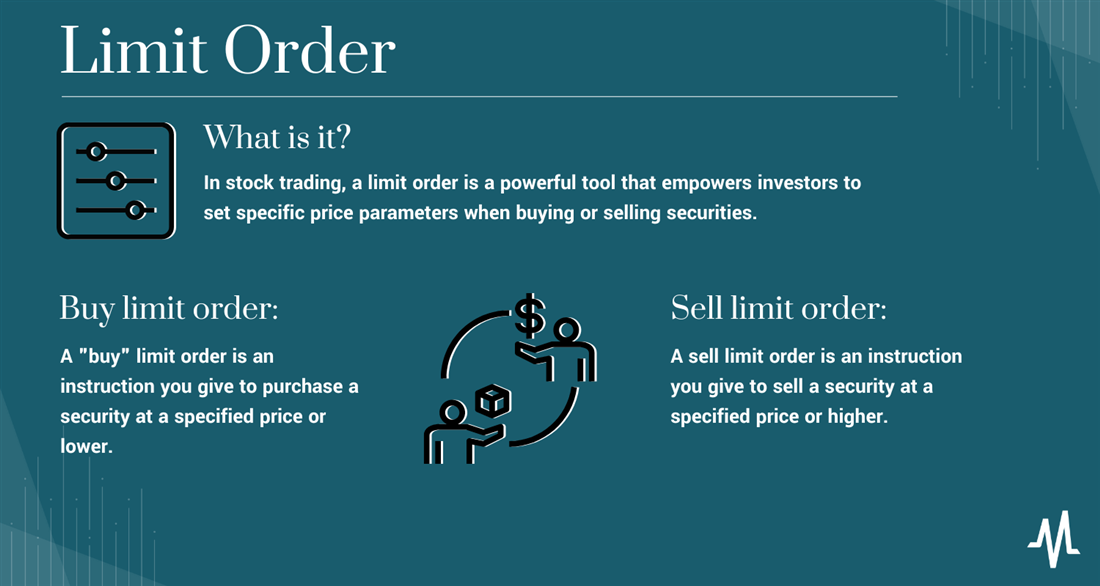

What is a Limit Order?

In stock trading, a limit order is a powerful tool that empowers investors to set specific price parameters when buying or selling securities. Understanding the intricacies of limit orders is essential, especially when exploring concepts like stop limit orders, their significance in stock trading and how they differ from market orders. Let's delve deeper into limit orders and gain a comprehensive understanding.

So, what is a limit order in stock trading? A limit order is an instruction given by an investor to a broker or trading platform, directing them to execute a trade at a predetermined price or better. Unlike a market order, which aims for immediate execution at the prevailing market price, a limit order prioritizes the desired price of a security above the transaction taking place. This gives traders greater control over their trading decisions and helps them align their trades with specific price targets.

The primary purpose of a limit order is to ensure that the trade executes at a price that meets the investor's criteria. When placing a limit order, you can set a specific price at which you are willing to buy or sell a security based on your analysis and desired entry or exit points. With limit orders, traders can enter a trade at a more favorable price than the current market price or sell at a higher price.

A limit order serves as a mechanism to capitalize on anticipated price movements. You can use potential price dips or corrections to your advantage by setting a limit order to buy a security. For example, suppose you believe a particular stock will likely experience a temporary price decline before rebounding. In that case, you can set a buy limit order at a price lower than the current market price. If the stock reaches or falls below the specified price, the limit order is triggered, and the trade executes at or below the designated limit.

What is limit order selling?

Conversely, you can use a limit order when selling a security. If you expect a stock to reach a certain price level before encountering resistance or a potential downturn, you can set a sell limit order at a price higher than the current market price. If the stock price reaches or surpasses the specified limit, the order is activated, and the security sells at or above the predetermined price.

Now that we have discussed buying and selling with limit orders, let's discuss stop orders. You can also use limit orders as stops. What is a stop limit order in stocks? A stop-limit order combines elements of a stop order and a limit order to give traders more precise control over the execution of their trades. It involves setting two price points: the stop and limit prices.

The stop price acts as the trigger for the trade. When the market price of a security reaches or falls below the stop price for a buy stop-limit order (or reaches or rises above the stop price for a sell stop-limit order), the order is activated and converted into a limit order.

The limit price, on the other hand, determines the maximum or minimum price at which the trader is willing to buy or sell the security. Once the stop order is triggered and converted into a limit order, the trade will only execute if the market price can be filled within the specified limit price range.

A stop-limit order allows traders to set specific price levels at which they want to enter or exit a trade. It provides added control and the ability to manage risk by defining the activation level (stop price) and the desired execution range (limit price).

