COGS is a crucial statistic for determining a company's gross profits. But what is COGS exactly? In this article, you'll learn how to calculate the cost of goods sold, why it’s essential for businesses and how COGS accounting influences the prices we pay at the register or online checkout page.

What is Cost of Goods Sold (COGS)?

COGS is a metric used by businesses to figure out the direct costs of manufacturing a product or service. Sometimes, this metric is referred to as the cost of sales, meaning how much the company spends to make and sell the product to the end consumer. The "cost of sale" number is what the company must charge for the product or service to break even. COGS is a company’s income statement, usually as the second item under revenue. Businesses can subtract the COGS figure from revenue to find their gross profits.

The cost of goods sold is measured in every industry. From small businesses with a handful of employees to large Fortune 500 companies, every enterprise uses some form of this metric to extrapolate data and help determine price points for products and services. Even companies that don’t keep inventory, like SaaS (software as a service) tech firms, must have accurate and reliable COGS data on hand to determine how much to charge for their subscriptions or programs.

What is the cost of goods sold? Let’s start with what’s stripped away from the cost of goods sold formula; overhead costs, marketing costs, utility expenses and shipping expenses are usually NOT included in the cost of sales calculation. The formula for cost of sales generally includes direct costs like labor expenses and raw materials.

Here’s a basic formula a hypothetical company might use to calculate their cost of goods sold numbers:

COGS = Inventory at Start of Period + Inventory Expenses - Inventory at End of Period

For example, suppose a company like the 3M Company NYSE: MMM wants to sell a new adhesive widget (and who doesn’t need more adhesive widgets?!). In that case, their COGS formula will include raw materials like plastic and adhesive plus labor costs like machinery and manpower. They’ll calculate how much widget inventory they have at the start of each quarter, add in inventory costs incurred during the period and then subtract the remaining inventory at the end of the quarter.

Dollars spent on things like advertising, factory space and pallets for shipping are likely not going to be included since 3M wants to know exactly how much it costs to produce a single adhesive widget, not the associated costs like operating expenses (those are factored into a different metric).

Note that the formula for cost of sales will include different variables depending on the company or industry. Some companies may identify inventory using different systems or factor in atypical costs like packaging. Certain pure service firms like law practitioners or consultants don’t even list COGS figures on their income statements, instead using similar metrics like cost of revenue or cost of services.

COGS in Different Industries

The cost of goods sold meaning on the balance sheet will vary since businesses don’t always track inventory the same way. Here are a few cost of sales examples across different industries.

