You don't have to be an experienced investor to have heard the phrase, "buy low and sell high." It sounds simple enough. But stock markets are volatile, and even the most experienced investors may need help timing the market.

But you can't lose money you don't put at risk. While that's true, you can't make money, either. That's where dollar-cost averaging comes in. It's an investment strategy that involves buying a fixed dollar amount of a certain asset, such as a stock, on a regular schedule, regardless of the share price. Investing the same amount at regular intervals allows you to take advantage of price variations to reduce your risk.

This article will define dollar-cost averaging and go over different examples of dollar-cost averaging. We'll also review the benefits and the potential drawbacks of dollar-cost averaging.

Understanding Dollar-Cost Averaging

What is dollar cost averaging in investing? Dollar cost averaging (DCA) is an investment strategy acknowledging that you may not want to risk investing a large lump sum of money all at once. So instead, DCA spreads out your purchase of an asset over a predetermined period, regardless of how the market trends.

The idea behind DCA is that instead of risking all your capital in one go, you can spread it across multiple investments at different prices. When you learn how to dollar cost average, you can buy more shares when prices are low and fewer when prices are high. A portion of your capital is always invested, and you don't have to worry about timing the market perfectly. Over time, this approach could save you money by taking advantage of price fluctuations in the stock market.

For example, let's say you have $5,000 to invest and decide to use dollar cost averaging over six months to invest in The Goldman Sachs Group NYSE: GS. You would break up your $5,000 into six equal payments of $833 each and invest them at regular intervals, such as biweekly or monthly, regardless of what the stock market is doing.

Some months, you may buy more stock when prices are low, increasing your potential returns. During other months, you may buy less stock when prices are high due to investors liking Goldman Sachs financials, reducing your potential losses.

Ultimately, the dollar-cost average helps remove some of the stress associated with investing by allowing you to get into the markets slowly without worrying about entering at the right moment. It also helps take emotion out of the process since you're investing set amounts based on predetermined intervals rather than trying to guess where stock prices will go next, often leading to emotional decisions instead of rational ones.

How Dollar-Cost Averaging Works

At its core, dollar-cost averaging is buying a fixed dollar amount of a security at regular intervals regardless of the price. When you use DCA, the amount of the security you buy will depend on its price at the time of purchase. If you participate in your company's 401(k) plan, you probably already employ a dollar-cost-averaging strategy.

A fixed percentage of your paycheck (that you select) goes into your 401(k) account and will be used to purchase shares of the securities in your account. Since many employer-sponsored plans don't permit you to invest in individual securities, this money frequently goes into mutual and exchange-traded funds (ETFs).

Although dollar cost averaging is sometimes a good strategy for investors with a low risk tolerance, the reality is that the DCA meaning is not to ensure that you won't lose money. Your gain (or loss) will completely depend on what stocks do during the time you're investing. In reality, security prices go up, and security prices go down, and using dollar-cost averaging allows you to take advantage of the "average" stock price over a given period.

Why Use a Dollar-Cost Averaging Strategy?

These examples illustrate the benefits and drawbacks of dollar-cost averaging. First, we'll take a look at the benefits. When stocks are trading in a tight range or declining, dollar cost averaging allows you to buy shares when they're "on sale." Think of it like going to the grocery store. You can buy a certain item, say peanut butter, any day of the week. But when you buy it on sale, you're getting the same quantity of the item, but you're paying less per ounce.

In fact, grocery stores frequently have sales that encourage consumers to "stock up and save" with the theory being that you buy more of an item you often use while it's on sale and therefore save money over time.

The other benefit of dollar cost averaging is that developing a consistent investing habit takes the guesswork out of "when" to buy a stock. Many investors don't have the time and enthusiasm to actively trade stocks. Some may even engage in day trading, seeking to profit from minimal movements in a stock. Dollar-cost averaging is a conservative, low-risk strategy that doesn't ensure an investor will not lose money.

The consistency of making regular stock purchases (no matter the cost) has positively impacted portfolios over time.