Limit orders allow you to be more precise in your trading strategies. They eliminate the need to constantly monitor the market and enable you to set specific price targets without pressure to make split-second decisions.

Two Most Common Types of Limit Orders

Limit orders come in different forms, each serving a specific purpose in stock trading. Understanding the two most common types of limit orders, buy limit orders and sell limit orders, is crucial for traders looking to optimize their trading strategies.

Buy Limit Order

A "buy" limit order is an instruction you give to purchase a security at a specified price or lower. This order type is useful when you believe a particular stock has the potential for an upward price movement but trades at a higher price than desired. By setting a buy limit order, you can avoid overpaying for the stock while still positioning yourself to benefit from a potential rally.

Let's consider an example to illustrate how a buy limit order works: Suppose a trader is interested in purchasing shares of Apple NASDAQ: AAPL, currently trading at $190 per share. However, based on Apple's analyst ratings and a review of the company's most recent earnings transcripts, the trader believes that a stock price dip to $180 or below presents an attractive buying opportunity. The trader can place a buy limit order at $180 to take advantage of this potential dip. If the market price reaches or falls below $180, the order will be triggered, and the trade will execute at or below the specified limit.

Buy limit orders give traders a disciplined approach to entering the market at desired price levels. They enable investors to avoid impulsive buying decisions driven by short-term price fluctuations and help align trading decisions with a predetermined strategy and risk tolerance.

Sell Limit Order

A sell limit order, on the other hand, is an instruction given by an investor to sell a security at a specified price or higher. This order type is useful when traders anticipate that a stock they own may reach a certain price level before encountering potential resistance or a downward trend. By setting a sell limit order, traders can lock in profits or exit positions at a desired price.

Let's consider an example to illustrate how a sell limit order works: Suppose an investor owns shares of Delta Air Lines NYSE: DAL, trading at $47 per share. After reviewing Delta Air Lines' financials and positive media sentiment, you believe the stock may reach a price of $60 or higher before potentially facing a reversal. In this case, the investor can place a sell limit order at $60. If the market price reaches or surpasses $60, the order will be triggered, and the trade will execute at or above the specified limit.

Sell limit orders allow you to implement a disciplined approach to profit-taking or exiting positions. By setting predetermined price levels for selling, you can avoid the temptation to hold onto positions for too long and secure gains according to your trading plan.

How Limit Orders Work

Limit orders play a fundamental role in executing trades with precision and control. Understanding how limit orders work can help optimize your trading strategy. When you place a limit order, you specify the maximum price you are willing to pay for a buy order or the minimum price you are willing to accept for a sell order. The limit order goes to the market, which remains active until you execute or cancel them.

The security's market price must reach or fall below the specified limit price. Once the market price reaches the limit price, the buy limit order is triggered and converted into a market order. A market order is an order to buy or sell a security at the best available price in the market.

Conversely, to execute a sell limit order, the security's market price must reach or exceed the specified limit price. Once the market price reaches the limit price, the sell limit order is triggered and converted into a market order to sell the security at the best available price.

Similar to a buy limit order, a sell limit order sets a minimum price the trader will accept for the sale. However, it does not guarantee the execution of the order. The order will only be filled if the market price reaches or surpasses the limit price before the order expires or is canceled.

Limit orders offer several benefits to traders, including:

- Price control: By setting a specific price you are willing to buy or sell, you have greater control over your trades, ensuring you enter or exit positions at desired price levels.

- Avoiding unintended trades: Limit orders help traders avoid executing trades at unfavorable prices caused by sudden market fluctuations or price gaps.

- Disciplined trading: Limit orders encourage disciplined trading by allowing traders to adhere to predetermined strategies and price targets, reducing the influence of emotional decision-making.

While limit orders offer advantages, there are a few considerations for traders to keep in mind:

- Order execution: There is no guarantee that a limit order will be executed. The order may go unfilled if the market price does not reach or exceed the specified limit price.

- Timing and market volatility: Market conditions and volatility can impact the execution of limit orders. In fast-moving markets or during periods of high volatility, the market price may bypass the specified limit price, resulting in an unfilled order.

- Partial fills: A limit order can be partially filled if not enough shares are available at the specified limit price. Traders should know that partial fills can occur, especially when dealing with illiquid securities.

Limit orders provide traders with a method to exert control over the execution of their trades by setting specific price parameters. By understanding the mechanics of limit orders and considering their benefits and potential considerations, traders can leverage these order types effectively to optimize their trading strategies and achieve better trade outcomes.