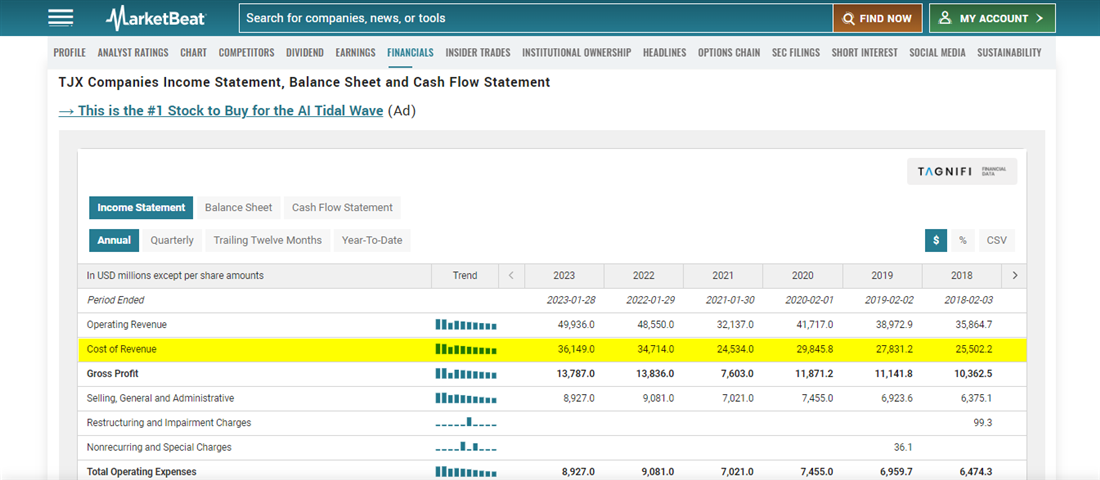

Retailers and Wholesalers

The store doesn’t manufacture the items you purchase in a retail outlet. Instead, clothes, games, appliances and other items purchased at stores are manufactured elsewhere and sold to the retailer, who then sells the item at a markup for profit. In the COGS formula for a retail or wholesaler, inventory purchases will be the largest costs. Here’s a quarterly income statement for TJX Companies Inc. NYSE: TJX, which operates TJ Maxx, Marshall’s and HomeGoods stores. COGS is referred to as the cost of revenue in this sample.

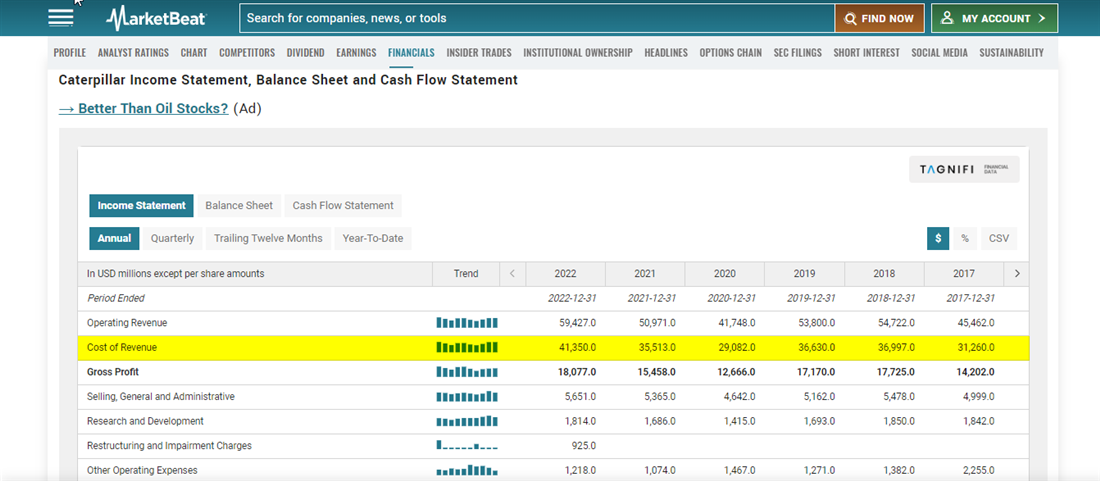

Manufacturers

Manufacturers have high initial capital expenditures, like factories and equipment, to scale up their operations. However, for manufacturers, COGS mainly comprises materials and labor costs. For example, mining and construction equipment company Caterpillar Inc. NYSE: CAT has to purchase steel, plastic and other raw materials for fabrication, factor in labor costs (i.e., machinery wear and tear) and storage costs and consider the depreciation of their inventory.