Examples of Dollar-Cost Averaging

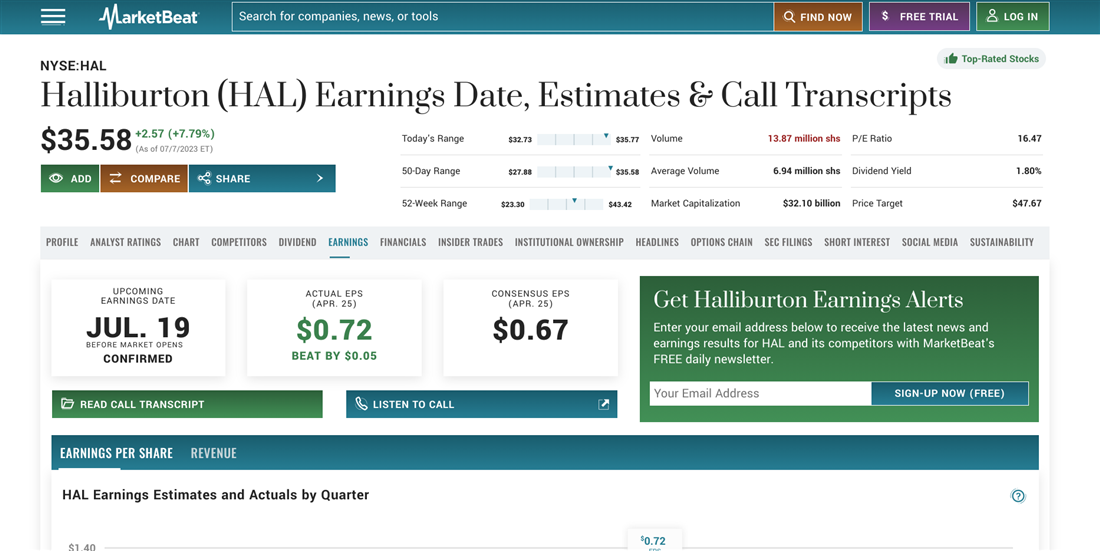

Let's say John buys $5,000 of stock in Halliburton Company NYSE: HAL, priced at $20 per share for a total of 250 shares. He doesn't buy any additional shares. After holding the stock for five months, the stock had climbed to $35 per share after a strong Halliburton earnings call.

His $5,000 investment is now worth $8,750.

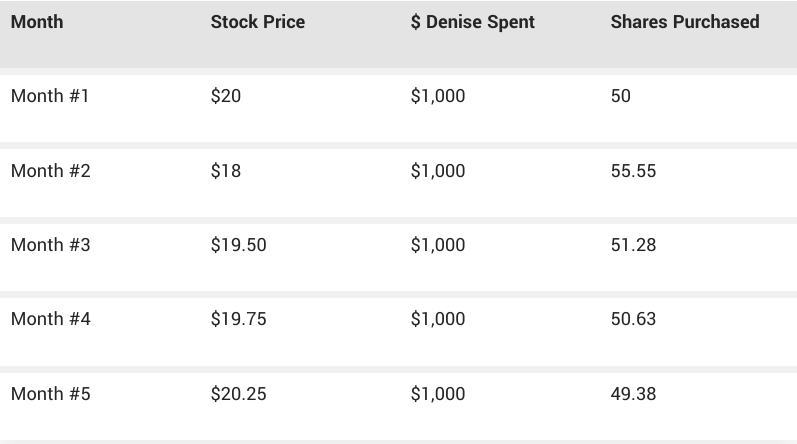

Meanwhile, Denise buys $1,000 of the same stock for 50 shares. She continues to invest $1,000 monthly in the stock, regardless of the price. At the end of the fifth month, will John's portfolio be worth more or less than Denise's?

To understand which investor may have really "won the trade," we have to take a closer look at different scenarios for the stock.

Using this scenario, we can determine how much Denise’s portfolio would be worth.

Over time, Denise purchased 224.12 shares (50 + 55.55 + 50 + 40 + 28.57). At $35 per share, her portfolio would be valued at $7,844.12. That's just over $900 less than the value of John's portfolio. However, Denise paid an average of $23.60 per share, whereas John paid a flat $20 per share.

Now, let's look at a different scenario:

In this example, Denise would have purchased 256.84 shares, now worth $5,201.01. John's 250 shares would be worth $5,062.50. Denise would be ahead. Furthermore, she would have paid an average of $19.50 per share compared to the $20 per share paid by John.