Example of a Limit Order

Let's go through an example of a limit order using General Electric NYSE: GE stock to illustrate how this order type works. General Electric is a top-rated blue-chip stock primarily classified as an industrial company, not a consumer staple or discretionary company. GE's operations span various industrial sectors, including aviation, power, renewable energy, healthcare and transportation. Suppose you want to purchase GE shares, trading at $100.

However, after reviewing GE's financials and GE's analyst ratings and considering its market sectors, you believe a potential dip in the stock's price to $90 or below presents an attractive buying opportunity. You place a buy-limit order to take advantage of this anticipated price movement.

Here's a breakdown of the example using a table to visualize the order:

|

Price

|

Action

|

Order Type

|

|

$100

|

None

|

Current price

|

|

$90

|

Buy limit

|

Waiting to execute

|

The table above shows the current market price for GE stock is $100 per share. You set a buy limit order at $90, indicating you are willing to purchase the stock at $90 or below.

Now, let's explore two possible scenarios:

Scenario 1: Order Execution

|

Price

|

Action

|

Order Type

|

|

$100

|

None

|

Current price

|

|

$90

|

Buy limit

|

Triggered

|

|

$89

|

Market order

|

Executed

|

In this scenario, the market price of GE stock reaches $90 or falls below it, triggering your buy limit order. The buy limit order then converts into a market order, and the trade is executed at the best available price in the market. Let's assume the market order fills at $89 per share, below your specified limit price.

Scenario 2: Order Not Executed

|

Price

|

Action

|

Order Type

|

|

$ 103

|

None

|

Current price

|

|

$90

|

Buy limit

|

Waiting to execute

|

In this scenario, the market price of GE stock increases to $103 but does not reach or fall below your specified limit price of $90. As a result, your buy limit order remains untriggered and unfilled.

These examples demonstrate the working of a buy limit order using General Electric NYSE: GE stock. By setting a specific limit price of $90, you can control the maximum price you are willing to pay for GE shares. If the market price reaches or falls below your limit price, the order is triggered and executed at the best available price. However, if the market price does not reach your specified limit, the order remains unfilled, allowing you to reassess your trading strategy.

Limitations of Limit Orders

Limit orders, despite their advantages, also have certain limitations. One primary limitation of limit orders is their lack of guaranteed execution. Filling a limit order requires the market price to reach or cross the specified limit price. If the market fails to reach the limit price within the order's validity period or if the order is canceled, it may go unfilled.

Limit orders can be vulnerable to market volatility. Both penny stocks and blue-chip stocks can reach extreme volatility levels. The price may move quickly in highly volatile or rapidly changing market conditions, potentially skipping past the specified limit price. As a result, the limit order may not execute, leading to missed trading opportunities.

Another limitation to consider is the possibility of partial fills. If insufficient shares are available at the specified limit price to fulfill the entire order, it creates an order imbalance, resulting in only partially filling your limit order. This means that only a portion of the order will be executed, and the remaining shares will remain open until the market reaches the limit price again.

Limit orders have a time-sensitivity aspect. They are valid for a designated period, and if the market fails to reach the limit price within that timeframe, the order will expire and be automatically canceled. Traders need to be mindful of the duration of their limit orders and adjust them accordingly to adapt to changing market conditions.

The liquidity of a stock or market can also affect the execution of limit orders. In less liquid markets or thinly traded stocks, there may not be enough buyers or sellers available at the specified limit price. This can result in delayed or unfilled orders.

Traders should be aware of the limitations of limit orders and carefully consider their trading strategies. Alternative order types like market orders or stop orders, may mitigate these limitations. Each order type carries its advantages and considerations, and traders should select the most suitable order type based on their trading goals, risk tolerance and prevailing market conditions.

Differences Between a Limit Order and Other Order Types

The Securities and Exchange Commission reports that market, limit, and stop orders are the three most common types of orders. When trading stocks, investors must understand the different order types that cater to various trading strategies and objectives. Understanding the differences between a limit order and other commonly used order types, such as market and stop orders, is crucial for effective market navigation.

A limit order allows traders to buy or sell a security at a specific price or better. It provides precise control over the maximum buy price or minimum sell price. However, a limit order does not guarantee execution. It relies on the market price reaching or crossing the specified limit price within the validity period. Traders are protected from unfavorable prices by using limit orders.

A market order is an instruction to buy or sell a security at the current market price. It prioritizes immediate execution over price control. Market orders are executed as soon as possible at the best available price. Traders do not have control over the exact execution price with market orders, but execution is generally guaranteed as long as sufficient liquidity exists.

A stop order, such as a stop-loss or stop-limit order, protects against losses or trigger trades at specific price levels. Stop orders are activated when the market price reaches or crosses a specified stop price. Once triggered, they become market orders (stop market orders) or limit orders (stop limit orders) for execution. Stop orders help manage risk by setting predefined exit points or activating trades at desired price levels. However, like limit orders, stop orders do not guarantee execution if the market fails to reach the specified stop price.