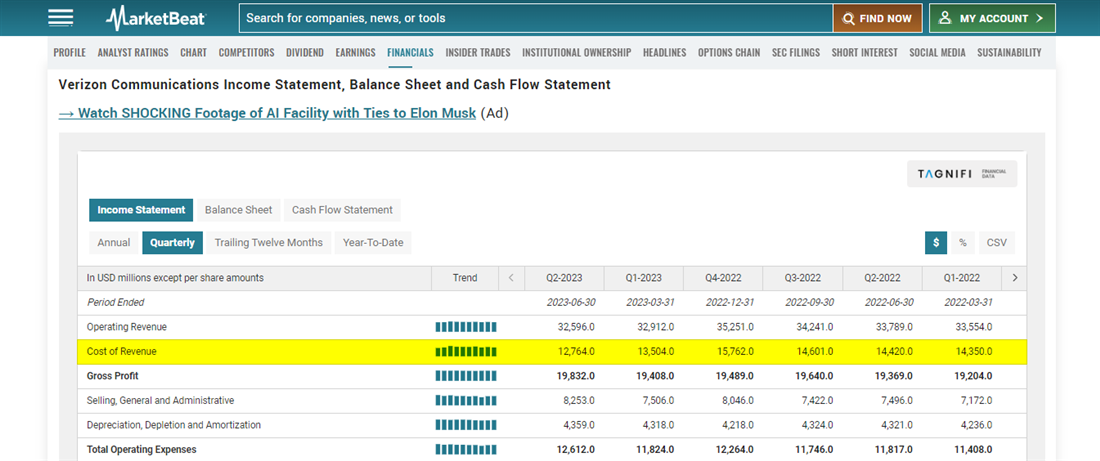

Service Providers

A service company doesn’t generally keep inventory, so the COGS calculations aren’t performed like a retailer or manufacturer. For example, consider a cable company like Verizon Communications Inc. NYSE: VZ. Verizon does keep some inventory, such as equipment like gateways or trucks. But their primary business is providing cable and internet service, which isn’t kept in a warehouse or facility. In the COGS formula for a service provider, expenses like sales commissions, direct labor, tools and transportation costs will factor in.

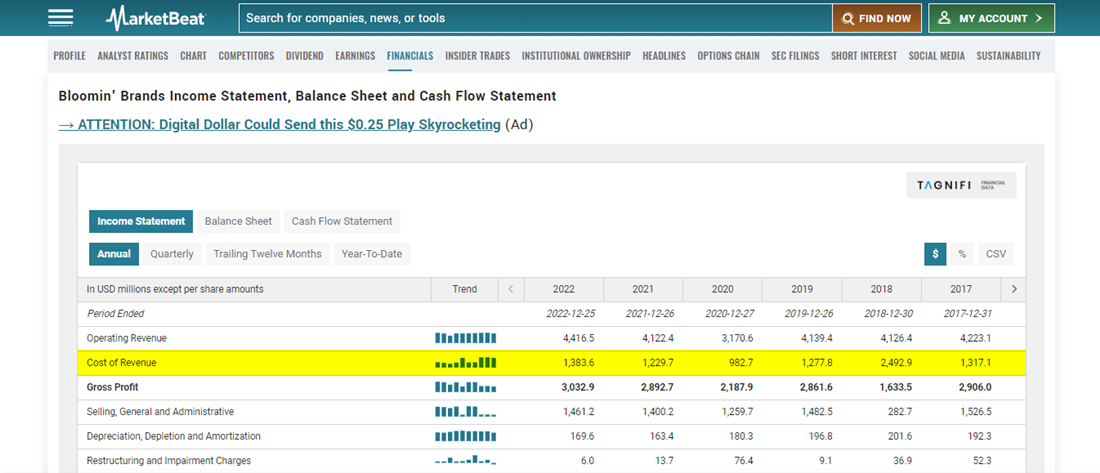

Restaurants

Thin margins are common in restaurants, so consistent COGS bookkeeping is necessary. Restaurants have their hands in several different cookie jars when acquiring the materials and products needed for serving food. A company like Bloomin’ Brands Inc. NASDAQ: BLMN, which operates Outback Steakhouse and Bonefish Grill restaurants, might consider the following in their COGS formula: meats, vegetables, spices, seasoning, garnishes and other ingredients.

What’s not in the formula? Plates, cups, silverware, cleaning supplies and other products used in operating the restaurant, but not food production.

E-Commerce

The COGS calculation for e-commerce includes product inventory but costs other businesses may not include, like shipping, packaging, software and duties/fees for transportation. Shopify Inc NYSE: SHOP is one of the largest e-commerce platforms in the world; its income statement and cost of revenue figures are listed below.

Cost of Goods Sold in Action: Examples

Here’s a hypothetical example: if you run a business buying and selling sports memorabilia, you’ll have to keep track of inventory using the specific ID convection since each piece is unique. You don’t need to purchase raw materials or factor in labor costs since you don’t produce the memorabilia; you purchase and resell it at an upcharge.

Your quarterly business COG formula would take account of all inventory at the beginning of the quarter, add in any purchases you made during the quarter, and then subtract the remaining inventory at the end of the quarter. Day-to-day costs like transportation, office supplies and store rent aren’t included in COGS; these are operating expenses.