Pros and Cons of Dollar-Cost Averaging

Dollar-cost averaging is a safer strategy for many investors, but it has pros and cons like any other technique.

Pros

DCA is a popular strategy because of its numerous pros:

- Less emotion: You can buy more shares when prices are low and fewer shares when prices are high, helping to reduce the average purchase price.

- Less volatility: By investing regularly over time, you can even out highs and lows in the stock market and ensure you stick with your long-term financial goals.

- Diversification: A regular dollar cost averaging program makes having multiple stocks in your portfolio simpler and easier.

- Lower commission fees: Trading costs can add up, but with dollar cost averaging, you spread your risk over time so that commissions don't eat into your overall profits.

- Less risky: When investing in individual stocks or funds, there's always a fear that you could be buying at the wrong moment, missing out on better prices down the line. Dollar-cost averaging eliminates this worry by taking away many decision points.

Cons

Like any strategy, DCA has its cons. Some of them include:

- Limited gains: A dollar-cost averaging strategy can limit your potential gains if a stock rises in price dramatically and you've only invested a fixed amount each time.

- Needs discipline: This strategy requires discipline to regularly invest small amounts over a long period, which can be challenging. Sticking to a dollar-cost averaging plan can also be difficult during market downturns or when stocks are volatile.

- Not foolproof: This strategy doesn't guarantee success. Taking profits during good times and reinvesting them during bad times may not necessarily produce better returns, as the value of securities can still fluctuate and result in losses. DCA is not always a better strategy than investing all at once or using another systematic strategy, such as value averaging or rebalancing.

- Not for everyone: Dollar-cost averaging probably isn't for you if you want to manage your portfolio actively or have a higher risk tolerance and are willing to take on more volatility in hopes of greater returns.

- Higher fees: If you're investing in mutual funds or ETFs, you may pay higher fees.

Who Should Use Dollar-Cost Averaging?

Dollar-cost averaging is most effective if you have a long time horizon and no expectation of short-term profits. It's perfect if you prefer to focus on the big picture. You should look elsewhere if you have short-term goals or aggressive trading strategies.

Large institutional investors tend to avoid DCA investing because it can be extremely costly to set up across multiple accounts, and many aren't willing to take the risk that no tangible gain will come from this method over time.

How Often Should You Consider Dollar-Cost Averaging?

When considering dollar cost averaging, consider frequency. In general, spread out your investments to at least every month or two in order to take advantage of any market fluctuations. Your investment amount per interval should also reflect your risk tolerance and financial goals. For example, more aggressive investors may invest larger sums more frequently, while those with less risk tolerance may choose to invest smaller amounts at longer intervals.

Dollar-Cost Averaging Can Minimize Risk

Overall, dollar-cost averaging can be a helpful strategy if you're a conservative investor looking to build a portfolio over time with minimal risk. By investing smaller amounts more regularly, you're better protected from the volatility of the market and may save yourself money on purchase prices.

FAQs

You should now have a good idea of what dollar-cost averaging is, how it works and why it might be a strategy worth trying. Below, we answer some further questions you might have.

What is dollar-cost averaging in simple terms?

Dollar-cost averaging (DCA) is an investment strategy that involves buying a fixed dollar amount of a certain asset regularly, regardless of the share price. Investing the same amount at regular intervals allows you to take advantage of price variations to reduce your overall costs and risk.

Is dollar-cost averaging a good strategy?

Yes, dollar-cost averaging is a good strategy if you're looking to build a portfolio over time with minimal risk. By investing smaller amounts more regularly, you're better protected from the volatility of the market and can benefit from lower average purchase costs.

This strategy also takes much of the emotion out of investing because it allows you to buy more shares when prices are low and fewer when prices are high. However, DCA's not guaranteed to produce better results than other systematic strategies, such as value averaging or rebalancing.

What is an example of a dollar-cost average?

An example of dollar cost averaging is an investor who invests the same amount each month into a specific stock or mutual fund. For example, suppose Shannon decides to invest $200 monthly into Procter & Gamble Co. NYSE: PNG after checking Procter & Gamble analyst ratings, regardless of the price. In that case, her average cost per share will be lower than if she had bought the shares all at once when the price was higher.

By investing on a regular basis, she's taking advantage of both rising and falling prices. Over time, her cost per share will even out.

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report