Understanding the distinctions between these order types is essential for traders. Limit orders offer price control and protection but may not always execute. Market orders prioritize speed of execution but lack price control. Stop orders provide risk management and activation at specific price levels but do not guarantee execution.

Traders should select the most suitable order type based on their trading goals, risk tolerance and prevailing market conditions. By utilizing the appropriate order type, traders can effectively execute their strategies and confidently navigate the markets.

How Long Does a Limit Order Last?

The duration of a limit order refers to the length of time it remains active in the market. Traders can choose different timeframes for their limit orders, depending on their trading objectives and market conditions. As the name suggests, a day order remains active only for the trading day it is placed. If the market fails to reach or cross the specified limit price and executes the order by the end of the trading day, the order will expire and cancel automatically. Day orders suit traders who prefer short-term trading strategies or want to reassess their orders daily.

A good-'til-canceled (GTC) order remains active until it is filled or manually canceled by the trader. Unlike a day order, it does not expire at the end of the trading day. GTC orders are convenient for traders with longer-term investment horizons or who want to maintain their orders in the market until they are executed or canceled. However, it's important to note that GTC orders may have an expiration date imposed by the broker or exchange, typically ranging from several months to a year.

A fill or kill (FOK) order is an order type with immediate execution requirements. It must be either entirely executed or canceled. If the order cannot fill entirely upon entry, it is instantly canceled, preventing partial fills. FOK orders are used when traders seek immediate execution or prefer not to have their orders partially filled.

An immediate or cancel (IOC) order is similar to a FOK but allows partial execution. The unfilled portion of the order is canceled immediately after the partial execution, ensuring no further execution attempts occur. IOC orders provide flexibility, allowing traders to capture available liquidity while quickly canceling the remainder of the order.

Traders need to understand the implications of each duration option for limit orders. Day orders offer a short-term timeframe, while GTC orders are suitable for longer-term perspectives. FOK and IOC orders prioritize immediate execution but differ in treating partial fills.

Traders should also consider the rules and limitations their brokerage or exchange imposes. Some platforms may have specific guidelines on order durations, such as maximum duration limits for GTC orders or restrictions on FOK or IOC orders. For instance, a limit order remains in effect at Charles Schwab for one full year, whereas other investment brokerages like Robinhood only allow for 90 days. Familiarize yourself with these guidelines to ensure proper order management.

Limit Orders: The Key to Smart Trading

Understanding and utilizing limit orders can be valuable as you navigate the stock market. By setting specific price parameters, limit orders offer control over trade execution and protect against unfavorable prices.

However, it is essential to acknowledge the limitations of limit orders, such as the possibility of non-execution in volatile or illiquid markets. Traders should consider their trading goals, risk tolerance and prevailing market conditions when deciding on the appropriate order type. Ultimately, with the right strategy and thoughtful implementation, limit orders can help traders maximize their returns while minimizing losses, providing a solid foundation for trading success.

FAQs

Let's address some common questions regarding limit buy orders to provide further clarity and understanding. Whether new to trading or seeking to expand your knowledge, these FAQs will illuminate various aspects of limit orders. Exploring these frequently asked questions can enhance your understanding of limit orders' benefits, use cases and potential downsides.

Are limit orders a good idea?

Limit orders can be a good idea for specific trading strategies and situations. They offer traders control over the price at which they buy or sell a security, allowing them to set specific entry or exit points. Limit orders can be particularly useful when traders want to target a specific price level or avoid overpaying for a security.

However, it's important to note that the suitability of limit orders depends on individual trading goals, risk tolerance and market conditions. Carefully assess your strategies and consider limit orders' potential benefits and drawbacks.

Why would you use a limit order?

You may choose to use a limit order for various reasons. One primary advantage of limit orders is that they provide price control, allowing traders to set the maximum price they are willing to pay or the minimum price they are willing to accept.

This can be useful when you have specific price targets or want to avoid unfavorable prices. Limit orders also offer protection against sudden price swings and can help traders manage their risk more effectively. By using limit orders, you can implement disciplined trading strategies and maintain price discipline.

Is there a downside to limit orders?

While limit orders have advantages, they also have limitations and potential downsides. One significant downside is that limit orders do not guarantee execution. If the market price fails to reach or exceed the specified limit, the order may go unfilled, potentially resulting in missed trading opportunities.

In highly volatile or illiquid markets, the price may quickly move past the specified limit price, making it challenging to execute the order. Make yourself aware of these limitations and carefully consider their trading objectives and market conditions when using limit orders.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.