Why COGS Matters

The cost of sales or goods sold is an important component in the profitability equation, and businesses must keep good records to minimize it. A high COGS figure can damage a company since revenue spent on inventory and sales costs won’t turn into profit.

As mentioned, COGS usually appears below revenue on a company’s income statement. That’s because COGS includes only the direct costs of selling the company’s product or service. Cutting overhead or reducing marketing budgets won’t affect these direct costs, so COGS is considered the break-even point. To turn a profit, the company must charge a price at a minimum equal to the cost of selling their goods. Without proper COGS calculations, company executives will have no idea how profitable (if at all) the business is.

COGS vs. Expenses: What’s the Difference?

Plenty of different costs and expenses go into running a business, but not all of them are directly involved in the manufacturing and selling of products. Expenses like office supplies, salaries, marketing campaigns and other day-to-day costs are operating expenses (or opex in business speak). Operating costs are not in the COGS equation but are still important to the income statement.

Also on the ledgers are capital expenses (or capex). Operating expenses are the day-to-day costs of running the business, while capital expenses are usually large one-time purchases like factories, vehicles or equipment. For example, if a construction company purchases a new fleet of trucks, that’s considered a capital expense. However, the maintenance and fuel required to run the fleet would be on the operating expense side. Neither capital nor operating expenditures are included in the computation for the cost of goods sold.

How to Value Inventory When Calculating Cost of Goods Sold

Calculating inventory value can be time-consuming and tedious, so several "shortcut" identification methods are used in generally accepted accounting principles (GAAP). Figuring out how to work out the cost of sales is an important initial step for any company, especially those moving significant inventory. United States GAAP allows for four main methods of identifying and reporting inventory over a particular period.

- Specific identification: This ID method is scarcely used because it requires detailed bookkeeping. The inventory ID is usually reserved for unique and nonfungible items, like paintings, automobiles or limited edition collectibles.

- First-in, first-out (FIFO): FIFO is used when the first items produced are the first items to be sold. A company that sells its oldest products first will often have a lower COGS figure since material and manufacturing prices tend to rise over time.

- Last-in, first-out (LIFO): If FIFO means the oldest products are sold first, LIFO must mean the newest products are sold first. Why would a company sell its newest products first? When production costs rise, companies can use LIFO to lower tax payments and pair costs with revenue more efficiently.

- Weighted price average: The weighted average method doesn’t account for old or new inventory but instead uses the average price of the goods sold over the period to create the formula for the cost of sales. A weighted average is the simplest acceptable method and can help smooth infrequent cost spikes during volatile times.

Using COGS to Your Advantage

How can a business metric like cost of goods sold help an investor? Since keeping the cost of goods sold down is important for a company’s profitability, investors can use COGS numbers from quarterly earnings reports to gauge how well a company manages its inventory and fixed costs.

Business accountants can occasionally get creative when calculating the cost of goods sold, but companies attempt to keep these expenses consistent and manageable. When COGS rises, companies must raise product and service prices to match revenue. For companies in the consumer staples sector that sell goods with inelastic demand, these costs can often pass on to customers with little pushback.

But suppose a company in the consumer discretionary sector sees its costs of goods sold figures rise. In that case, there may not be as much room to push those costs onto the end consumer and profitability could suffer. A drag on profits could hurt the stock, so investors who notice rising COGS numbers on income statements might sell their shares in preparation for declining profits.

Investors Can Apply COGS to Stock Evaluation

COGS might look like another number on a company’s quarterly earnings report. Still, it's an important metric because it determines what a company must charge for its products or services to turn a profit. Expenses included in the cost of sales definition are usually fixed and not at the company's discretion.

If the cost of selling a good or service rises, negative impacts can impact the company’s bottom line, especially if customers resist price increases. Investors can use COGS to make educated guesses about the future profit margins of individual companies. An income statement showing a stark rise in the cost of goods sold could be the canary in the coal mine in terms of a future stock price decline.

Before you consider Bloomin' Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloomin' Brands wasn't on the list.

While Bloomin' Brands currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.